- The US Dollar Index (DXY) is approaching its yearly support trends

- The June CPI release is expected to influence market volatility and rate cut expectations

- DXY, EURUSD, and USDMXN analysis

The sustainability of the US disinflationary trajectory towards the Fed’s 2% inflation target will be tested today with the release of the June CPI indicator. The latest rate cut probabilities on the CME Fed Watch tool for September indicate a 68% chance for a target rate between 5.00 – 5.25% and a 3.3% chance for a target rate between 4.75 – 5.00%. These probabilities will adjust based on updates to the US inflation rate.

The latest bull trends of the market are currently on hold to proceed or reverse with respect to the upcoming CPI figures.

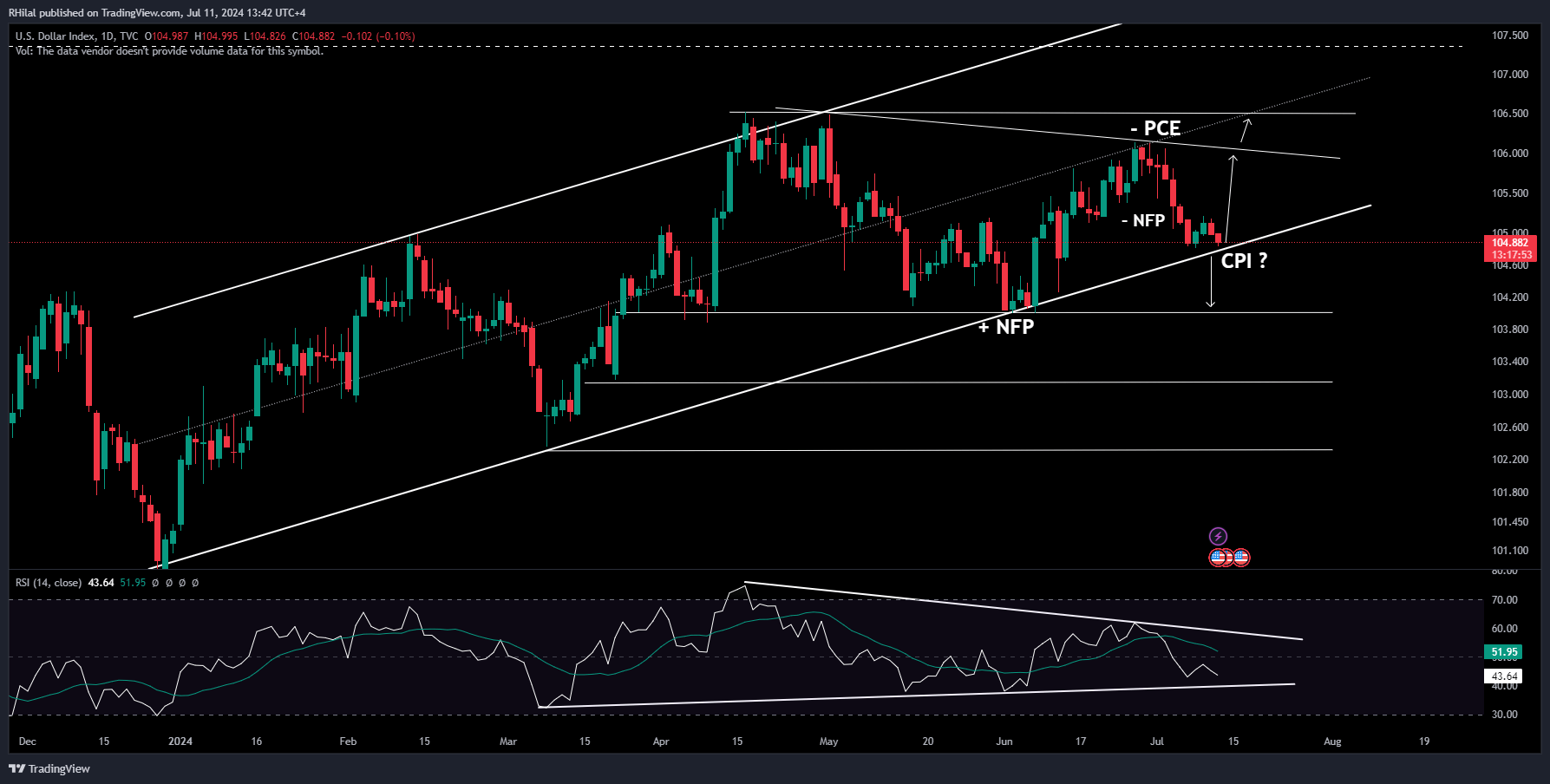

DXY – Weekly Time Frame – Logarithmic Scale

Source: Tradingview

The US Dollar is hovering near the trendline connecting its yearly lows. From a daily perspective, the Relative Strength Index (RSI) is narrowing within a contractionary range, suggesting potential volatility in either breakout direction. If the DXY breaks below its yearly trendline, the previous lows from June and March 2024 could act as potential support levels.

On the upside, positive CPI results could push the DXY back up towards the 106-zone aligning with the highs of June and April 2024.

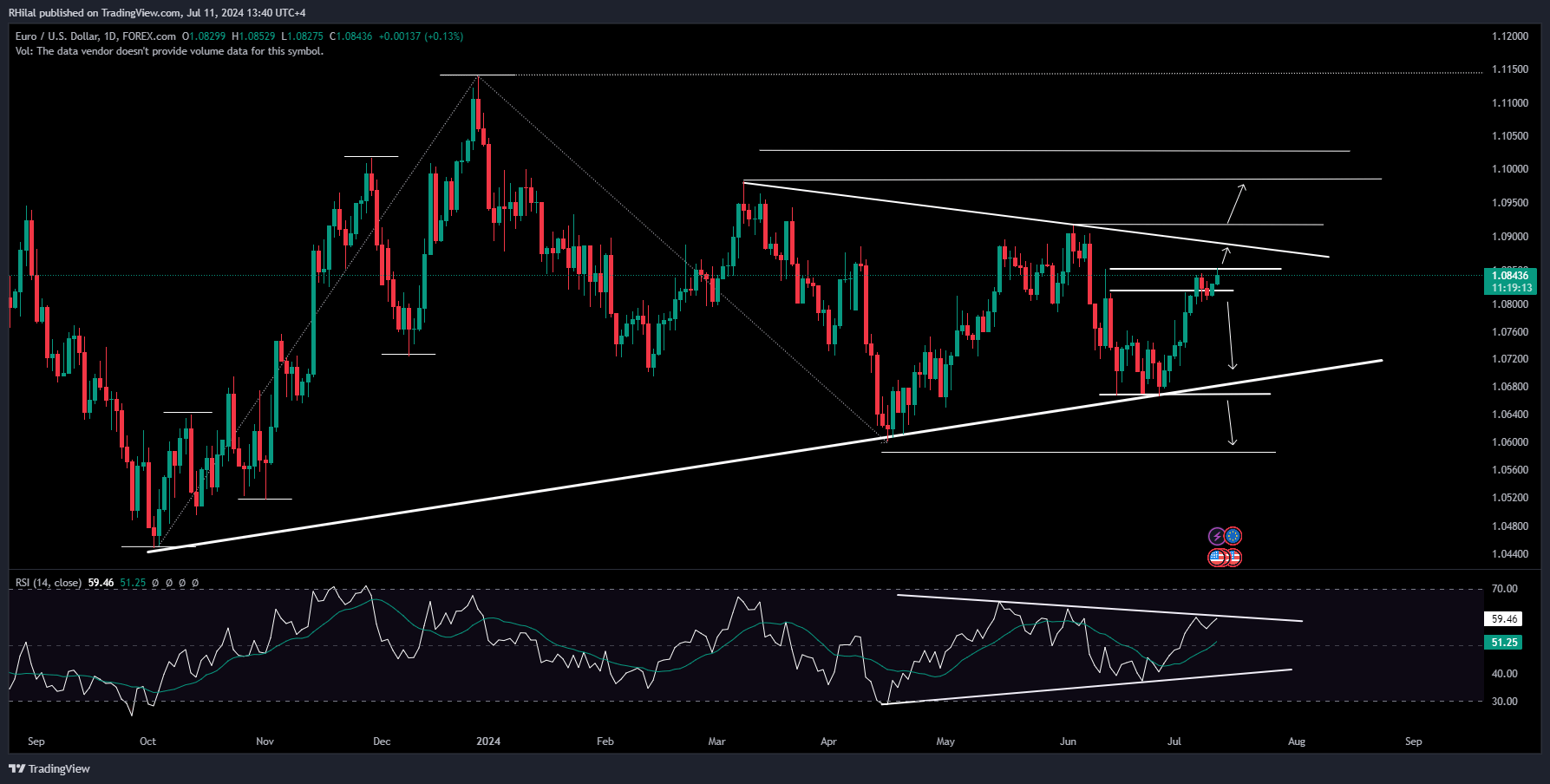

EURUSD: Daily Time Frame – Logarithmic Scale

Source: Tradingview

The EURUSD is currently aligned with a significant spike high recorded in June 2024 at the 1.0850 level. Cooling inflation data could drive the EURUSD above the 1.09 zone, targeting levels of 1.0920, 1.0980, and 1.1020.

Conversely, an increase in inflation data beyond market expectations could push the EURUSD back down towards the lower end of the 1.07 zone, with potential support levels at 1.0760, 1.0700, and 1.0667.

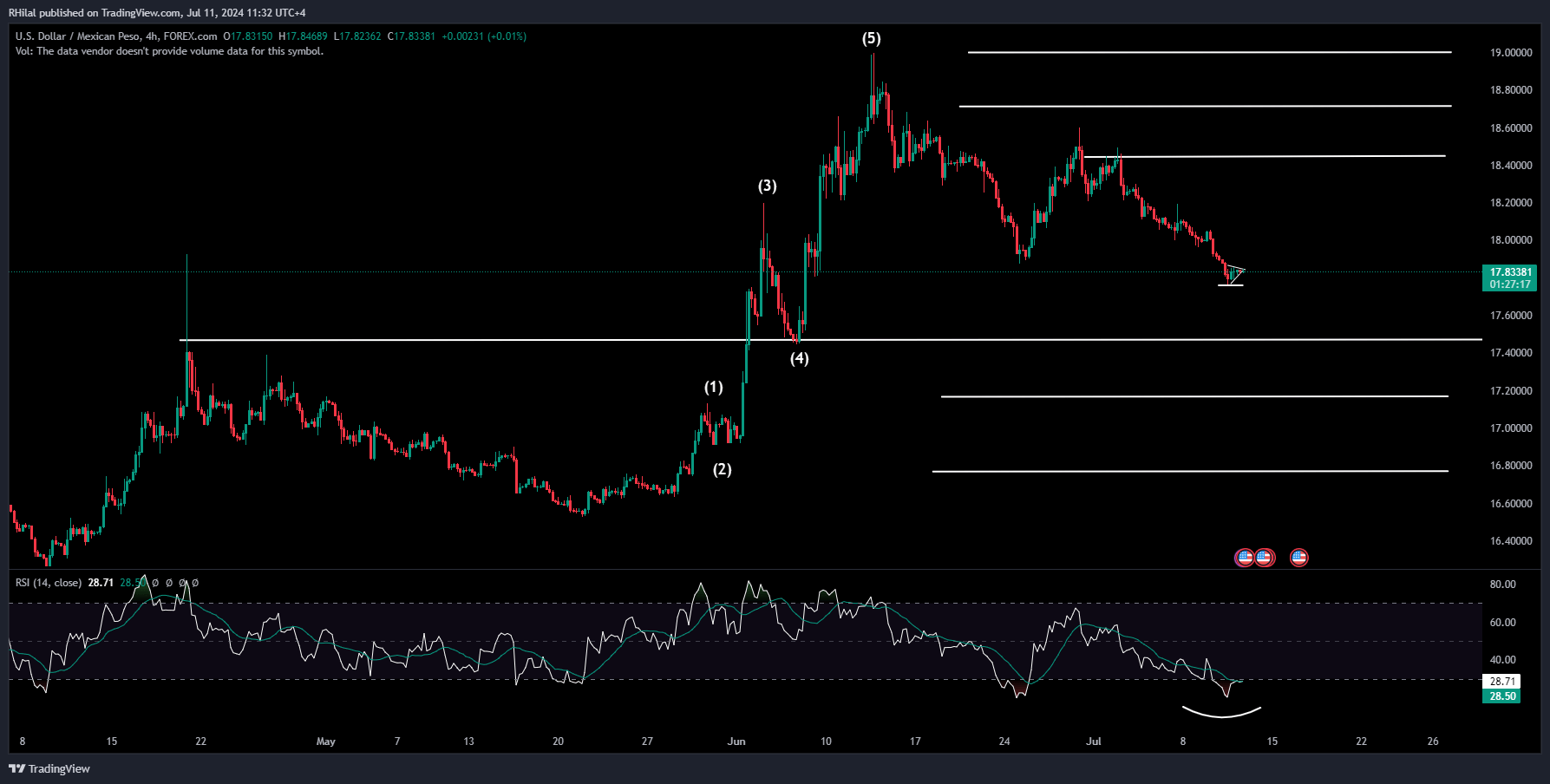

USD MXN Analysis: USDMXN – 4h Time Frame – Logarithmic Scale

Source: Tradingview

From a 4H perspective, USDMXN is trading with oversold momentum, as its Relative Strength Index (RSI) is trading below 30. From a price action perspective, a small consolidation near the 17.70 low is observed.

On the upside, upward breaks and positive momentum for the US Dollar could drive the uptrend back to the potential resistance levels of 18.44, 18.80, and 19.00.

On the downside, a break below 17.70 could meet a potential support near the 17.50 level, which aligns with:

- The 0.618 Fibonacci retracement of the trend extending between the May 2024 low and the June 2024 high.

- A previously respected resistance and support level, aligning with the previous trend’s 4th wave.

- The 100% Fibonacci extension of the drop from the high of June 2024.

In a more extreme scenario, a drop below 17.50 could lead the trend towards potential support levels near 17.20, 16.80, and 16.40.

--- Written by Razan Hilal, CMT