EUR/USD rises on trade tariff doubts & ahead of EZ CPI data

- USD falls to a weekly low on trade tariff questions

- Eurozone CPI is expected to rise to 2.5% YoY

- EUR/USD rises above 1.04

EUR/USD is extending its recovery for a second day as the USD falls to a weekly low and is ahead of the eurozone inflation data.

The best dollar has fallen to a weekly low versus its major peers as traders speculate that President-elect Donald Trump's proposed tariffs will be more aggressive than initially expected.

The dollar fell sharply yesterday following reports from the Washington pace that Trump's aides were considering plans to apply specific tariffs on certain sectors, which has eased concerns over wider levees. The dollar had some of those losses after Trump denied the reports. However, the market knows Trump's bark can be worse than his bite. These latest developments have certainly raised questions about the extent to which Trump may be applying tariffs.

Today, the focus will also be on US Jolts job openings and the ISM services index for December, which is due out later today. This week is a busy week as far as U.S. economic data is concerned, culminating on Friday with the US non-farm payroll report, the first major test for the markets this year.

The euro is rebounding, given that the eurozone had been a target of Trump's tariff threats. The rebound could continue if inflation data comes in stronger than expected.

Eurozone inflation is expected to accelerate 2.5% annually up from 2.2% in the previous month. Hotter-than-expected inflation could wipe out any remaining expectations for a 50 basis point cut anytime soon. The markets are pricing in around 425 basis point rate cuts this year.

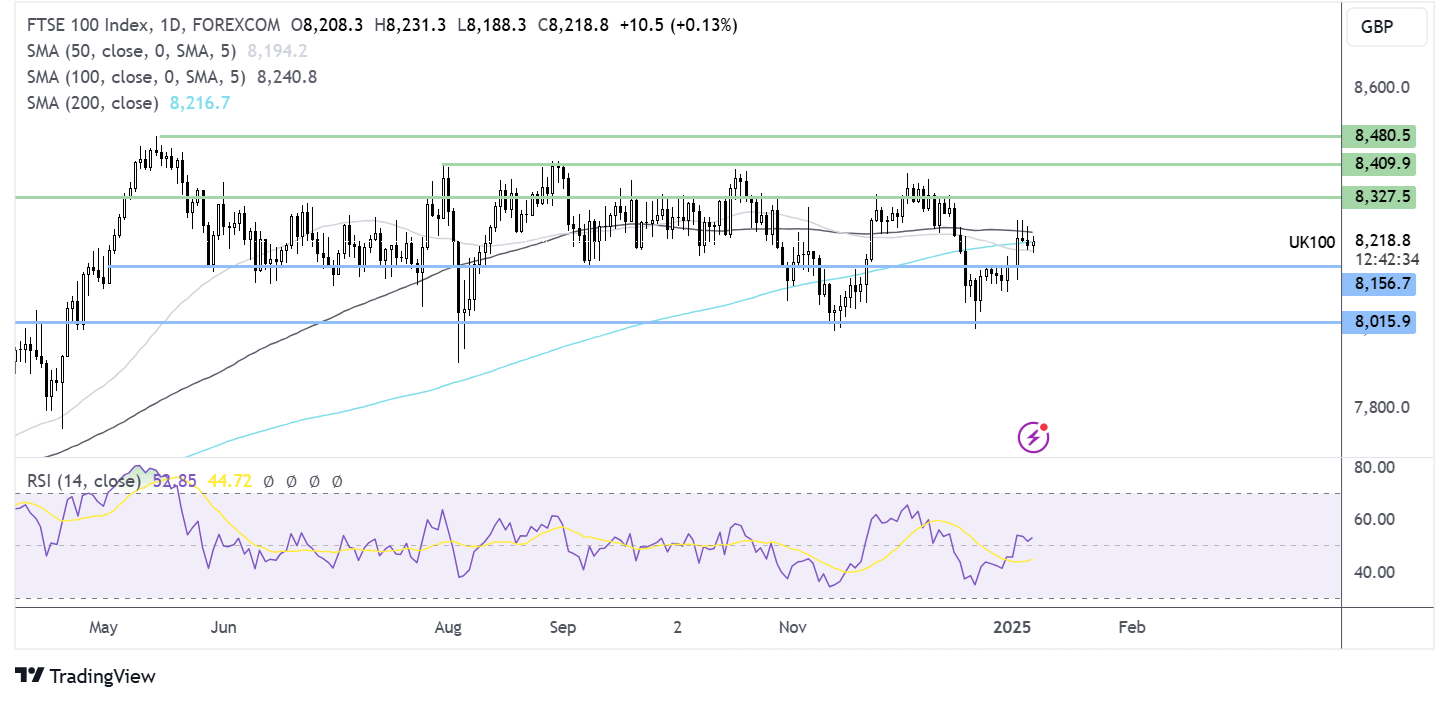

EUR/USD forecast – technical analysis

EUR/USD has been trending lower from 1.12, forming a series of lower highs and lower lows. Last week, the price hit a Nasir of 1.0220. While the price has rebounded off this low, rising above 1.0350, the November low, the downtrend remains intact.

Buyers would need to rise above 1.0460 regions to create a higher high. A rise above here could then see a test of the falling trendline resistance at 1.0520.

Sellers will look to extend the bearish trend by breaking below 1.0350 and retesting 1.0220, creating a fresh lower low and bringing the parity into focus.

FTSE falls as house prices ease and Next raises profit guidance

- Halifax house price data shows first monthly fall in 9 months

- Supermarkets drop despite record grocery spending

- Next lifts its profit forecast

- FTSE trades within a familiar pattern

The FTSE is trading marginally lower on Tuesday, reversing modest gains from the previous session. Investors are reacting to mixed data and corporate updates.

Halifax reported that UK house prices fell 0.2% in December, marking the first monthly decline in nine months. However, annual growth reached 3.3%, the highest since 2021.

Data from Kantar’s showed that grocery spending reached a record high over Christmas with Britain's biggest supermarket group, Tesco's and #2 Sainsbury's, along with discounter Lidl, the winners, posting sales growth of five percent, 3.5%, and 6.6%, respectively. Tesco's young performance increased its share of the market by 28.5%, and Sainsbury's achieved its highest market share since December 2019. However, supermarkets are failing to gain on the news amid concerns that tax rises and other increases in the national minimum wage will be inflationary this year.

Separately, the British Retail Consortium showed that Black Friday spending helped to boost retail sales in late 2024, but overall sales for the quarter were disappointing.

Total retail spending rose 3.2% in the four weeks to December 28 after a 3.3% drop in the month before. However, a late Black Friday distorted year-on-year comparisons, and Q4 spending as a whole increased just 0.4% in annual terms. This week's data comes as Britain's economy lost momentum in the second half of 2024, going to caution following the Labour government's first budget.

In company-specific news, retailer Next is rising 3% after lifting profit guidance and strong holiday sales despite forecasting slower growth for the upcoming year.

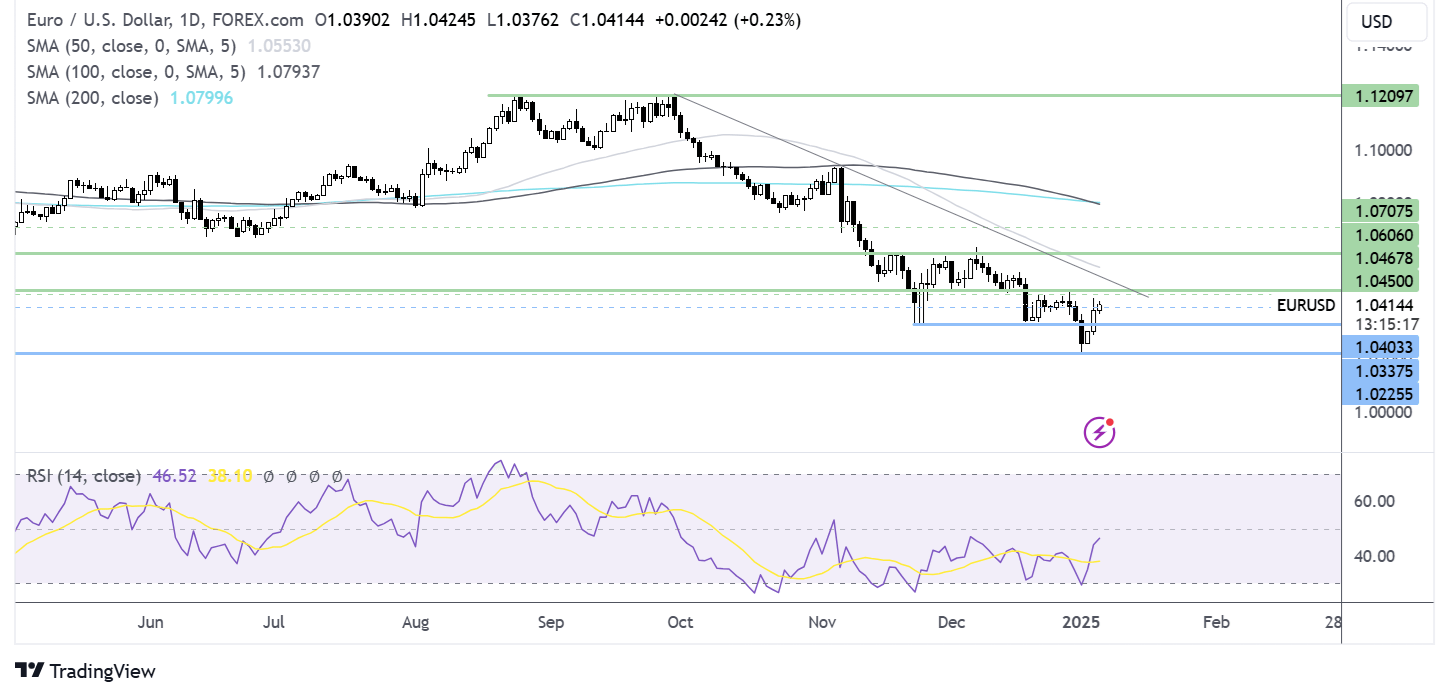

FTSE forecast - technical analysis

The FTSE has traded within a holding pattern for much for the past year, capped on the upside by 8325 and on the lower side 8150.

More recently, the price recovered from a breakout to 8000, retaking 8150 and testing the 200 SMA at 8220. Should buyers rise above here, 8325 comes into focus ahead of 8400.

On the downside support is seen at 8150 and below here 8000.