EUR/USD Outlook

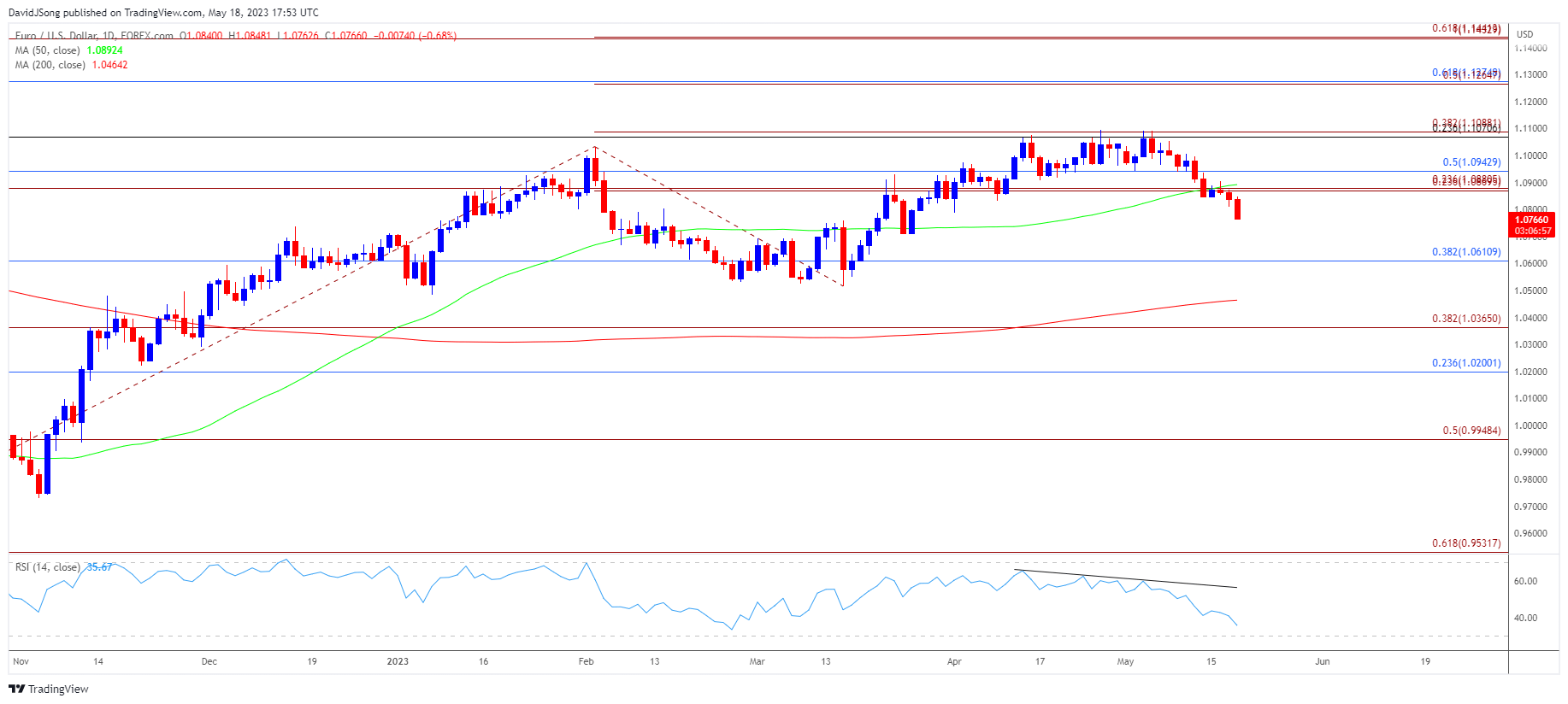

EUR/USD extends the series of lower highs and lows from the start of the week to take out the April low (1.0788), and a further decline in the exchange rate may continue to push the Relative Strength Index (RSI) towards oversold territory as the oscillator still reflects a downward trend.

EUR/USD Outlook: Break of April Low Pushes RSI Toward Oversold Zone

EUR/USD falls to a fresh monthly low (1.0763) after failing to trade back above the 50-Day SMA (1.0892), and the exchange rate may continue to give back the rebound from the March low (1.0516) amid the lackluster response to the positive slope in the moving average.

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

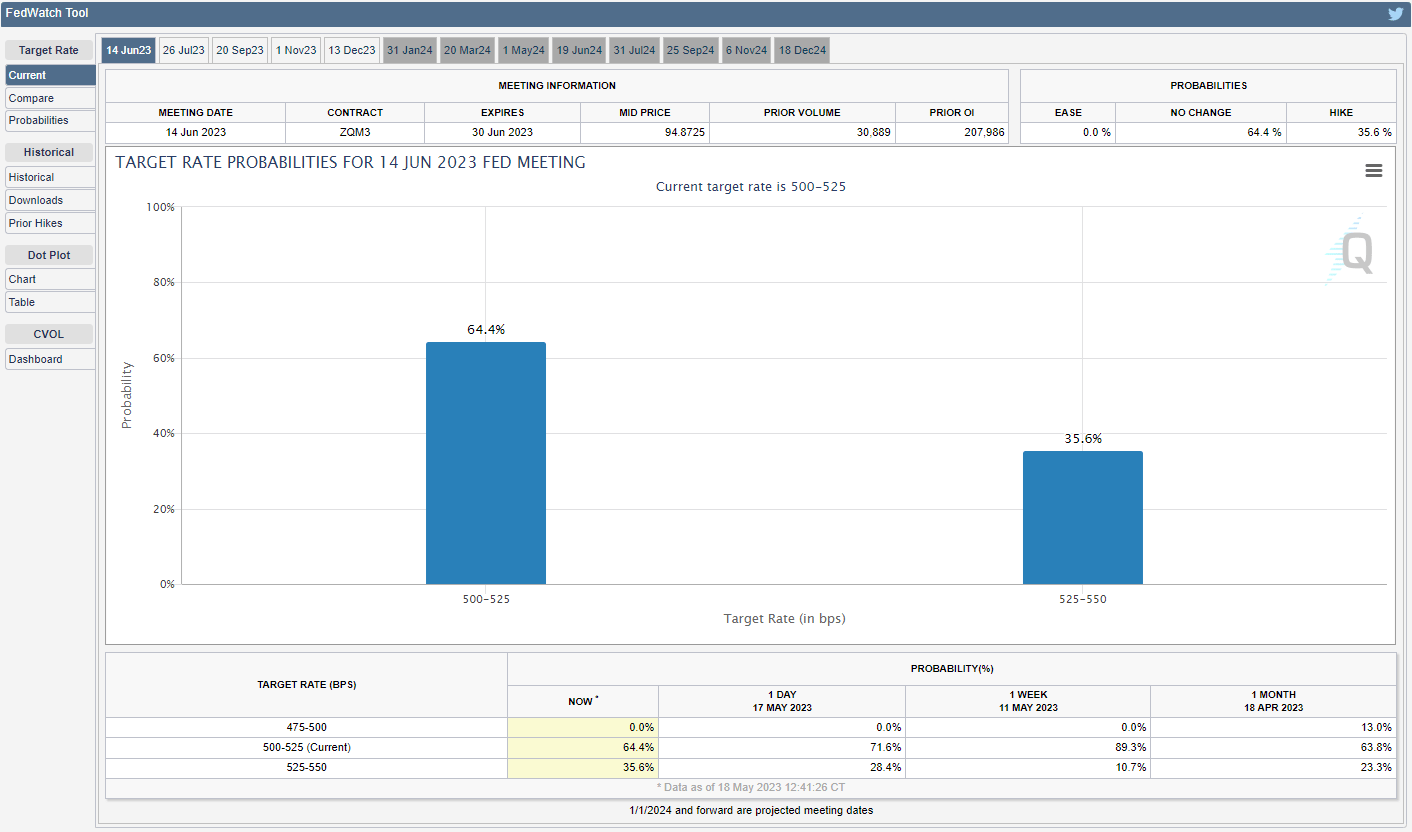

Source: CME

The recent strength in the Greenback takes shape as US Treasury yields push to fresh monthly highs, and it seems as though market participants are altering their outlook for US monetary policy as the CME FedWatch Tool now reflects a 60% probability of seeing the Federal Open Market Committee (FOMC) move to the sidelines.

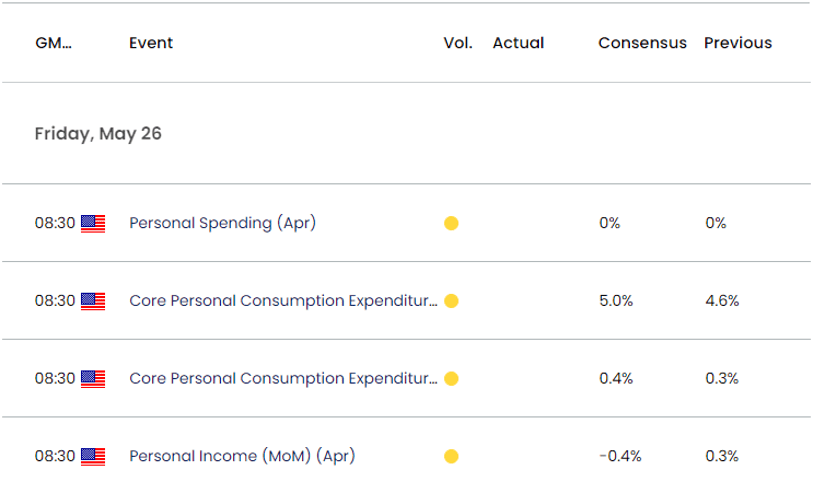

Growing speculation for a more restrictive policy may keep EUR/USD under pressure as price growth in the US remains well above the Fed’s 2% target, and it remains to be seen if the update to the Personal Consumption Expenditure (PCE) Price Index will sway the FOMC as the report is anticipated to show sticky inflation.

The core PCE, the Fed’s preferred gauge for inflation, is projected to increase to 5.0% in April from 4.6% per annum the month prior, and evidence of persistent price growth may push Chairman Jerome Powell and Co. to extend the hiking-cycle especially as the labor market remains tight.

Until then, speculation surrounding Fed policy may impact EUR/USD as the recent strength in the Greenback coincides with the rise in US yields, and developments coming out of the US may influence the near-term outlook for the exchange rate especially as the European Central Bank (ECB) no longer provides forward guidance for Euro Area policy.

With that said, EUR/USD may continue to trade to fresh monthly lows as it extends the series of lower highs and lows from the start of the week, and a further decline in the exchange rate may push the Relative Strength Index (RSI) towards oversold territory as the oscillator still reflects a downward trend.

Euro Price Chart – EUR/USD Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD extends the series of lower highs and lows from the start of the week after struggling to trade back above the 50-Day SMA (1.0892), and the exchange rate may no longer respond to the positive slope in the moving average as it takes out the April low (1.0788).

- A break/close below 1.0610 (38.2% Fibonacci retracement) raises the scope for a test of the March low (1.0516), and a further decline in EUR/USD may continue to push the Relative Strength Index (RSI) towards oversold territory as the oscillator still reflects a downward trend.

- A move below 30 in the RSI is likely to be accompanied by a further decline in EUR/USD like the price action from last year, but the oscillator may mirror the behavior from February if it reverses course ahead of oversold territory.

- In turn, EUR/USD may attempt to defend the March low (1.0516) if the RSI manages to hold above 30 and shows the bearish momentum abating.

Additional Resources:

Gold Price Vulnerable After Failing to Defend Monthly Opening Range

USD/JPY Reverses Ahead of Monthly Low to Eye 200-Day SMA

--- Written by David Song, Strategist

Follow me on Twitter at @DavidJSong