The economic calendar is beginning to ramp up with a key US inflation report, Fed members speaking ahead of the FOMC minutes and a BOC cash rate decision.

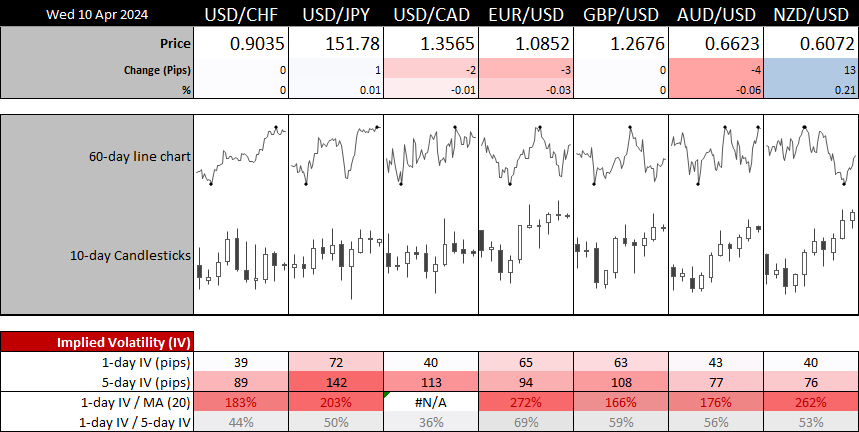

Implied volatility has spiked for several FX majors over the next 24 hours, with EUR/USD, NZD/USD and USD/JPY 24-hour IV at least double their 20-day average. And that means we could be off to a slow start for today's European session until US CPI data is released just after lunch. The BOC are not expected to change policy, although they might tip their hat to lower inflation and softer CPI expectations in their statement. We also have several Fed members speaking after US CPI, which could mix things u a bit.

Today we look at key levels for EUR/USD, USD/CHF and crude oil.

Events in focus (GMT +1):

- 13:30 – US inflation

- 13:45 – Fed Bowman speaks

- 14:45 – BOC interest rate decision, statement (no change expected)

- 15:30 – Crude oil inventories

- 15:30 – BOC press conference

- 17:45 – Fed Goolsbee, Barkin Speaks

- 19:00 – FOMC minutes

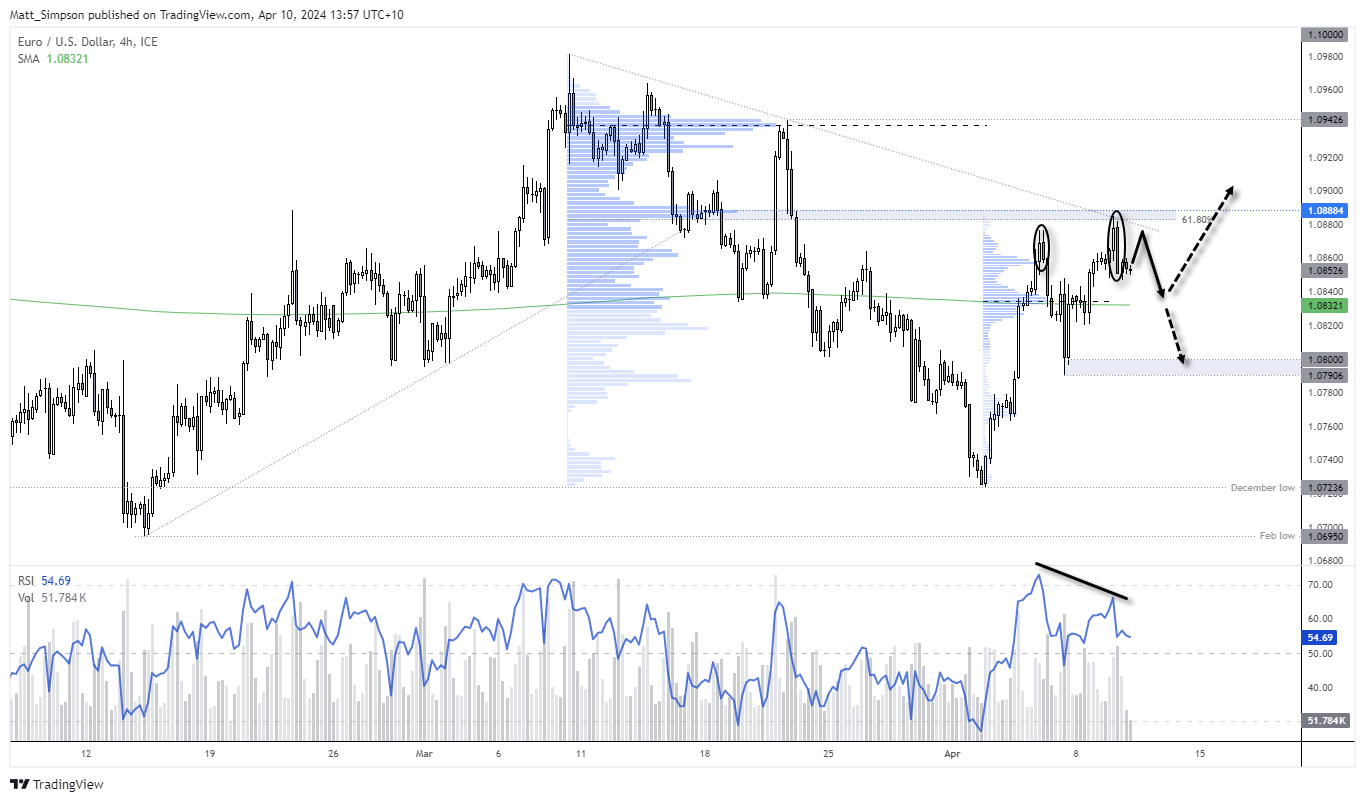

EUR/USD technical analysis (4-hout chart):

EUR/USD enjoyed a solid rally from the December low early last week, although that rally now appears to be losing steam. Tuesday’s high only managed a marginal gain above Friday’s high which has allowed a bearish divergence to form with the RSI (14). And a 2-bar bearish reversal (which includes and engulfing candle) formed around a 61.8% Fibonacci retracement level, high-volume node and trend resistance.

I suspect we’re in for some quiet trade over the next few hours, with the potential for some sharp moves in the lead up to the US inflation report as the market seeks out liquidity to absorb. And my guess is this could see the market move higher to fill some liquidity gaps within the previous bearish engulfing candle, before the CPI figures drop and the ‘real move’ commences.

Today’s bias is to fade into moves beneath yesterday’s highs, in anticipation of a move lower towards the 200-day MA and high-volume node around 1.0832, a break beneath which brings 1.0820 and 1.0800 into focus.

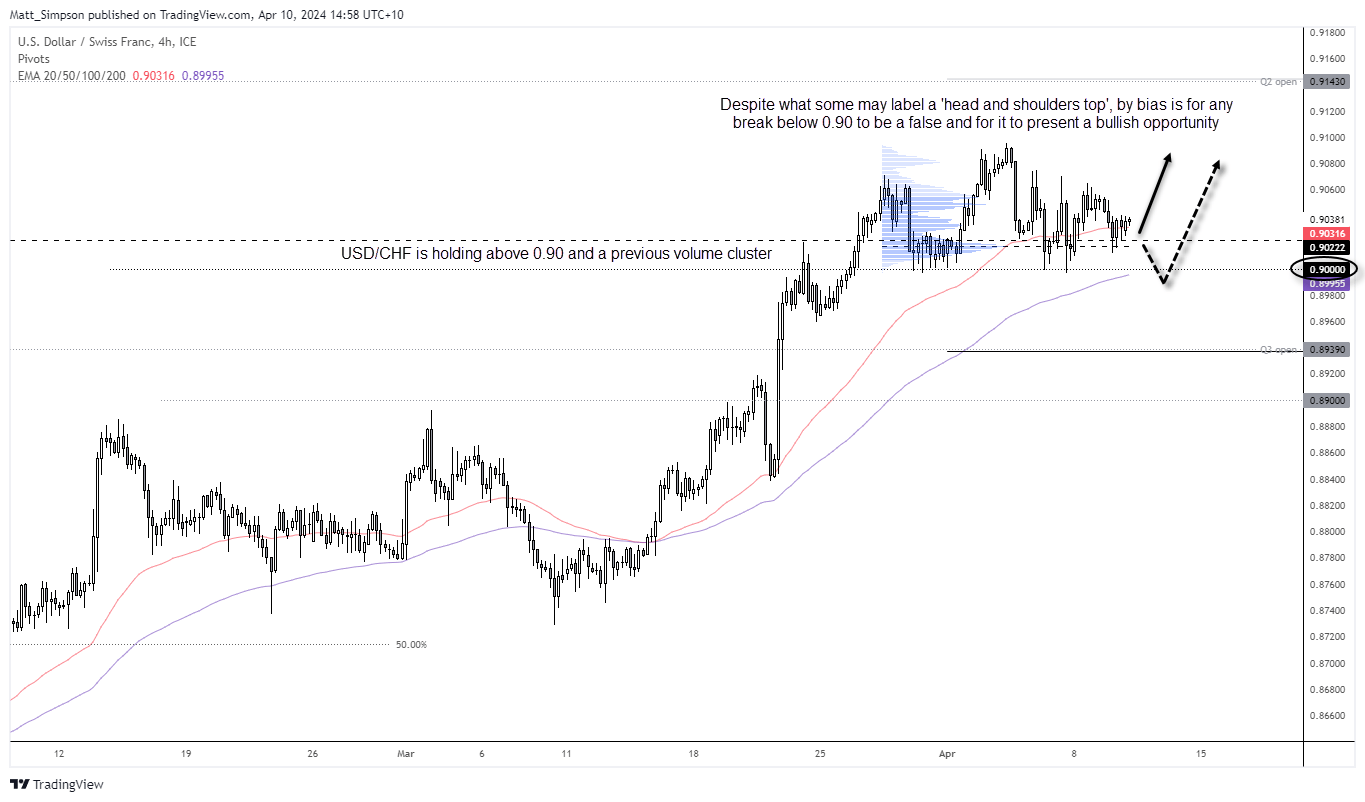

USD/CHF technical analysis (4-hout chart):

The continued weakness of the Swiss franc has allowed a much cleaner bullish trend on USD/CHF compared with the relative dollar performance against other forex majors. It reached my 0.90 target at the end of March and entered a period od consolidation, and is forming what some may call a ‘head and shoulders’ top pattern.

However, my bias is for the trend to continue higher given its respect of 0.90 as support. And should prices dip beneath that key level, I suspect it will be short lived and snapped up by bulls to deem any downside break of 0.90 as a fakeout before continuing higher.

Bulls could either see dips towards 0.90 or ait for a break above the current consolidation to assume bullish trend continuation.

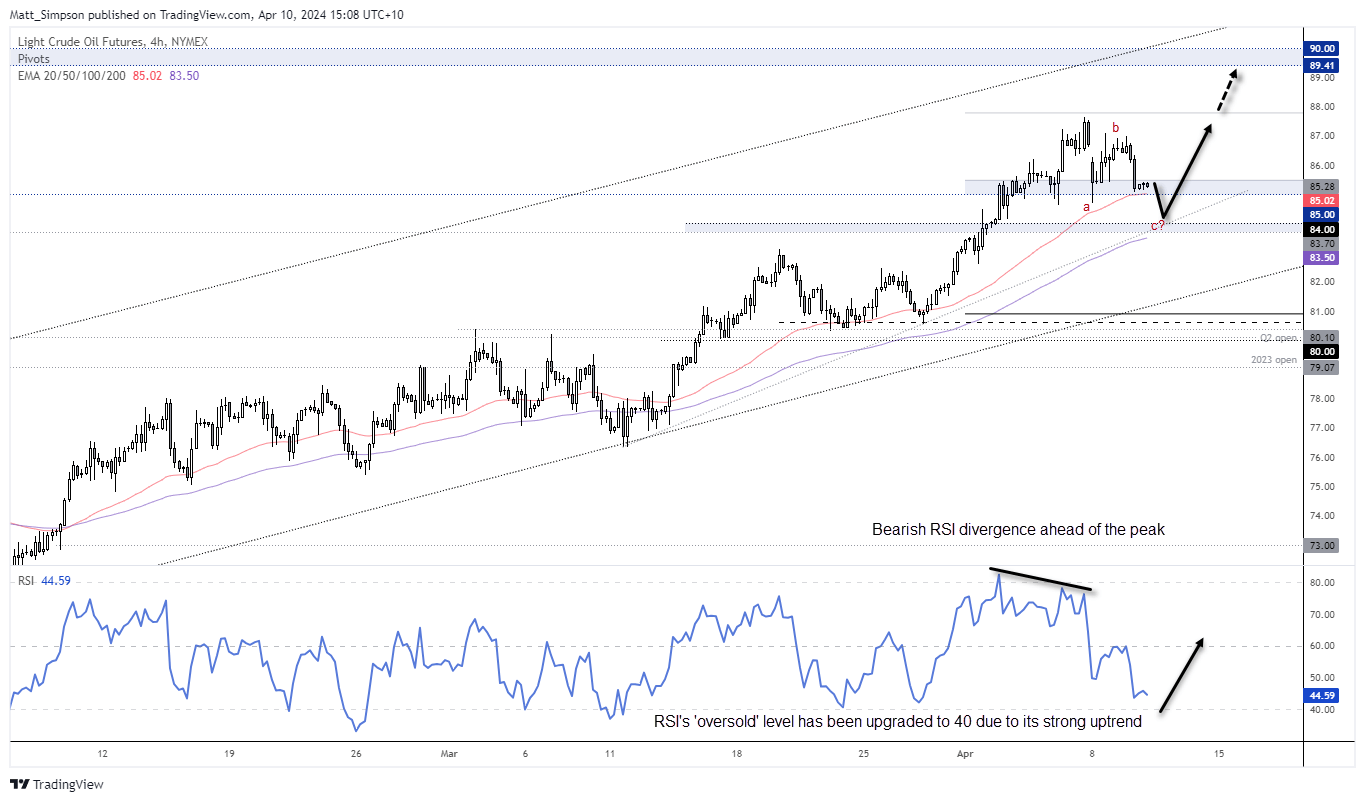

WTI crude oil technical analysis (4-hout chart):

I noted in this week’s COT report that managed funds and large speculators are piling into long bets of crude oil, yet shorts remain subdued. And that means that market positioning alongside the bullish price action has placed crude oil remains on my ‘buy the dip’ watchlist.

The trend structure is clearly bullish on the 4-hour chart and it trades well within a broader bullish channel. An internal trendline hints at support around $84, so any dips towards it will pique my bullish interest. Besides, crude oil does not appear to have yet completed a 3-wave retracement, which can be standard in such trends. And RSI (14) has not yet dipped to oversold, which has been upgraded to 40 as it is within an uptrend.

Therefore, the bias is for a deeper pullback towards $84 before bullish momentum returns and pushes crude oil prices to a new cycle high.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge