Asian Indices:

- Australia's ASX 200 index rose by 47 points (0.65%) and currently trades at 7,228.30

- Japan's Nikkei 225 index has risen by 61 points (1.7095%) and currently trades at 28,115.74

- Hong Kong's Hang Seng index has risen by 72.99 points (0.42%) and currently trades at 17,497.40

- China's A50 Index has fallen by -11.99 points (-0.1%) and currently trades at 12,183.32

UK and Europe:

- UK's FTSE 100 futures are currently up 12 points (0.16%), the cash market is currently estimated to open at 7,464.84

- Euro STOXX 50 futures are currently up 13 points (0.33%), the cash market is currently estimated to open at 3,942.90

- Germany's DAX futures are currently up 39 points (0.27%), the cash market is currently estimated to open at 14,461.35

US Futures:

- DJI futures are currently up 2 points (0.01%)

- S&P 500 futures are currently down -27.5 points (-0.23%)

- Nasdaq 100 futures are currently down -2.25 points (-0.06%)

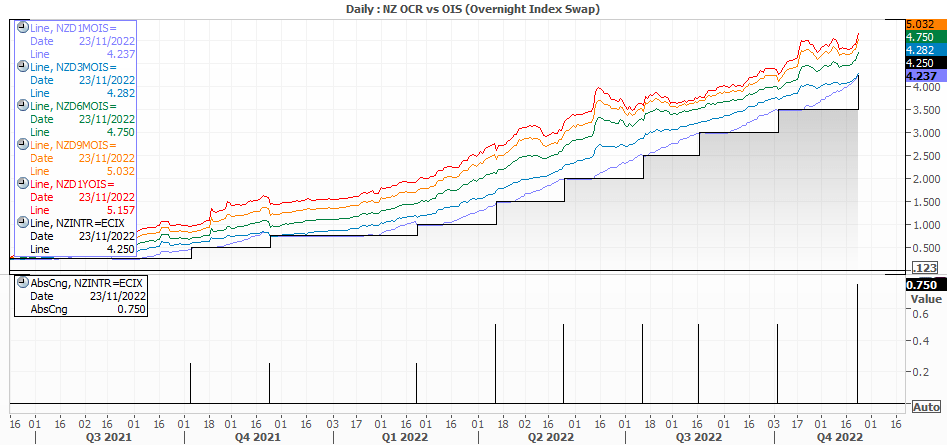

Summary of RBNZ statement and MPC

- The RBNZ hiked their overnight cash rate for a ninth consecutive meeting by a historic 75bp, taking the OCR from 3.5% to 4.25%

- Increases of 50, 75 and 100 basis points were considered.

- The committee agreed that the cash rate needed to reach a higher level, and sooner than previously indicated

- 2024 OCR projection was increased to 5.5% from 4.1%

- GDP downgraded to 0.1% in 2024, from 0.8% in the prior MPS

- CPI upgraded to 7.5% in 2023 (5.3%) prior and 3.8% in 2024 (3.01% prior)

- Unemployment to rise to 5% in 2024 (4.6% prior)

The 75bp hike and statement was about as hawkish as you get could bet without going for a 100bp hike (which was also considered). Whilst the usual pattern of raising inflation forecasts and lower growth expectations were apparent, the terminal rate being lifted from 4.1% to 5.5% in 2024 raised an eyebrow or two. This places the RBNZ slightly above the Fed’s terminal rate of 5 – 5.25% but also later. But it has also helped push AUD/NZD closer to the initial 1.0700 target mentioned in yesterday’s preview with 1.0600 also a likely contender with the relatively dovish RBA. NZD/CAD has also retested its cycle high.

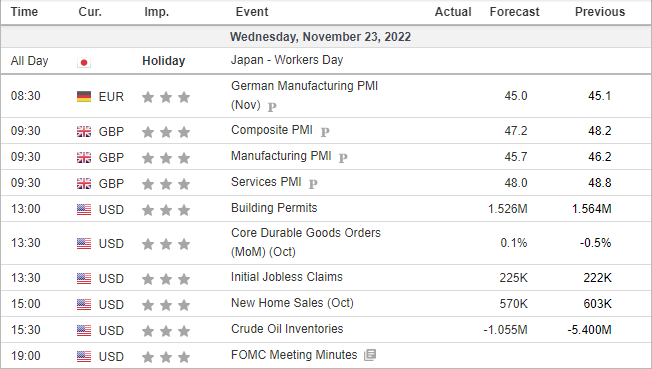

FOMC minutes in focus:

The November FOMC minutes are in focus at 19:00 GMT, and traders will be seeking clues as to whether the Fed are leaning towards a 75 or 50bp hike in December. As money market are currently estimating a ~76% probability of a 75bp hike, it could give stock markets a boost if the minutes lean towards a 50.

But as the meeting occurred ahead of the weaker-than-expected inflation report, Fed members lacked this important piece of the puzzle. So in that respect, the minutes may already be out of date. And as we have already heard some Fed members reiterate their hawkish stance to reverse the ripples seen after the soft inflation print, a 75bp hike in December remains alive and well.

In simple terms, if traders perceive another 75bp hike in December then it could weigh on equity prices – although markets are already favouring this scenario. But if they do somehow lean towards a 50bp hike, it could help lift spirits on Wall Street – which tends to benefit the day ahead of Thanksgiving anyway looking at average returns the day prior.

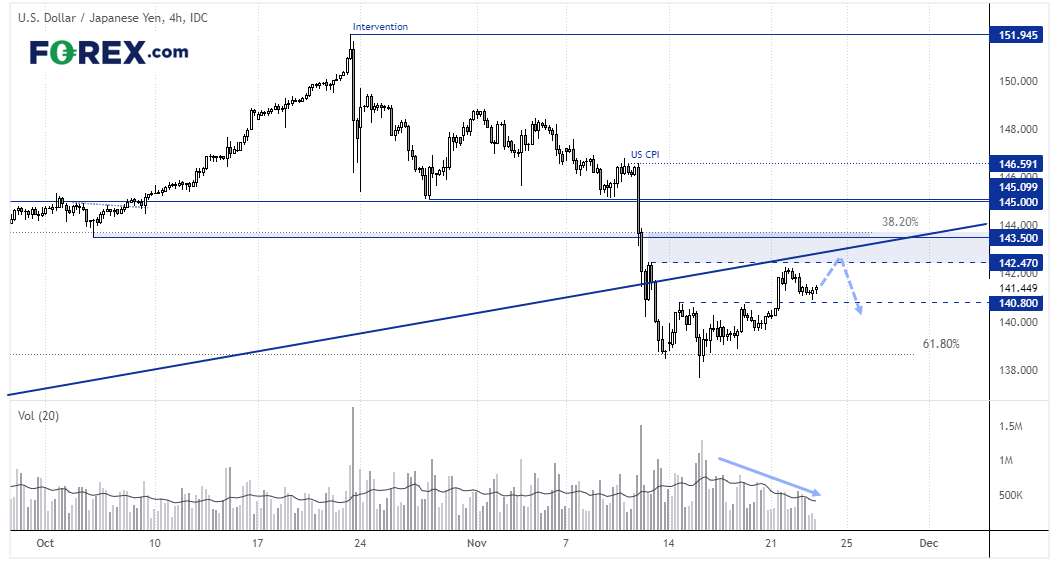

USD/JPY 4-hour chart:

The US dollar has moved higher in line with the bias outlined in earlier reports. However, upside momentum is lacking as we approach the release of the FOMC minutes and US Thanksgiving on Thursday.

USD/JPY is trending higher from the November 15th low, but volumes are trending lower which suggests a lack of buying power overall. Prices have retraced from the 142 high but holding above 140.8 support, so perhaps there’s the potential for another leg higher. However, take note of resistance levels overhead including the broken trendline, 142.47 high and 143.50 low. I’m therefore cautiously bullish and looking out for a potential swing high around 142.47 – 143.50, if one doesn’t arrive sooner.

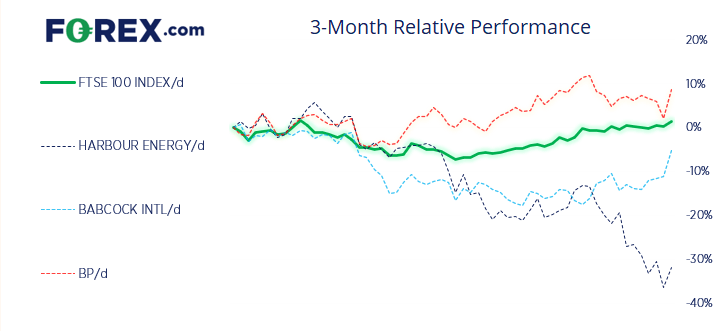

FTSE 350 market internals:

FTSE 350: 4132.36 (0.66%) 22 November 2022

- 229 (65.43%) stocks advanced and 112 (32.00%) declined

- 9 stocks rose to a new 52-week high, 0 fell to new lows

- 12.57% of stocks closed above their 200-day average

- 50.57% of stocks closed above their 50-day average

- 5.43% of stocks closed above their 20-day average

Outperformers:

- + 7.05% - Harbour Energy PLC (HBR.L)

- + 6.62% - Babcock International Group PLC (BAB.L)

- + 6.52% - BP PLC (BP.L)

Underperformers:

- -10.70% - Petrofac Ltd (PFC.L)

- -9.57% - Wizz Air Holdings PLC (WIZZ.L)

- -9.25% - TBC Bank Group PLC (TBCG.L)

Economic events up next (Times in GMT)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.