EUR/USD Key Points

- The ECB is suggesting that US economic outperformance is in itself a reason to cut interest rates, widening the expected monetary policy divergence on either side of the Atlantic.

- Between a Fed meeting, NFP, Eurozone Core CPI, and Eurozone Flash GDP, there is a full slate of economic data to watch this week.

- EUR/USD may have seen its bounce off 1.0600 support stall at 1.0740 – see the levels to watch moving forward.

How Will the ECB React to the Prospect of a Less Dovish Fed?

Heading into a new week, the ongoing interest rate debate within the European Central Bank (ECB) is intensifying, particularly in contrast to the Federal Reserve's increasingly less dovish policy plans (read: fewer interest rate cuts than expected).

Last week’s comments from ECB officials, including Italy’s central bank governor Fabio Panetta, highlight the potential need for further rate cuts in Europe, even as the Fed maintains or even increases interest rates due to persistent inflation in the U.S. This divergence stems from generally solid economic growth in the US (last week’s disappointing Q1 GDP estimate notwithstanding) while Europe is experiencing diminishing inflationary pressures, making the case for cutting interest rates on the continent more compelling.

Panetta, speaking at an ECB event, emphasized the risks of not accounting for the powerful influence of U.S. monetary policy, which can have significant spillover effects on global financial conditions. He noted that unexpected monetary tightening in the U.S. could lead to negative impacts on inflation and economic output in the eurozone. This sentiment was also echoed by other ECB officials. Put simply, the ECB is suggesting that US economic outperformance is in itself a potential reason to cut interest rates, widening the expected monetary policy divergence on either side of the Atlantic.

Amid these discussions, the ECB is nearly unanimously signaling a likely rate cut at its upcoming June meeting, provided inflation continues to align with their forecasts.

With fears of stagflation rearing their heads after last week’s combination of slower-than-expected GDP growth and higher-than-expected price pressures in the US, the focus will shift back toward Europe next week, with traders keeping a close eye on the economic data below.

European Economic Data to Watch This Week

In addition to the high-impact US data on tap this week, highlighted by the Federal Reserve monetary policy meeting on Wednesday and the monthly Non-Farm Payrolls (NFP) report on Friday, there will be plenty for EUR/USD traders to monitor in Europe as well:

Monday

- German Preliminary CPI

- Spanish Flash CPI

Tuesday

- French Flash GDP

- German Retail Sales

- French Preliminary CPI

- Spanish Flash GDP

- German Employment Report

- Italian Preliminary GDP

- German Preliminary GDP

- Eurozone Core CPI

- Italian Preliminary CPI

- Eurozone Flash GDP

Wednesday

- Eurozone Bank Holiday – No Economic Data

Thursday

- Eurozone Flash Manufacturing PMI

Friday

- Eurozone Employment Report

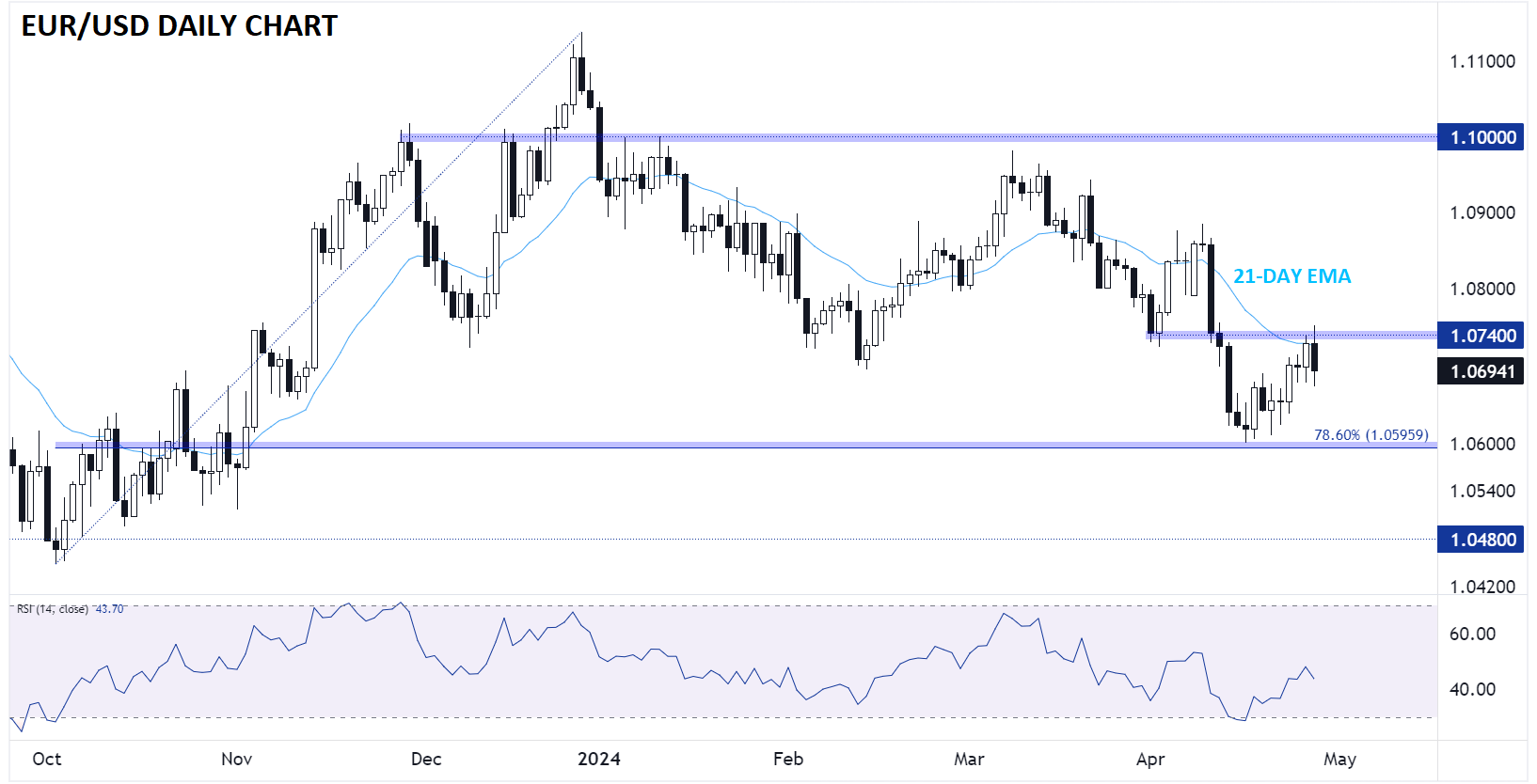

Euro Technical Analysis – EUR/USD Daily Chart

Source: TradingView, StoneX

Turning our attention to the chart, EUR/USD may have seen its bounce off 1.0600 support stall at 1.0740. The world’s most widely-traded currency pair rallied up into that previous-support-turned-resistance level before reversing sharply on Friday on the back of the hotter-than-expected Core PCE report.

Looking ahead to this week, the combination of high-impact US and European data will play a major role in how EUR/USD trades, but the technical picture, along with the potential for a continued widening in the interest rate differentials between the two rivals, points to more potential weakness back toward 1.0600 as long as the key 1.0740 level holds as resistance.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX