Asian Indices:

- Australia's ASX 200 index fell by -26.7 points (-0.4%) and currently trades at 6,602.60

- Japan's Nikkei 225 index has fallen by -285.94 points (-1.08%) and currently trades at 26,137.53

- Hong Kong's Hang Seng index has fallen by -298.75 points (-1.37%) and currently trades at 21,554.32

- China's A50 Index has fallen by -223.93 points (-1.5%) and currently trades at 14,734.74

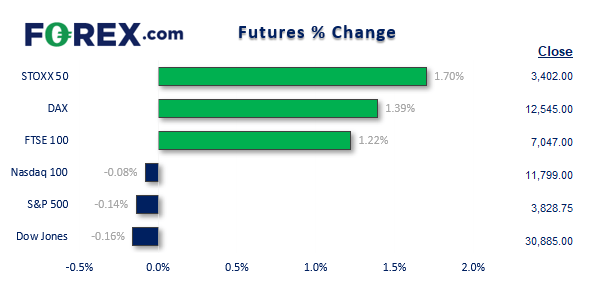

UK and Europe:

- UK's FTSE 100 futures are currently up 86 points (1.24%), the cash market is currently estimated to open at 7,111.47

- Euro STOXX 50 futures are currently up 57 points (1.7%), the cash market is currently estimated to open at 3,416.83

- Germany's DAX futures are currently up 174 points (1.41%), the cash market is currently estimated to open at 12,575.20

US Futures:

- DJI futures are currently down -52 points (-0.17%)

- S&P 500 futures are currently down -11.75 points (-0.1%)

- Nasdaq 100 futures are currently down -5.75 points (-0.15%)

You may have noticed the volatility in yesterday’s European session, stemming from weak business sentiment and fears of a recession. With markets sensitive to European data then it is worth keeping an eye on several data points today. Germany release industrial orders and manufacturing output at 07:00 BST. S&P Global release construction PMI data for Germany, France, Italy and the broader Eurozone at 08:30 BST. Ultimately, any signs of doom and gloom in the data is likely to weight further on sentiment in the region.

The DAX closed to a 2-month low

The DAX reached the March lows yesterday and closed just beneath them, during its most volatile day in four months. That is closed at the low of the day and volatility is increasing at the lows suggests there could be further downside for this trend. The 10-day eMA has capped as resistance and we suspect bears are now eyeing up a move to 12,000 – near the monthly S2 pivot point. And that could be reached within a day or two if the current direction and levels of volatility persists. Whilst the bias remains bearish below 12,915, bears may be tempted to fade into any rally below 12,600.

DAX 30 trading guide

US PMI data also in focus

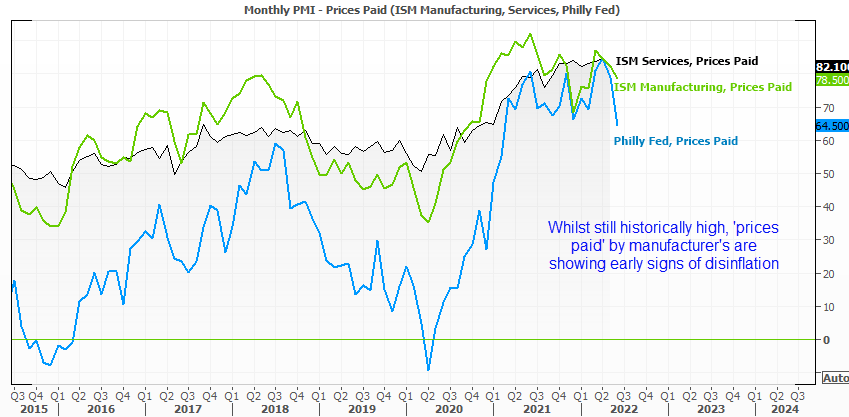

Of course, fears of a recession are not limited to Europe. I have covered several data points recently which suggest growth will continue to slow and, with it, inflationary pressures. Recently we have seen regional PMI’s contract and on Friday the ISM manufacturing index sank to a 2-year low. New orders also contracted for the first time since the pandemic, and employment contracted for a second month.

However, with the economy very much service based then we’re keeping a close eye on whether the ISM services report also loses steam. It is released today at 15:00 – just 15 mins after the S&P Global PMI data for the US. Should we see further weakness in the ISM services report then it points to a broad slowdown in the US. The only upshot for all of this is that is deflationary, and several reads of ‘prices paid’ by manufactures have turned lower from recent highs.

FTSE 350 – Market Internals:

FTSE 350: 3895.69 (-2.86%) 05 July 2022

- 65 (18.57%) stocks advanced and 280 (80.00%) declined

- 2 stocks rose to a new 52-week high, 82 fell to new lows

- 14.86% of stocks closed above their 200-day average

- 25.71% of stocks closed above their 50-day average

- 1.14% of stocks closed above their 20-day average

Outperformers:

- + 5.30% - Dechra Pharmaceuticals PLC (DPH.L)

- + 3.59% - Ascential PLC (ASCL.L)

- + 3.54% - SEGRO PLC (SGRO.L)

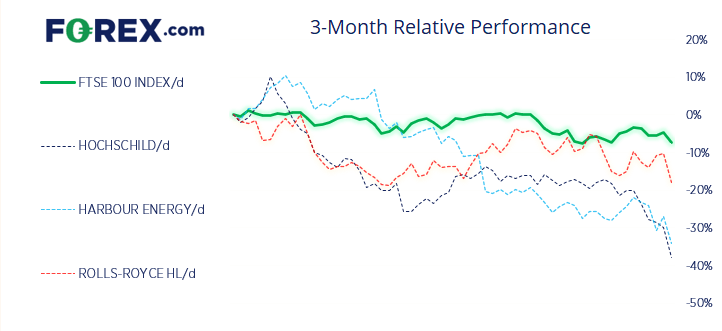

Underperformers:

- -11.42% - Hochschild Mining PLC (HOCM.L)

- -9.63% - Harbour Energy PLC (HBR.L)

- -8.57% - Rolls-Royce Holdings PLC (RR.L)

Economic events up next (Times in BST)

- 13:30 – BOE Cunliffe talks about Central Bank digital currencies

- The FOMC release minutes of the meeting from the 14 – 15th of June

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.