- GBP/USD has recorded six consecutive sessions of declines, approaching the key support at 1.21779, a level not seen since 2023.

- UK 10-year bond yields have surged to 4.9%, adding short-term pressure on the pound.

Over the last five sessions, the pound has lost enough ground to push the GBP/USD down by approximately 3%. The price is now at a critical support level, primarily due to growing uncertainty stemming from the large-scale bond sell-off in the United Kingdom.

Debt Increase

The UK has experienced a significant sell-off of fixed-income securities, attributed to slow economic growth and high levels of government debt. As a result, 10-year bond yields, which move inversely to the price of the bonds themselves, have climbed to 4.94%, a level not seen since the 2008 financial crisis.

Source: TradingEconomics

Although higher bond yields might seem attractive for international investment, the current context paints a different picture. High yields are perceived as a hindrance to controlling the government’s growing debt levels, which could destabilize plans announced in October 2024 involving tax increases and debt strategies aimed at boosting stable economic growth.

In this scenario, the UK government is not directly responsible for the rising borrowing costs (increased government bond yields), but the situation could further erode confidence in the pound, exerting additional bearish pressure on the GBP/USD. For now, the market views the dollar as a safer option compared to the debt issues plaguing the UK.

GBP/USD Technical Outlook

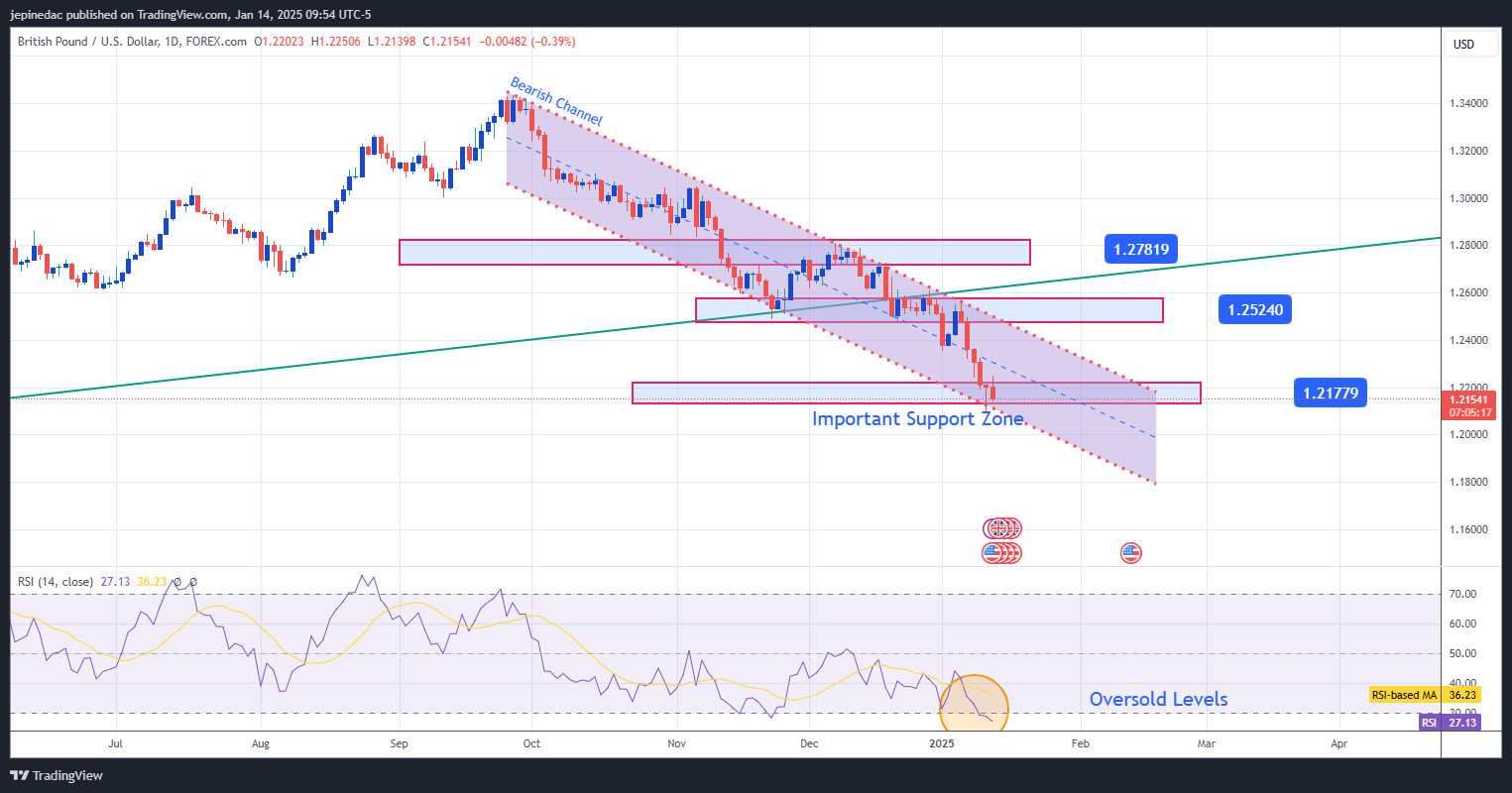

The GBP/USD has logged six consecutive sessions of losses, reflecting the pound's significant weakness. The bearish trend has notably accelerated in the short term.

Source: StoneX, Tradingview

- Bearish Channel: The pair is currently following a clearly defined bearish channel since the September 2024 highs. The strong selling trend has pushed the price to the lower boundary of the channel. If this level is breached, imbalances between supply and demand could trigger temporary bullish corrections.

- RSI Oversold: The RSI has fallen below the 30 level, signaling an oversold condition in the market. This could indicate that the bearish trend has been too steep in the short term, increasing the likelihood of bullish corrections around the current support zone.

Key Levels:

- 1.21779: The most important support level, corresponding to levels of indecision in 2023 and aligned with the lower boundary of the current bearish channel. Sustained oscillations below this level would reinforce the bearish outlook for the coming sessions, intensifying the downtrend on the chart.

- 1.25240: The nearest resistance, located in a neutral zone identified in December 2024 and aligned with the upper boundary of the bearish trendline. Bullish movements toward this area could jeopardize the continuation of the bearish channel and provide an opportunity for a new buying phase in GBP/USD.