EUR/USD looks to Eurozone inflation data

- Eurozone CPI to confirm 2.6% vs 2.8% previously

- FOMC rate decision on Wednesday

- EUR/USD struggles around 1.09

EUR/USD is holding steady amid a cautious market mood ahead of the Federal Reserve interest rate decision on Wednesday.

The U.S. dollar has risen to a 10-day high versus its major peers after stickier-than-expected inflation last week raised the prospect of the Federal Reserve keeping rates high for longer. The Fed could now look to cut interest rates just twice this year rather than the three times previously expected. A hawkish Federal Reserve could give the US dollar a boost, pulling EUR/USD lower.

While the Fed rate decision is the main focus show in town this week for the pair, eurozone inflation data will be released today. However, it's worth noting that this is the second reading for February, so it's likely to be less market-moving than the preliminary release. Expectations are for inflation to confirm a cooling to 2.6% YoY, down from 2.8% in January.

The data comes after ECB policymaker Olli Rehn confirmed that the central bank has started discussing cutting interest rates. He also said that he could see a scenario emerging where several rate cuts were needed this year.

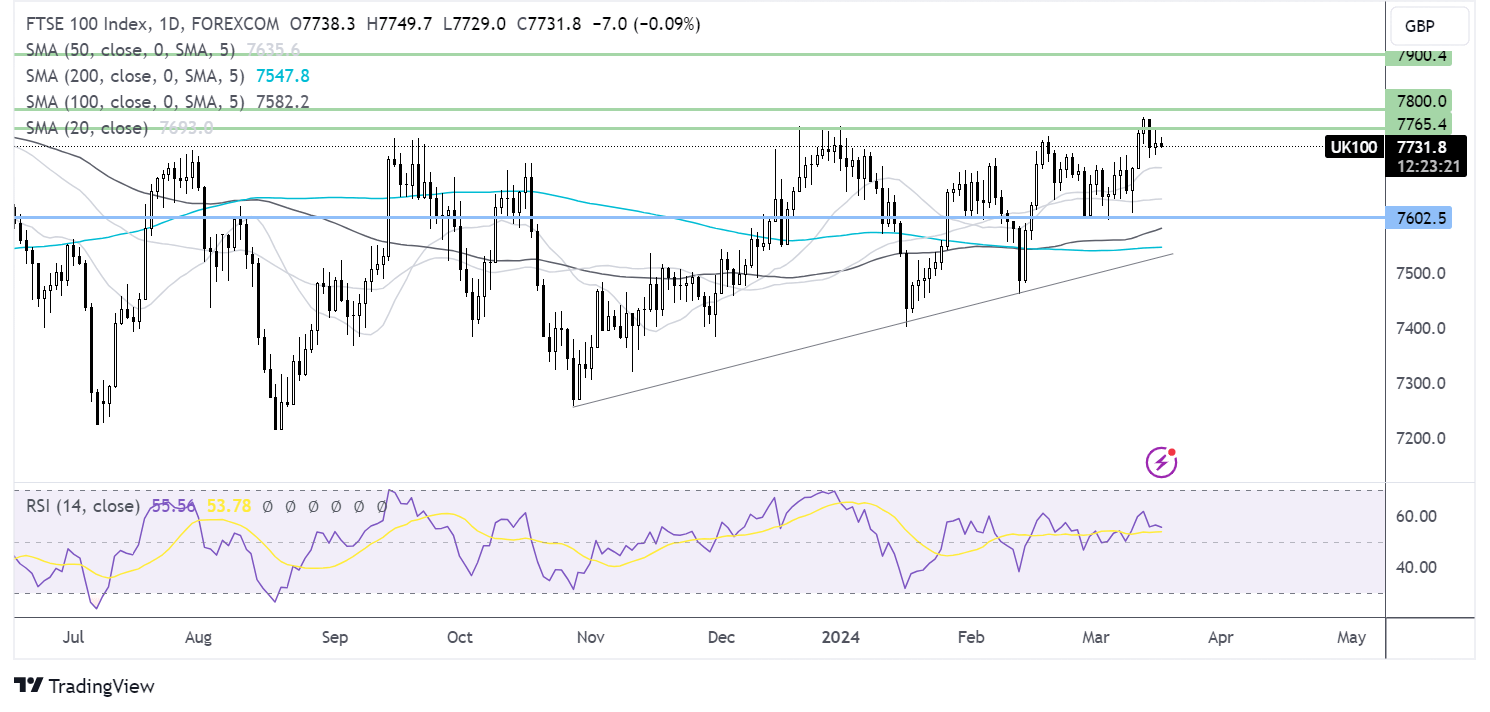

EUR/USD forecast – technical analysis

EUR/USD fell below its rising trendline dating back to mid-February and struggles around 1.09. While the price remains above the 200 SMA, it needs a move back over 1.09 to bring 1.0980, the March high, back into focus and 1.10, the psychological level.

Should the price face rejection at 1.09, a test of the 200 SMA at 1.0840 could be on the cards. Below here, 1.08, the March low comes into focus.

FTSE struggles on central bank jitters and after China data

- Chinese retail sales & industrial production beat forecasts

- BoE & Federal Reserve announce rate decision this week

- FTSE falls from 10-month high

The FTSE and its European peers have opened quietly after mixed data from China and ahead of a busy week for central bank decisions.

Chinese factory output and retail sales were better than expected from January to February, pointing to a solid start to the year and offering optimism that the struggles in the Chinese market could be bottoming out.

Retail sales were 5.5%, ahead of the 5.2% expected, although down slightly from 7.4% in the previous month. Meanwhile, industrial production rose 7%, defying expectations of easing to 5%.

While the data supports the view that the Chinese economy started 2024 on the front foot, there are some reasons to be cautious. The Lunar New Year's holiday likely boosted retail sales and industrial output, lifting consumption and oil refinery throughput owing to increased travel demand.

Meanwhile, real estate concerns remain in focus after property investment dropped 9%, highlighting the ongoing crisis in the sector, which is a key pillar of the economy.

Resource stocks such as mines and oil majors are pushing higher, finding some comfort from the data. Burberry is also doing well, given that Chinese consumers make up a significant part of sales.

Looking ahead, this week sees a plethora of central banks announcing their interest rate decisions, including the Federal Reserve and the Bank of England

Neither the Fed nor the BoE is expected to move on interest rates, and both are likely to be cautious about providing further clarity on the start of rate cuts.

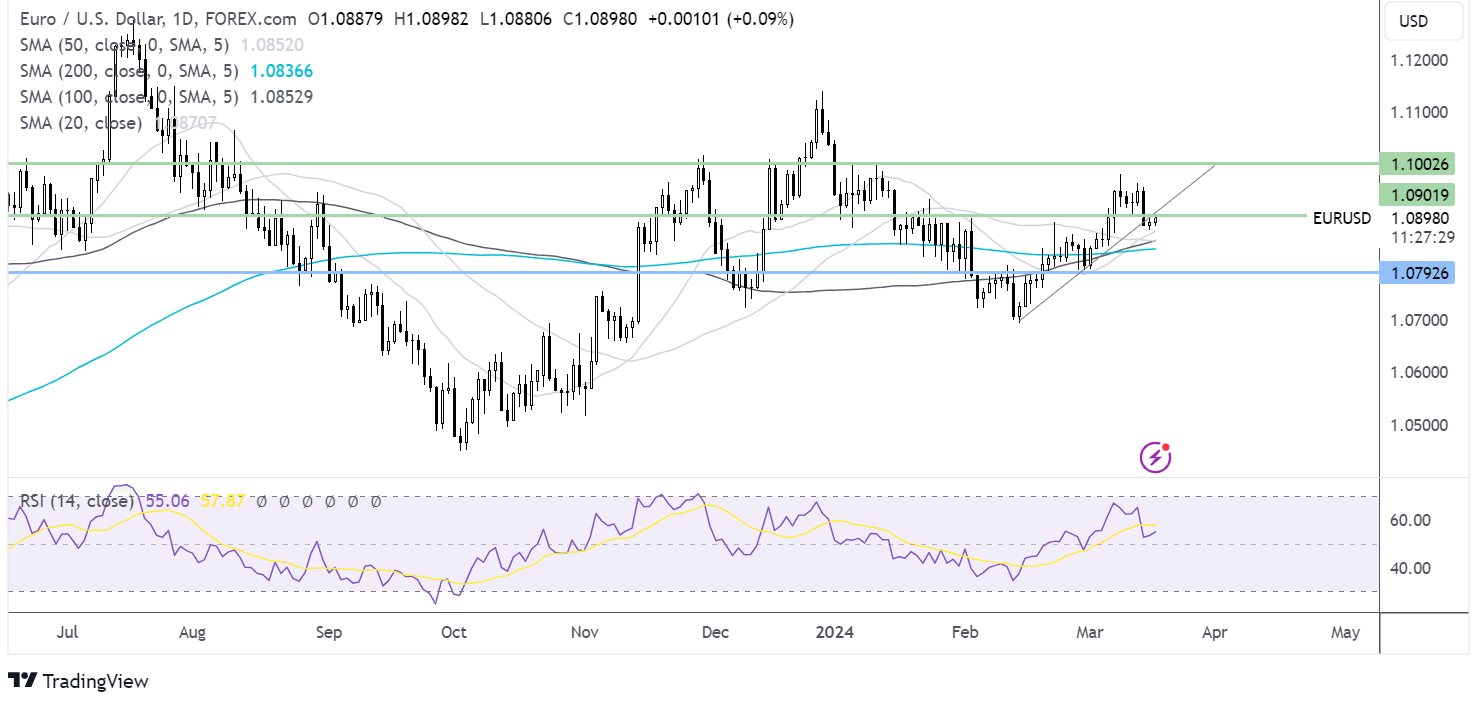

FTSE forecast – technical analysis

The FTSE had seen a series of higher highs and higher lows before running into resistance at 7780, a 10-month high. From here the price has eased lower. Support can be seen at 7700, 20 SMA, and static support. However, 7600 is the pressure point. A break below here could see sellers gain traction and expose the 200 SMA at 7550.

On the upside, buyers will look for a rise above 7770, the January high, to extend the bullish run towards 7785, the March high to 7800.