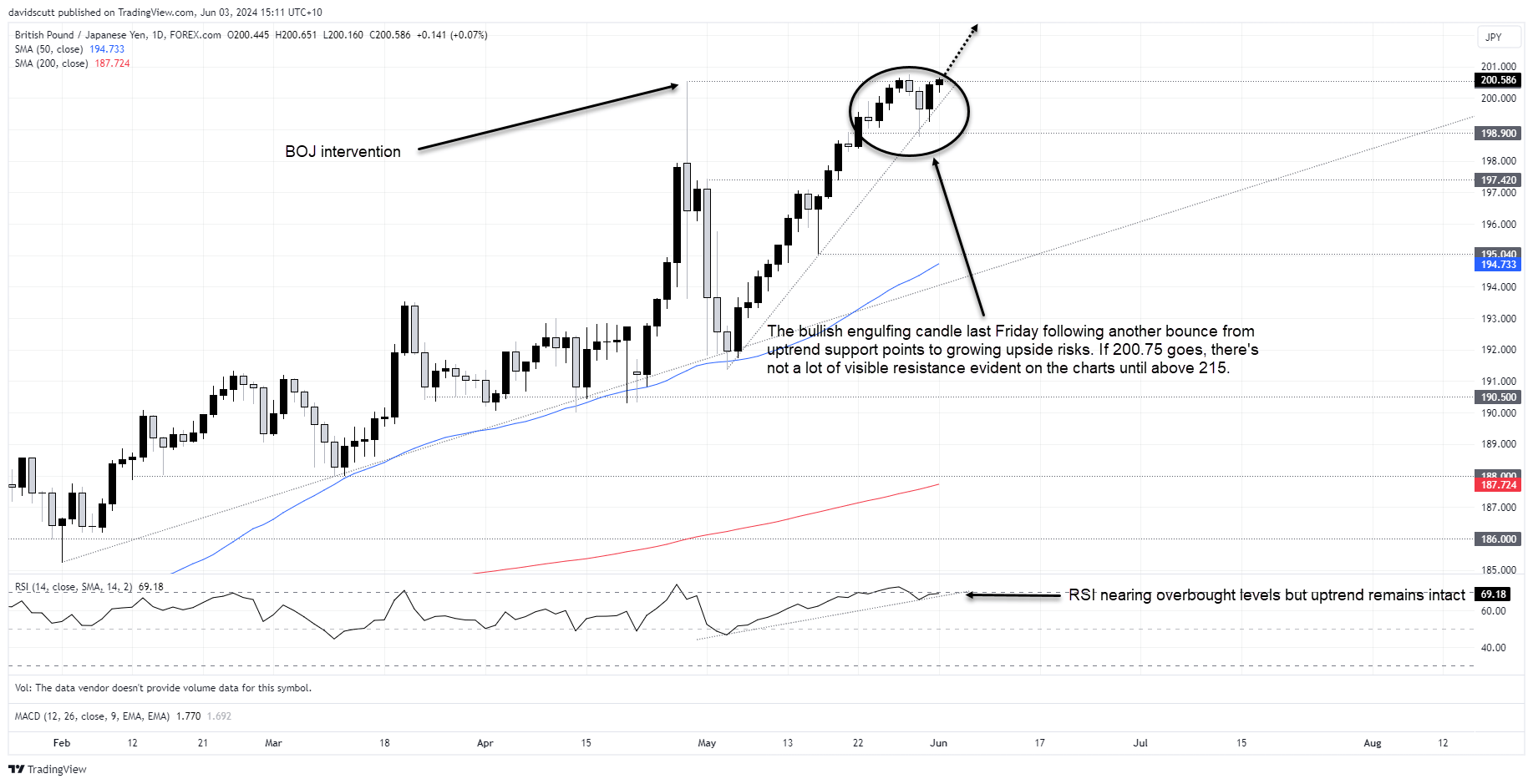

GBP/JPY is coiling up and primed to fire, sitting in a strong uptrend while bumping up against horizontal resistance dating back to when the Bank of Japan initiated a record FX market intervention to support the Japanese yen in April.

The daily chart below tells the story, showing that after retracing to the low 190s once the intervention episode concluded, GBP/JPY has been squeezing higher, gaining over eight big figures from early May within a broader uptrend.

The uptrend was tested on both Thursday and Friday last week, with the latter sparking a strong reversal which delivered a bullish engulfing candle. Heading into the London open on Monday, resistance above 200.55 is managing to cap gains for now. However, should the pair managed to clear 200.75 – the high set on May 29 – it may encourage further upside should traders look to buy the break.

If 200.75 does go, you could look to enter longs with a stop below 200.55 for protection. There’s very little in the way of visible technical resistance until above 215, meaning selecting big figures for your trade target may be advantageous. Should the price move in your favour, consider raising your stop to entry level or higher, allowing for a free hit on upside.

While there are numerous risk events to navigate this week, the calendars in the UK and Japan are comparatively quiet, leaving nonfarm payrolls, the ECB rate decision and ISM services PMI as the key releases to consider.

For those considering a long GBP/JPY position, a risk positive environment where there’s no significant adjustment to the US interest rate outlook would be an ideal backdrop, allowing for yield differentials and carry trade flows to continue.

-- Written by David Scutt

Follow David on Twitter @scutty