Euro technical outlook: EUR/USD short-term trade levels

- Euro price charts - Daily & 240min

- EUR/USD reverses sharply off uptrend resistance- now testing initial uptrend support

- Resistance 1.08, 1.0865/89, 1.1033 - support 1.0636, 1.05, 1.0405/61

Euro has been in free-fall for the past two-weeks with EUR/USD plunging into a major support pivot around the 2023 yearly open- its decision time for the bears. These are the updated targets and invalidation levels that matter on the EUR/USD short-term technical charts.

Discuss this EUR/USD setup and more in the Weekly Strategy Webinars beginning February 27th.

Euro Price Chart – EUR/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

Technical Outlook: Euro plunged more than 3.4% off the monthly high with EUR/USD now testing a key pivot zone at 1.0636-1.0705 – a region defined by the 2020 swing low, the December high-close and the objective 2023 yearly open.

I’m on the lookout for possible price inflection here with a break / close below this threshold threatening a larger correction within the broader uptrend. Key daily resistance now stands with the objective February open / 61.8 % retracement of the monthly range at 1.0865/89.

Euro Price Chart – EUR/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

Notes: A closer look at Euro price action shows EUR/USD opening the week at confluent support at 1.0636-1.0705. Initial resistance is eyed at the 1.08-handle with a breach / close above 1.0889 needed to mark resumption of the September uptrend towards key the 76.4% retracement of the 2022 range / yearly high at 1.1033.

A break below this key pivot zone could fuel an accelerated decline with such a scenario exposing 1.05 and the 2017 low-day close / 38.2% retracement of the October advance at 1.0405/61- an area of interest for possible downside exhaustion / price inflection IF reached.

Bottom line: EUR/USD has reversed off confluent uptrend resistance with the pullback now testing initial uptrend support- we’re looking for a reaction down here. From at trading standpoint, a good zone to reduce portions of short-exposure / lower protective stops – rallies should be capped by yearly open resistance IF price is heading lower on this stretch.

Review my latest Euro weekly technical forecast for a look at the longer-term EUR/USD trade levels.

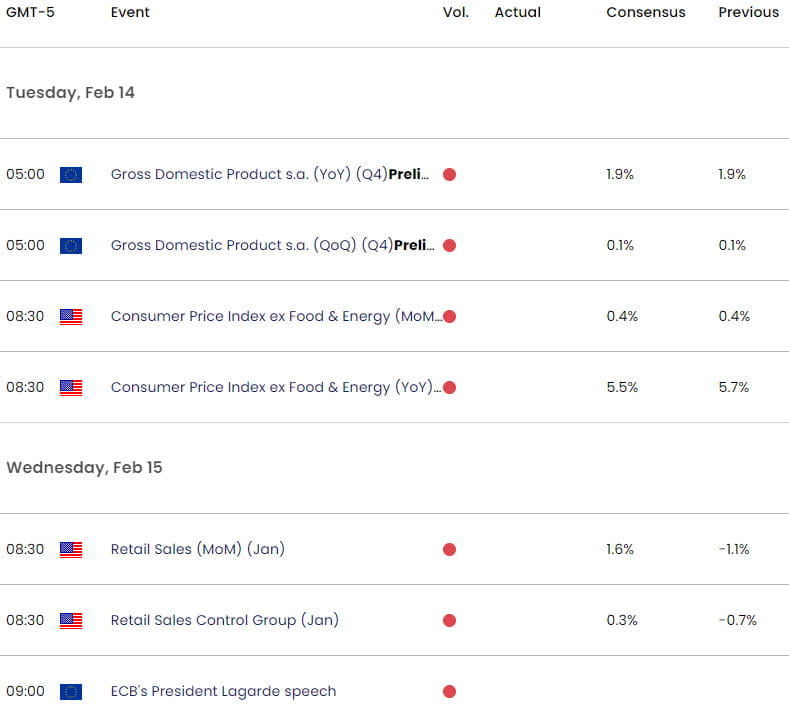

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex