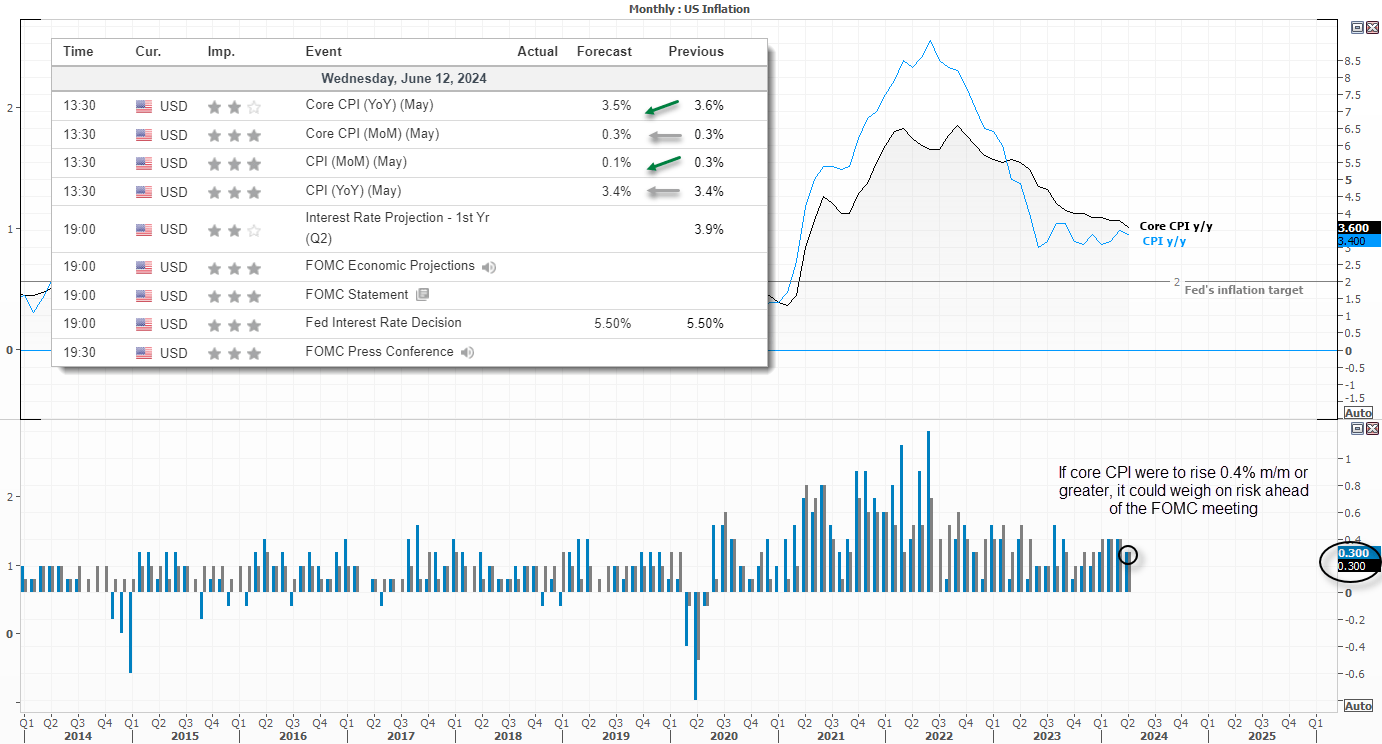

The incoming US inflation report and FOMC meeting are highly anticipated events, as they can shape expectations for Fed policy beyond 2026. This lineup is rare, having occurred only seven times in the past ten years. The Fed will be as nervous as everyone else in the hours leading up to the inflation report, as a hot CPI report means a longer day in the office, as they'll be forced to revise their communications. The CPI report has the potential for some nasty, knee-jerk market reactions - especially if inflation throws a curveball at the Fed with a hot print.

Of course, what traders really want to know is whether the Fed will signal a September cut, and how many cuts may be on the agenda through to 2025.

Core CPI is expected to soften to 3.4% y/y from 3.6%, and remain flat at 0.3% m/m. These aren’t exactly low figures relative to the Fed’s inflation forecast, but they are at least beneath the Fed’s interest rate target of 5.25 – 5.50%. But with the recent NFP figures fresh in the minds of traders, it may not take much of an uptick to throw a spanner in the works and weigh on risk. Therefore, an m/m print of 0.4% or greater could send the US dollar higher and weigh on risk just hours ahead of the Fed meeting.

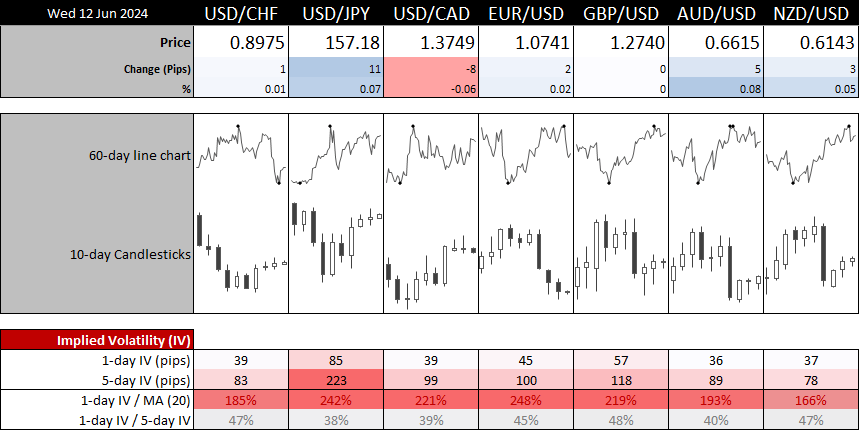

Implied volatility spikes ahead of US inflation, FOMC meeting

This chart perfectly encapsulates the importance of the next 24 hours, with 1-day implied volatility levels exceeding 200% of their 20-day averages for several FX majors. The IV levels are highest for USD/JPY, EUR/USD and USD/CAD, and the narrow ranges in today’s Asian session show a hesitancy to needlessly play around ahead of these big events.

I’m going into this meeting on the assumption that the Fed aren’t in a position to be too dovish. Yet that may not make the most interest move given the US dollar sold of aggressively following Friday’s NFP report. Therefore it may not take much of a dovish hint to help reverse some of these moves.

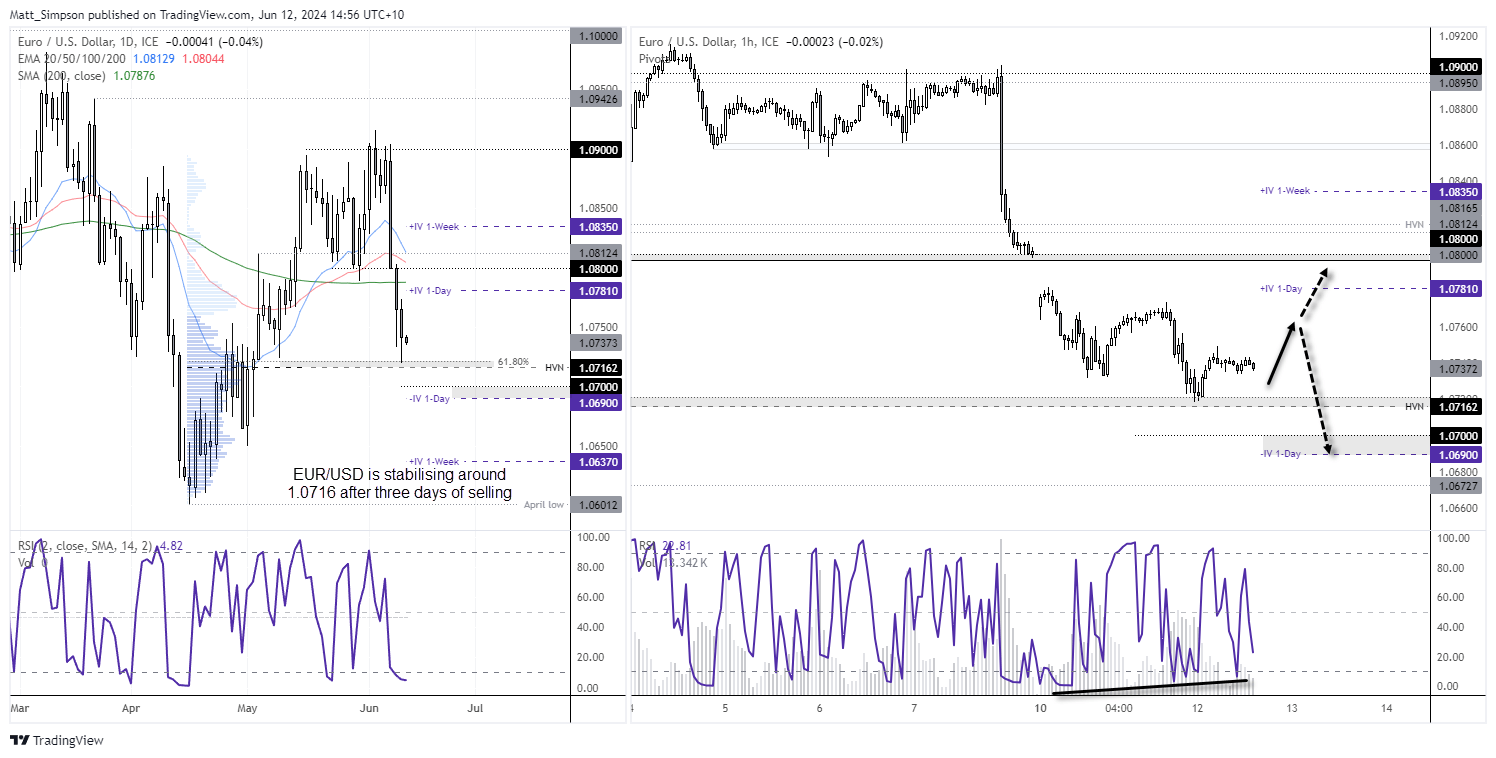

EUR/USD technical analysis:

The strong NFP report sent EUR/USD sharply lower from 1.09, closing lower for three days, and it is marginally lower in today's Asian session. Yet, support was found at the 1.0716 high-volume node, 38.2% Fibonacci level, and the lower wicks of Monday and Tuesday show that bears are losing steam. If the Fed provides a dovish outlook, EUR/USD could rip higher from these support levels.

Note that the upper 1-day implied volatility level sits near the 200-day average, and the lower IV level is just beneath the 1.07 handle.

A bullish divergence is forming with RSI on the 1-hour chart, further showing bearish momentum is waning. Should US inflation tick even slightly lower, EUR/USD could potentially bounce into the FOMC meeting. Ultimately, whether EUR/USD can hold onto any rebound depends on whether the Fed retains the several cuts the dot plot hinted at through next year. There is a real risk that appetite for cuts may have dwindled, sending the US dollar higher to the detriment of all else.

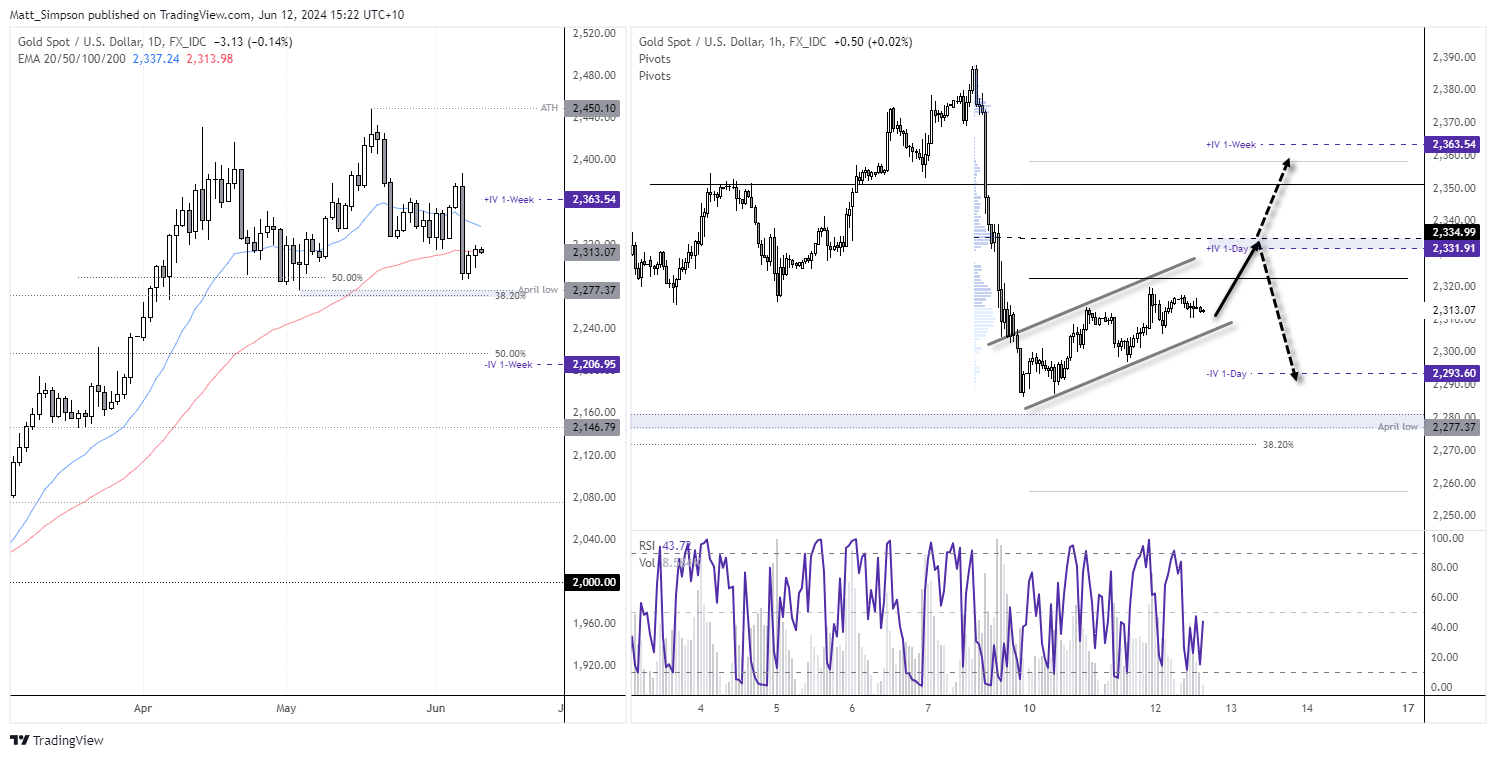

Gold technical analysis:

Gold rose for a second day in line with my bias, although the bullish ‘enthusiasm’ is anything but. Prices have risen modestly from Friday's NFP low and are now hovering around the 50-day EMA.

The 1-hour chart shows a potential retracement channel forming, which suggests momentum could eventually roll over. However, there is no clear indication that it has topped on this timeframe yet. Should prices continue higher, areas of resistance to monitor for potential reversals could include the weekly pivot point (2322) and the high-volume node near the 1-day implied volatility band (2332).

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge