Market pricing appears to be sobering up and has done away with 50bp Fed cuts. It took a while longer than I expected, but Fed fund futures are now backing the 25bp November and December cuts the Fed effectively telegraphed at their last meeting.

It could be argued pricing still remains too dovish for next year, and EUR/USD may have further to fall should US data continue to outperform expectations while the ECB up their dovish rhetoric. Two risk events this week to keep an eye on include the FOMC minutes today and US CPI report tomorrow.

Should the minutes reveal more divisions within the ranks over future easing, yields and the USD could strengthen. I am not expecting a strong set of inflation figures tomorrow, but that could come as a nasty surprise to USD bears. In all likelihood, I feel the USD could do a minor pullback before its bullish move from last week extends, and that could eventually see EUR/USD head for the 1.09 and 1.08 handles.

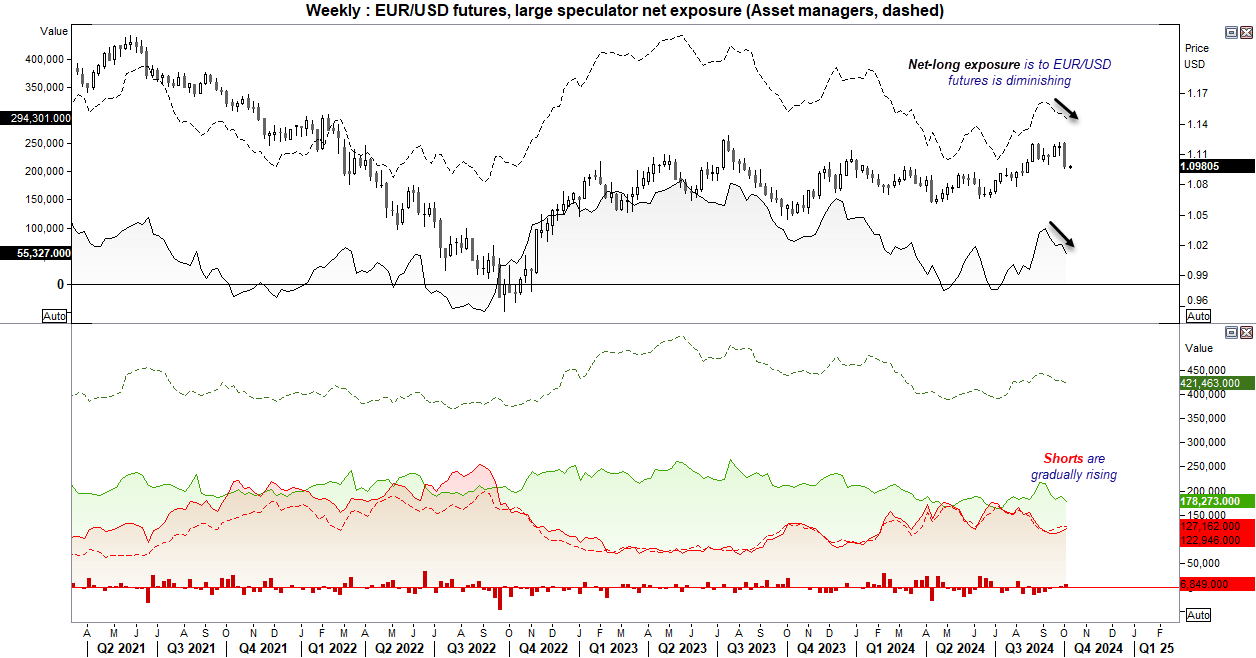

EUR/USD futures market positioning – COT report:

Large speculators increased bearish bets against the euro for a third week, and trimmed longs for the third week out of four. Whereas asset managers increased gross longs for a fourth week and trimmed longs for a third week out of four. This saw a slight reduction of net-long exposure from both traders, and to their least bullish net exposure in seven weeks.

This is not overly bearish positioning, although large speculators are much closer to flipping to net-short exposure with a net-long exposure of 55.3k contracts, compared to the 294.3k from asset managers. But I suspect net-long exposure has diminished further as EUR/USD continued to weaken from Wednesday through to Friday after the COR data was collected. We have also heard more support of easing from some ECB members.

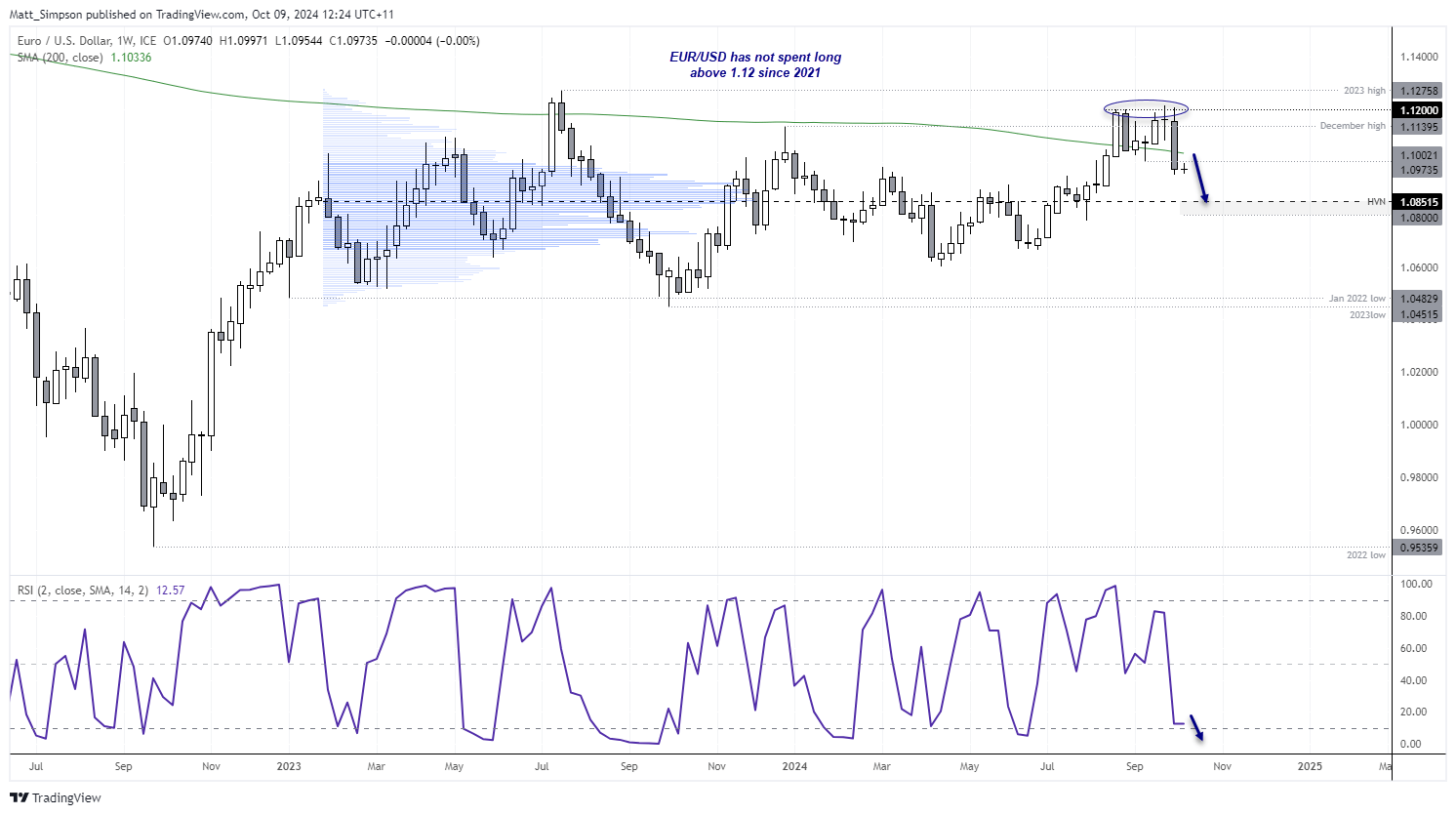

EUR/USD technical analysis (weekly chart):

The surge of USD strength resulted in EUR/USD forming an elongated bearish engulfing / outside week, during its worst week in 25. It also closed beneath its 200-week average. And its selloff did not come without warnings, given its repeated failure to close above 1.12 in the weeks ahead of the reversal lower.

Also note that EUR/USD fell 11 consecutive weeks from the 2023 high during a 7% decline, a level it has failed to retest since. A bearish hammer formed below the 200-week MA in December, and a dark cloud cover reversal also formed around the recent highs in August. The weekly RSI (2) is not yet oversold, and if US data outperforms while the ECB tout cuts, we could be looking at further downside.

Perhaps a move to 1.08 I snow on the cards. It is around the centre of the sideways range since 2023, and just 50 pips beneath the high-volume node (HVN) of that time span. Prices are also less than last week’s bearish range away from it.

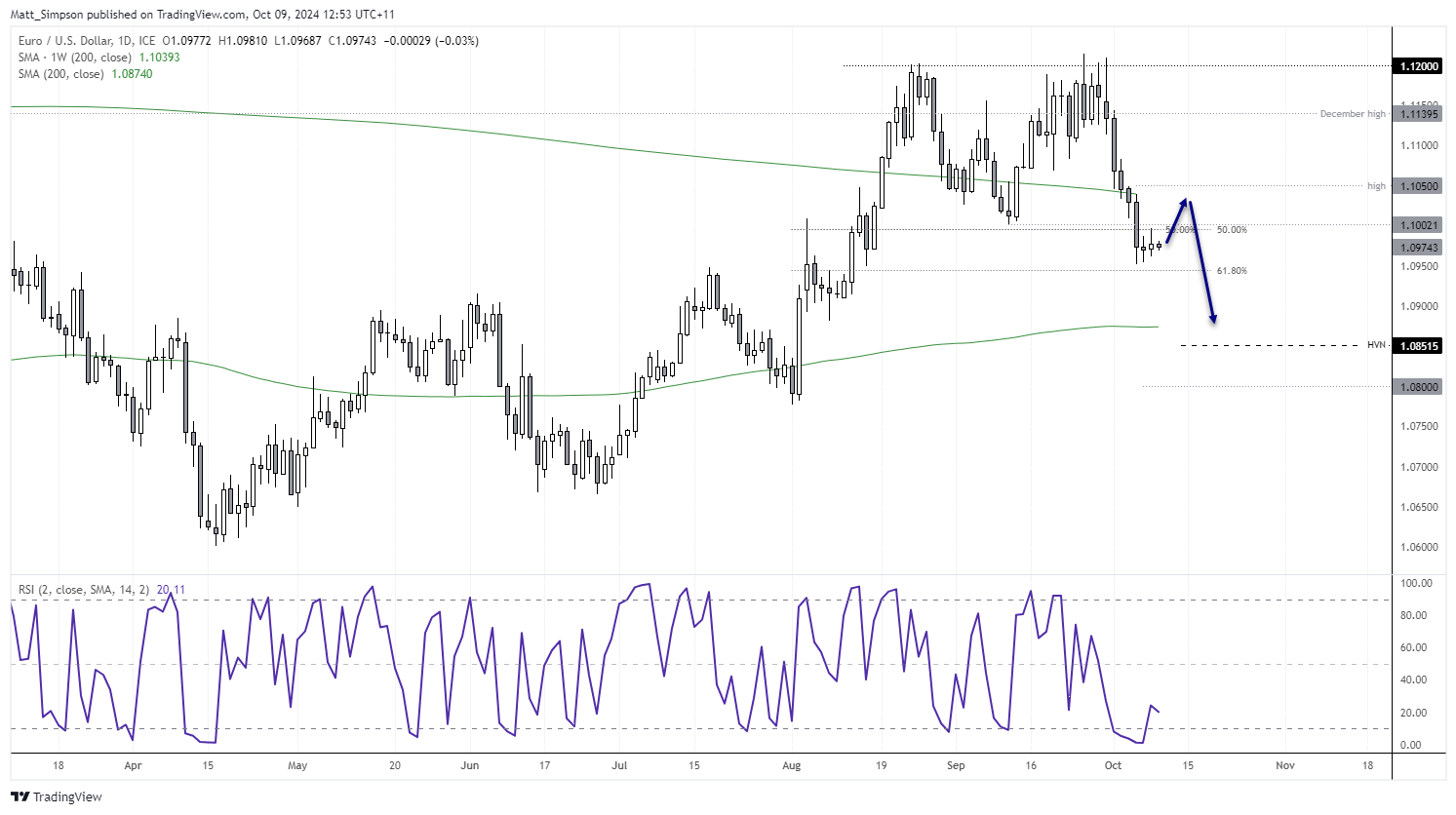

EUR/USD technical analysis (daily chart):

Prices are trading within a tight consolidation around last week’s lows. The longer it can hold around current levels, the odds of a bounce increase in my view. For now, the 1.10 handle and 1.1021 low are capping as resistance, ahead of the release of the FOMC minutes and UC CPI report tomorrow.

A break above 1.1021 assumes a small countertrend move, but for now I doubt it will break above the 200-week MA, just below 1.1050. And that makes it a resistance zone for bears to consider fading into, in anticipation of a move towards 1.09, just a above the 200-day MA. A break beneath which brings the 1.0800/50 zone into focus for bears.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge