Key Events

- FOMC Minutes (Wednesday)

- French, German, Eurozone, and US PMI’s (Thursday)

- Jackson Hole Symposium – Fed Powell Statement (Friday)

With a keen interest for the markets to price in trends based on outlook expectations, positive rallies are seen besides the drop of the US dollar ahead of the insights from the FOMC minutes and Fed Powell’s statement. The market is leaning toward a dovish outlook from the Fed, which Powell is expected to confirm on Friday following the insights from today’s FOMC minutes release.

The state around the health of the US economy along the monetary easing track towards the remainder of 2024 is awaited, and it happens to be aligned with election volatility risk, given the agenda differences and tight competition between Harris and Trump.

Technical Outlook

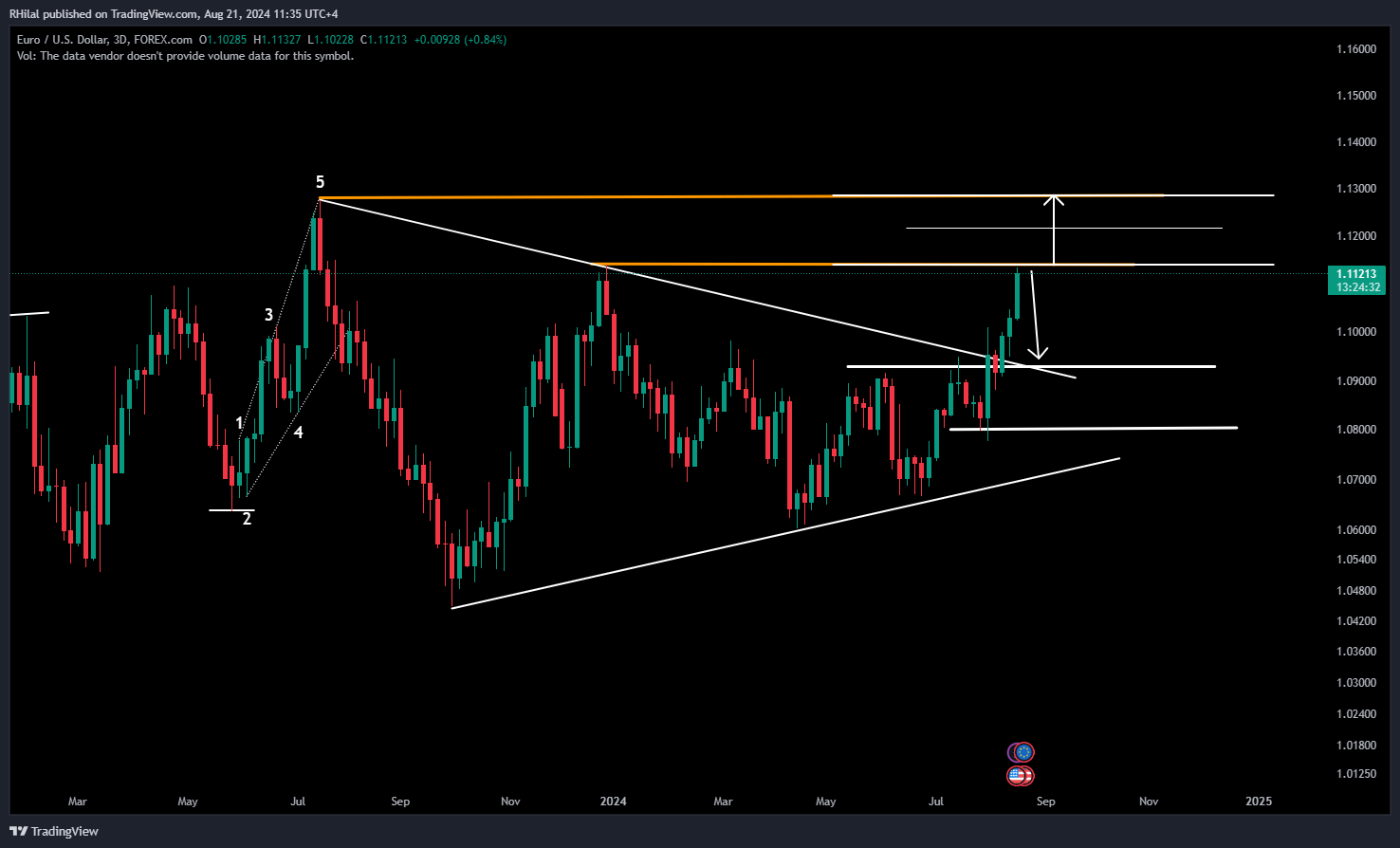

EURUSD, Silver Analysis: EURUSD – 3 Day Time Frame – Log Scale

Source: Tradingview

After retesting the December 2023 highs near the 1.1140 level, the next levels for the EURUSD’s upward momentum are 1.1220 and 1.1280. Market expectations are increasingly tilting towards monetary policy easing and potential rate cuts, adding pressure on the US Dollar Index and supporting the Euro’s trend back to 2023 highs. As EURUSD tests the 1.114 resistance, further uptrends could be confirmed with a close above this level.

However, given the high volatility expected from the FOMC minutes and PMI data leading up to the Jackson Hole Symposium, the possibility of a pullback remains. A potential retreat could see the pair revisiting the 1.09 range, towards levels 1.0980, 1.0930, and 1.09 respectively.

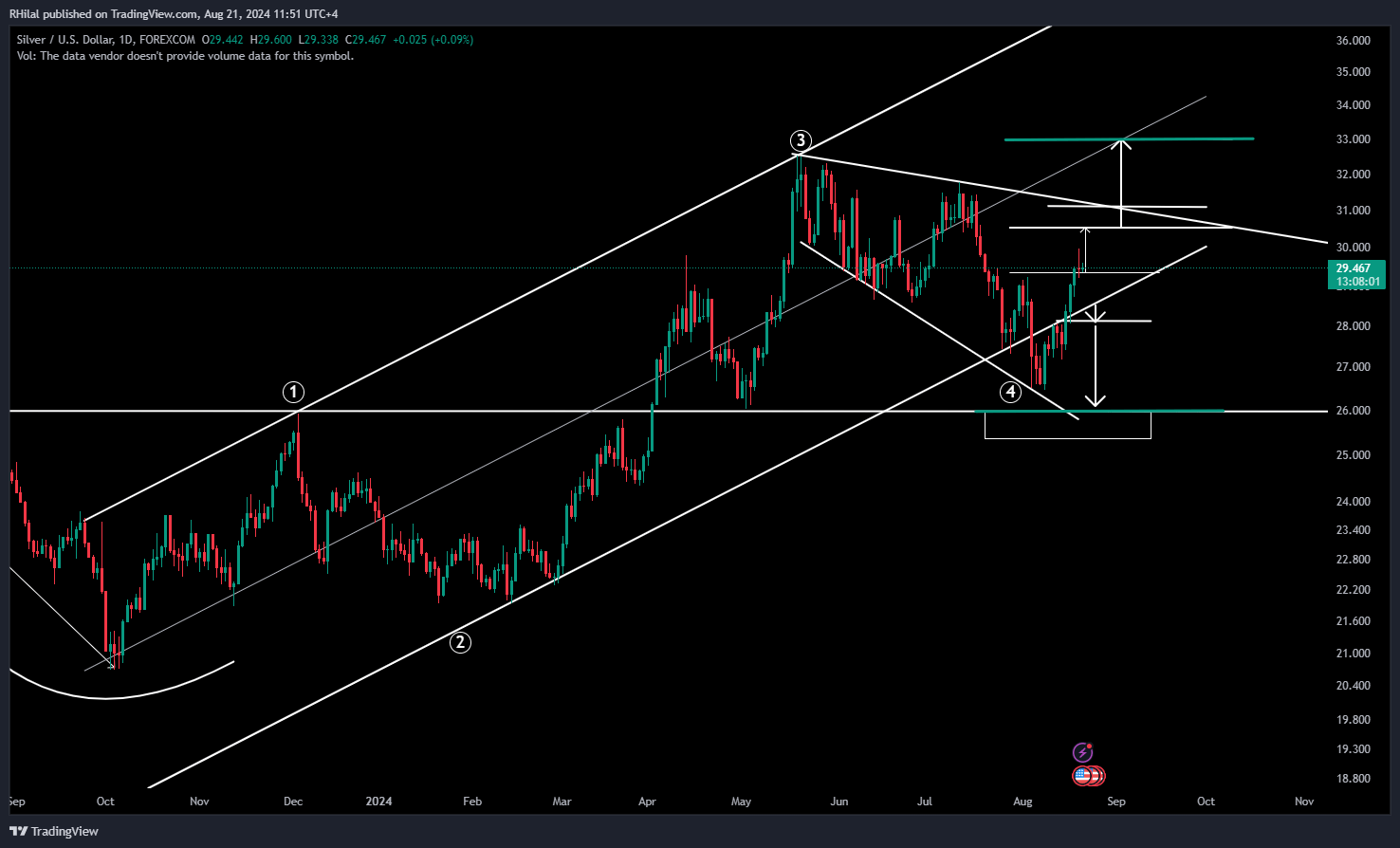

EURUSD, Silver Analysis: XAGUSD – Daily Time Frame – Log Scale

Source: Tradingview

Silver has regained strength within its primary uptrend, driven by the new highs retested by gold, the weakening US Dollar, and the increased appetite for safe-haven investments. Silver is now approaching the 30-barrier as resistance, with further targets at 31.20, 31.80, and 33.

However, any unexpected shifts, such as a stronger US Dollar or geopolitical resolutions, could see Silver finding support back at the 28 and 26 zones, respectively.

--- Written by Razan Hilal, CMT on X: @Rh_waves