Despite recent geopolitical risks in Europe posing potential threats to the euro, the common currency has managed to remain relatively resilient against its major counterparts, including the US dollar and Japanese yen. Most recently, a tense stalemate between Spain’s central government and the Catalonia region’s independence movement has also failed thus far in making any substantially negative impact on the euro.

The key upcoming event that could make a significant impact, whether positive or negative, will be the European Central Bank’s (ECB) policy decision and press conference set for a week from now, on Thursday of next week. Prior to that ECB meeting, key services and manufacturing PMI data for France, Germany, and the Eurozone as a whole, will be released on Tuesday.

Although an interest rate increase is certainly not expected from the ECB next week, euro traders will be paying extremely close attention to any indications by ECB President Mario Draghi of the central bank’s plans to taper its monthly asset purchases. Most expect the ECB to announce that it will begin reducing those purchases starting in January, down from the current €60 billion/month. The key questions remain, however, as to the specific magnitude of that reduction as well as the planned duration of the asset purchase program. The ECB will likely be wary about sounding too hawkish or aggressive in its tapering plans, as any such talk or action would undesirably exacerbate euro strength.

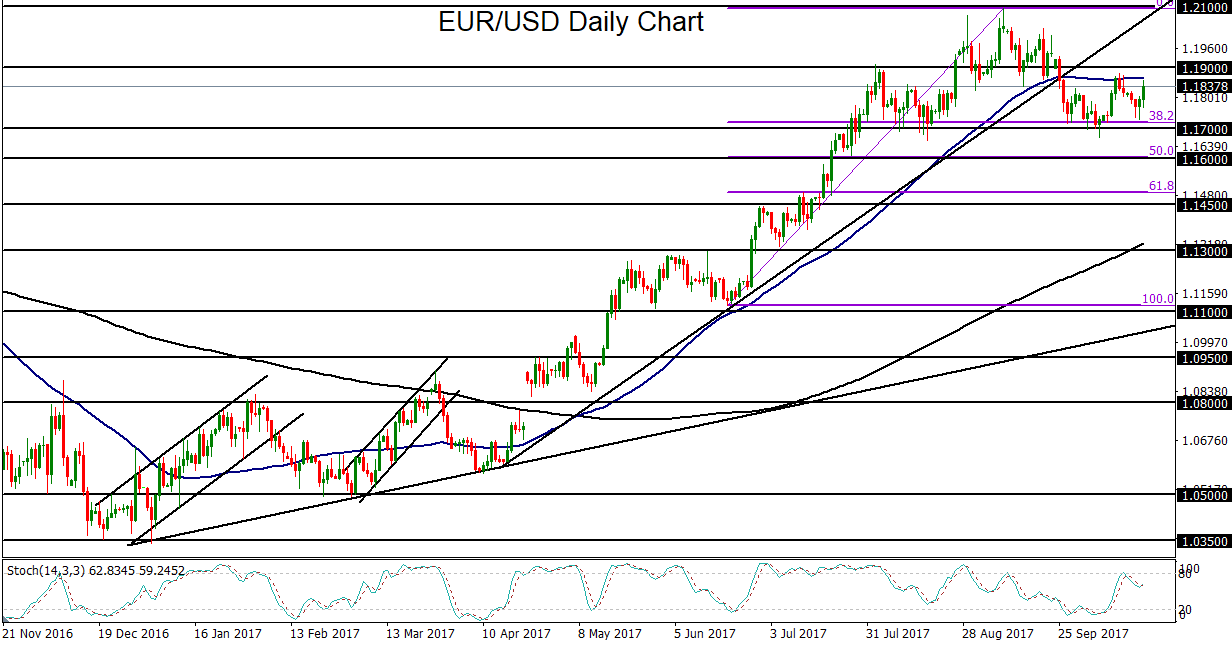

Ahead of this pivotal ECB decision, the euro, as noted, has remained resilient even in the face of significant geopolitical concerns. The euro has generally been trading in a range against the US dollar for the past three weeks, after the EUR/USD currency pair broke down in late September below a key uptrend line that has been in place since April. Currently, EUR/USD is trading just under its 50-day moving average and between key price levels around the 1.1700 support area to the downside and the 1.1900 resistance area to the upside. The ECB decision next week will help dictate if and in what direction the euro may break this trading range. A likely scenario is that the central bank may advocate a more gradual tapering process over a longer period of time than expected, in part to avoid further euro strengthening. If this is the case, the euro could take a hit and EUR/USD could stumble, especially if Fed-driven dollar support resumes. In this event, a EUR/USD breakdown below 1.1700-area support could pressure the currency pair towards key downside targets around the 1.1600 and 1.1450 support areas.