Euro Outlook: EUR/USD

EUR/USD snaps the series of higher highs and lows from last week after attempting to trade back above the former-support zone around the April low (1.0601), and the European Central Bank (ECB) meeting may fuel the recent weakness in exchange rate as the Governing Council is anticipated to further unwind its restrictive policy.

EUR/USD Monthly Opening Range Intact Ahead of ECB Rate Decision

EUR/USD struggles to hold its ground following the kneejerk reaction to the US Non-Farm Payrolls (NFP) report, but the update to the US Consumer Price Index (CPI) may do little to sway the exchange rate as the core rate of inflation is seen holding steady at 3.3% in November.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

Euro Economic Calendar

In turn, the ECB meeting may have a greater impact on EUR/USD as the Governing Council is expected to reduce the benchmark interest rate to 3.00% from 3.25%, and developments coming out of the central bank may produce headwinds for the Euro should President Christine Lagarde and Co. show a greater willingness to further support the Euro-Area.

With that said, EUR/USD may give back the advance from the last week’s low (1.0461) if the Governing Council prepares to further normalize monetary policy in 2025, but a hawkish ECB rate-cut may generate a bullish reaction in the Euro as it curbs speculation for lower interest rates.

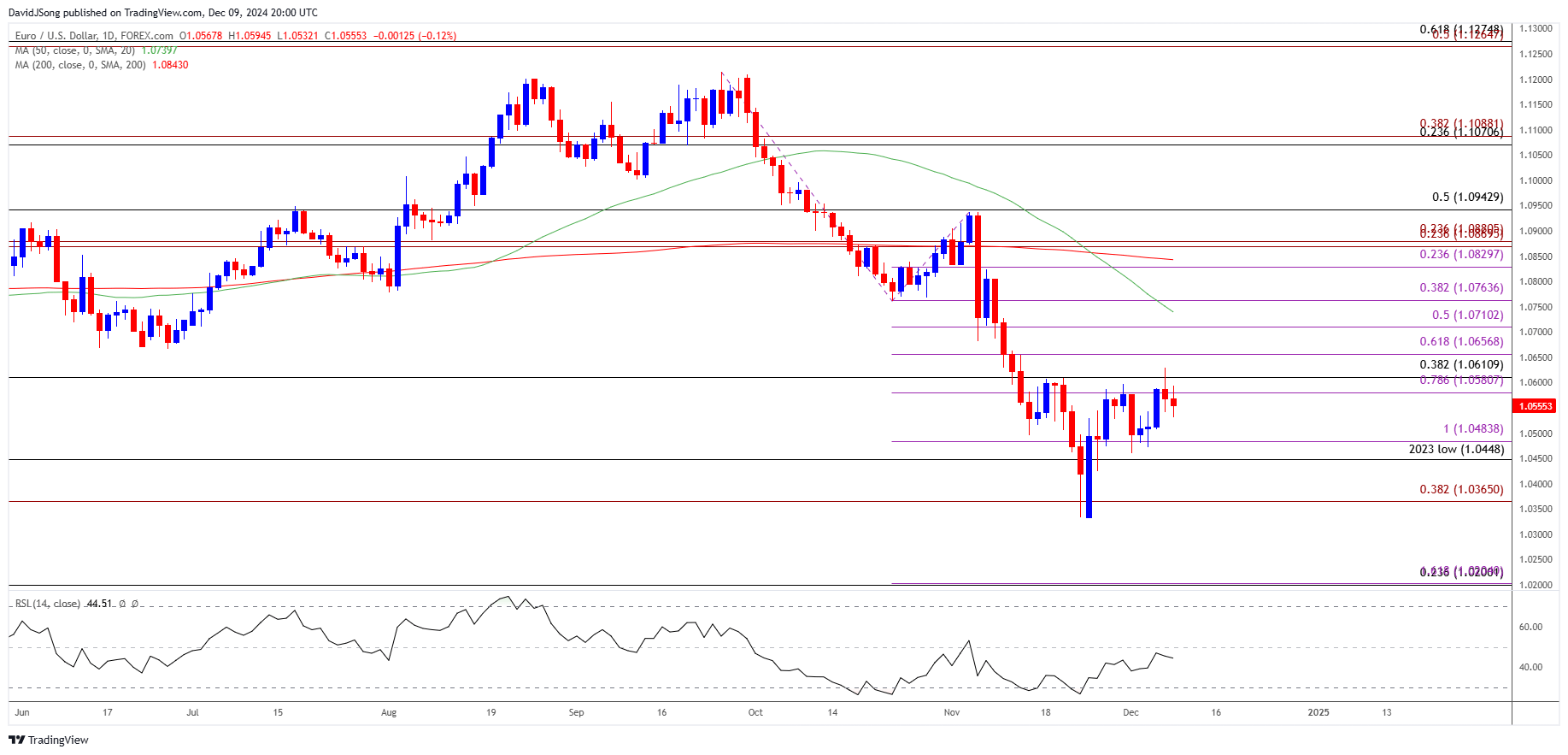

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD pushed above the former-support zone around the April low (1.0601) during the first week of December, but the exchange rate may trade within the monthly opening range as it snaps the recent series of higher highs and lows.

- Lack of momentum to close above the 1.0580 (78.6% Fibonacci extension) to 1.0610 (38.2% Fibonacci retracement) region may push EUR/USD back towards the 1.0448 (2023 low) to 1.0480 (100% Fibonacci extension) zone, with a break/close below 1.0370 (38.2% Fibonacci extension) opening up the yearly low (1.0333).

- Next area of interest comes in around 1.0200 (23.6% Fibonacci retracement), but a close above the 1.0580 (78.6% Fibonacci extension) to 1.0610 (38.2% Fibonacci retracement) region may push EUR/USD back towards 1.0660 (61.8% Fibonacci extension).

- Need a break/close above 1.0710 (50% Fibonacci extension) to open up 1.0770 (38.2% Fibonacci extension), with the next area of interest coming in around 1.0830 (23.6% Fibonacci extension) to 1.0880 (23.6% Fibonacci extension).

Additional Market Outlooks

USD/CAD Forecast: Canadian Dollar Vulnerable to BoC Rate Cut

GBP/USD Remains Susceptible to Bear Flag Formation

Australian Dollar Forecast: AUD/USD Eyes Yearly Low Ahead of RBA

Gold Price Outlook Mired by Flattening Slope in 50-Day SMA

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong