EUR/USD Outlook

EUR/USD initiates a series of higher highs and lows as the Euro appreciates against most of its major counterparts, and the exchange rate may stage further attempts to clear the April 2022 high (1.1076) as it breaks out of the range bound price action from last week.

EUR/USD forecast: April 2022 high back on radar

EUR/USD approaches the monthly high (1.1076) as it rises for the third consecutive day, and speculation surrounding the European Central Bank (ECB) may keep the Euro afloat as the Governing Council keeps the door open to implement another 50bp rate hike at its next meeting on May 4.

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

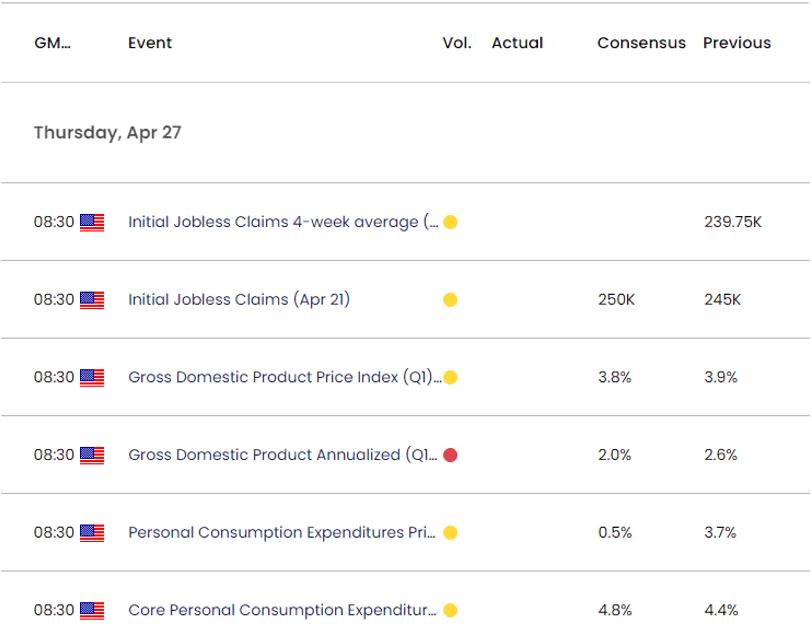

At the same time, the US Gross Domestic Product (GDP) report may sway EUR/USD as the update is anticipated to show a slowing economy, while the core Personal Consumption Expenditure (PCE) index, the Federal Reserve’s preferred gauge for inflation, is now expected to uptick to 4.8% from 4.4% per annum during the same period.

A rise in the core PCE may push the Federal Open Market Committee (FOMC) to pursue a more restrictive policy as Fed Governor Lisa Cook warns that ‘there is evidence that the path back to our low and stable inflation goal could be long and is likely to be uneven and bumpy,’ and the central bank may tame speculation for an imminent change in regime as ‘the US labor market is very strong.’

In turn, expectations for another 25bp Fed rate hike on May 3 may keep EUR/USD within the monthly range, but Chairman Jerome Powell and Co. may continue to adjust the forward guidance for monetary policy as US households and businesses face tightening financing conditions.

With that said, EUR/USD may continue to carve a series of higher highs and lows as it breaks out of last week’s range, but the exchange rate may consolidate over the remainder of the month if it stages another failed attempt to breach the April 2022 high (1.1076).

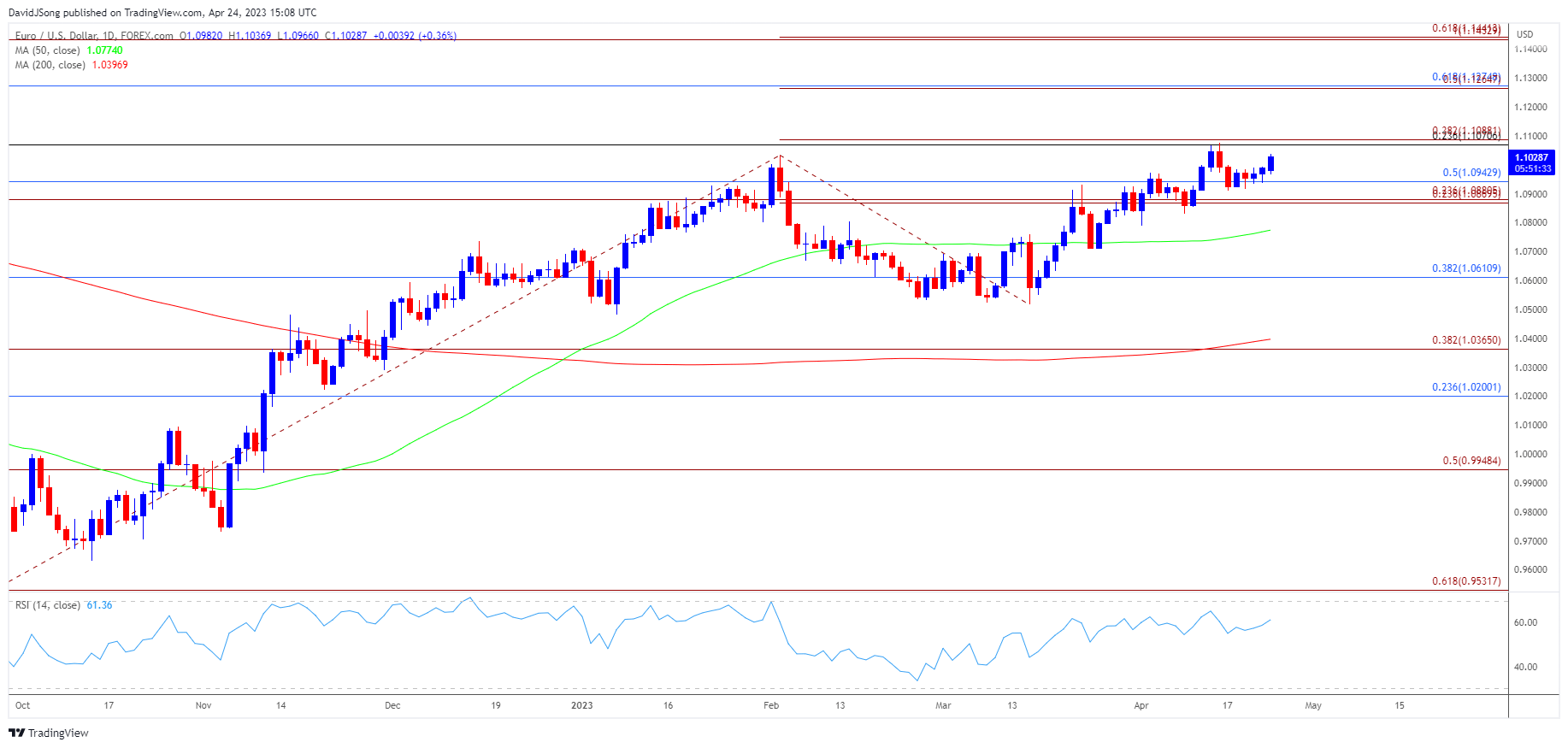

Euro Price Chart – EUR/USD Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD initiates a series of higher highs and lows as it breaks out of the range bound price action from last week, and the exchange rate may test the April 2022 high (1.1076) as it bounces back from the 1.0880 (23.6% Fibonacci extension) to 1.0940 (50% Fibonacci retracement) region.

- A break/close above the 1.1070 (23.6% Fibonacci retracement) to 1.1090 (38.2% Fibonacci extension) area opens up the March 2022 high (1.1233), with the next region of interest coming in around 1.1270 (50% Fibonacci extension) to 1.1280 (61.8% Fibonacci retracement).

- However, failure to clear the April 2022 high (1.1076) may keep EUR/USD within the monthly range, with a move below the 1.0880 (23.6% Fibonacci extension) to 1.0940 (50% Fibonacci retracement) region bringing the monthly low (1.0788) on the radar.

Additional Resources:

Gold price defends weekly low going into Fed blackout period

AUD/USD outlook clouded by 'Death Cross' formation

--- Written by David Song, Strategist