Asian Indices:

- Australia's ASX 200 index fell by -116.9 points (-1.6%) and currently trades at 7,198.00

- Japan's Nikkei 225 index has fallen by -56.34 points (-0.17%) and currently trades at 33,518.80

- Hong Kong's Hang Seng index has fallen by -388.73 points (-1.98%) and currently trades at 19,218.35

- China's A50 Index has fallen by -128.3 points (-1%) and currently trades at 12,646.03

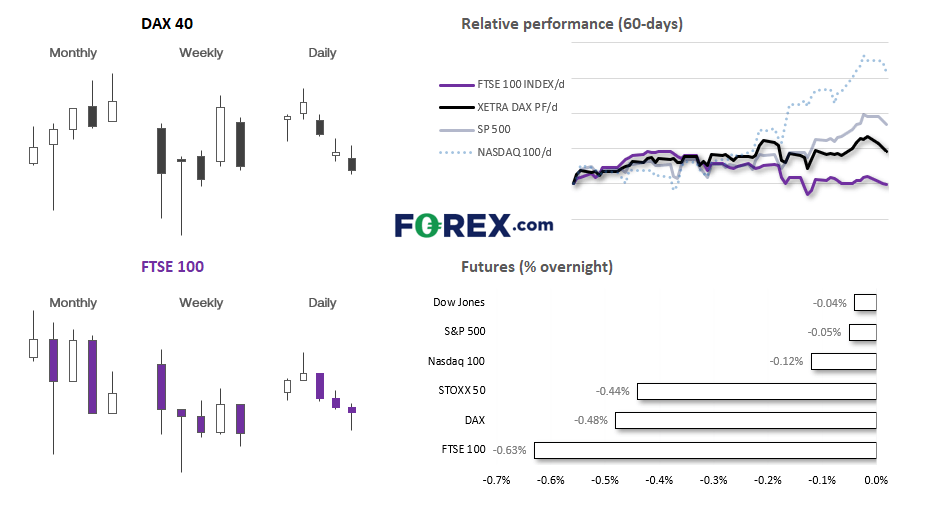

UK and Europe:

- UK's FTSE 100 futures are currently down -48.5 points (-0.64%), the cash market is currently estimated to open at 7,510.68

- Euro STOXX 50 futures are currently down -19 points (-0.44%), the cash market is currently estimated to open at 4,303.75

- Germany's DAX futures are currently down -79 points (-0.49%), the cash market is currently estimated to open at 15,944.13

US Futures:

- DJI futures are currently down -16 points (-0.05%)

- S&P 500 futures are currently down -2.25 points (-0.05%)

- Nasdaq 100 futures are currently down -19 points (-0.13%)

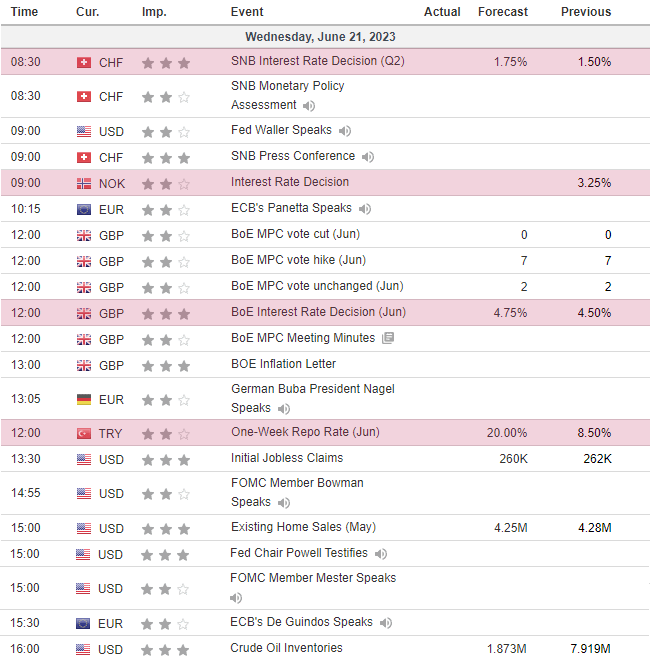

- Four central bank meetings are scheduled for today’s European session, starting with the SNB at 08:30 BST, Norway’s CB at 09:00, the BOE at 12:00 and Turkey’s CB at 12:00

- Whilst the consensus for the BOE and SNB favour a 25bp hike, we wouldn’t discount the potential for a 50bp hike from either

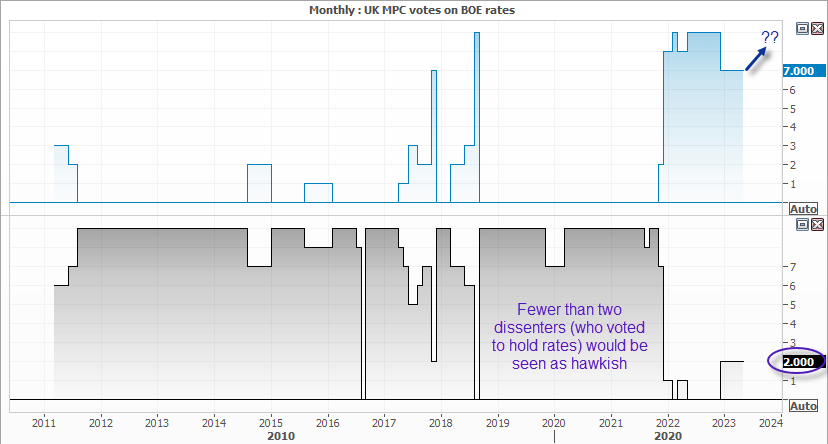

- The BOE are grappling with higher wages, inflation and a tight labour market, a hawkish 25bp hike seems likely at a minimum with the potential for fewer dissenters

- The CBRT (Turkey’s central bank) might deliver an eye-watering 1,250bp hike if the consensus is correct

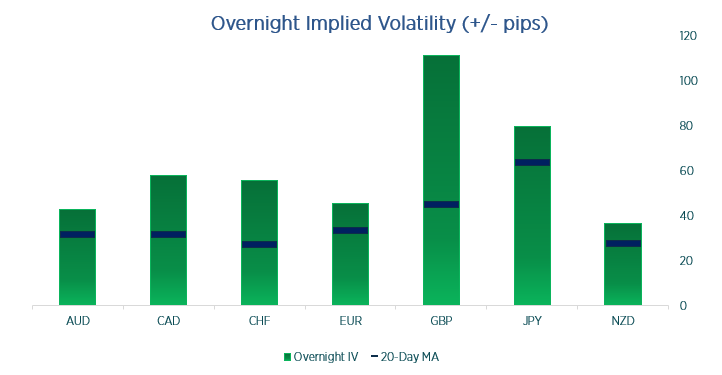

- Volatility has been very low overnight, although 1-day implied volatilities for all FX majors are above their 20-day averages (Implied volatility for GBP/USD is more than twice its 20-day average)

BOE expected to hike by 25bp (but don’t discount 50)

To think that the BOE were seriously considering pausing their tightening cycle back in Q4 is almost surreal, given inflation and wages are seemingly in a race to the top. The tight labour market and higher wages are fuelling the very demand-spiral the BOE feared the most, with core CPI rising to a 31-year high of 7.1% just yesterday. A 25bp was a given, but with five 25bp hikes now fully priced in on the 1-year OIS (and ~37% of a 50bp today), GBP traders should take nothing for granted and be prepared for the latter scenario.

Even if the BOE hike by 25bp, it would be seen as very hawkish if we see fewer than two MPC members dissent like that have since December. A 9-0 in favour would send a strong hawkish message with 8-1 in favour a close second, whilst a 7-2 in favour with a 25bp hike might make some question if money markets have over-estimated the terminal rate.

However, whilst higher rates traditionally means a stronger currency and weaker stock market, we have to question whether an aggressive hike could actually weigh on the pound as it shows full intent of the BOE breaking the economy to control inflation. We saw this very pattern on NZD pairs under the same circumstances during this tightening cycle, as hikes crushed business sentiment and their economic outlooks. And if the GBP falls on recessionary concerns, it will likely be accompanied by the FTSE too.

Conversely, perhaps a 25bp hike could be seen as a copout and support the FTSE. Either way, volatility can likely be expected for the event.

The SNB are also expected to hike by 25bp (but don’t discount a potential 50bp hike either)

The SNB (Swiss National Bank) has an enviably low base rate of 1.5%. Inflation has nearly returned to their 2% target a 2.2% year, yet SNB members are as hawkish as every when they speak publicly. The consensus is a 25bp hike, but with the RBA and BOC delivering hawkish hike following a pause, inflation roaring in the UK and the Fed promising more hikes this year, it’s not an impossible scenario to consider closing the gap with a 50bp hike today. Besides, is a 25bp is expected and delivered, volatility will be low (along with downside risks of betting on a 50bp hike). Remember, the SNB delivered a 50bp hike at the start of their tightening cycle when few were expecting it. And that could send the Swiss franc sharply higher, to the detriment of USD – our preferred currency to pair against the franc.

Turkey expected to have higher interest rates rates today

With President Erdogan re-elected and a new central bank puppet ‘chief at the helm’, Turkey are expected to follow more traditional methods of controlling interest rates by raising them as opposed to lowering them. Economists are in agreement that the CBRT (Central Bank of the Republic of Turkey) are set to raise interest rates today, but by how much remains to be seen. Rates currently sit at 8.5% with a median estimate for a 1,250bp hike to 21%, although some suspect it may be a slower route to higher rates given Erdogan’s reluctance to do so, for so long. Either way, USD/TRY may be watching purely for entertainment purposes if nothing else.

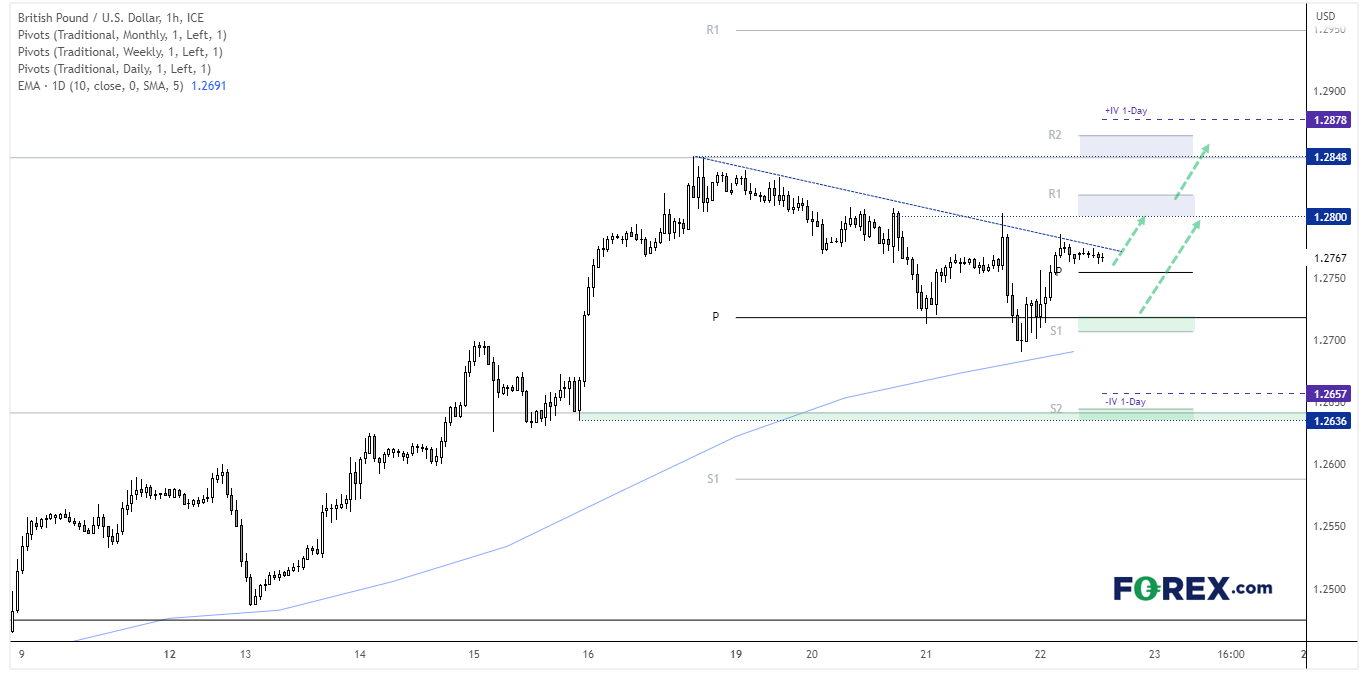

GBP/USD 1-hout chart:

Yesterday’s strong inflation report saw GBP/USD spike to our initial resistance zone around 1.2800 before reversing sharply lower. Support was found just above the 1.2700 handle and prices recovered back above the weekly pivot point before volumes began to rise alongside prices to show buyers stepping back in. Prices are consolidating in a tight range below trend resistance, and today’s bias is for another move to (and beyond) the 1.2800 / daily R1 zone, with the potential to break to a new cycle high. Tae note that the upper 1-day implied volatility level is above the daily R2 pivot at 1.2878.

Should prices pull back from the consolidation, we’d look for evidence of a swing low around or above the weekly pivot point / daily S1 zone, or the daily pivot point before its next anticipated move higher.

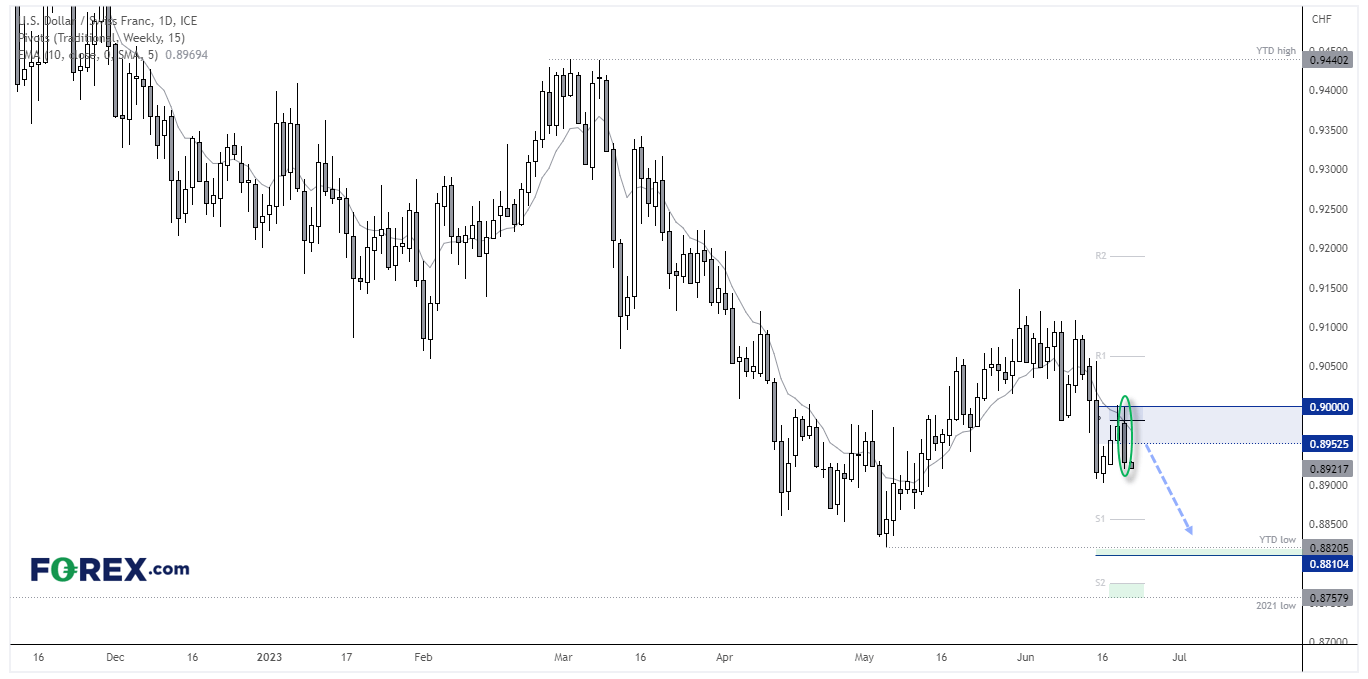

USD/CHF daily chart:

USD/CHF has produced a prominent swing high around 0.9000 with a bearish engulfing day, which is also part of a double top. Whilst it trades near cycle lows, we favour a break beneath it given its established downtrend (and the SNBs potential for a hawkish hike). The bias remains bearish beneath the 0.9000 high, but would also consider fading into moves beneath Tuesday’s low (which could increase the potential reward to risk ratio). We’re now looking for prices to move towards the YTD lows around 0.8820.

Economic events up next (Times in GMT+1)

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge