Risk-on has been a key theme in the markets from around mid-January and that trend continued after Trump’s inauguration, where a delay in tariff announcements fuelled further optimism. While the stock market has been the major beneficiary, we have also seen the likes of the euro, Canadian dollar and Mexican peso all staging a relief rally. The risk on trade has also benefited the pound, but it is far too early to say whether the GBP/USD forecast has turned bullish.

Market Sentiment dominated by Trump’s Tariff Talks

While markets are buoyed by Trump’s restraint in enforcing blanket trade tariffs on imports into the US, caution is palpable. The daily rhetoric from Trump continues to stir the waters, leaving investors on edge. His threats of imposing trade tariffs on China and the EU remain a cloud over potential market gains. The latest warning? A 10% tariff on Chinese imports, which he said is still under consideration. So, while there has been relief that there weren’t any immediate tariffs, celebrations might be cut short.

UK fiscal woes keeping a lid on GBP/USD forecast

In Britain, December’s budget figures revealed a wider-than-expected deficit, driven by increased debt interest payments. Borrowing rose to £17.8 billion, far exceeding the forecasted £14.1 billion. These figures underscore the uphill battle for Chancellor Rachel Reeves as she navigates mounting fiscal pressures, leaving the pound vulnerable to further volatility.

US Dollar weakens - for now

Investors have been trimming long USD positions amid the recent strong performance of US Treasuries, putting yields under pressure. and the temporary reprieve from immediate tariff announcements. Yet, the tariff situation remains fraught with complexity.

The focus has shifted to Canada and Mexico, following Monday’s threat of 25% tariffs. Both currencies have seen a decent bounce since Friday, suggesting markets are still clinging to hopes of delayed measures.

Today’s US calendar is void of any major data. The question now is whether Treasury yields will fall further lower to put more pressure on the dollar’s momentum.

GBP/USD technical analysis

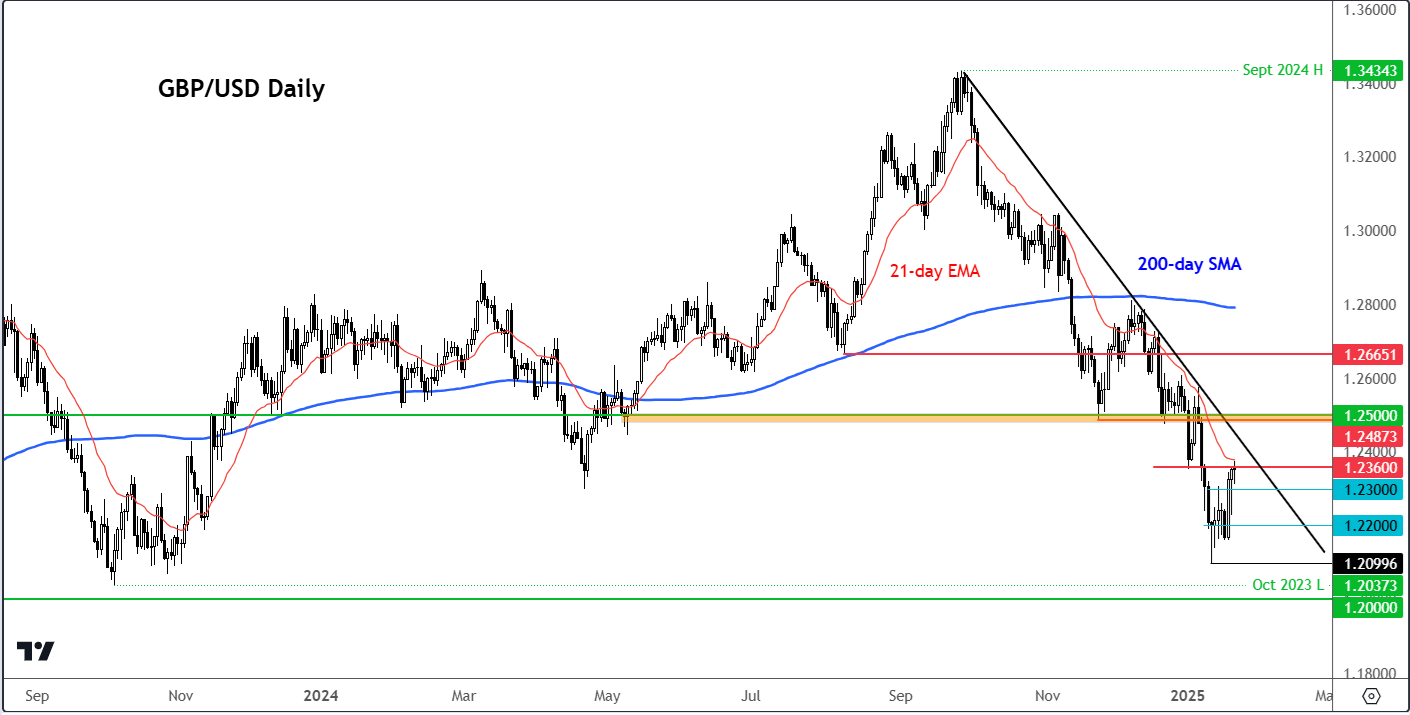

The technical GBP/USD forecast has improved along with all other USD pairs, but it is far too early to say whether rates have hit a bottom.

Source: TradingView.com

Indeed, the series of lower highs and lower lows since the GBP/USD peaked in September remain intact for now. The bearish trend line connecting those lower highs is also in place.

In fact, the GBP/USD was now testing the first important area of resistance starting at around 1.2360, which roughly marks the low from the start of the year. The bearish trend line itself comes in around 1.2450, while arguably the most important resistance is seen in or around the 1.25 handle.

So, there are lots of hurdles that need to give way for the tide to turn decisively bullish. Until that happens, we will have to treat this recovery as a normal retracement inside the larger bear trend.

A couple of short-term support levels to watch include 1.2300, 1.2250 and 1.2200. If we start to see the breakdown of these levels in the coming days, then that could be a sign that the prevailing bearish trend has resumed.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R