- EUR/USD struggled late last week despite the Fed delivering a dovish surprise

- Weakness in GBP and CNY may have contributed to poor performance

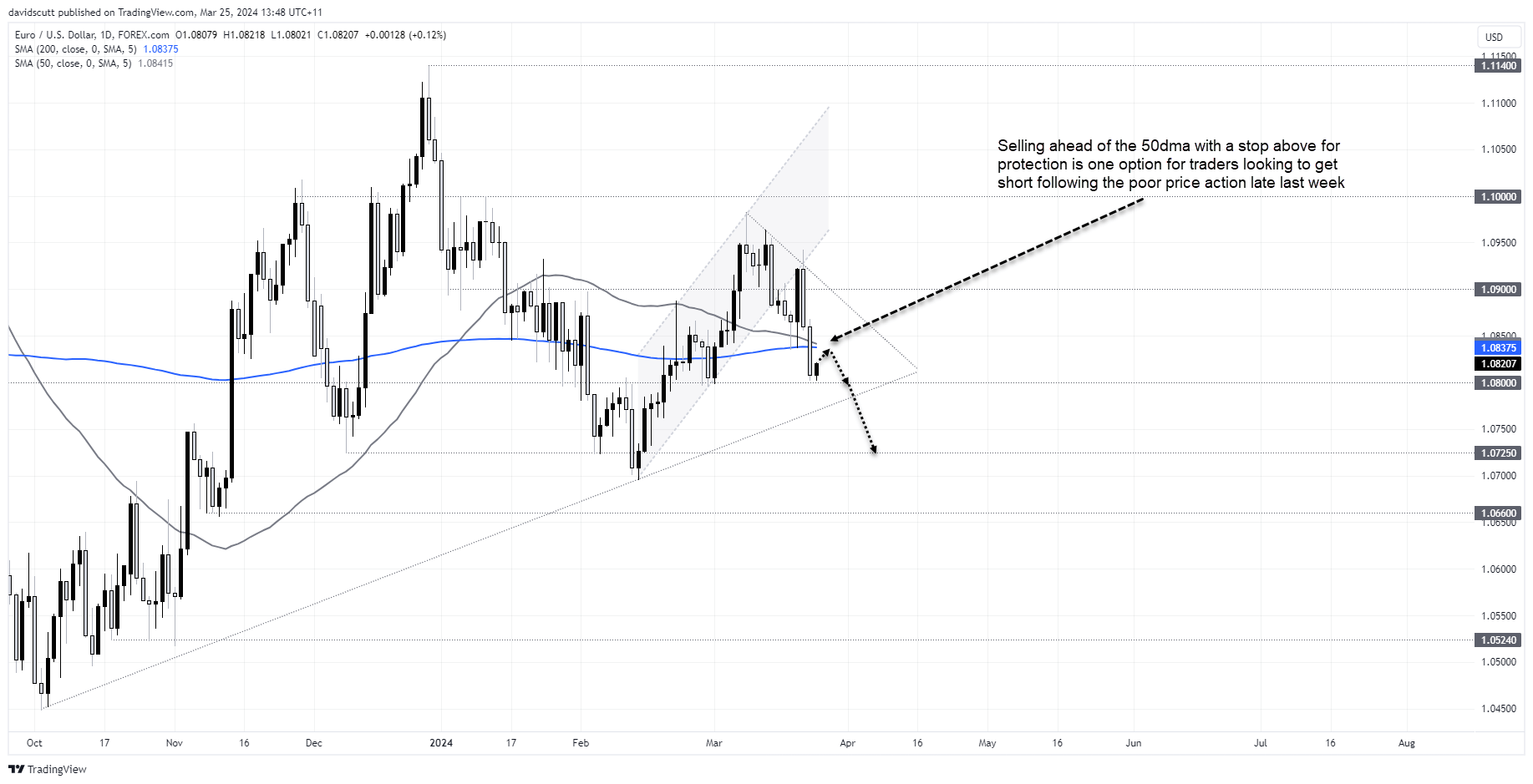

- Having fallen through the 50dma, selling rallies is now favoured

The summary

EUR/USD was poor last week, finding little benefit from the Federal Reserve delivering a dovish surprise at its March FOMC meeting. The Bank of England’s dovish pivot, coupled with an abrupt weakening in the Chinese yuan on Friday, may have contributed to the bearish price action, seeing EUR/USD break its 50 and 200-day moving averages.

With little event risk to speak of in the week ahead, selling rallies is favoured.

The background

With not only the Fed but RBA, BOJ, SNB and BoE delivering dovish surprises last week, markets were given every excuse to ramp up risk appetite into the weekend but didn’t, with the US dollar index (DXY) managing to strengthen despite narrowing yield differentials with the euro and Japanese yen, the largest weightings in the index.

EUR/USD was one of the worst performers, printing a bearish engulfing candle after being rejected at downtrend resistance on Thursday, following that up with another bearish candle on Friday. Given the strong positive correlation it has with GBP/USD on a daily basis, the Bank of England’s dovish shift may explain some of the softness in EUR. With the Chinese yuan coming under pressure on Friday, that flowed through to other major FX pairs against the dollar, adding to EUR downside.

Technically, the break of the 50-day moving may be important given how influential it's been when interacting with the price in the past.

EUR/USD finished the week just above support at 1.08, looking vulnerable with momentum continuing to build to the downside. With the 50dma looking like it may cross the 200dma from above, the pair may have death cross headlines to contend with shortly, too.

The trade setup

Selling pops towards the 50dma is favoured considering the bearish price action in EUR/USD last week, allowing for stops to be placed above the level for protection.

The initial target would be support at 1.08 with uptrend support dating back to when the Fed pivoted away from rate hikes the next after that. A break of the latter could lead to a more sustained push towards the 1.07-1.0725 zone.

Another potential short idea would be to simple sell a downside break of 1.08, should it occur, with a stop above the level for protection.

A clean break back above the 50dma would signal a shift in preference to buy dips rather than sell rallies.

The wildcards

The biggest risk event for EUR/USD this week – the US core PCE inflation report – was essentially made null and void by Federal Reserve chairman Jerome Powell when he suggested strength in recent inflation reports was not enough to deter the FOMC from scaling back its expectations for easing in the year ahead. The acknowledgement hints other Fed commentary may be less impactful than usual this week.

The performance of the Chinese yuan may also be influential on EUR/USD in Asia, with a stronger-than-expected fix from the PBOC on Monday leading to a broad offer in the US dollar. As CNY weakness may have contributed to strength in the USD last week, so too may it contribute to USD weakness should the early moves on Monday be sustained.

Being quarter-end, capital flows could also throw up some unusual price action in the coming days. There may be a need to stay nimble.

-- Written by David Scutt

Follow David on Twitter @scutty