Article Outline

- Key Events: Trump Policies, PMIs, and BOJ Decision

- Technical Analysis: DXY, EURUSD, XAUUSD 3-Day Time Frame

Trump Inauguration Recap

Trump’s latest statements at his inauguration emphasized the return of America’s "golden age," which, in Trump’s terms, translated to strict borders, trade wars, and oil oversupply. Surprisingly, no comments were made about the cryptocurrency industry, despite the release of the Trump and Melania coins, which caused significant overnight market spikes.

Following these statements, the US Dollar slightly retreated from its recent 110 high, accompanied by a pullback in US indices. Oil declined for the fourth consecutive day, falling back to the $75 zone, while gold held its ground above $2700 amid market uncertainty regarding the potential costs of Trump’s policies.In addition to Trump’s unpredictable remarks as he resumed his market influence, volatility risks this week are expected to peak on Friday with an anticipated BOJ 25 bps rate hike and the release of Eurozone, US, and UK PMI data, events known to significantly impact the EURUSD pair.

Technical Analysis: Quantifying Uncertainties

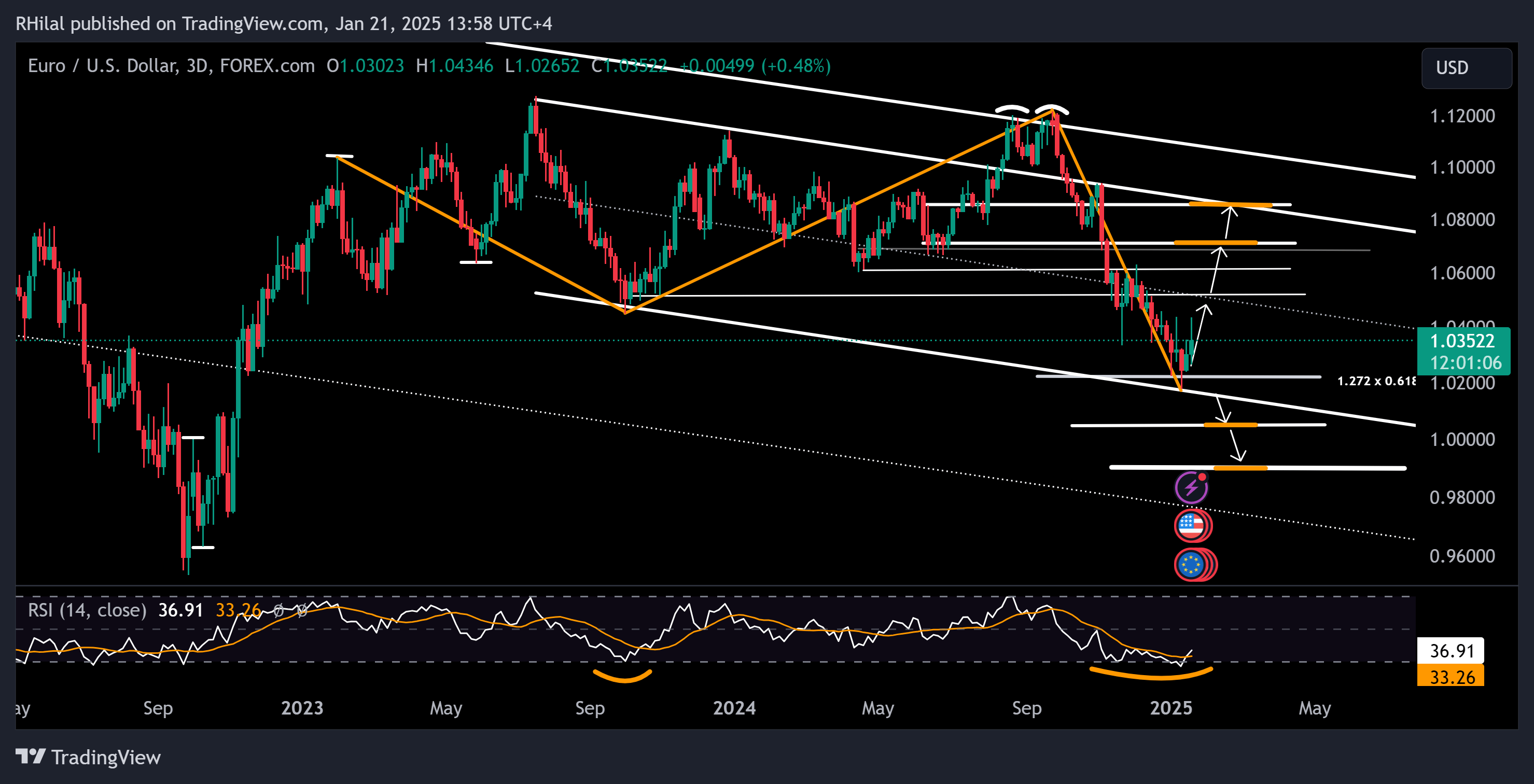

EURUSD Forecast: 3 Day Time Frame – Log Scale

Source: Tradingview

Source: Tradingview

The euro is consolidating near a potential reversal point, supported by the Relative Strength Index (RSI), which has rebounded from oversold levels seen in 2023. The 1.0170 level serves as a critical point for the EURUSD’s downtrend from September 2024 to January 2025.

Upside Potential:

If the euro holds above this level, it could climb toward 1.0520, 1.0620, and 1.0850, aligning with the upper border of the descending channel spanning from July 2023 to January 2025.

Downside Risks:

A break below 1.0170 could pave the way for parity at 1.0000, with further downside targeting the 0.99–0.98 zone.

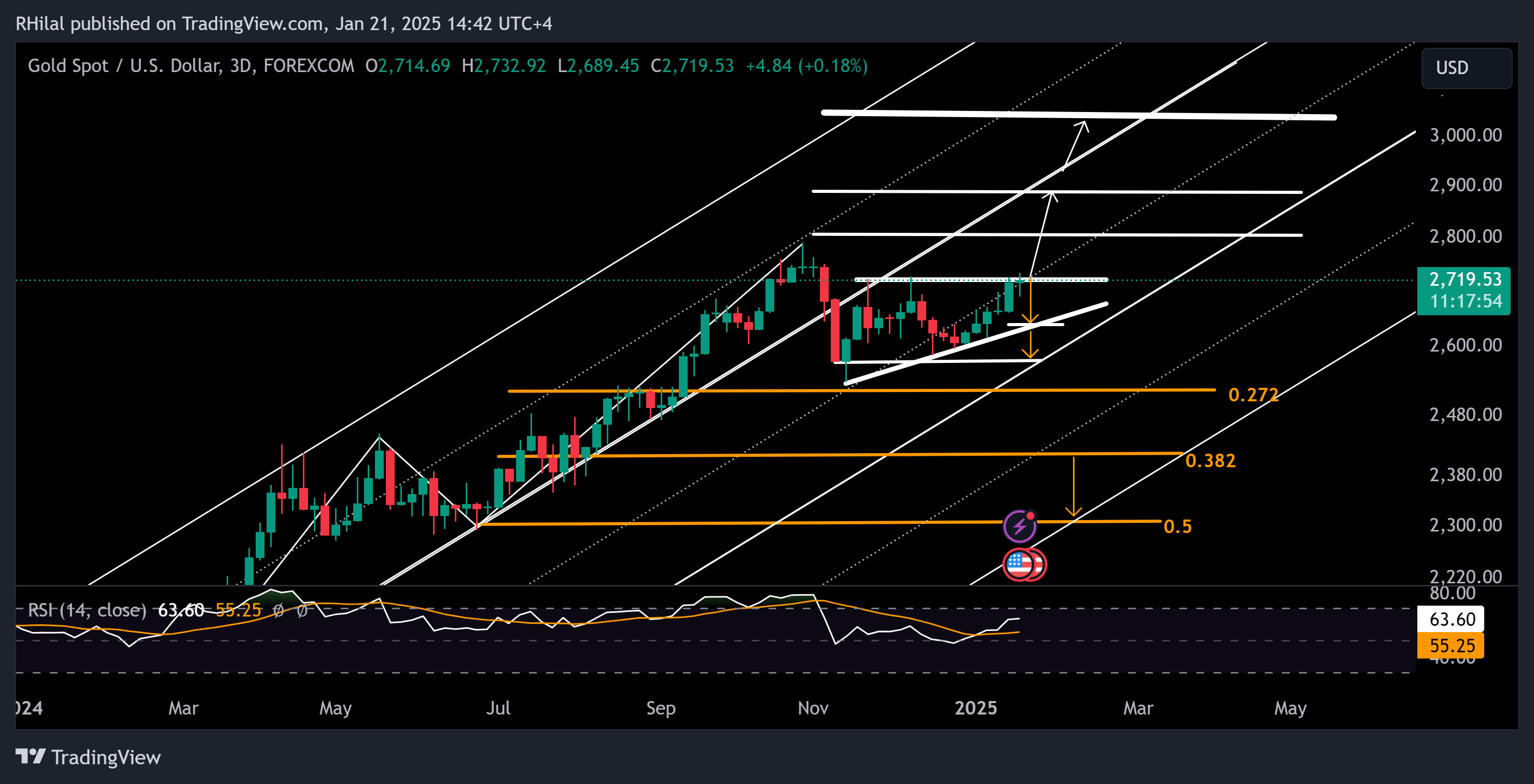

XAUUSD Forecast: 3-Day Time Frame – Log Scale

Source: Tradingview

Gold’s bullish trend is currently testing the $2730 resistance level, a barrier that must be cleared to sustain the upward momentum. A firm close above $2730 would confirm a continuation of the uptrend beyond the November–January consolidation, with next resistance levels at $2760 and $2800, and further highs at $2890 and $3050.

Support Levels:

If gold fails to hold above the $2730 resistance, the lower boundary of the consolidation will act as support. A break below the $2700 level could trigger declines toward $2640, $2600, and $2570.

Written by Razan Hilal, CMT

Follow on X: Rh_waves

On You Tube: Forex.com