Trading ranges for forex majors are extremely tight ahead of today’s NFP report, with all but USD/JPY moving less than 20-pips during the Asian session (USD/JPY didn’t impress much either with its 36-pip daily range). Yet the 1-day implied volatility ranges for USD/CAD, GBP/USD and NZD/USD are more than twice their 10-day average range.

And this makes sense, given Canada releases employment figures alongside December’s NFP report, political and economic woes in the UK and the lower liquidity levels for NZD/USD in general and its exposure to the USD.

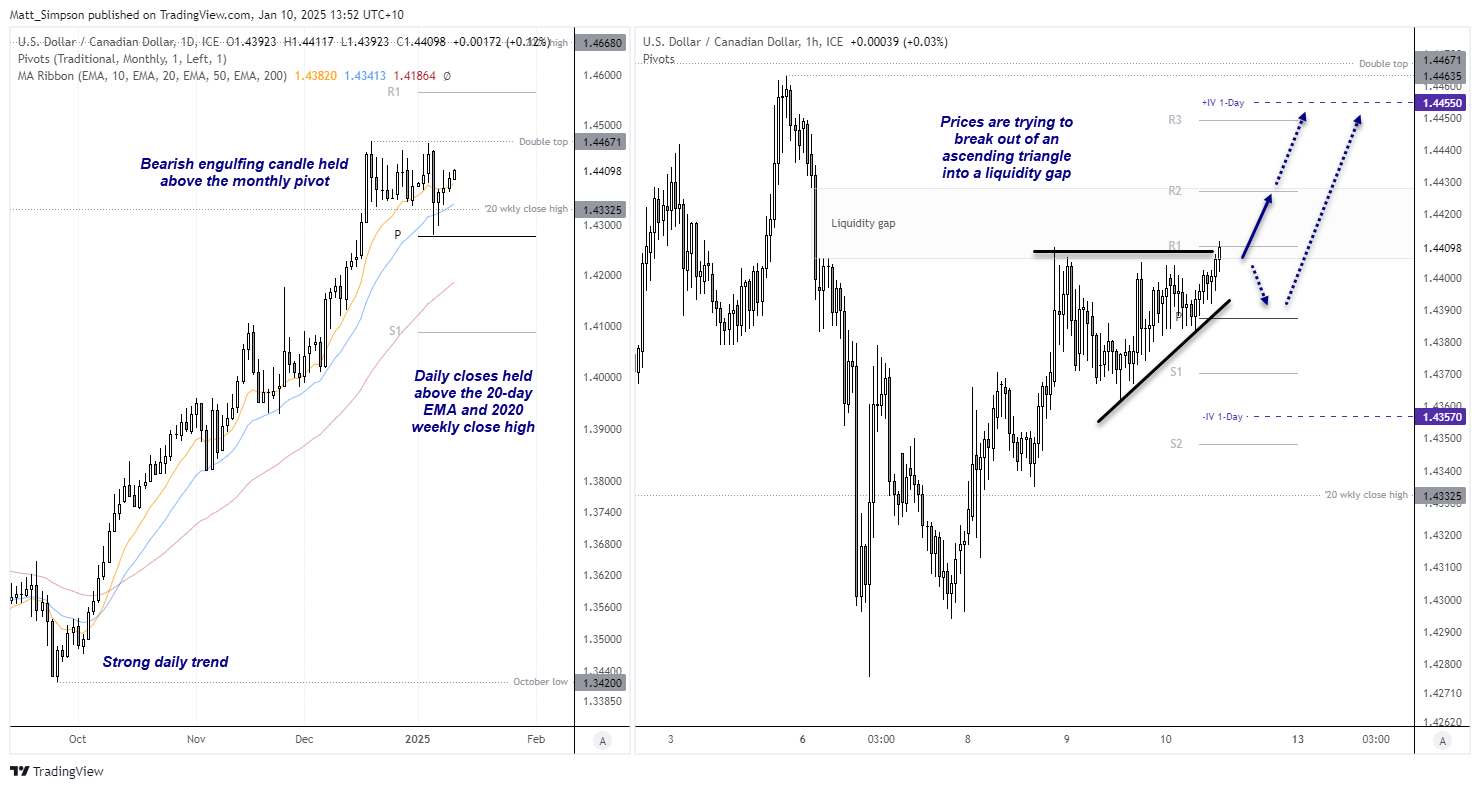

USD/CAD technical analysis

The rally from the October low has been nothing short of impressive. Prices entered a sideways range in December, and its volatile bearish engulfing day on January 6 found support at the monthly pivot point. It is also interesting to note that the daily closes have held above the 2020 weekly close high and 20-day EMA, to show demand in place for USD/CAD.

The 1-hour chart shows an uptrend, and prices are trying to break above the daily R1 pivot. Moreover, it is entering a liquidity gap which could essentially suck prices up to 1.4428 near the daily R2 pivot, on the assumption this liquidity gap is destined to be closed.

But if volatility is to live up to expectations, USD/CAD could rise above the daily R3 pivot if a strong NFP report is accompanied with a soft jobs report from Canada. And that would see prices trade just beneath the double top / December high, to excite bullish breakout traders.

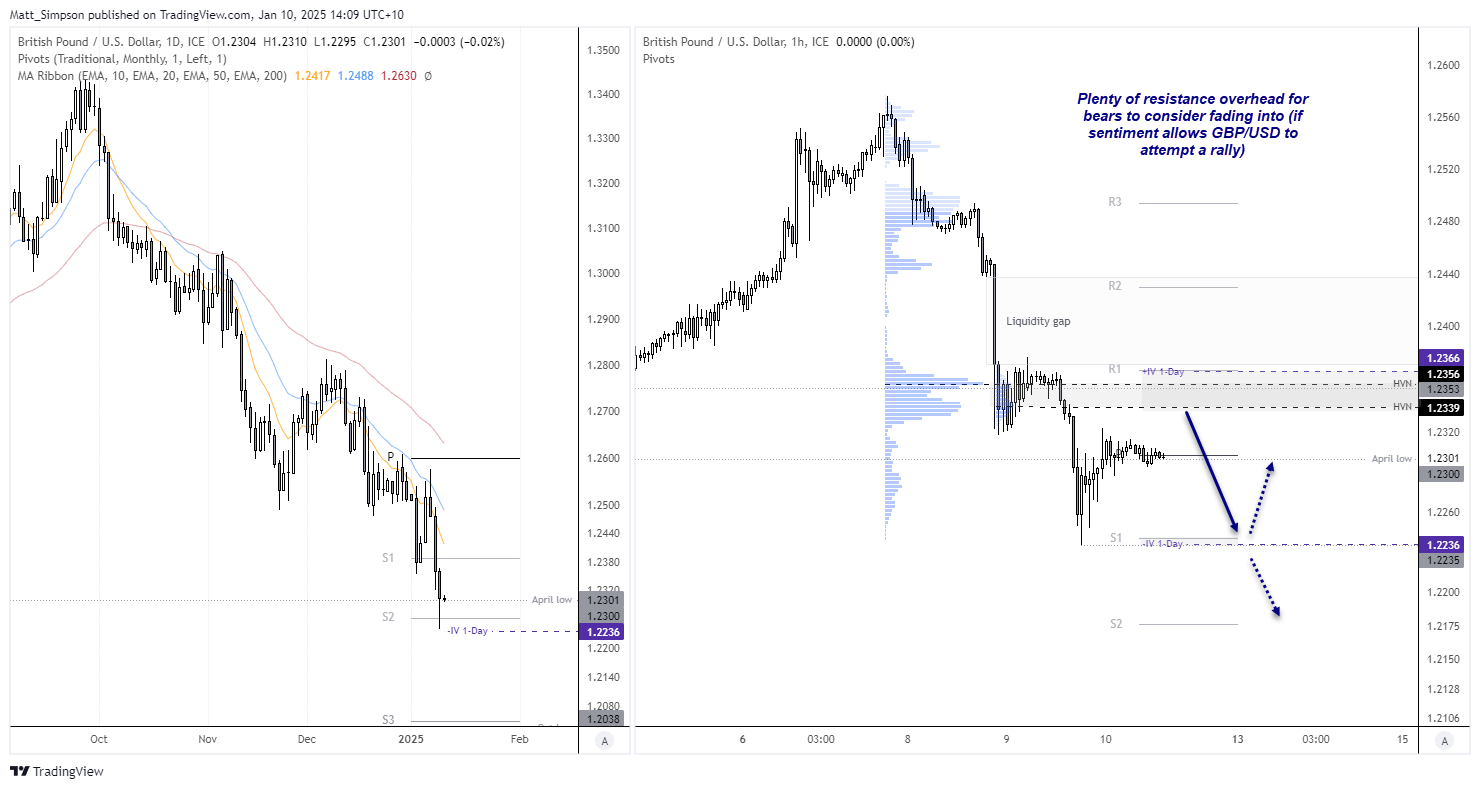

GBP/USD technical analysis

Prices are hugging the April low around the 1.23 handle and daily pivot point, amid a very strong bearish trend on the daily chart. Not only does GBP/USD have the prospects of a potentially strong NFP report to contend with, but UK political headlines (or tweets from Musk) are also there to mix things up.

Therefore, my bias is to fade into any rallies up to the daily R1 pivot. Note the two high-volume nodes (HVN) which could cap gains up to the daily R1 pivot. But if, by some miracle, sentiment in the UK bond market picks up and NFP figures are surprisingly bad, a break above 1.2380 would take GBP/USD into a liquidity gap which could spur a stronger rally.

For now, I am guard for a continuation of losses and retest of yesterday’s low, monthly S2 pivot and lower 1-day implied volatility band.

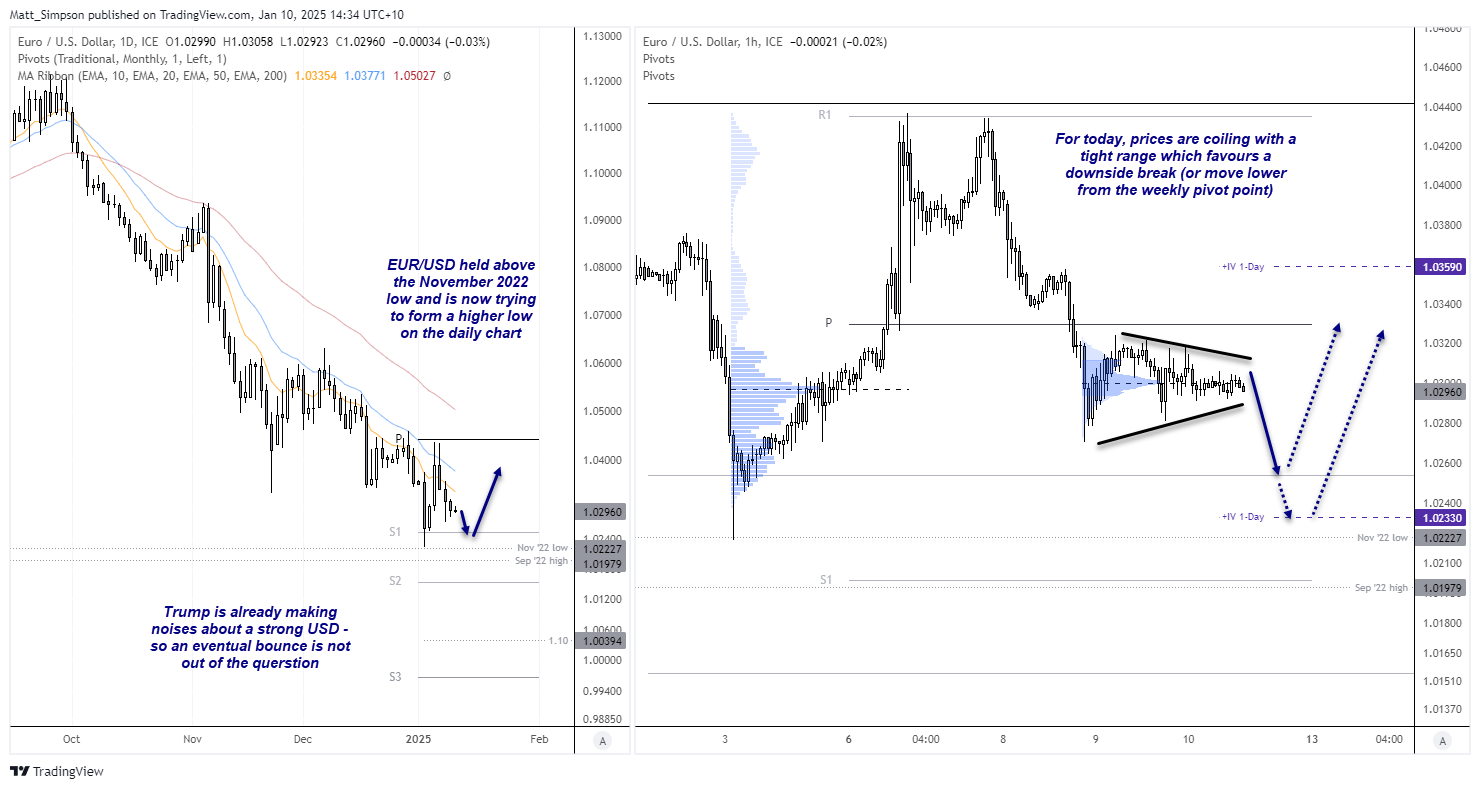

EUR/USD technical analysis

If NFP pumps out decent numbers, EUR/USD is likely to chalk up a fourth consecutive down day. However, we have already seen the euro rebound from the November 2022 low and it appears to be attempting to form a higher low on the daily chart. So even if EUR/USD sells off initially, a potential higher low could remain in play if prices hold above this weeks low as we head into next week.

Besides, Trump is already making noises about the USD being too strong. And Trump has a tendency to get what he wants, so perhaps a case for a lower USD is beginning to form.

But for today, prices are consolidating within a tight range beneath the weekly pivot point (1.0330). Bears could seek to fade into moves towards 1.0320 with the monthly S1 pivot (1.0258) and November 2022 low in focus, which seems achievable given the lower 1-day implied volatility level resides in the area.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge