If Jerome Powell and company were on the fence about whether or not to signal that the Fed would start tapering soon, fears of debt contagion in the world’s second-largest economy (and today’s attendant -2% drop in major US indices) will no doubt push them toward a more cautious, noncommittal outlook.

Even putting aside global risks, recent US domestic data has decreased the urgency for the Fed to start tapering asset purchases; this month alone, the lackluster 235K reading on the August NFP report, combined with the CPI inflation rate moderating slightly to “just” 5.3% year-over-year (and the “core” CPI reading falling to 4.0%), means neither aspect of the US central bank’s dual mandate may be pressing enough for the Fed to indicate that it will start normalizing policy immediately. That said, there are still many diverse viewpoints within the Fed’s policymaking committee, so a surprise taper hint can’t be completely ruled out.

Check out our primer on tapering to see why it is so significant for traders and investors!

FOMC meeting: What to watch besides taper talk?

Separately, the Fed will also issue its quarterly economic projections, including 2024 estimates for the first time. Most traders and economists expect the median “dot” for interest rate liftoff from near-0.00% interest rates to remain in 2023, though it would only take a couple members growing a tad more hawkish to flip the median “dot” to next year.

The central bank will also provide an update on how it sees economic growth, unemployment, and inflation evolving over the coming years; despite the Fed’s historically poor track record of economic projections, any tweaks to those forecasts will no doubt be closely scrutinized for hints about what way the monetary policy winds are blowing.

Market to watch: GBP/USD

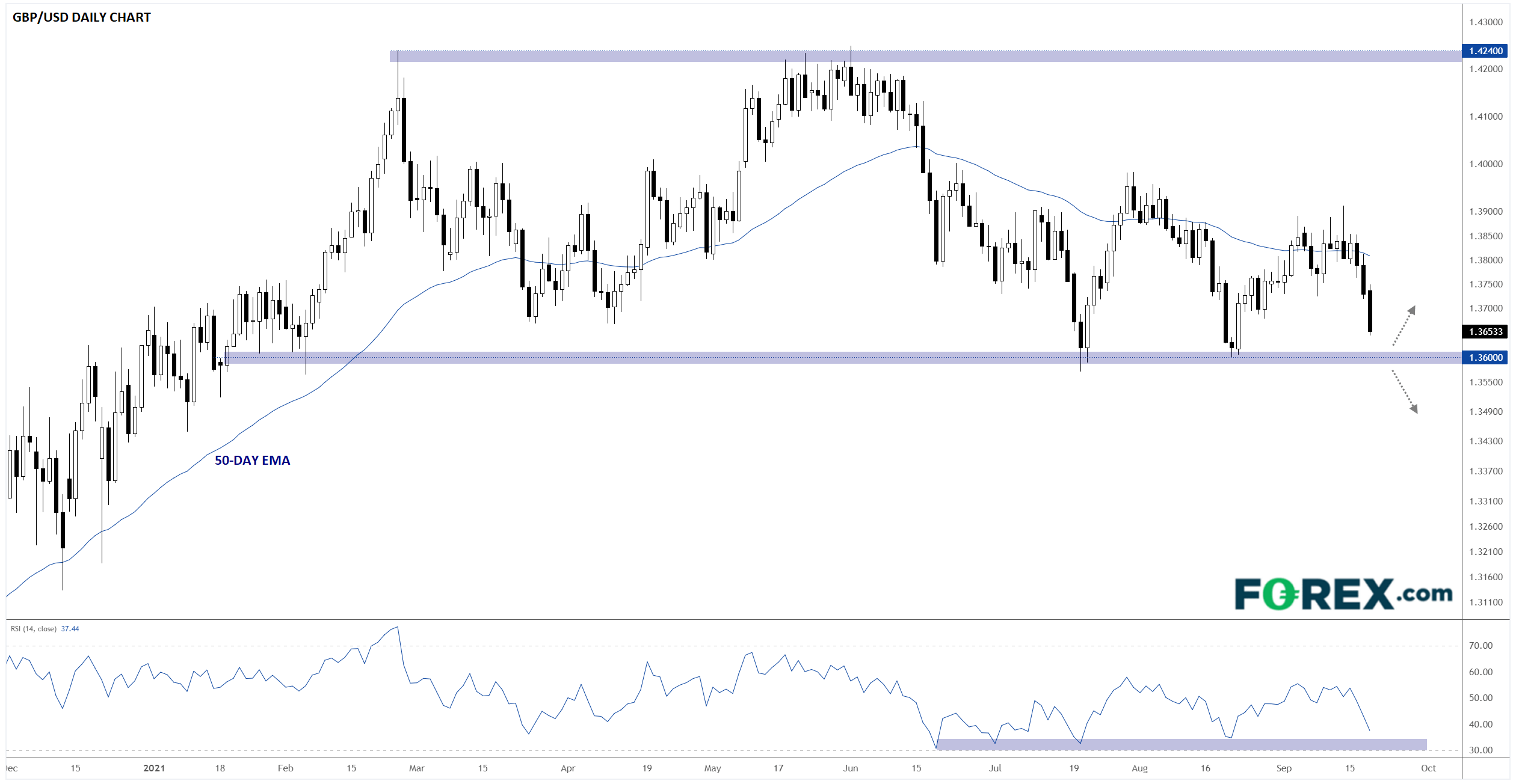

To be clear, the US dollar is likely to see a reaction across the board if there are any surprises from this week’s FOMC meeting, but GBP/USD is one pair that is approaching a particularly significant level. Since mid-January, cable has consistently found support near the 1.3600 handle, including multi-hundred-pip bounces in both July and August.

With rates once again approaching that key level, Wednesday’s FOMC meeting may determine whether we see yet another bounce or finally break through that floor. If we see a hawkish outcome from Powell and company (optimistic economic projections, hints of a taper announcement as soon as next month, etc), bears could push GBP/USD down through support at 1.3600 and expose 1.3400 or lower in the coming days. Meanwhile, a more dovish outcome (downbeat economic projections, no taper hints, etc) could provide support to GBP/USD and lead to another bounce back toward 1.3800 or higher.

Source: TradingView, StoneX

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log-in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.