- FTSE analysis: Time for UK benchmark index to join global stock market rally

- Soft UK GDP data raises expectations of BoE rate cuts

- Fed expected to hold, market watching for policy clues

The under-performing FTSE managed to bounce modestly off its earlier lows as the pound fell after data showed the UK economy shrank more than expected, prompting traders to ramp up bets on Bank of England interest-rate cuts next year. Investors here are keeping an eye out on the Federal Reserve rate decision today, before the focus turns to the BoE (and ECB) on Thursday. The pressure is building for a more meaningful rally. Could that start today?

FTSE analysis: Can UK stocks join global rally?

Held back by recent gains in the pound and falling crude oil prices, as well as a struggling Chinese market, the FTSE has missed out on the big rally we have seen in other European and US indices in recent weeks. The DAX in particular has been very strong, setting new record highs this week. On Wall Street, the major indices have been inching closer to their old highs. Both the mainland European and US indices have been supported by expectations of interest rate cuts in 2024.

Yet, the UK’s benchmark index has barely moved higher. But now, markets have factored in almost 100 basis points of easing in 2024 from the BoE. Three quarter-point cuts were already factored in, but ow there is an 85% probability of a fourth cut. The first cut is seen around June but could come sooner if inflation weakens sharply in the next few months.

Prices could fall back rapidly due to the fact the economy is very soft with subdued activity across the key sectors. The bigger-than-expected 0.3% drop in monthly GDP and 0.5% fall in construction output we saw earlier today suggests the BoE’s tight policy is choking the economy.

The latest repricing of interest rates aligns BoE expectations more closely with those for the Federal Reserve, which is anticipated to reduce borrowing costs by at least one percentage point in the next year. The FOMC is set to announce its policy decision later on Wednesday, followed the BoE’s MPC on Thursday.

FTSE technical analysis

Source: TradingView.com

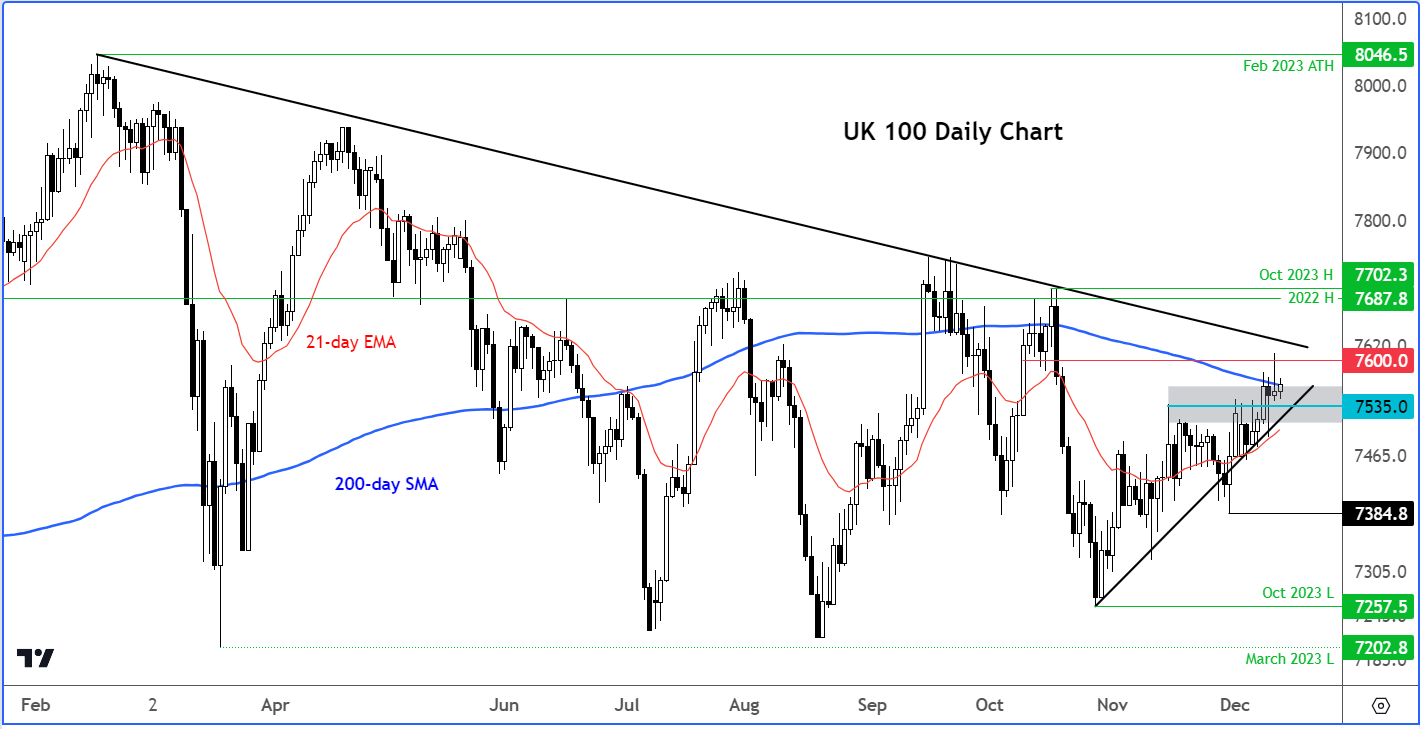

So, the FTSE hasn't been joining the party like other European and US stock markets lately. It needs to start playing catch-up and step up its game. There were some good technical indications happening recently. The FTSE climbed back above the 21-day moving average and pushed through several short-term resistance levels. A bullish trend line has been established, connecting these interim higher lows.

The index has been testing the 200-day average around 7560/70 area in the last few days. So far, it has not been able to break through it. But the ongoing global stock market rally suggests there is a decent chance we could see a rally through the 200-day average soon. There’s also an additional resistance in the 7600-7620 range, where we also have a bearish trend line converging.

The slow grind higher suggests the FTSE is potentially gearing up to break higher in the coming days. Even though the UK index has been making lower highs all year, it hasn't really taken a big hit. It's been hanging out in a wide range without diving too deep. Surprisingly, it's stayed above the March low of 7202, even when there were a couple of bearish attempts to break that level—twice during the summer and once in October. The fact that it's holding up well despite all the big risks out there suggests it might be ready to go up more meaningfully soon.

-- Content created by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R