EUR/USD Outlook

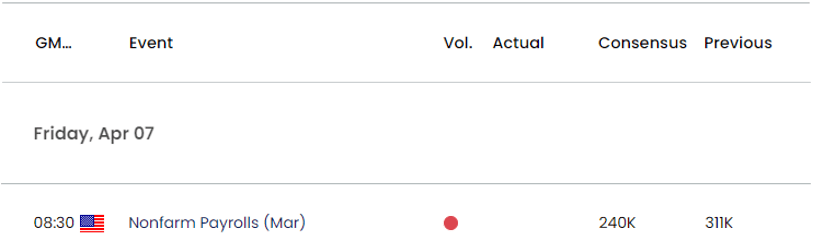

EUR/USD struggles to test the yearly high (1.1033) as it fails to extend the series of higher highs and lows from the start of the week, and the US Non-Farm Payrolls (NFP) report may drag on the exchange rate as the update is anticipated to show another rise in employment.

EUR/USD struggles to test yearly high ahead of NFP report

The near-term rally in EUR/USD appears to be stalling as it consolidates below the weekly high (1.0973), and developments coming out of the US may influence the exchange rate as Federal Reserve officials retain a hawkish outlook.

While speaking at New York University, Cleveland Fed President Loretta Mester recognized that ‘wages are still growing at an annual rate of about 4-1/2 to 5 percent,’ with the official going onto say that ‘inflation remains too high and too stubborn’ as price growth remains well above the central bank’s 2% target.

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

The comments suggest the Federal Open Market Committee (FOMC) may pursue a more restrictive policy as Mester reiterates that ‘some additional policy firming may be appropriate,’ and the update to the NFP report may push the Fed to implement higher interest rates as the economy is expected to add 240K jobs in March.

However, a weaker-than-expected NFP print may prop up EUR/USD as it fuels speculation for a change in the monetary regime, and it remains to be seen if the FOMC will continue to alter the forward guidance at the next interest rate decision on May 3 amid signs of a slowing economy.

With that said, the update to the NFP report may sway the near-term outlook for EUR/USD as the Fed seems to be nearing the end of its hiking-cycle, but the failed attempt to test the yearly high (1.1033) may lead to a near-term pullback in the exchange rate if it fails to hold above the monthly low (1.0788).

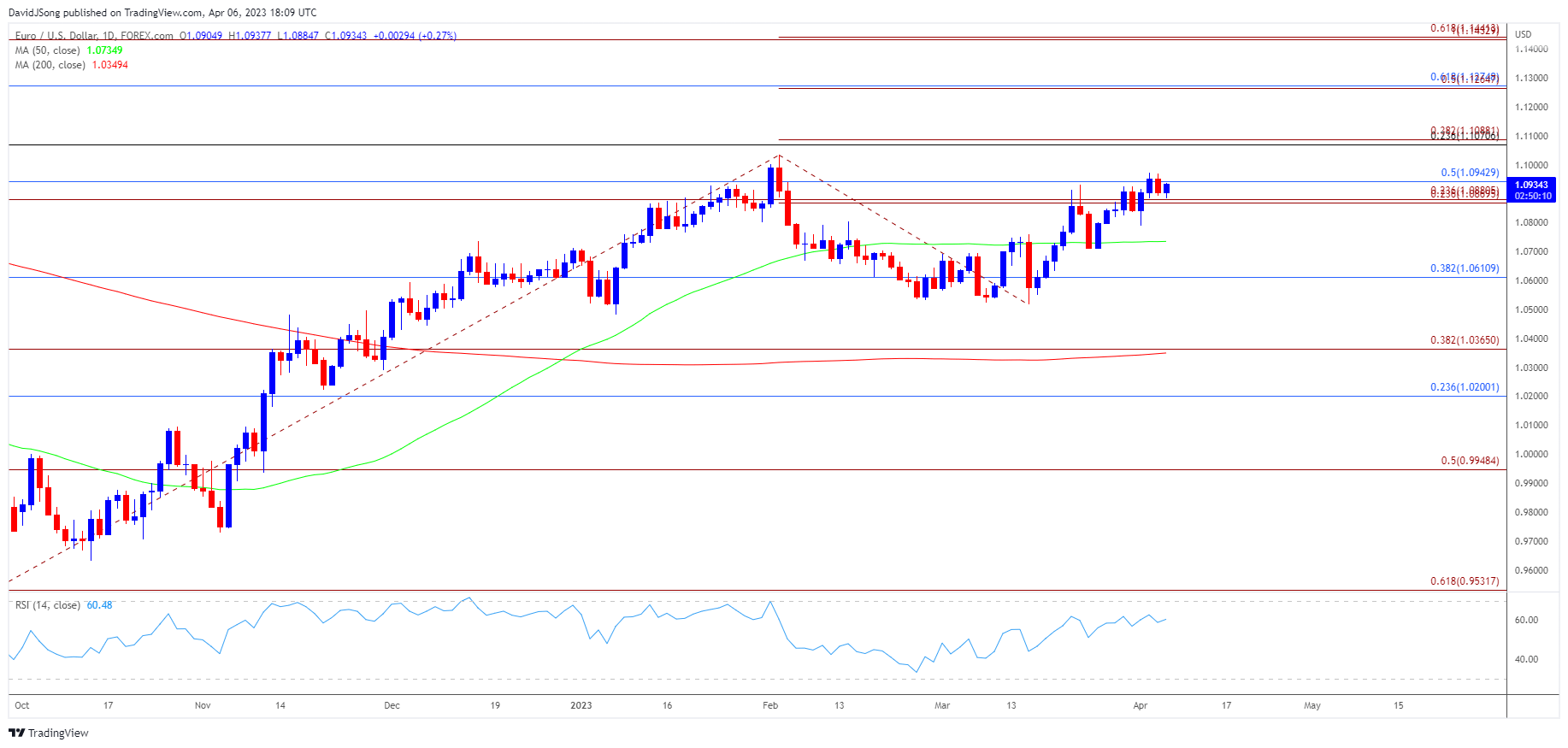

Euro Price Chart – EUR/USD Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD struggles to test the yearly high (1.1033) as it snaps the series of higher highs and lows from the start of the week, and the exchange rate may threaten the opening range for April if it fails to hold above the 1.0880 (23.6% Fibonacci extension) to 1.0940 (50% Fibonacci retracement) region.

- A move below the monthly low (1.0788) may push EUR/USD towards the 50-Day SMA (1.0735), with the next area of interest coming in around 1.0610 (38.2% Fibonacci retracement).

- At the same time, EUR/USD may stage further attempts to test the yearly high (1.1033) as long as it holds above the monthly low (1.0788), with the next region of interest coming in around 1.1070 (23.6% Fibonacci retracement) to 1.1090 (38.2% Fibonacci extension).

Additional Resources:

Gold price forecast: RSI flirts with overbought territory

USD/JPY struggles to trade back above 50-Day SMA ahead of NFP

--- Written by David Song, Strategist

Follow me on Twitter at @DavidJSong