EUR/USD rises after German consumer confidence & ahead of US GDP data

- German consumer confidence rose to 24.

- US Q1 GDP is expected to slow to 2.5% from 3.4%

- EUR/USD tests 1.07-1.0725 resistance zone

The EUR/USD is pushing higher after a flat finish yesterday as investors digest stronger-than-expected German consumer confidence and look ahead nervously to US GDP data later today.

GfK German consumer confidence rose to -24 in May, up from -27.3 in April. The data show that income expectations rose to the highest level since January 2022, and the willingness to spend also increased, although it was still low by historical standards.

The data comes after yesterday's stronger-than-expected business confidence figures and stronger-than-expected services PMI data earlier in the week, adding to the view that the German economy is starting to recover from its downtrend.

A recovery is good news and is unlikely to knock the ECB off its path to cut interest rates at the June meeting. However, what is unclear is what will happen after the June meeting. Investors will look to ECB Isabel Schnabel's comments for more clues over the future path for interest rates.

Meanwhile the U.S. dollar is slipping lower with attention on US GDP data later today. Expectations are for US GDP to have slowed slightly in Q1 to 2.5% annualised, down from 3.4% in Q4 of 2024.

The market and the Fed will be watching this data closely for signs of how the US economy is holding up. U.S. data across the first quarter was broadly ahead of expectations, and inflation proved to be sticky.

Stronger-than-expected Q1 GDP figures could mean the Fed will not be able to cut interest rates until later in the year, potentially boosting the USD. Meanwhile, weaker-than-expected growth could see the market bring forward rate cut expectations, putting the USD lower.

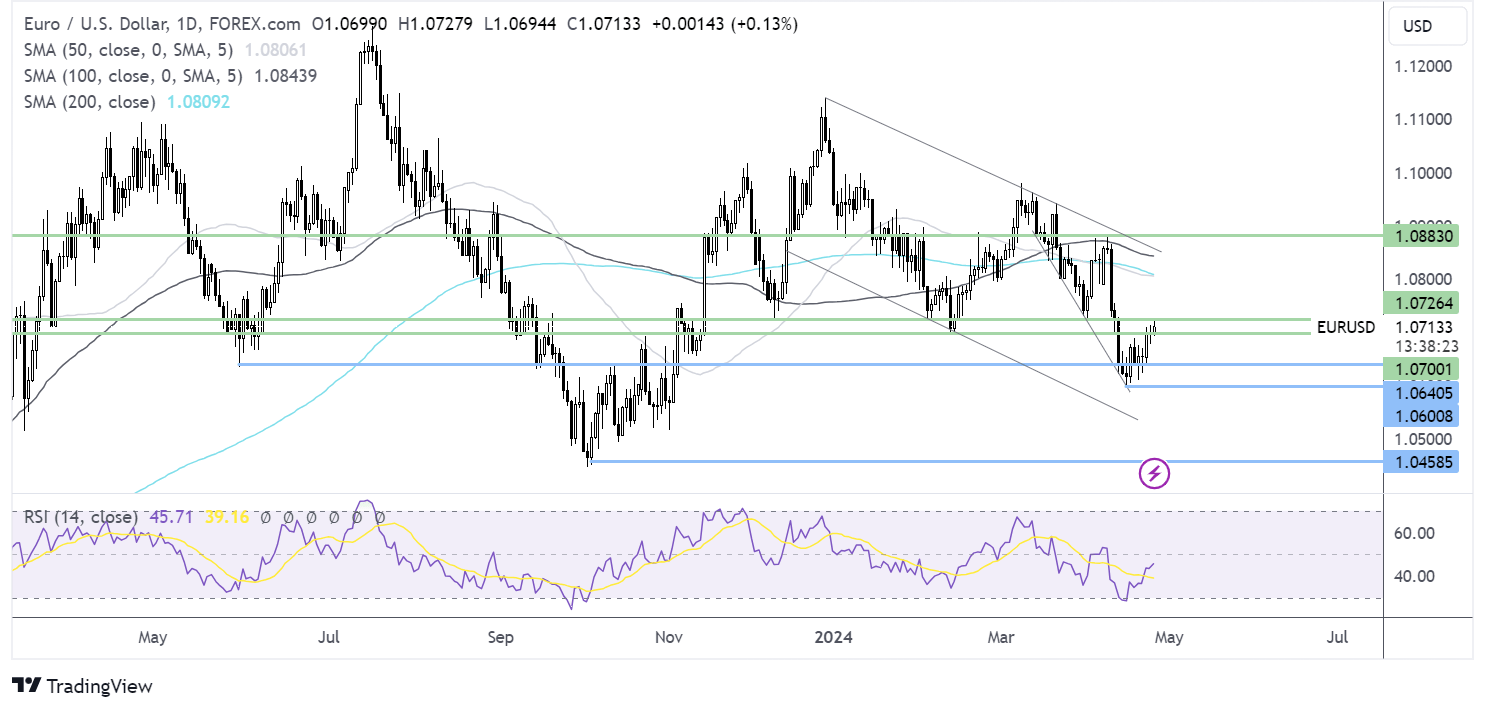

EUR/USD forecast – technical analysis

EUR/USD trades within a longer-term downward channel. The price has extended its recovery from 1.06, the April low, and is testing the 1.07-1.0725 resistance zone. A rise above here brings 1.0765 in focus ahead of 1.08/ 1.0810 the 200 SMA.

Failure to rise above the 1.07 – 1.0725 zone could see sellers push the price towards 1.0640, the May 2023 low, ahead of the 1.06, the 2024 low.

FTSE rises on mining M&A news & after-earnings

- Anglo American jumps on BHP buyout offer

- Barclays, Unilever, AstraZeneca rise post earnings

- FTSE rises towards 8100

The FTSE is rising toward a record high, boosted by strong gains in the mining sector and as investors cheered earnings from the likes of Barclays Unilever and Astra Zeneca.

Given its lack of tech exposure, the index is not affected by weakness in tech stocks after the Meta selloff. Meta has fallen sharply, hitting the US NASDAQ futures and other indices in Europe, but the FTSE is unscathed.

Anglo-American trades almost 10% higher after a buyout offer from BHP Billiton. There are reports that it could take a premium of around 28% above Anglo-American's recent share price to get the deal through, hence the large jump.

Once the deal is completed, it will likely be among the ten biggest mining deals by value and has the potential to create the world's largest copper miner, with around 10% of global output. Given that copper is a key ingredient in the EV and green energy transition, this could be huge. Cooper prices are up 15% so far this year. It also raises the prospect of more M&A activity within the sector.

Barclays is trading almost 4% higher despite posting a 12% fall in first-quarter profits.

Unilever is also up 4% after the consumer goods company posted Q1 sales grew 4.4% ahead of forecasts.

Meanwhile, AstraZeneca is up over 5% after the drug maker reported quarterly revenue and profits above market estimates.

Separately, the FTSE has also been supported by expectations that the Bank of England could start to cut interest rates sooner, which has lifted retailers in recent sessions.

Looking ahead, attention will be on U.S. data and more US earnings, which could impact sentiment.

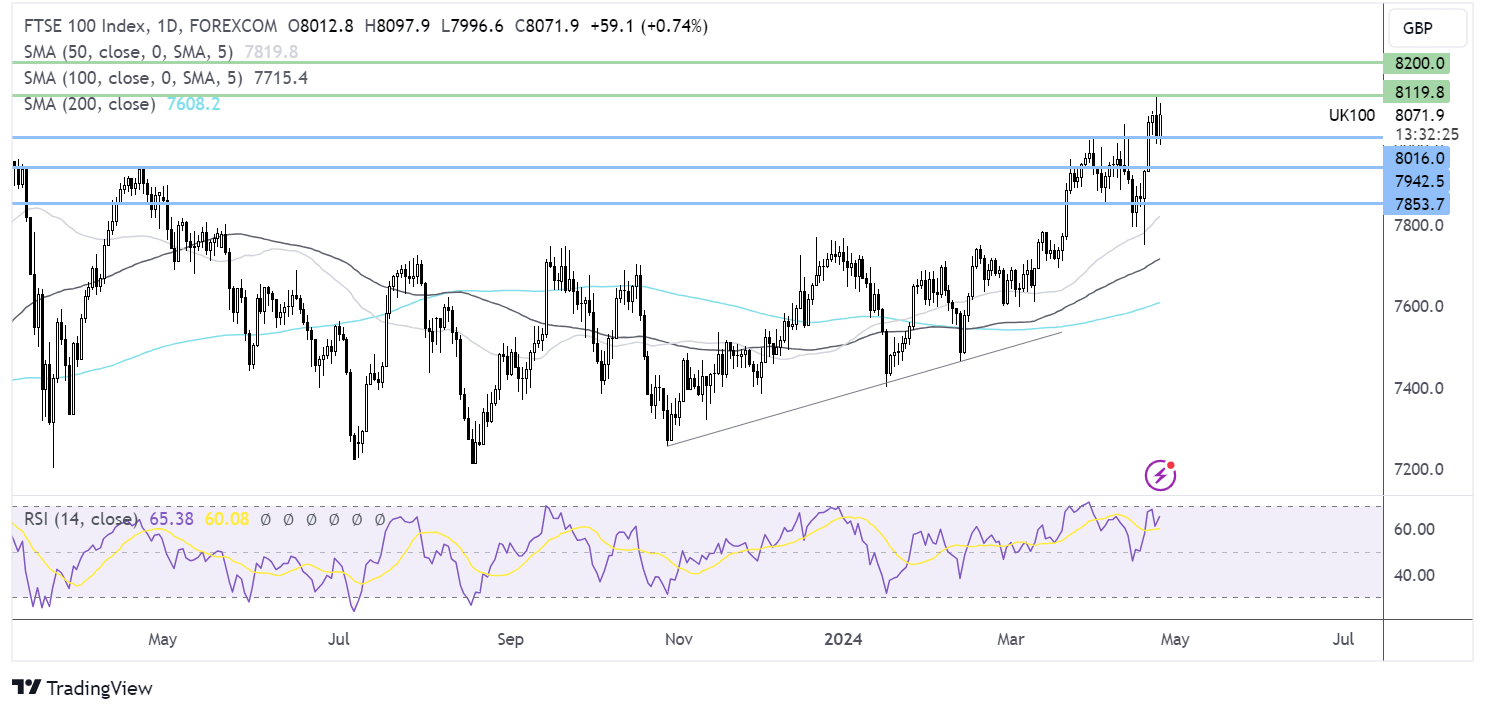

FTSE forecast – technical analysis

The FTSE has recovered from support around 8000 and is surging higher towards 8120 and fresh all-time highs towards 8200. The price trades above its upward-sloping SMAs, and the RSI supports further gains while it remains out of overbought territory.

Support can be seen at 8000, the weekly low. A break below here opens the door to 7940 the April 2023 high.