Market positioning from the COT report - as of Tuesday July 16, 2024:

- Futures traders reduced their net-long exposure to the USD by -$6.7 billion last week, according to the IMM (International Money Market)

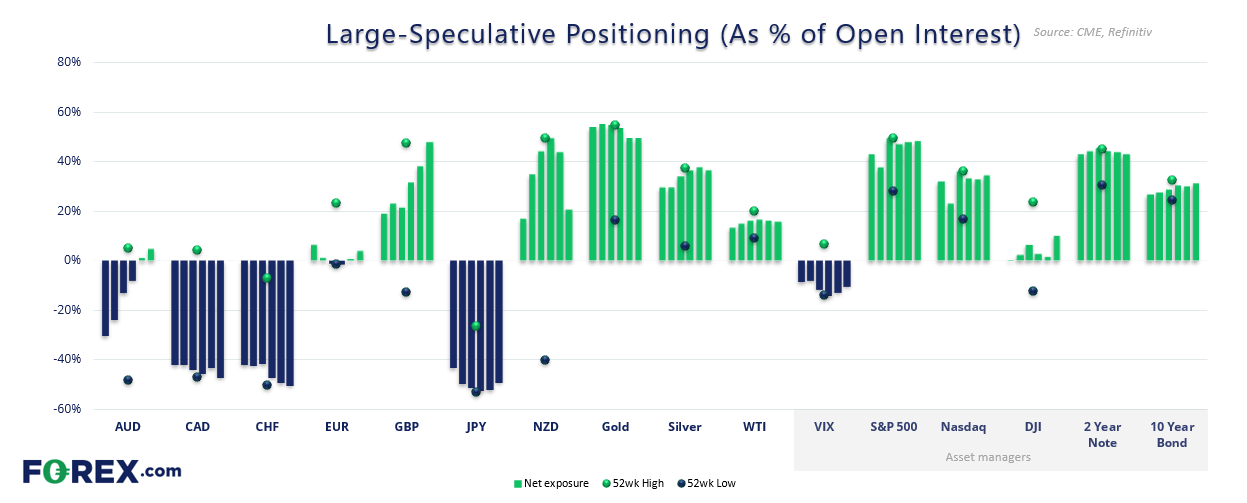

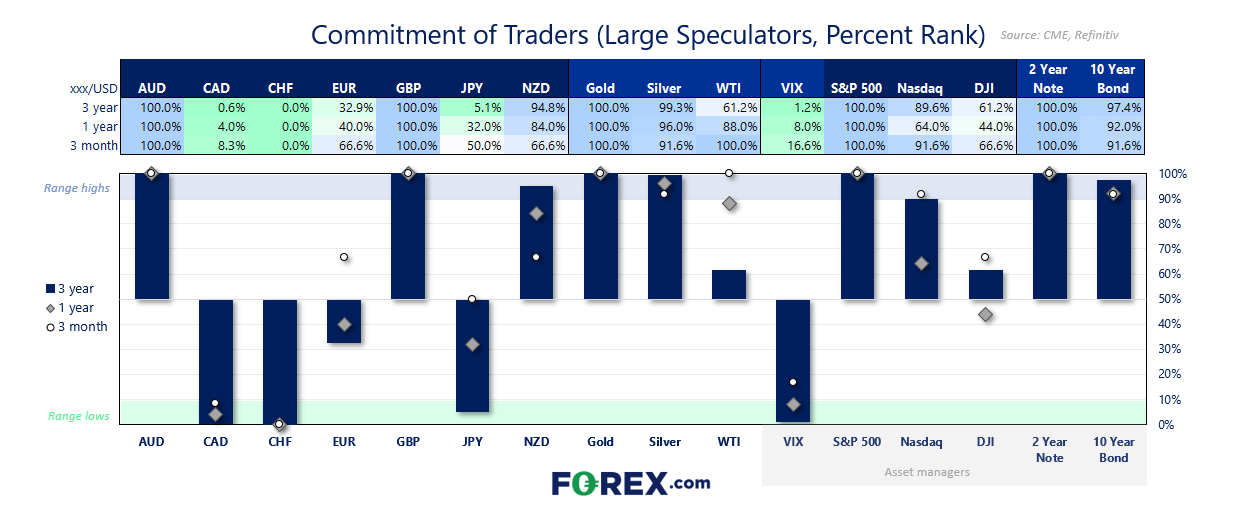

- Net-long exposure to GBP/USD futures surged to a record high among large speculators

- They also pushed net-short exposure to Swiss franc futures to a 7-year high, and not far from its own record high

- The traders were also net-long to EUR/USD and AUD/USD for a second week, although bearish price action ibn the second half of last week suggests this may have been short lived

- Net-short exposure to Japanese yen futures fell at the fastest weekly pace in 10, and second fastest pace since March 2020 (the pandemic)

- Managed funds and large speculators both increased their net-long exposure to gold futures by ~30k contracts, ahead of its latest record high

- Asset managers trimmed net-short exposure to VIX futures for a second week from their record high

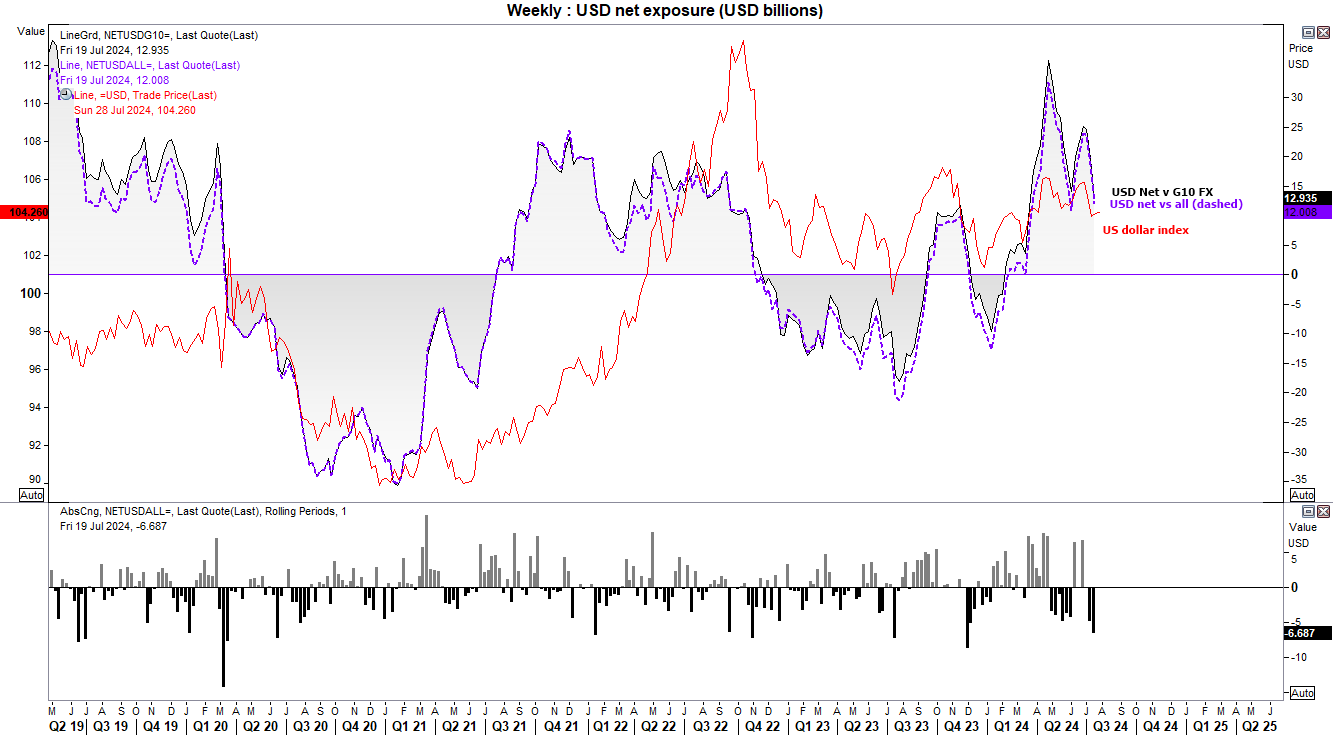

US dollar positioning (IMM data) – COT report:

The -$6.7 billion of USD exposure last week dragged net-long exposure to the dollar down to a 5-week low. It was the second week in a row of trimmed long exposure, and the fastest weekly pace since December. Whilst the prospects of a slowing US economy and multiple Fed cuts could continue to weigh on the US dollar in the weeks or months ahead, politics will also be a factor for traders to take on. The US dollar regained some ground last week during the phase of risk-off in the second half of the week, to remind us that Fed policy is not the only game in town any more.

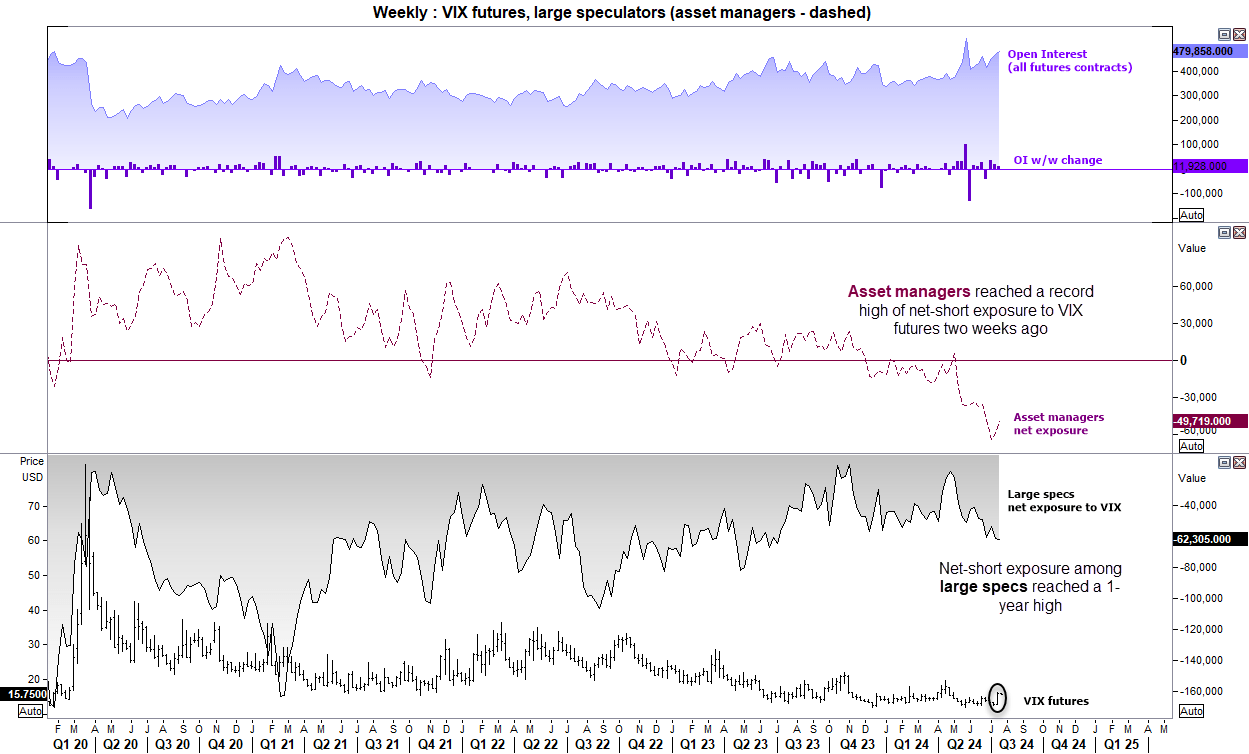

Volatility index futures (VIX) - COT report:

Just two weeks ago, asset managers were net-short VIX futures by a record amount. Last week large speculators were their most bearish on VIX futures in one year. Unfortunately for them, the VIX went on to print its most bullish month since September as risk-off tone dominated sentiment to see Wall Street indices fall alongside gold prices.

The VIX closed to an 11-week high, but at 15.8 foes not seem overly elevated. And with investors soi heavily newt-short VIX futures, it might not take much to see further short covering and a higher VIX. As looking back though recent history, it doesn’t tend to just rise for one week from low levels.

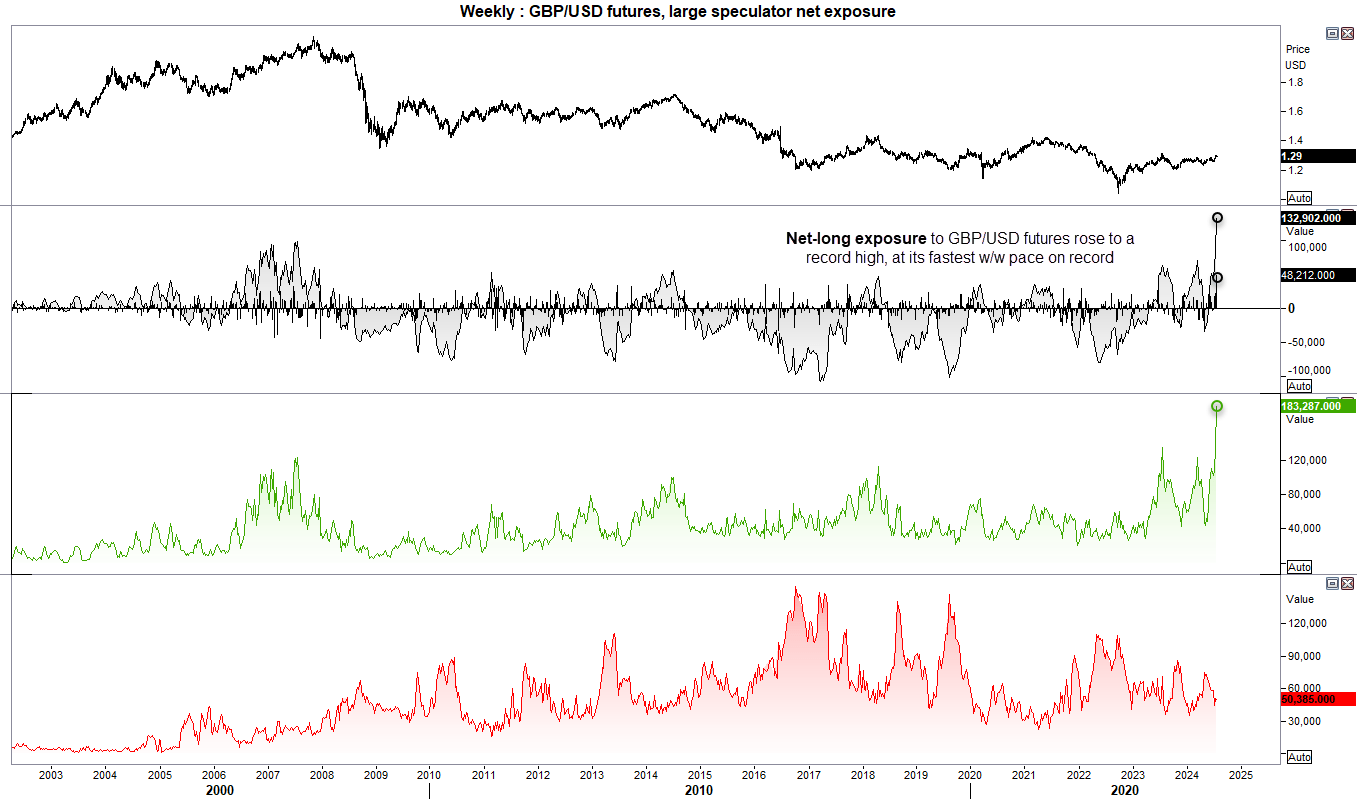

GBP/USD (British pound futures) positioning – COT report:

Hot economic data from the UK continues to undermine the BOE’s efforts to talk a dovish game. Still, it seems that August remains a potentially live meeting for the central bank, even if it is still 50/50 as to whether they act or not. But the impact of better-than-expected data was apparent on market positioning last week.

Large speculators not only pushed net-long exposure to their most bullish level on record, but the weekly pace of adding 48k contracts was also its most aggressive on record.

However, the risk-off tone that dominated markets last week saw the US dollar regain traction as a safe-haven and sent GBP/USD lower between Thursday and Friday to fall from its 1-year high set on Wednesday. And this should serve as a warning that interest-rate differentials and monetary policy expectations are not the only game in town any more. In fact, they clearly take a back seat when the implications of the US election rattle investors enough.

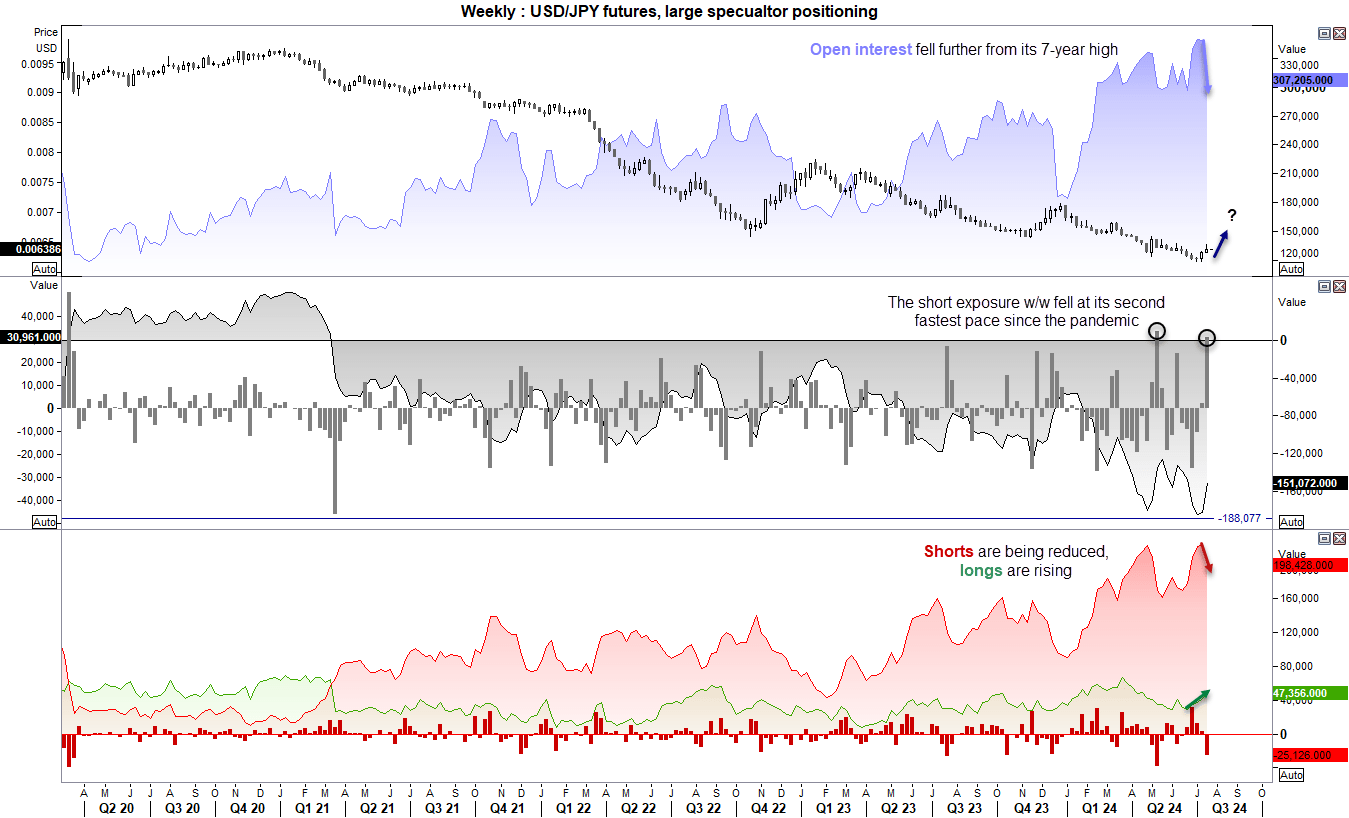

JPY/USD (Japanese yen futures) positioning – COT report:

We may have reached the point where being long the yen is a safer bet than not. Calls for faster policy normalisation are on the rise for the BOJ, the Fed are heading towards multiple rate cuts and US politics (and its ramifications for global trade) could see the yen return as a safe haven.

Two weeks ago, net-short exposure to yen futures rose to within a cat's whisker of its all-time high set in 2007. Yet last week’s COT data shows that net-short exposure fell at its second fastest weekly pace since March 2020, or its fastest in 10 weeks. Open interest was also lower, with large speculators decreasing shorts for a second week and new long bets are creeping higher. Put all of that together, and USD/JPY seems like a pair to fade into rallies for now.

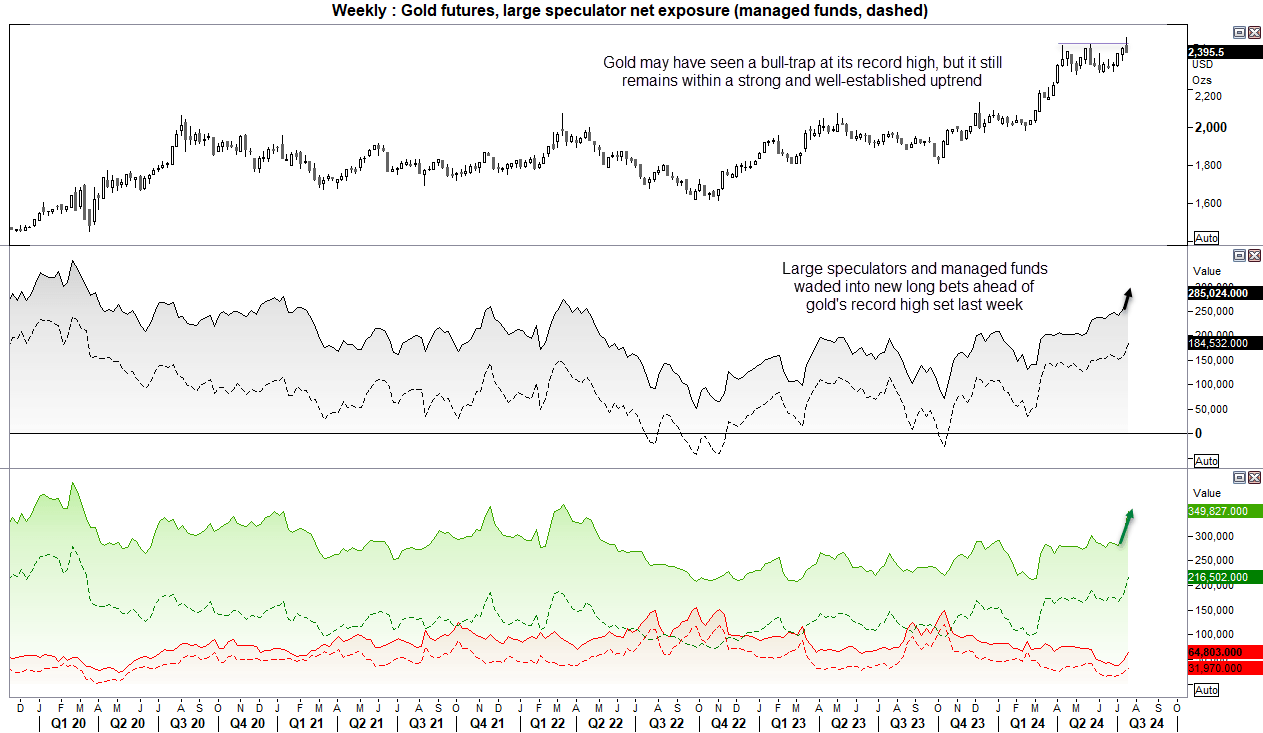

Gold futures (GC) positioning – COT report:

Large speculators and managed funds would have gone home on Tuesday feeling good that they had waded into gold and pushed it to a new record high. It is a shame it did not last long, as momentum slowly turned lower on Wednesday before gaining pace and pushing gold futures back to just below 2400 by Friday. It was a bull trap then.

Investors seemingly moved to cash in the second half of last week, with gold prices falling alongside Wall Street indices as the VIX touched a 12-week high.

Despite the wobble at the highs, gold’s strong and established uptrend remains intact and investors seem more likely to buy dips and take it to record highs than not.