Asian Indices:

- Australia's ASX 200 index rose by 17.4 points (0.26%) and currently trades at 6,807.30

- Japan's Nikkei 225 index has fallen by -50.2 points (-0.18%) and currently trades at 27,649.05

- Hong Kong's Hang Seng index has risen by 287.7 points (1.4%) and currently trades at 20,850.64

- China's A50 Index has risen by 67.94 points (0.49%) and currently trades at 14,060.11

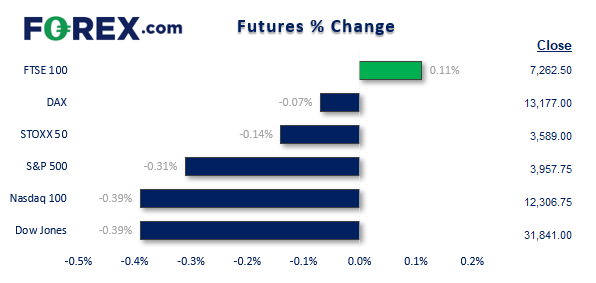

UK and Europe:

- UK's FTSE 100 futures are currently up 8 points (0.11%), the cash market is currently estimated to open at 7,314.30

- Euro STOXX 50 futures are currently down -5 points (-0.14%), the cash market is currently estimated to open at 3,599.16

- Germany's DAX futures are currently down -9 points (-0.07%), the cash market is currently estimated to open at 13,201.32

US Futures:

- DJI futures are currently down -126 points (-0.39%)

- S&P 500 futures are currently down -47.25 points (-0.38%)

- Nasdaq 100 futures are currently down -12.25 points (-0.31%)

Energy prices were higher overnight after Russia said it would cut its gas supply to Europe from Wednesday. This is a blow to hopes that economic pressures would ease across Europe after Russia previously said they would allow Ukraine to export grain from the Black Sea. And these fears have been exacerbated on reports that Russia is attacking coastal regions in the Black Sea area.

Naturally, supply concerns have resurfaced and this could continue to place upwards pressure on oil prices. Over the past two weeks we have seen managed funds trim their short exposure to WTI futures, and last week increased long exposure. So perhaps we have already seen a low in oil prices over the near-term.

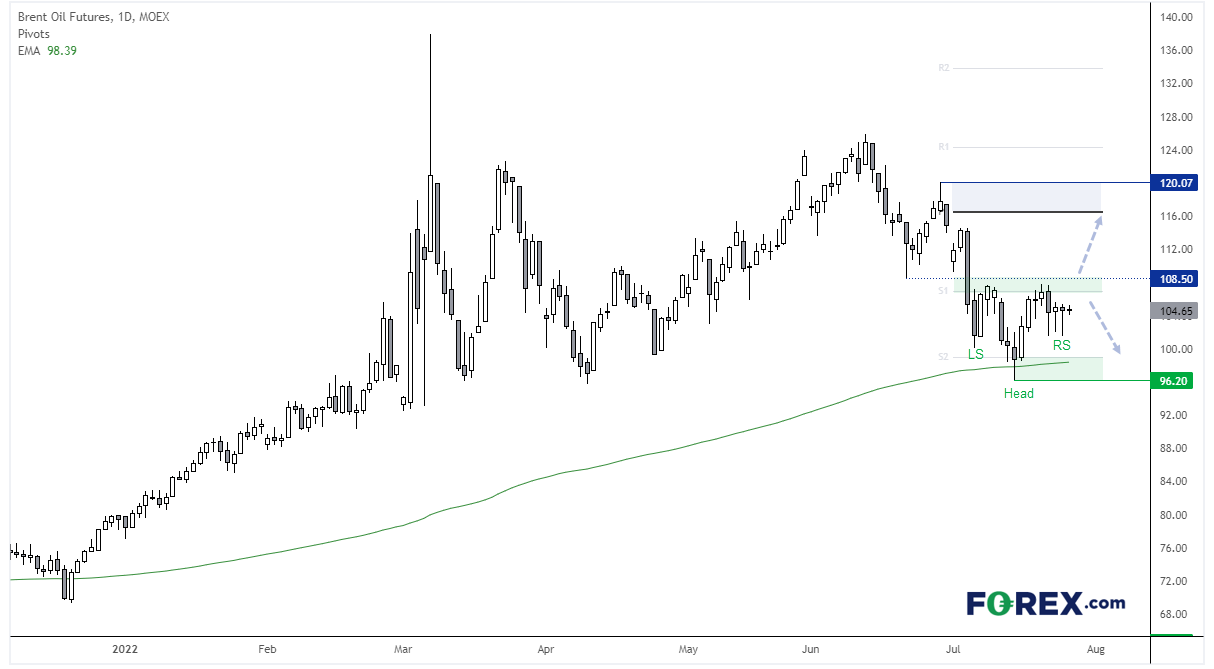

Brent daily chart:

Brent fell around -23% from the June high before finding support at its 200-day eMA. Prices have since recovered back above $100 and retested a prior swing high, and a subsequent pullback leaves a potential inverted head and shoulders pattern (H&S) on the daily chart. Two bullish hammers have formed as part of a potential ‘right shoulders’ (RS).

If successful the pattern projects a target around $120, near the monthly pivot point. Traditionally traders would wait for a break above the neckline to confirm the pattern. However, an alternative approach is to enter during the ‘RS’ phase to anticipate the breakout, otherwise known as the Quasimodo pattern. The risk here is the market fails to break above resistance, but it can increase the potential reward to risk ratio. In either case, the bias would remain bullish above the recent hammer low / RS.

Cautious trade leads to tight ranges

Volatility was low overall as we head towards this week’s FOMC meeting. Traders continue to favour a 75-bp hike, although a 100-bp remains a noteworthy possibility. GBP was the strongest major currency whilst USD and CHF were the weakest, but with ranges remaining tight it is difficult to read too much into their relative strength.

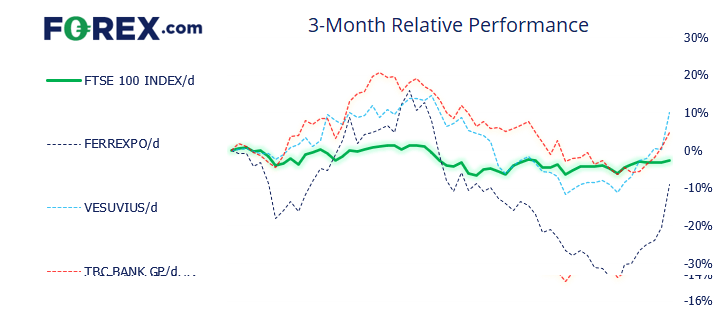

FTSE 350 – Market Internals:

FTSE 350: 4075.64 (0.41%) 22 July 2022

- 157 (44.73%) stocks advanced and 176 (50.14%) declined

- 7 stocks rose to a new 52-week high, 1 fell to new lows

- 29.34% of stocks closed above their 200-day average

- 79.77% of stocks closed above their 50-day average

- 22.79% of stocks closed above their 20-day average

Outperformers:

- + 14.18% - Ferrexpo PLC (FXPO.L)

- + 9.91% - Vesuvius PLC (VSVS.L)

- + 4.01% - TBC Bank Group PLC (TBCG.L)

Underperformers:

- -6.45% - Jupiter Fund Management PLC (JUP.L)

- -4.81% - Chrysalis Investments Ltd (CHRY.L)

- -4.74% - Carnival PLC (CCL.L)

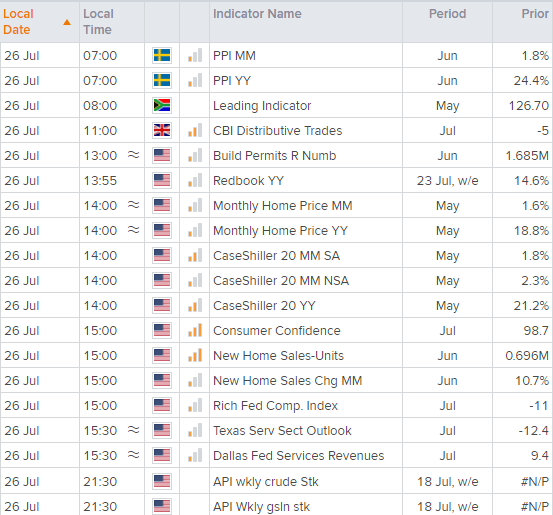

Economic events up next (Times in BST)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.