In reaction to this morning’s release of weaker UK inflation data that has effectively paved the way for the Bank of England to become more aggressive with its rate cuts, the GBP/USD plunged below the 1.30 handle to hit its weakest point since August 20, before bouncing off its lows. However, with the US dollar momentum gathering pace, the risks remain skewed to the downside in so far as the short-term GBP/USD outlook is concerned. The greenback is likely to remain supported as we near the US presidential election, partly because the market will want to factor in a potential win for Donald Trump, as the national lead in the polls that Kamala Harris had enjoyed has been shrinking in recent days. Trump is hawkish on protectionism, and a win for him should be bad news for currencies such as the Chinese yuan, Mexican peso, the euro and to lesser degree the pound.

Pound slumps as UK CPI weakens sharply

Sterling dropped across the board this morning after the September CPI report missed expectations on all fronts. Not only was the headline CPI print of 1.7% both below the previous reading of 2.2% and the BoE’s target, the closely-monitored services inflation dropped more sharply to 4.9% from 5.6% previously, than 5.2% expected. The Bank of England’s own projection for this aspect of the CPI was 5.5%. So, this was without any question good news in so far as the BoE’s fight against inflation goes. It should now mean two more rate cuts are on the way in November and December, following the initial rate cut on August 1. In fact, the data opens the door for a 50 bps cut in November, given the comments by Governor Andrew Bailey earlier this month when he said the pace of easing could increase should inflation data allow it. However, split Monetary Policy Committee (MPC) may ultimately mean we will only get a 25bps, but there is definitely more room for dovish repricing of UK interest rates in light of the latest inflation data.

US dollar extends advance as traders’ focus turn to US presidential election race

The US dollar remained on the front foot against other currencies too, most notably the euro with the EUR/USD dropping below the 200-day average today, ahead of tomorrow’s ECB rate decision and US retail sales data. In the US, a light economic data calendar means the focus is turning to politics and the upcoming presidential election. Yesterday, Donald Trump spoke about the Fed’s independence and more to the point, tariffs. He struck a notably hawkish tone on protectionism, specifically taking aim at US car imports from Europe and Mexico. If Trump wins, this should be good news for the US dollar. It is likely that the markets are slowly but surely pricing in the odds of him becoming president again, and some of the dollar buying can be attributed to that.

For more, visit the FOREX.com 2024 US Presidential Election Hub

GBP/USD outlook: technical analysis and trade ideas

Source: TradingView.com

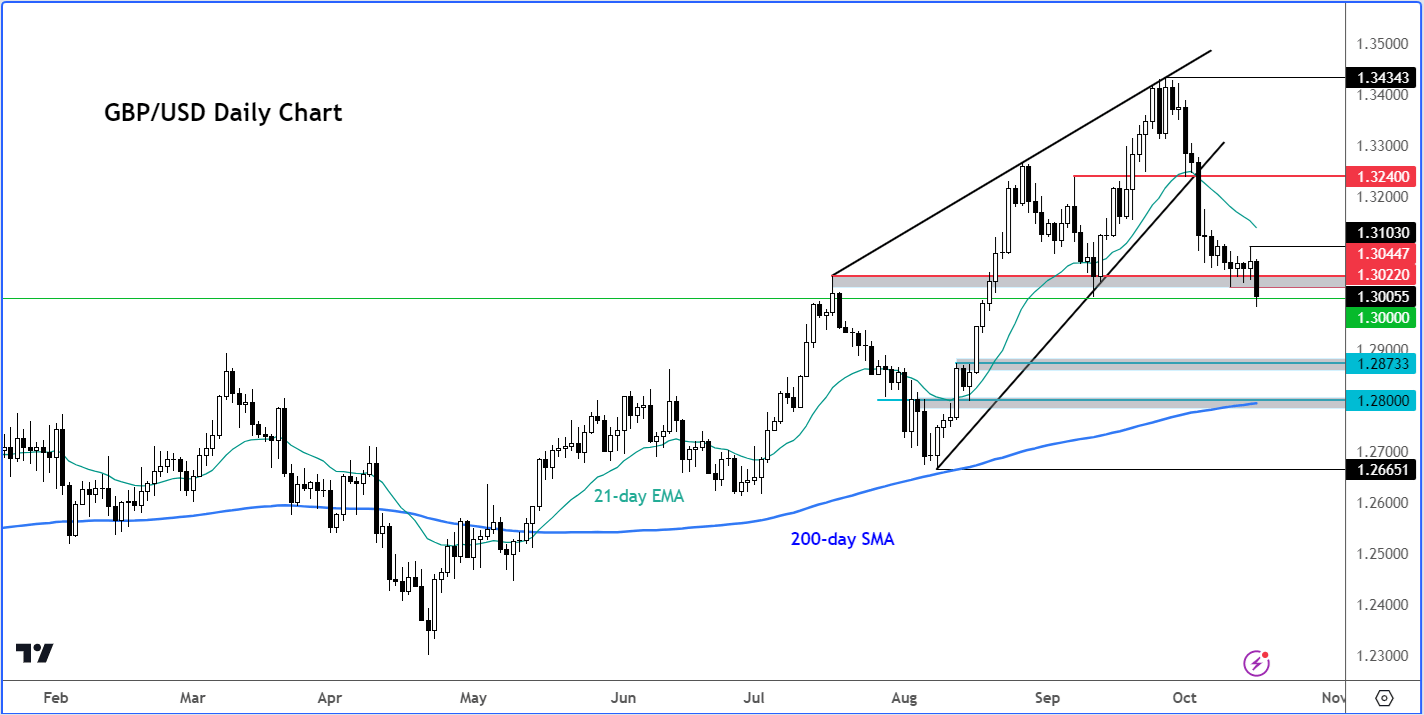

The breakdown below support at 1.3020-1.3050 area (highlight on the chart) is yet another blow to the GBP/USD outlook from a technical point of view, as it further increases the bears’ control. Unless we see the formation of an interim higher high, the path of least resistance will remain to the downside. This week’s high comes in at 1.3103, and this level will now the line in the sand for me in so far as the short-term GBP/USD outlook is concerned. If the bearish trend persists for the cable, the next downside target below the 1.30 handle is around 1.2870, marking the point of origin of the breakout in mid-August. Below that level, 1.2800 is the next nig target where we also have the 200-day average coming into play.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R