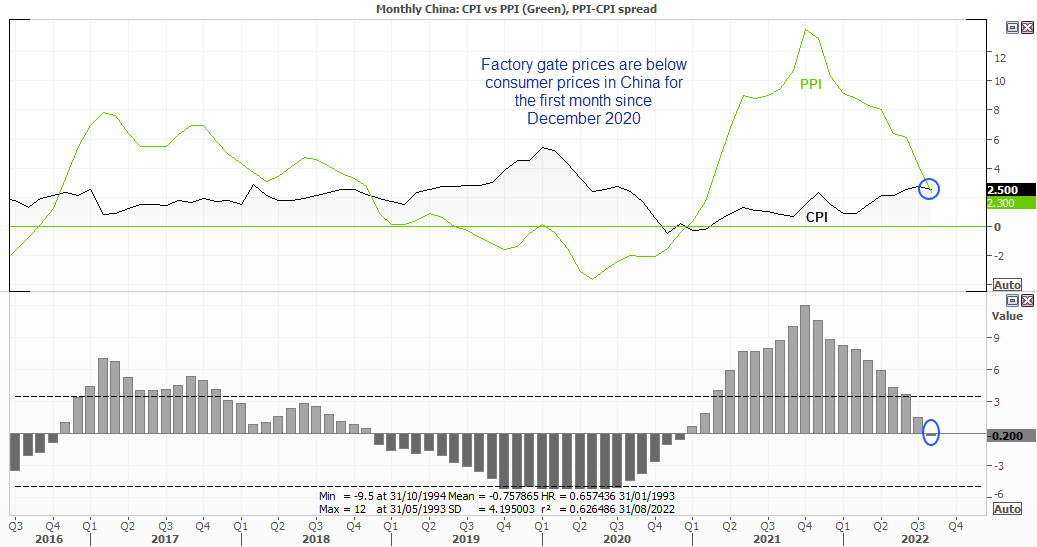

Factory prices in China (also known as producer prices or PPI) rose just 2.3% y/y in August, its slowest rate of inflation since February 2021. It was also the first month producer prices were below consumer prices (CPI) since December 2020. Yet CPI also softened slightly from to 2.5% y/y, down from 2.7%. With PPI being a key input for consumer prices, it suggests less upside pressures for consumers. Yet it also points to weaker growth prospects for China which has already seen analysts downgrade their forecasts for 2022.

Trade data earlier this week revealed that imports rose just 0.3% y/y, although two obvious factors for demand are the weaker yuan and COVID restrictions. Yet the weaker currency has not helped to support exports, which rose just 7.1% compared with the 12.8% expected. Ultimately it points to lower growth for China, but does bring hope of peak inflation globally.

How CPI impacts forex

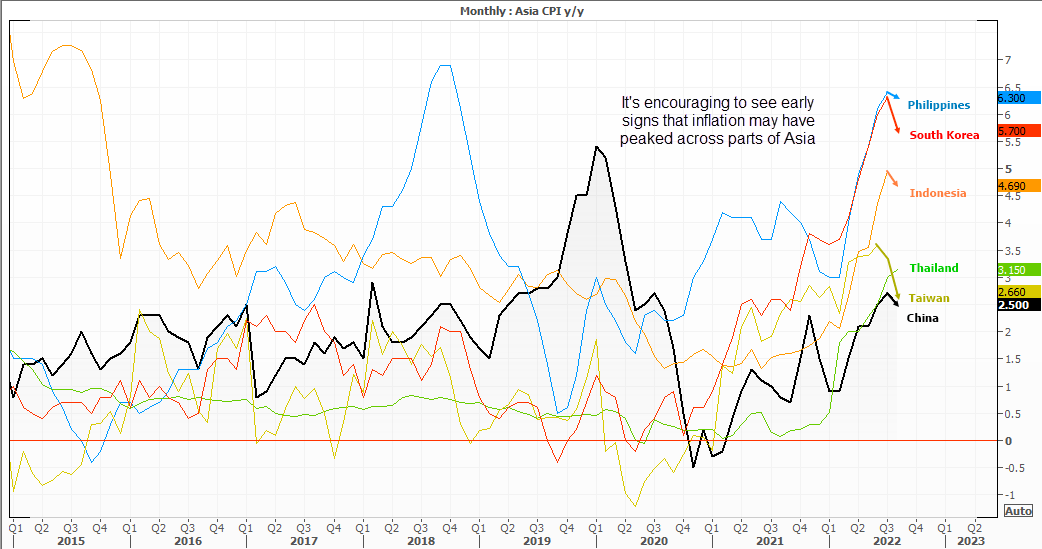

Early signs if disinflation across parts of Asia

We can also see that early signs of disinflation are apparent across other parts of Asia. Disinflation means that prices are still rising (positive) but at a slower rate, and not to be confused with deflation which are when prices are moving lower (negative).

A quick look at some Asian inflation prints also shows that:

- South Korea’s inflation rose 5.7% from a peak of 6.3% - its -0.6 point drop was its most disinflationary since October 2020.

- Taiwan’s annual inflation softened by 0.7% in August – its most disinflationary month since April 2020.

- Philippines annual inflation softened for the first month in seven.

- Indonesia’s annual inflation softened -0.25% in August, which is its largest monthly decrease since June 2021.

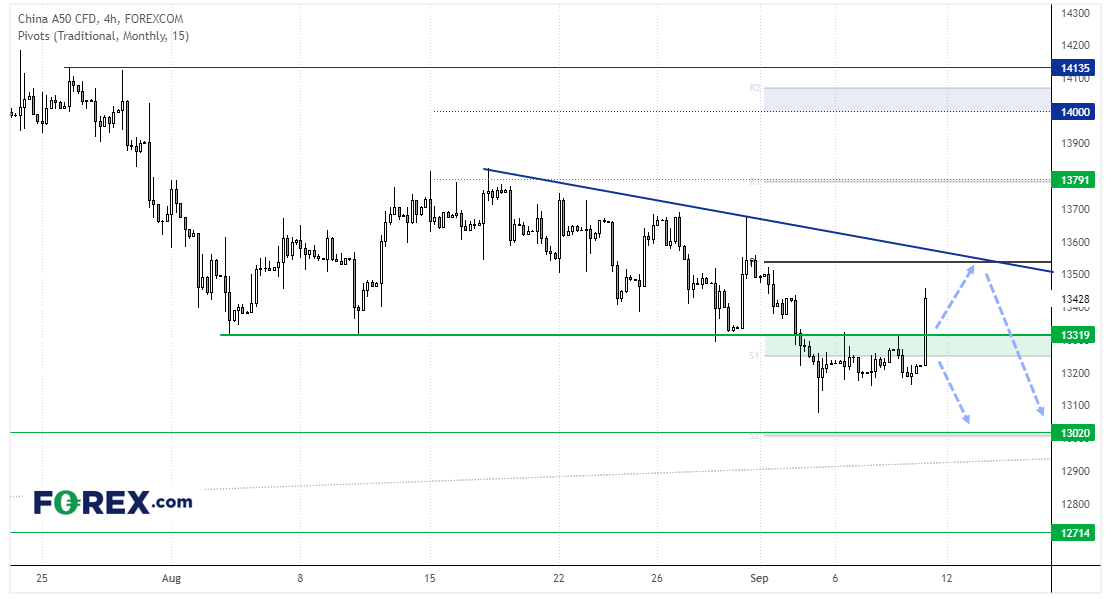

China’s equities rally on hopes of further stimulus

With data for China remaining fragile and pointing towards weaker growth, with it comes hopes that further stimulus will arrive. That has seen China’s benchmark indices lead the Asian session today, with the Hang Seng rising around 2.5% and the China A50 up around 1.3%.

A bullish spike on the China A50 took prices above 13,320 resistance, yet there has been a lot of choppy trading within the 13,320 – 13,800 range since the end of August. For the near-term, intraday traders could consider bullish setups above 13,320 and target trend resistance or the monthly pivot point around 13,350. But until we see a clear trend develop, range-trading strategies are preferred (fade into resistance, bullish setups around support).

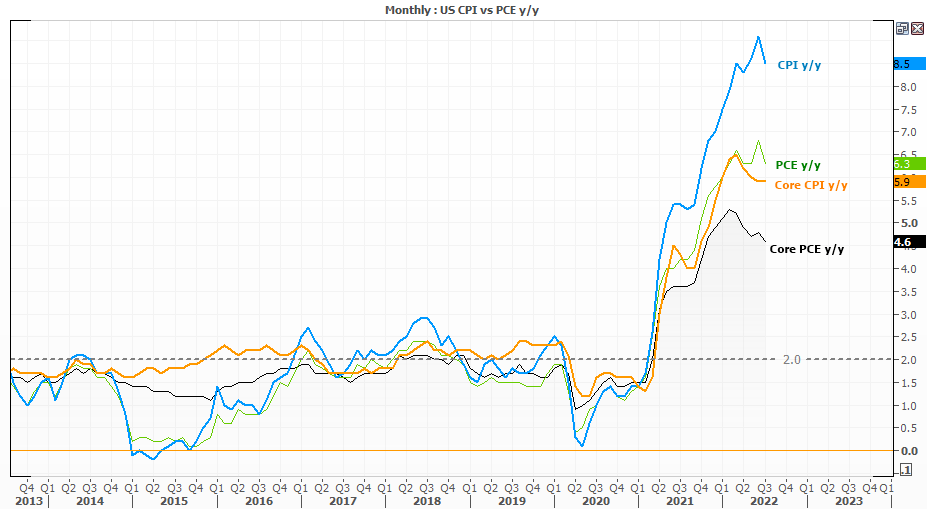

US CPI data in focus on Tuesday

Clearly, inflation remains too high for many central banks - but it is a step in the right direction. And if export nations such as South Korea, Taiwan and China are seeing softer prices then it bodes well for their trading partners, such as the West.

We have US inflation data on Tuesday to look forward to. And with core commodities. market-based inflation expectations and prices paid by US companies pointing lower, the Fed have some more breathing room should realised inflation move lower. (Not that it will prevent them from hiking rates by 75bp this month of course).

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.