- Gold is hanging tough on the charts despite growing fundamental headwinds

- It’s being heavily influenced by the US dollar right now

- If the Fed continues to signal three rate cuts in 2024 when it meets next week, it may trigger another wave of buying

Gold traders have a decision to make with fundamental headwinds building from a stronger US dollar and higher bond yields with the price yet to meaningfully respond.

Headwinds grow from higher bond yields, US dollar

Having rocketed to record highs last Friday on the back of a softer dollar and declining US bond yields, the tailwinds for gold have since reversed with hotter-than-expected US CPI and PPI figures seeing markets pare 2024 rate cut expectations ahead of the Federal Reserve’s FOMC meeting next week.

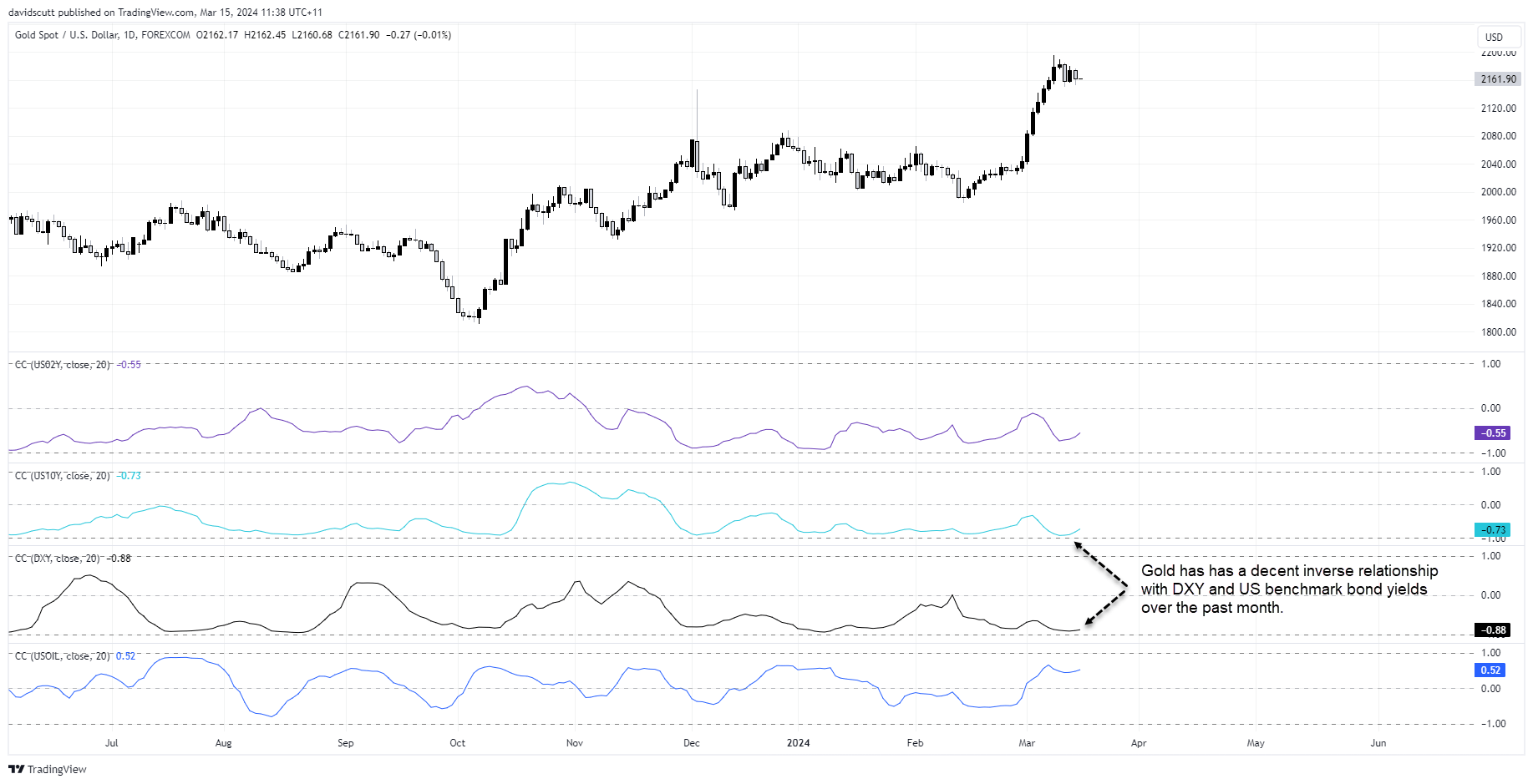

Looking at the rolling correlation gold has had with US bond yields and dollar on the daily chart over the past month, it’s clear the strongest relationship has been an inverse one with the US dollar index (DXY) at -0.88. Over the same timeframe, there’s also been a decent inverse relationship with US 10-year yields at -0.73. The relationship with short-end US yields and crude oil have been nowhere near as strong.

Yet gold is holding up

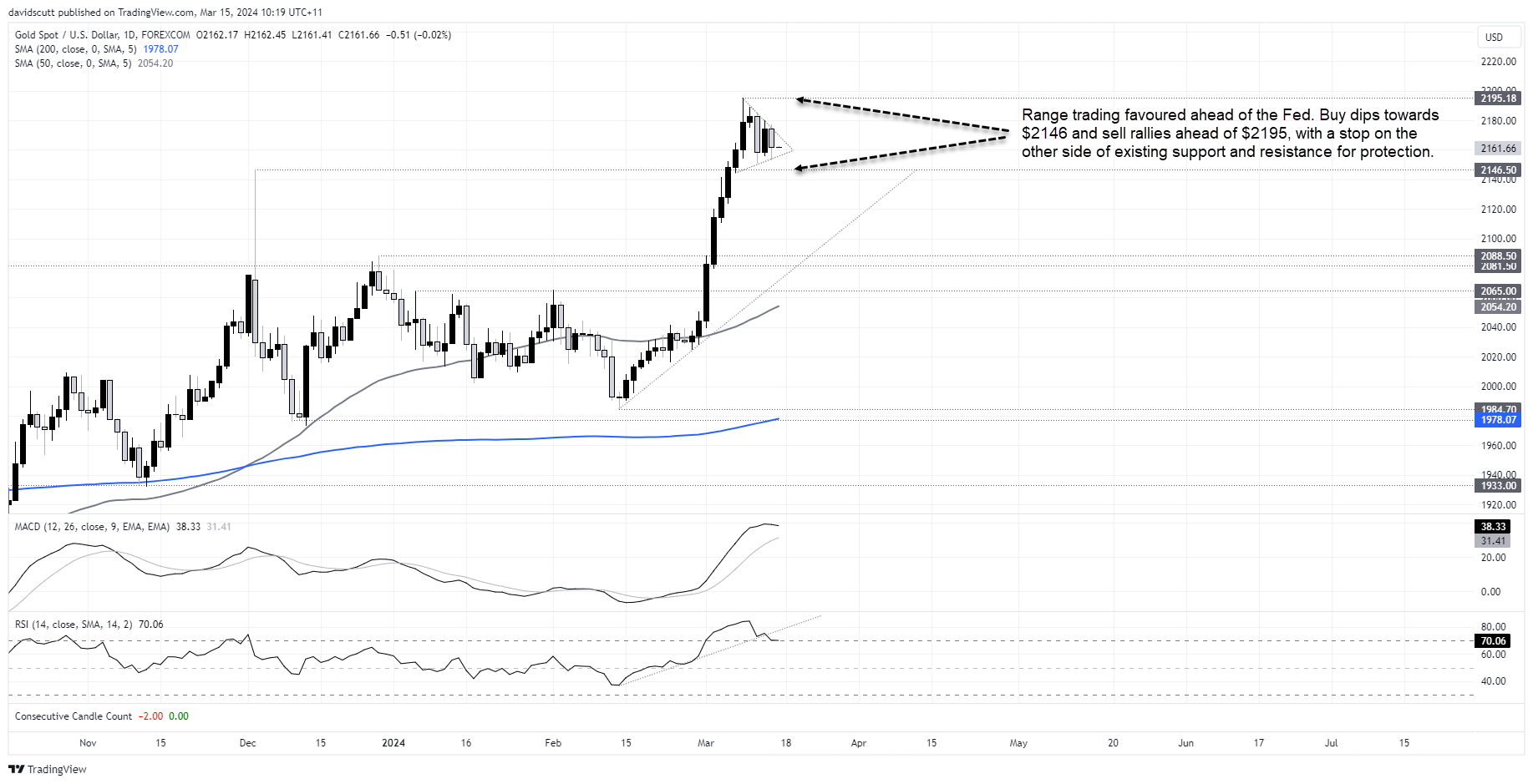

With DXY and US long bond yields lifting over the past week on the back of stronger US inflation reports, it comes as no surprise that gold’s upside thrust has stalled. But considering the scale of the moves, it’s somewhat surprising gold hasn’t been hit harder, especially given how overbought it had become on a variety of momentum metrics. Even now, RSI on the daily suggests gold remains overbought.

Will the Fed finish the inflation fight?

As discussed in an earlier note, a factor that may explain gold’s resilience to its traditional adversaries may be growing unease about the commitment of the Federal Reserve to bring inflation back to its 2% mandate, a hypothesis bolstered by market expectations for inflation continuing to push further away from the target since the middle of February.

We’ve now seen two months in a row of hotter-than-expected US inflation, demonstrating the challenge in not only cooling inflation but keeping it that way. Yet every Fed speaker we heard prior to the media blackout before next week’s FOMC meeting continued to discus rate cuts. This tension between what markets are thinking and what the Fed has been saying has been spilling over into other markets recently, including commodities.

That’s why next week’s FOMC meeting is important, providing an opportunity for the Fed to show commitment to completing the inflation fight through its statement and updated dot plot projections, along with Jerome Powell’s press conference.

The answer may determine gold’s next move

Even though momentum in the US economy appears to be waning, the latest inflation prints make it difficult for the Fed to justify keeping the three rate cuts it signaled for 2024 Back in December. Given it would only take a couple of FOMC members to change their forecasts from three cuts to two to move the median projection higher, there’s a growing risk that scenario will eventuate. I’d be as bold to call it likely. But if there’s not a hawkish tilt in the latest set of projections, with three cuts still projected, it could easily spark a new round of upside for inflation expectations and gold.

That may explain gold’s reluctance to unwind before the Fed – unease at its commitment to “walk the last mile”.

Gold coiling up

Sitting in a symmetrical triangle pattern after entering from below, convention suggests upside risks are there despite the bearish outside day candle earlier this week. Yet fundamentals, along with waning upside momentum as shown with MACD starting to rollover and RSI breaking its uptrend, suggest the exact opposite. It’s not an easy decision for traders to buy or sell right now.

It wouldn’t surprise to see the price trade through the triangle with the Fed just ahead, pointing to the potential for range trade between $2146 and $2195 over the next few days. But depending on what the Fed signals next week, continuing to suggest three rate cuts this year will likely greenlight a new wave of buying, propelling gold to new highs.

-- Written by David Scutt

Follow David on Twitter @scutty