Equity markets rallied back on Monday and safe-haven demand took a downturn as Hurricane Irma abated and North Korea refrained from conducting more missile tests (for the time being). The US dollar found a bit of footing as it rebounded after having dropped to a multi-year low against a basket of other major currencies late last week. Meanwhile, the British pound managed to stay well-supported in the run-up to a week featuring major economic data releases and a key central bank decision from the UK.

On Tuesday, the UK Consumer Price Index will be released. This key inflation indicator is expected to show a 2.8% increase in prices year-over-year for August, which would be an increase from the previous month’s 2.6%. Wednesday brings UK jobs data that will also impact the pound. And on Thursday, the highly anticipated Bank of England rate decision will take center stage. Though a rate hike is not expected at this time, the BoE has the potential to become more hawkish in-line with other major central banks, especially if the preceding UK inflation and employment data impress. In this event, the pound could get a further boost against the dollar, given the increasingly dovish outlook for US monetary policy via the Fed.

On the US side, this week will also feature key inflation data – Wednesday’s US Producer Price Index for August (+0.3% expected) and Thursday’s Consumer Price Index for August (+0.3% expected) – along with August’s retail sales data (+0.1% expected).

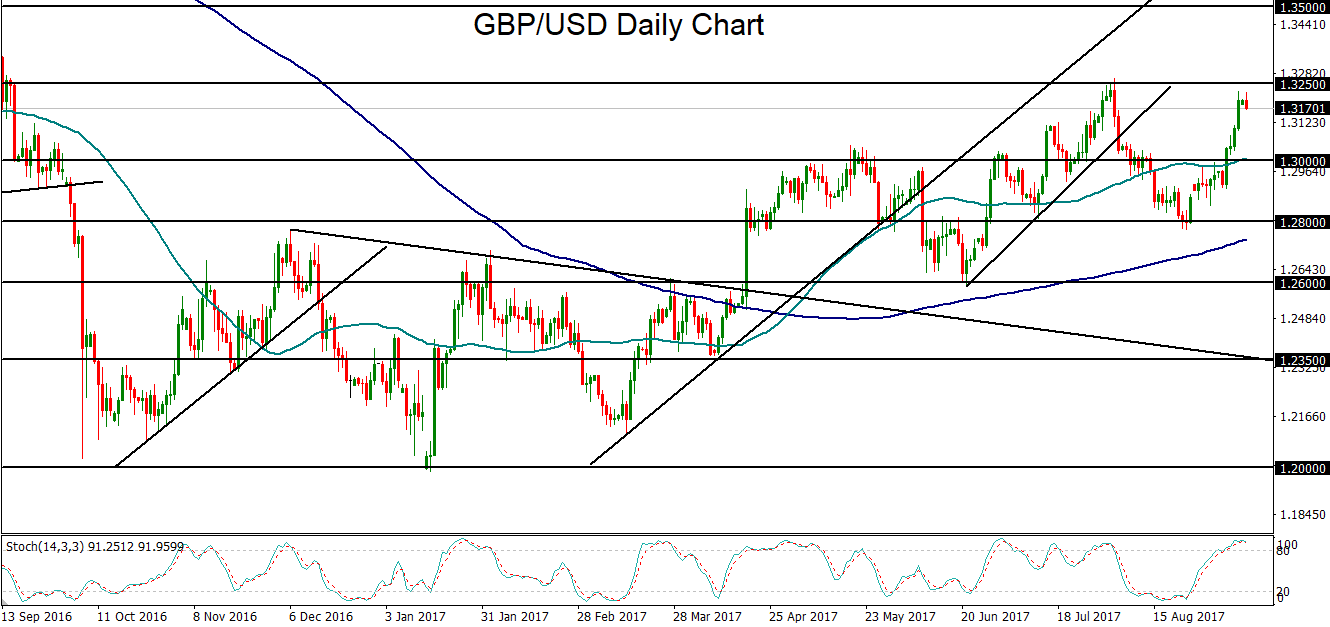

In the run-up to this series of economic releases from both sides of the pond, GBP/USD has been entrenched in a strong rally for most of the past three weeks as the dollar has fallen sharply and the pound has stayed well-supported against its major rivals. The pair has recently risen well above the key 1.3000 psychological level to approach the 1.3267 high reached in early August, before pulling back modestly on Monday’s noted dollar rebound. Amid the key data and central bank decision coming out of the UK this week, GBP/USD has a strong possibility of breaking out to the upside, especially if a potentially more hawkish statement from the Bank of England is viewed in contrast with a more dovish-leaning Fed. In the event of such a breakout above early August’s noted high, the next major upside target is around the key 1.3500 resistance area.