Asian Indices:

- Australia's ASX 200 index rose by 55.4 points (0.75%) and currently trades at 7,476.60

- Japan's Nikkei 225 index has risen by 474.01 points (1.32%) and currently trades at 36,437.28

- Hong Kong's Hang Seng index has fallen by -318.99 points (-2.08%) and currently trades at 14,989.70

- China's A50 Index has risen by 40.61 points (0.37%) and currently trades at 11,096.54

UK and European indices:

- UK's FTSE 100 futures are currently up 25 points (0.34%), the cash market is currently estimated to open at 7,486.93

- Euro STOXX 50 futures are currently up 41 points (0.92%), the cash market is currently estimated to open at 4,489.83

- Germany's DAX futures are currently up 141 points (0.85%), the cash market is currently estimated to open at 16,696.13

US index futures:

- DJI futures are currently up 53 points (0.14%)

- S&P 500 futures are currently up 12 points (0.25%)

- Nasdaq 100 futures are currently up 111 points (0.64%)

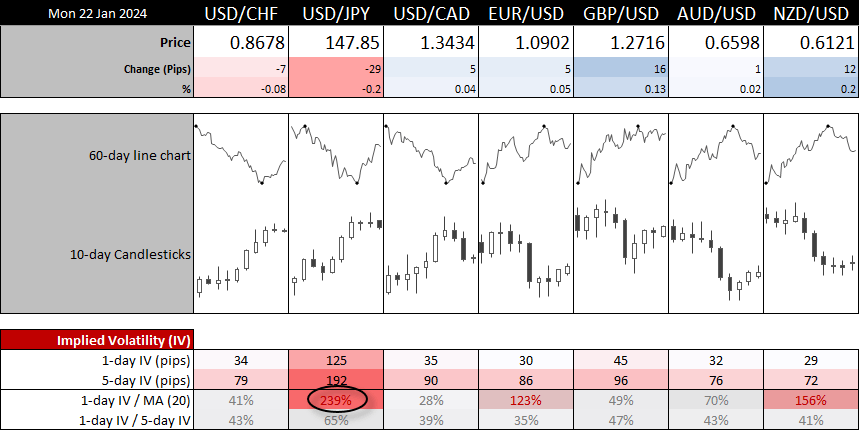

Implied volatility for the next 24 hours is quite varied among forex majors. Tomorrow’s BOJ (Bank of Japan) meeting has seen the IV shoot up to 239% of its 20-day average, which implies and up or down move of ~125 pips, which accounts for 65% of the week’s implied range. However, take note that the conclusion of the BOJ meeting is ~22 hours away, so that could mean quiet trade for the coming European and US sessions.

The 1-day IV for EUR/USD sits at 123% of its 20-day MA, and outside of NZD/USD the remain forex majors IV’s are all below 100% of their 20-day averages, which implies difficult trading conditions due to a lack of volatility.

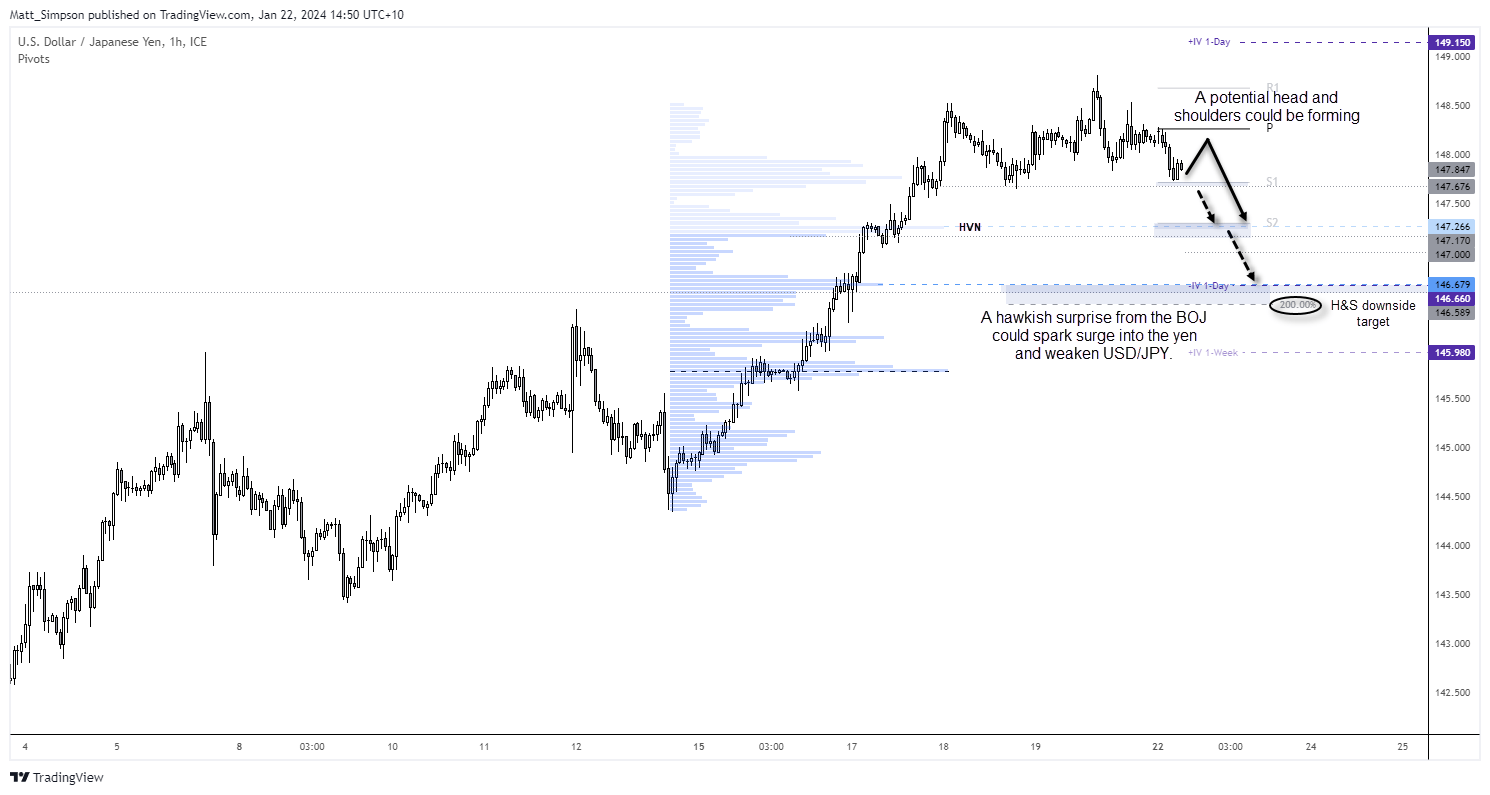

USD/JPY technical analysis (1-hour chart):

USD/JPY is on track for its best month since June 2022, having risen over 11% MTD. It is debatable how much upside potential remains for the remainder of the month given its strong start to the year. And for USD/JPY to simply continue higher and break above the BOJ intervention highs likely requires some sort of dovish surprise at tomorrow’s BOJ meeting – which would be quite some feat given their ultra-dovish policy. And if there were to be a surprise, I’d have to assume it would be of the hawkish variety which could send USD/JPY sharply lower.

And with little news flow and a pending meeting, I suspect any movement over the next three sessions may be technically driven and of the corrective nature. And this is due to the call for the US dollar to continue retracing on the daily chart before resuming its rally nearer to the end of the week.

USD/JPY is struggling to push higher, and has pulled back to the daily S1 pivot. Perhaps we’ll see a minor bounce form current levels before it tries to drive lower, in which case look for support around the 147.25 HVN (high volume node) to 147.

Also take note of a potential head and shoulders top, which projects a downside target around 146.50, just below the 1-day lower IV band and support cluster.

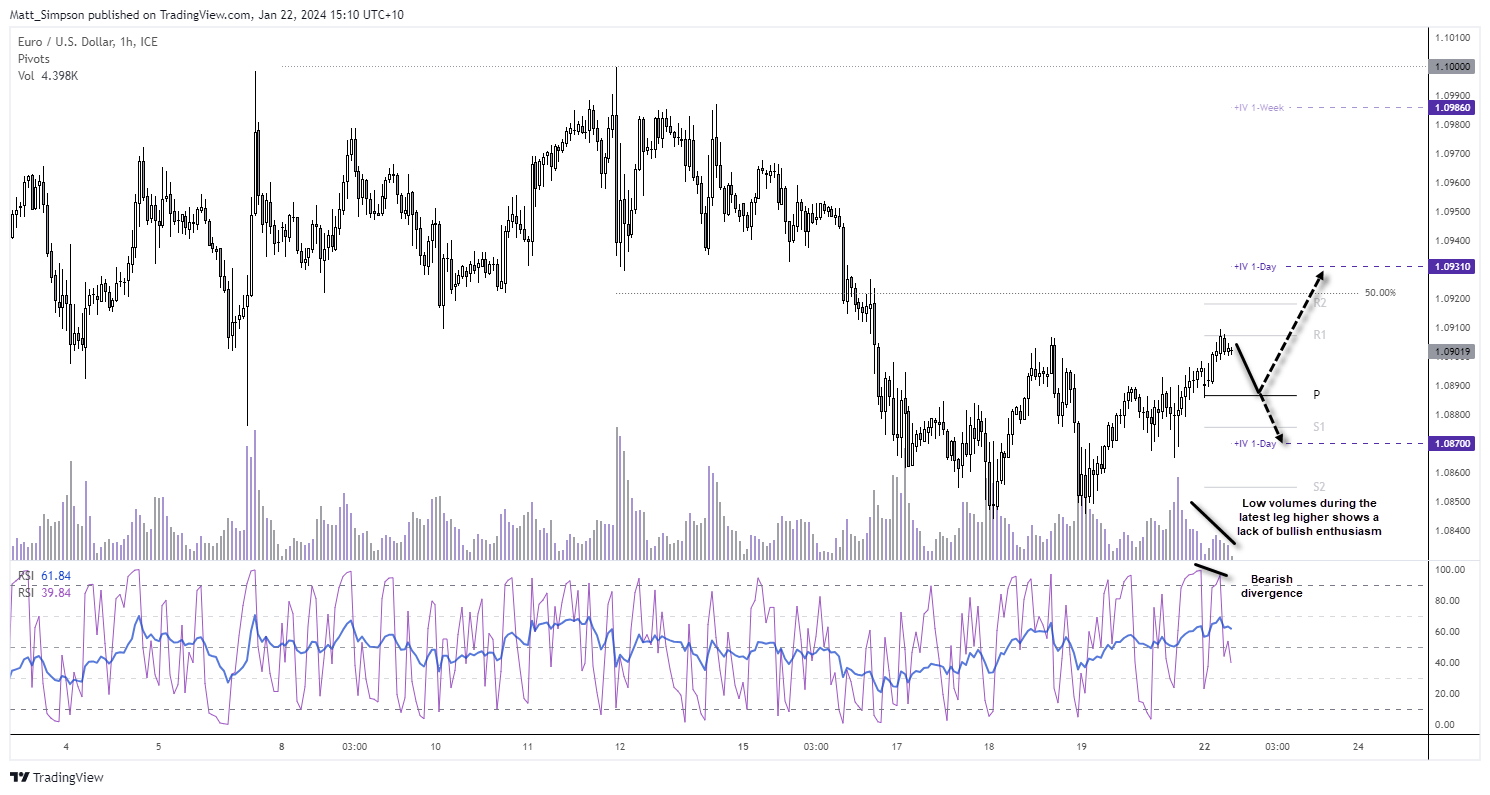

EUR/USD technical analysis (1-hour chart):

The euro rose to a 4-day high during Asian trade, although volatility has been typically low for a low-news, start-of-the-week day. EUR/USD has retraced lower after it failed to hold on to gains above the Jan 24 high, and as RSI (14) tapped oversold and RSI (2) moved into oversold alongside a bearish divergence, I suspect a retracement could be due before EUR/USD climbs slightly higher.

Also note that volumes have been very low during the move into these cycle highs, which shows a lack of bullish enthusiasm and increases the odds of a deeper retracement.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge