US Dollar Outlook: EUR/USD

EUR/USD slips to a fresh weekly low (1.1033) as the ADP Employment report shows a 143K rise in September versus forecasts for a 120K print, and a close below the 50-Day SMA (1.1040) may warn of a further decline in the exchange rate as it no longer responds to the positive slope in the indicator.

EUR/USD Vulnerable on Close Below 50-Day SMA

The opening range for October is in focus for EUR/USD as signs of a resilient US labor market casts doubts for another 50bp Federal Reserve rate cut, and the exchange rate may continue to give back the advance from the September low (1.1002) as it carves a series of lower highs and lows.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Meanwhile, the European Central Bank (ECB) may come under pressure to further support the Euro Area as the Consumer Price Index (CPI) narrows more-than-expected in September, with the headline reading falling to 1.8% from 2.2% per annum the month prior.

At the same time, the core CPI slipped to 2.7% from 2.8% during the same period, and evidence of easing inflation may push the ECB to deliver another 25bp rate cut as the Governing Council pledges to ‘follow a data-dependent and meeting-by-meeting approach to determining the appropriate level and duration of restriction.’

With that said, the Euro may face headwinds ahead of the next ECB meeting on October 17 as inflation falls below 2% for the first time since 2021, but the exchange rate may hold within the September range if it struggles to close below the 50-Day SMA (1.1040).

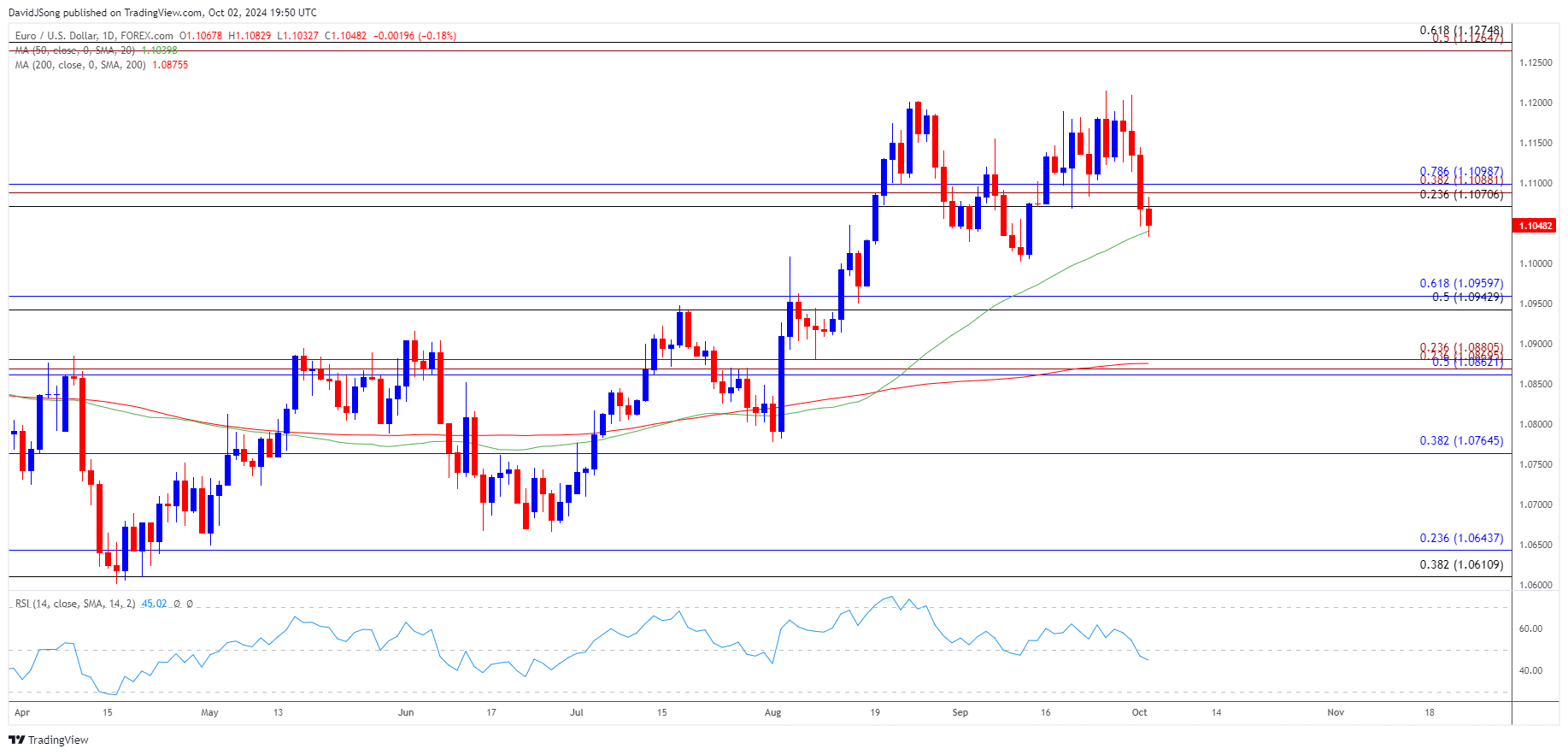

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD carves a series of lower highs and lows as it trades to a fresh weekly low (1.1033), and a close below the 50-Day SMA (1.1040) may push the exchange rate towards the September low (1.1002).

- Next area of interest comes in around 1.0940 (50% Fibonacci retracement) to 1.0960 (61.8% Fibonacci retracement) but EUR/USD may attempt to track the positive slope in the moving average if it fails to close below the indicator.

- Need a move back above the 1.1070 (23.6% Fibonacci retracement) to 1.1100 (78.6% Fibonacci retracement) area for EUR/USD to negate the bearish price series, with a breach above the monthly high (1.1144) bringing the yearly high (1.1214) on the radar.

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong