The EUR/USD was able to climb a little in the first half of Wednesday’s session. This was largely thanks to a positive risk sentiment, after China’s announcement of large-scale stimulus measures to support its slowing economy helped to boost the equity markets. This latest optimism comes alongside the positive market sentiment following the Federal Reserve’s rate cut last week. But despite these international factors, domestic concerns remain for the German economy, discouraging us to be very bullish on the EUR/USD forecast, despite the dollar’s overall bearish trend. Indeed, looking at euro crosses such as the EUR/GBP, which is approaching its post-Brexit lows, you can see that there is very little underlying strength for the euro and that the EUR/USD’s weakness is masked by a weak US dollar right now.

Eurozone’s growth engine spluttering

Recession concerns for Germany, the Eurozone’s largest economy, intensified after a rather poor set of PMI data that were released on Monday, especially for the manufacturing sector where activity seems to be contracting at a faster pace every month, with the PMI now at 40.3. The services Sector PMI also came in below expectations. In fact, the French and Eurozone PMIs were also quite weak.

With those disappointing PMI readings, no one was expecting today’s release of the German ifo Business Climate, which is a composite index based on 9,000 surveyed manufacturers, builders, wholesalers, services, and retailers, to show any improvement. And that proved to be the case with a reading of 85.4, which was not only below 86.1 expected, but it was also down from 86.6 the previous month.

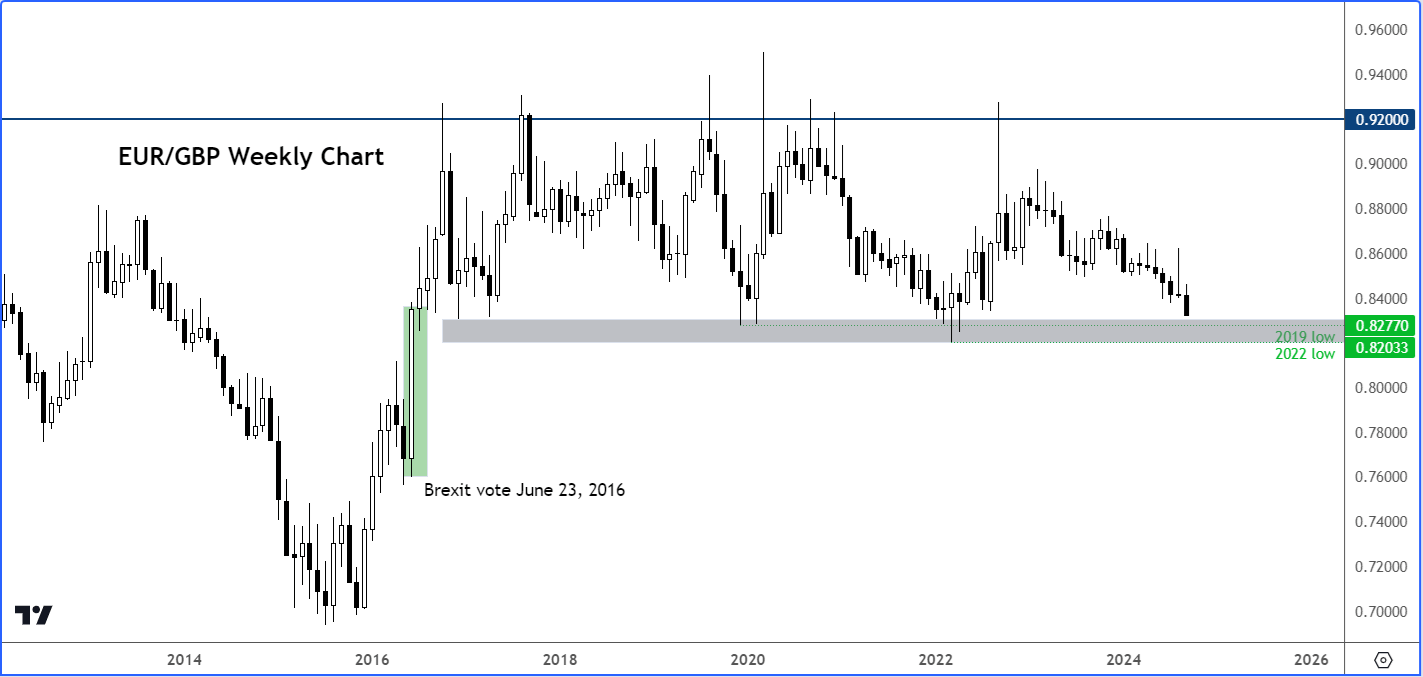

EUR/GBP nears post-Brexit lows to highlight Eurozone concerns

With the ECB hesitant to cut rates faster, China’s economy far from its growth goal to support Eurozone exports, you do have to wonder where growth for the Eurozone might come from. That’s why traders are not rushing to buy the euro despite today’s big surge in Chinese equities as a result of the latest round of stimulus measures. While a weaker US dollar is masking the EUR/USD weakness, looking at the EUR/GBP and several other euro crosses is telling.

The 'Chunnel', which is a reference to the Channel Tunnel that connects the UK and Europe, is approaching its post-Brexit lows nearing a band of prior support around 0.8200 - 0.8300. If you think of the troubles facing the UK economy right now, you’d think the EUR/GBP should be 2-3 hundred pips higher than it is right now. This therefore highlights what investors think of the Eurozone economy right now.

Lighter US calendar today

There are not any major data releases from the US as attention shifts stateside in the second half of the day. We will have a gauge of US consumer confidence by the Conference Board, which is projected to rise to 103.9 in September from 103.3 in August. A stronger reading could signal increased private consumption, supporting GDP growth and potentially boosting US dollar.

The outlook for the US dollar now largely hinges on upcoming economic data. The Fed’s decision to cut rates by 50 basis points last week was partly anticipated, and that surprise is already factored into the market. For further weakening of the US dollar, traders will need to see more signs of an economic slowdown, particularly in the jobs market.

Monday’s PMI release presented a mixed picture, with the services sector mostly meeting expectations while manufacturing fell to 47.0 from 47.9, contrary to predictions of a slight improvement. Key data releases later this week include New Home Sales (Wednesday), Final GDP estimate (Thursday), and the Core PCE index (Friday). Thursday will also feature several speeches from Fed officials.

Last week, the Fed cut rates by 50 basis points and indicated another 50-point cut is likely before year-end, while also lowering its growth and inflation forecasts. The Fed Chair described this cut as a step in unwinding the historic tightening cycle, aiming to reduce the risk of a downturn while the economy remains strong. Future moves will depend on labour market and to a lesser degree inflation data. While inflation is no longer a major concern for the Fed, any upside surprises in the Core PCE data could disrupt the current outlook and potentially turn the EUR/USD forecast bearish.

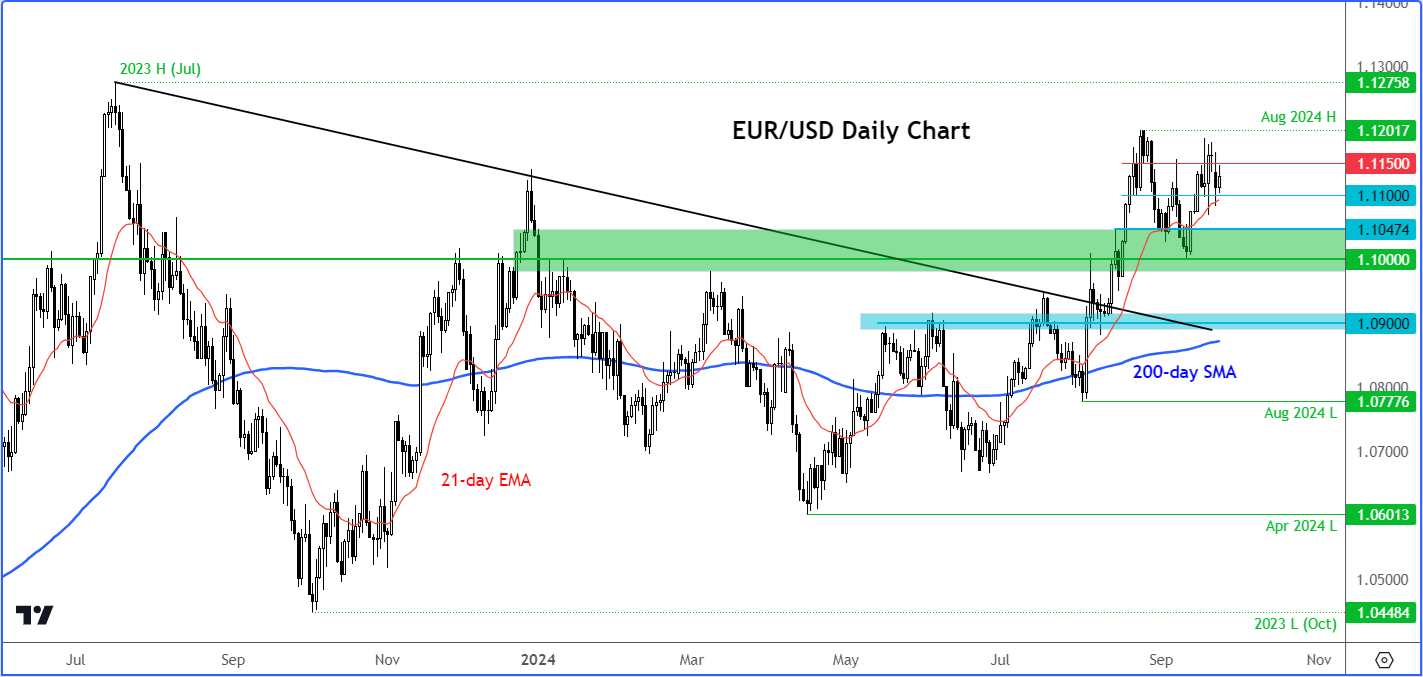

EUR/USD forecast: technical levels and factors to watch

Consolidation is the name of the game for the EUR/USD, which is being supported almost entirely by a weak US dollar right now and renewed optimism over China (one Europe’s large exports destinations). Support around 1.1100 has held for now – a closing break below it could potentially lead to a drop towards 1.1000 or even lower in the days ahead. Resistance comes in around 1.1150, followed by the August high of 1.1200 handle.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R