As we noted in our FOMC preview report on Monday, the Federal Reserve was never likely to make any immediate changes to monetary policy at today’s meeting, and that was before fears of Chinese property developer Evergrande collapsing under the weight of its massive debt load reached critical mass this week.

So it certainly wasn’t a surprise that Jerome Powell and company left interest rates and asset purchases unchanged at today’s meeting, but we certainly did get an elusive taper “hint.” In it’s statement, the central bank noted that, “if progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted.”

In a phrasing even the notoriously opaque Alan Greenspan would admire, Jerome Powell and company managed to meet the market’s expectations with a nod toward normalizing monetary policy in the near future… without necessarily committing to starting the process at its next meeting in November.

(…at least, in the official statement – more below!)

Beyond that there were three other key aspects of the meeting for hints about how monetary policy will evolve from here:

1) The monetary policy statement

Beyond the aforementioned taper hint, there was only one noteworthy tweak to the Fed’s monetary policy statement: The committee inserted a nod to the impact of COVID-19 cases slowing the recovery in certain sectors. Needless to say, this minor update was not a meaningful market mover.

2) The summary of economic projections (SEP)

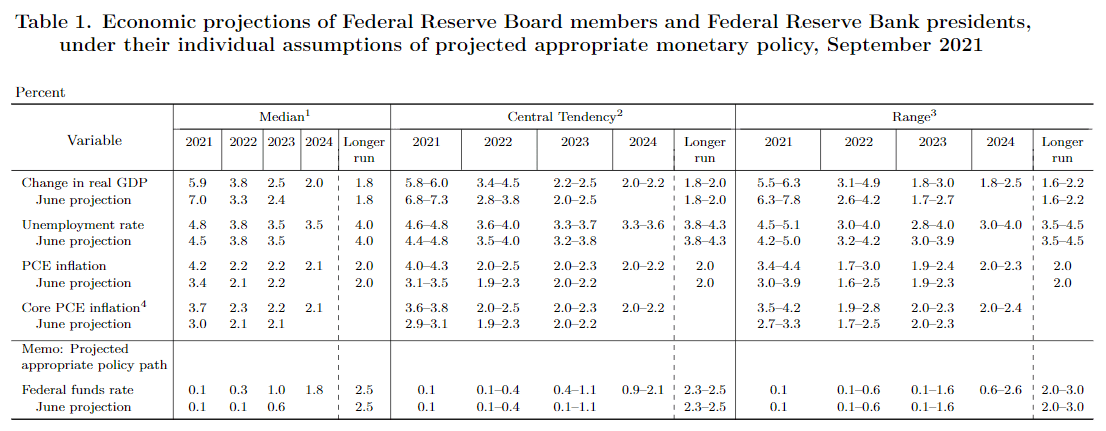

Thankfully, the accompanying update to the FOMC’s quarterly economic projections was a bit more interesting. The closely-scrutinized “dot plot” of interest rate projections showed an even split between Fed officials (9) who see interest rate liftoff in 2022 and those who see it later than that (9, with 8 of those projecting the first interest rate hike in 2023).

Separately, the median Fed official also increased his or her projection in the following ways:

- Real GDP growth now projected lower in 2021, higher in 2022 and moderately higher in 2023

- Unemployment now projected higher in 2021 and lower in both 2022 and 2023

- Core PCE inflation now projected higher in 2021, 2022, and 2023

Source: FOMC Summary of Economic Projections

On balance, these tweaks point to expectations for a US economic recovery that is posied to play out over multiple years, rather than continuing at a breakneck pace for just 12-18 months.

3) Chairman Jerome Powell’s press conference

Fed Chairman Powell is still speaking as we go to press, but the early highlights from his press conference clearly suggest that he’s leaning toward November taper announcement:

- VERY BROAD FOMC SUPPORT ON TIMING, PACE OF TAPER

- TAPER ENDING AROUND MID-2022 MAY BE APPROPRIATE

- ASSET BUYS STILL HAVE USE, BUT TIME TO BEGIN TAPER

- IF ECONOMY PROGRESSES AS EXPECTED, MAY MOVE AT NEXT MEETING

Reading between the lines, these comments suggest that Fed may have been within a vote or two of starting the taper process at this month’s meeting, a more hawkish development than many were anticipating.

See my colleague Joe Perry's upcoming report for analysis of how these developments are impacting markets!

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log-in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.