US employment once again surprised to the upside on Wednesday. 233k jobs were added to the US economy in October according to the ADP report, and September payrolls was upwardly revised to 159k from 143k. However, Q3 GDP was slightly softer at 2.8% y/y compared with 3% expected and prior. PCE prices were also softer at 1.5%, versus 2.7% forecast and 2.5% prior. This carves expectations for softer PCE figures in today’s monthly report and hot jobs in tomorrow’s NFP.

The euro was the strongest FX major on Wednesday, which saw EUR/USD rise to a 6-day high into its 200-day average and the USD dollar index fall to its 10-day EMA – in line with yesterday’s bias. GDP data for the eurozone and Germany’s CPI figures all surprised to the upside, prompting two ECB officials to push back on rate cuts.

Australia’s latest employment figures leave no room for the RBA to even joke about cutting rates, let alone have a serious discussion on the subject. While CPI slowed to 2.8% y/y, it was nowhere near the 2.3% forecast – even if it is a full percentage point beneath the 3.8% prior. Besides, trimmed mean remained at the elevated level of 0.8% q/q, and Q2’s figure was upwardly revised to 0.9%. Trimmed slowed to the 3.5% estimate, or half a percentage point to the very top of the RBA’s 2-3% target range.

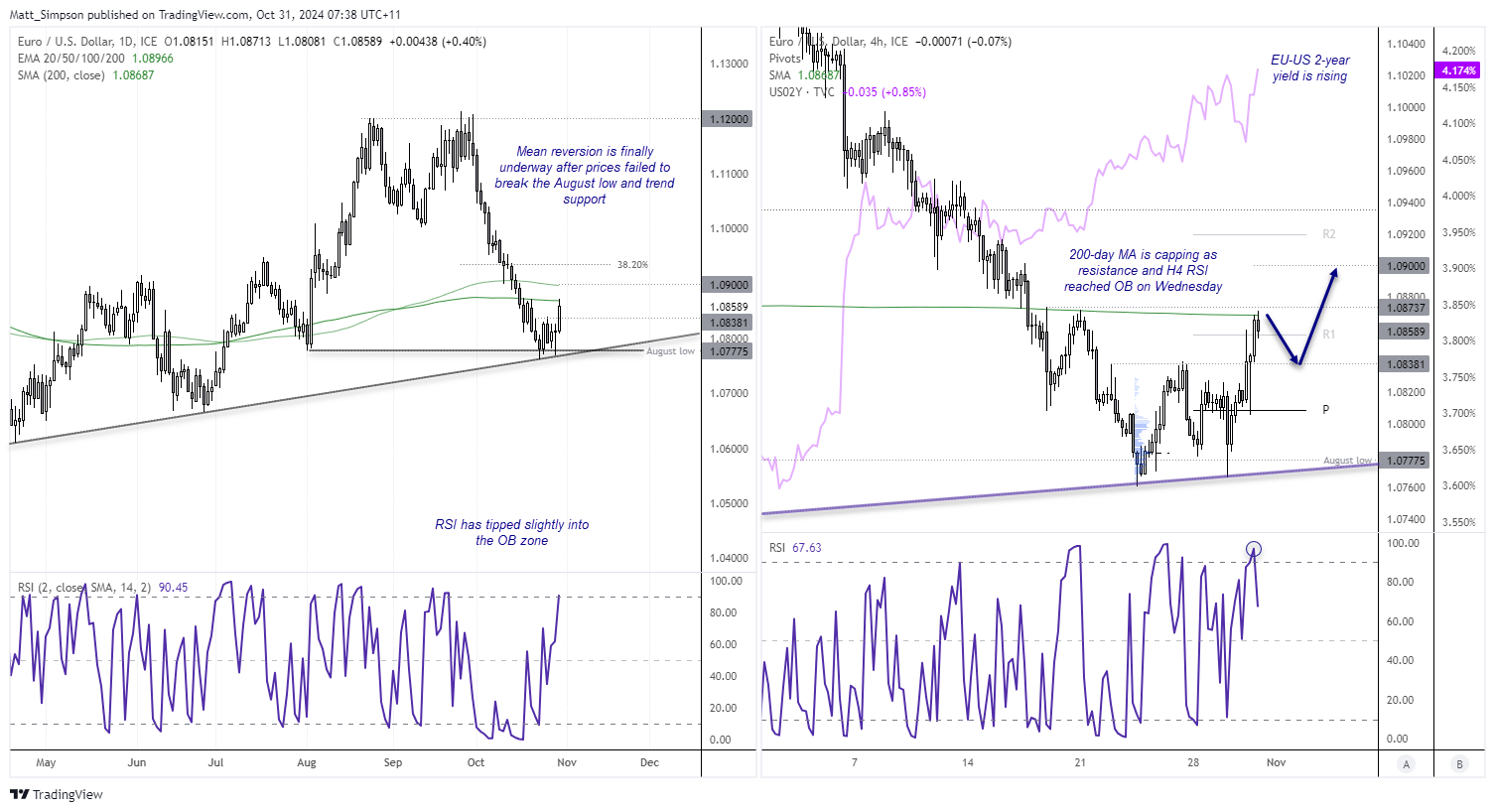

EUR/USD technical analysis:

The daily chart shows bullish range expansion broke out of the multi-day consolidation, which repeatedly failed to break the August low and held above the October trendline. Yet the RSI (2) is just within the overbought zone, and we have risk events looming including US PCE inflation and nonfarm payrolls which could send the US dollar – and therefore EUR/USD – either way. Not to mention month-end flows which can provide fickle price action at the best of times.

Still, bullish momentum on the 4-hour chart looks constructive. Prices are respecting the 200-day MA and the 1.0874 high as resistance for now, so perhaps a pullback towards 1.0838 is on the cards. A softer set of PCE figures could help EUR/USD break above the 200-day MA upon the relative shift of central bank expectations between the Fed and ECB and allow EUR/USD to close the gap with rising EU-US 2-year yield differentials.

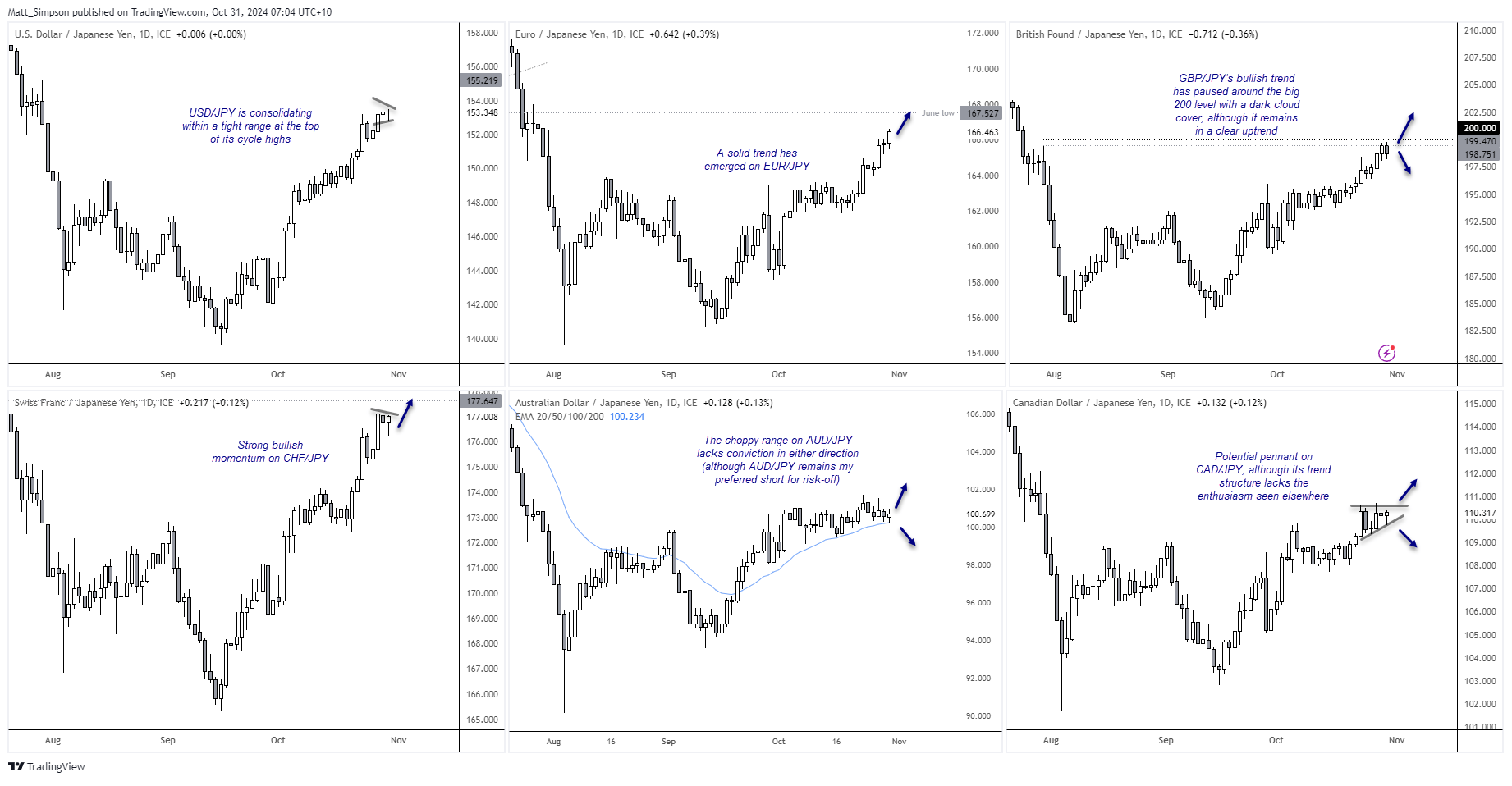

Yen technical analysis (USD/JPY, EUR/JPY, GBP/JPY, CHF/JPY, AUD/JPY, CAD/JPY):

The yen may find some safe-haven flows as we approach the election, and history shows that the yen tends to appreciate the Friday before the big event (and the two days that follow). For now I’ll stick to the daily chart to show the broader trend structures of key yen pairs.

USD/JPY: It’s an established bullish trend and prices are trading within a tight range, just off its cycle highs. Perhaps a move to 155 and 155.20 is on the cards, although with US dollar hinting at a retracement lower alongside potential safe-haven flows for both the USD and yen, perhaps this pairs could frustrate over the near term, in terms of cleaner price action.

EUR/JPY: A solid bullish trends has emerged and momentum is pointing firmly higher. With EU data now surprising to the upside, EUR/JPY is my favoured pair for a risk-on environment and for it to head for the June low, near the 168 handle.

GBP/JPY: This pair sits between USD/JPY and EUR/JPY in terms of its strength – not too hot, not too cold. We’ve seen a 2-bar bearish reversal (Dark cloud cover) form around the big level of 200, so it could provide a decent pullback should we hit a bout of risk off. This makes it a preferred short alongside AUD/JPY during times of turbulence, given it trades near the 200 level.

CHF/JPY: Another solid trend has emerged, and it looks like a bullish hammer has formed to mark a corrective low and hint at a bullish breakout. Take not of 177.65 resistance nearby, but CHF/JPY is a preferred long based on its price action (and to be ignored during times of risk-off given both CHF and JPY are safe-havens).

AUD/JPY: Price action on the daily chart is as fickle as ever and prone to false breaks in either direction. I’d prefer to stand aside, but it becomes a hot favourite for potential shorts during risk-off given its lacklustre performance during Wall Street’s recent gains.

CAD/JPY: The trend structure is more impressive than that of AUD/JPY, and a potential ascending triangle is forming. This could help it outperform AUD/JPY upon any risk-on move, but there are better pairs to look at for such times. Therefore, it remains favoured for risk=off – but I still prefer AUD/JPY for such occasions due to the pair’s lack of bullish enthusiasm.

Events in focus (AEDT):

The BOJ are unlikely to change policy today, but that is never a reason to drop ones guard against a central bank that likes to surprise. But the likely hung parliament for Japan’s new PM makes it more difficult for him to force the BOJ’s hand with hawkish pressure, and BOJ members are backing slow and steady hikes.

Australia’s retail sales are unlikely to move the needle for the RBA, but we want to see if consumer maintained their splurge for a second month – having posted surprisingly strong figures in August.

US PCE inflation is the main event today. With core PCE is expected to rise 0.3% m/m, it leaves less room for an upside surprise. And with the US dollar wobbling ahead of key events into the weekend, perhaps that leaves less room for USD strength too.

- 10:50 – JP industrial production, foreigner bond/stock purchases, retail sales

- 11:00 – NZ business confidence

- 11:30 – AU retail sales, building approvals, housing credit

- 12:30 – CN PMIs (NBS)

- 13:30 – BOJ interest rate decision (no change expected)

- 16:00 – CN construction orders, housing starts

- 17:30 – BOJ press conference

- 21:00 – BOE Breeden speaks

- 21:00 – EU CPI

- 22:30 – US job cuts (Challenger)

- 23:30 – PCE inflation, US jobless claims

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge