EUR/USD falls to a 2024 low ahead of a busy calendar

- USD rises to a yearly high on the Trump trade

- EZ GDP and ECB minutes are due

- EUR/USD falls below 1.0550 to aa 2024 low

EUR/USD has tumbled below 1.0550, dropping to a 2024 low amid U.S. dollar strength as investors look ahead to a busy day on the economic calendar.

The US dollar has risen to a 2024 high as the Trump trade continues and shows no signs of letting up. Yesterday, US inflation came in hotter than expected at 2.6%, and Federal Reserve officials alluded to a higher neutral rate. The market has been assuming that Trump's policies will be inflationary, meaning that the Federal Reserve will be cutting rates at a slower pace.

Attention will now turn to US PPI inflation data, which is expected to tick higher to 3% YoY, up from 2.8%. Rising PPI often points to an increase in CPI down the line.

Federal Reserve chair Jerome Powell will also speak. His comments come as the market weighs up on whether the Fed will cut rates again in the December meeting after cutting rates by 25% in November.

The Euro continues to trade lower, weighed down by fears that Trump tariffs could damage fragile economic growth in the region. This could result in the ECB cutting rates at a more aggressive pace.

Today, attention will be on eurozone GDP data, which is expected to confirm the 0.4% preliminary reading. A downward revision to the data could raise expectations of a 50 basis point cut in December.

The minutes to the latest ECB meeting will also be released. In this meeting, the ECB cut rates by 25 basis points. Investors will scrutinize the minutes for clues over the likelihood of a larger rate cut in December. However, it's worth noting that the meeting was before Trump's victory, and potential trade tariffs may have changed the outlook for the central bank.

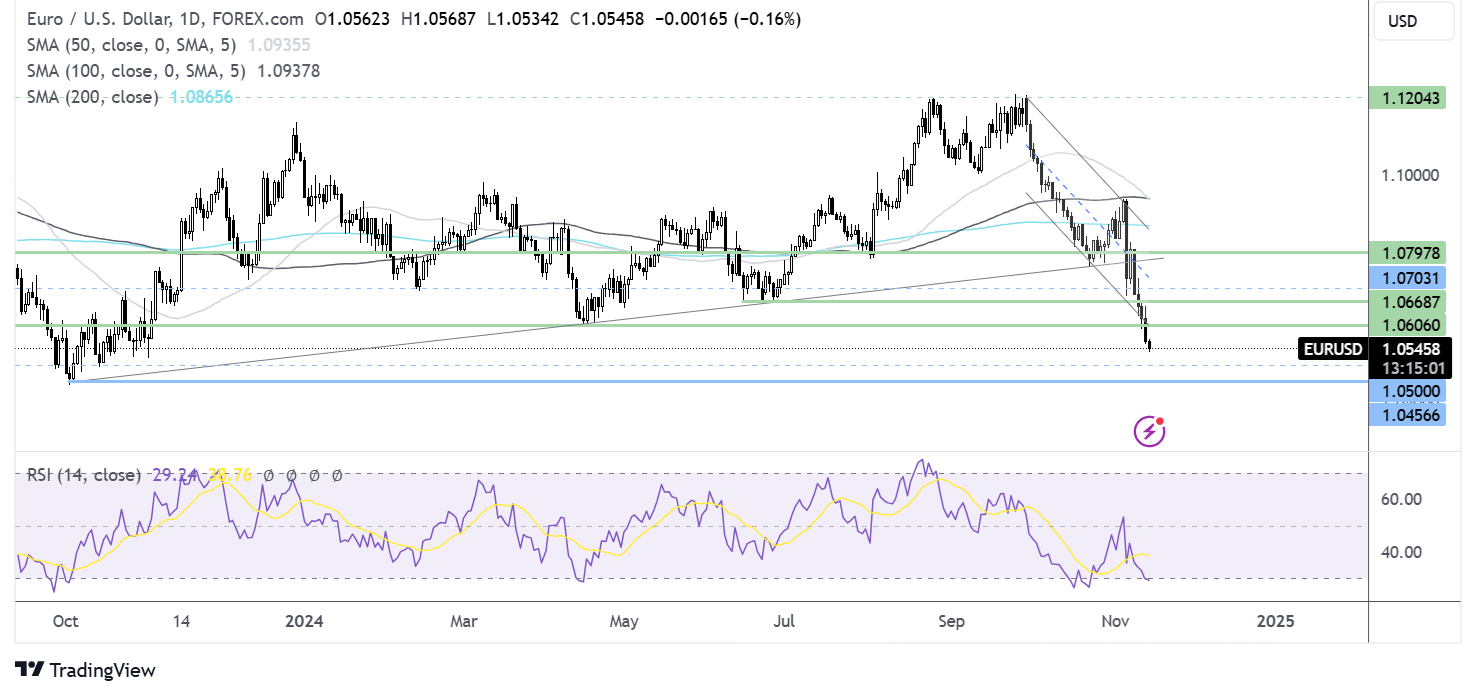

EUR/USD forecast – technical analysis

EUR/USD has broken below the lower band of the falling channel as it extends its sell-off. The 50 SMA is crossing below the 100 SMA in a bearish signal, and the RSI supports further downside while the RSI remains out of oversold territory.

The price broke aggressively below 1.06 as sellers look towards the 1.05 round number and 1.0450, 2023 low.

Any recovery must retake 1.06, the April low, to bring 1.0660, the June low, into play. A rose above here opens the door to 1.07 and 1.08.

FTSE holds steady ahead of BoE’s Bailey & US PPI

- FTSE trades at a 7-month low amid Trump tariff and China worries

- BoE Andrew Bailey is due to speak later

- FTSE tests 8000 support

The FTSE 100 has opened flat as investors digest corporate updates and await Bank of England governor Andrew Bailey's speech and US inflation data.

The Footsie, along with its European peers, has come under pressure in recent sessions after Trump's victory as the market frets over what potential trade tariffs could mean for the domestic and global economy. The first is also struggling amid ongoing concerns over the health of the Chinese economy despite recent stimulus measures; as a result, resource stocks have underperformed.

Attention is on Bank of England governor Andrew Bailey, who is due to speak later today. Investors will scrutinize his comments in light of the labor government's budget released at the end of last month and mixed jobs data earlier in the week. The market only sees a 15% probability of the Bank of England cutting rates again in December after cutting rates in November.

Looking ahead to the US session inflation data, PPI will be in focus and is expected to rise to 3% YoY from 2.8%. The date comes after signs of sticky CPI inflation and Fed speakers alluded to a higher neutral rate. Hot inflation could hurt market sentiment as the market assesses the likelihood of a fed rate cut in December.

In corporate news, WH Smith shares dropped down 6% after the retailer's results disappointed this morning.

On the Footsie 250, shares in Burberry jumped 13% after the luxury retailer announced a sweeping overhaul to its strategy in order to stem sales declines.

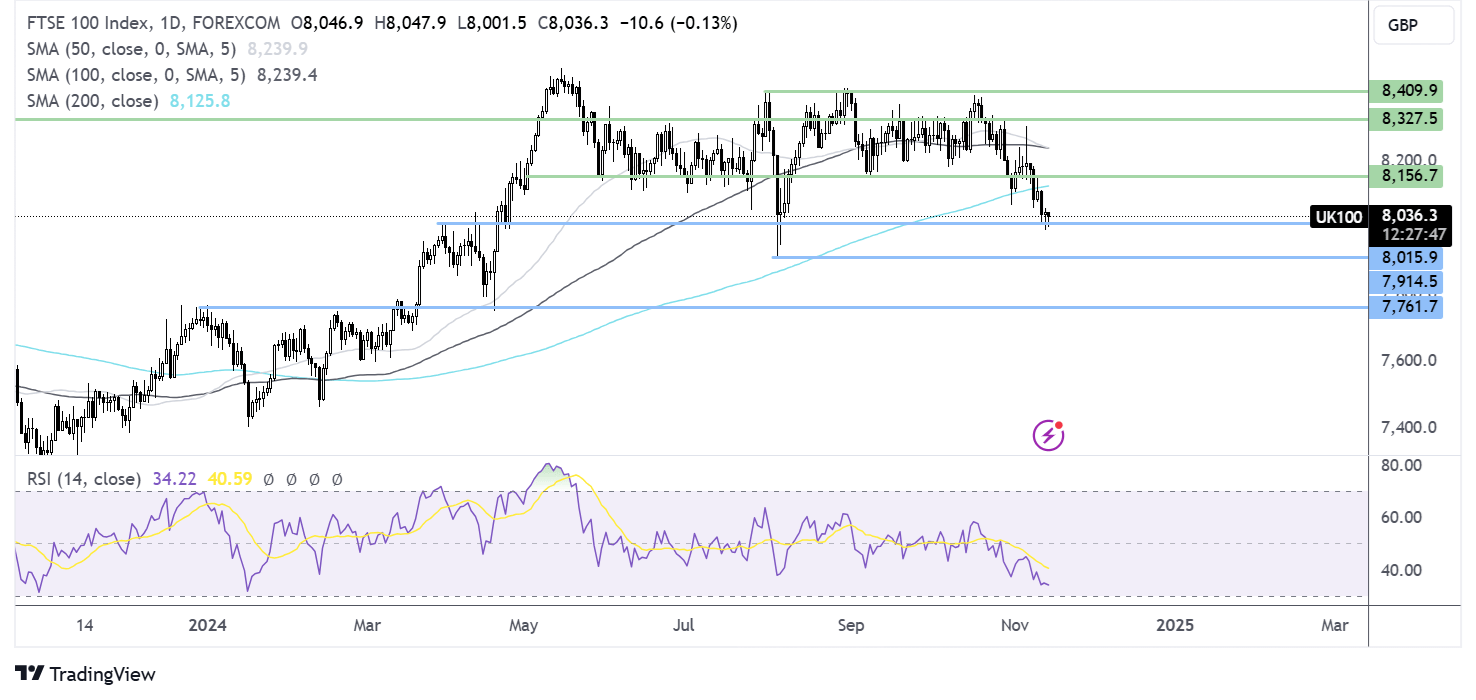

FTSE forecast - technical analysis

The FTSE has broken out of its holding pattern, taking out the 200 SMA and testing the 8000 support. Should sellers, supported by the RSI below 50, break below 8000, this will open the door to 7914, the August low, and 7770.

Should buyers successfully defend 8000, this brings the 200 SMA at 8120 into play ahead of 8150 and a return to the holding pattern.