- The EUR/USD has been following a steady downward trend since late September 2024 and is now approaching a key support zone in 1.02624.

- The ECB’s vice president has mentioned a possible dovish outlook for upcoming decisions, which has further weakened the euro against the US dollar.

- The interest rate differential, with 3.15% in Europe and 4.5% in the United States, continues to create investment challenges for the euro and could maintain bearish pressure on the EUR/USD in the short term.

The EUR/USD has dropped over 8% from the peak levels seen in September 2024. The dollar's dominance over recent months has been consistent, and the euro’s weakness has been exacerbated by comments regarding potential interest rate cuts from European Central Bank (ECB) members.

De Guindos Comments

The ECB’s vice president, Luis de Guindos, recently stated that the disinflation process in the eurozone is progressing favorably in the short term. He also referred to pending economic data ahead of the central bank’s decision on January 30, which, if aligned with forecasts, could justify a sustained dovish outlook in the short term.

The ECB has cut interest rates four times during 2024, stabilizing them at 3.15%. Currently, inflation stands at 2.4%, and it is expected that in the upcoming Consumer Price Index (CPI) release, this figure will remain unchanged. This inflation level is already considered attractive compared to the ECB’s 2% target, supporting De Guindos’ remarks about a dovish stance for the next decision.

On the other hand, De Guindos expressed concerns about trade policies with the United States due to the upcoming presidency of Trump. He also mentioned geopolitical risks, such as the war in Ukraine, which could continue to impact economic activity in Europe. In this highly uncertain context for 2025, the ECB may further reduce interest rates in an environment of stable inflation and slower economic growth in the region.

The euro’s weakness against the dollar is attributed not only to the interest rate differential of 4.5% in the United States versus 3.15% in Europe, but also to the confirmation of a potential dovish outlook in Europe, contrasting with the current neutrality in the United States. For now, the market expects higher rates remain in the US, attracting capital away from the eurozone and exerting bearish pressure on the EUR/USD.

EUR/USD Technical Forecast

Source: StoneX, Tradingview

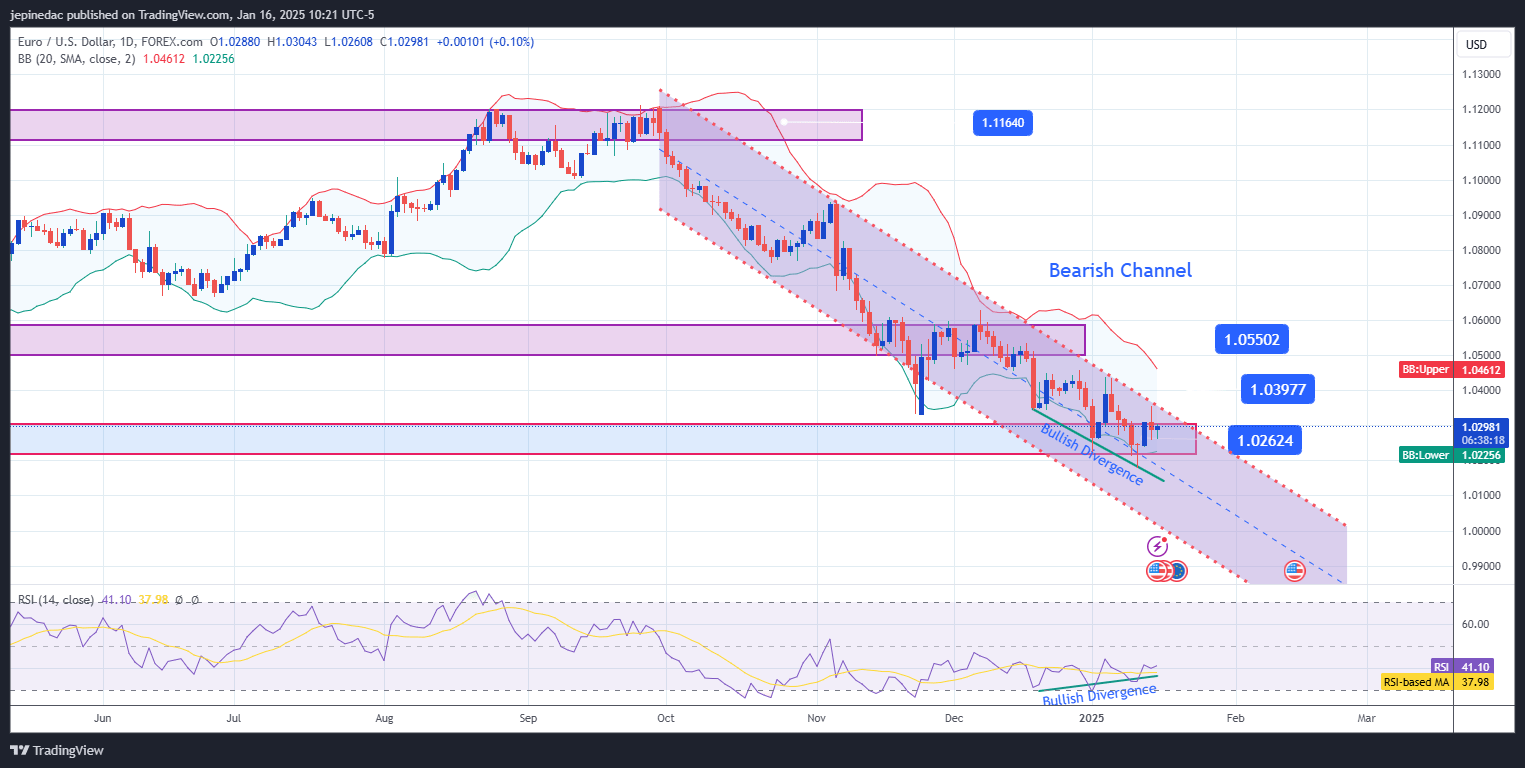

- Bearish Channel: Currently, the pair is following a clearly defined bearish channel from the September 2024 highs. The selling trend has been consistent in the short term, but the price is now facing a new support zone, whose break could confirm the channel’s bearish pressure in upcoming sessions.

- RSI Divergence: Los Lower lows in EUR/USD prices and higher lows in RSI values have indicated a short-term bullish divergence. This suggests that the current bearish momentum is losing strength based on the average of the last 14 periods, potentially signaling upward corrections, especially given the proximity to the current support zone.

Key Levels:

- 1.02624: This is the current support level on the chart and aligns with zones of indecision not seen since 2022. Persistent breaks below this level could confirm selling pressure and prolong the EUR/USD’s bearish channel.

- 1.03977: A nearby resistance zone corresponding to the last phase of consistent neutrality in price. This could be an attractive area for potential bullish corrections stemming from the RSI divergence.

- 1.05502: A crucial resistance level representing the November 2024 lows. Price movements nearing or crossing this level could mark the end of the bearish channel formation on the chart.

Written by Julian Pineda, CFA – Market Analyst