Asian Indices:

- Australia's ASX 200 index rose by 14.7 points (0.2%) and currently trades at 7,379.50

- Japan's Nikkei 225 index has risen by 139.51 points (0.49%) and currently trades at 28,702.03

- Hong Kong's Hang Seng index has risen by 37.95 points (0.16%) and currently trades at 23,140.28

- China's A50 Index has fallen by -23.04 points (-0.15%) and currently trades at 15,741.19

UK and Europe:

- UK's FTSE 100 futures are currently up 28.5 points (0.39%), the cash market is currently estimated to open at 7,370.16

- Euro STOXX 50 futures are currently up 17.5 points (0.42%), the cash market is currently estimated to open at 4,234.56

- Germany's DAX futures are currently up 53 points (0.34%), the cash market is currently estimated to open at 15,646.47

US Futures:

- DJI futures are currently up 21 points (0.06%)

- S&P 500 futures are currently up 6.25 points (0.04%)

- Nasdaq 100 futures are currently up 4 points (0.09%)

Asian trade echoed yesterday’s cautious gains, after failing to pick up from Wall Street’s rally. We’re hopeful that sentiment can remain buoyant during the last full-day’s trade today, as many major exchanges close early on Christmas eve.

Initial studies suggest Omicron may not be as severe as Delta

A study from South Africa, which is yet to be peer-reviewed, provides a glimmer of hope that the Omicron variant may be less severe than Delta. This follows on from separate research from London’s Imperial College which estimates Omicron’s hospitalisation rate could be 40-45% compared to Delta’s. It is still early days and the data is deemed to be on the messy side, but such reports from South Africa are the closest thing we have to a leading indicator right now with this variant.

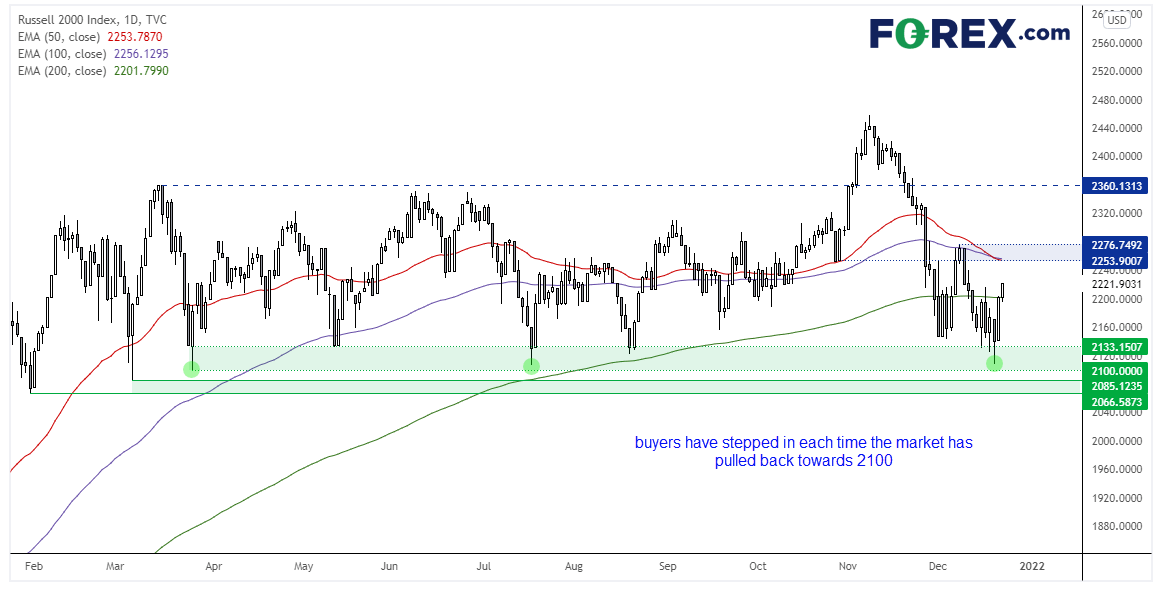

Russell 2000 shows the potential for a strong rally

One US market we’re keeping an eye on for some ‘catch-up’ gains is the Russell 2000. The small-cap index fell just under -15% since its November high, all the way back to the lows of its March to October range. Buyers have stepped in each time the market has pulled back to the 2085 – 2130 area since April, and it has been no different this week after the index printed a spike low just above 2100 and rallied once more. Moreover, it closed above tis 200-day eMA yesterday. Therefore, our bias remains bullish above 2100 with an initial target around 2250, where the 100 and 50-day eMA’s reside. A break above 2300 opens-up a run for 2360.

Keeping an eye on a potential oil breakout

As mentioned in today’s Asian Open report, WTI looks firm near the highs of a previous consolidation range so we are watching for a break of $74 to confirm (or assume) trend continuation. A direct break of yesterday’s low places that bias on the backburner.

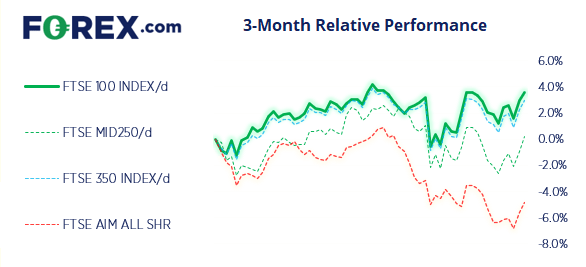

FTSE 350: Market Internals

The FTSE 100 closed at its high for the day for a second day running and closed in on our initial target near the December high. From here we want to see the FTSE hold above 7300 and, with any luck, bulls can push this higher ahead of Christmas towards 7400.

FTSE 350: 4195.82 (0.61%) 22 December 2021

- 287 (81.77%) stocks advanced and 57 (16.24%) declined

- 9 stocks rose to a new 52-week high, 0 fell to new lows

- 54.7% of stocks closed above their 200-day average

- 51% of stocks closed above their 50-day average

- 23.65% of stocks closed above their 20-day average

Outperformers:

- + 7.37% - Provident Financial PLC (PFG.L)

- + 5.50% - Syncona Ltd (SYNCS.L)

- + 4.79% - SSP Group PLC (SSPG.L)

Underperformers:

- ·-2.57% - Rentokil Initial PLC (RTO.L)

- ·-2.21% - Hochschild Mining PLC (HOCM.L)

- ·-1.65% - GCP Infrastructure Investments Ltd (GCPI.L)

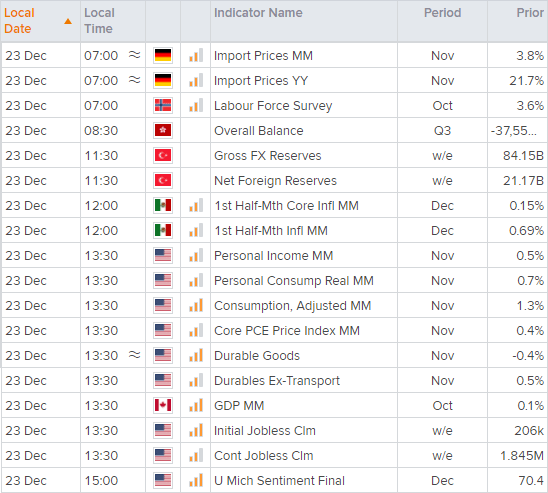

Up Next (Times in GMT)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.