French resident Emmanuel Macron called for a snap election after voters effectively handed more power to far-right parties, which could hamstring his ability to push through legislation over the next five years. Millions voted on Sunday for the EU parliamentary elections, which saw the far right make major gains and rattle the traditional powers.

Macron addressed the nation on Sunday and said “I’ve decided to give you back the choice of our parliamentary future through the vote. I am therefore dissolving the National Assembly.” The votes are expected to take place om June 30 and July 7.

This saw the euro gap lower against its FX peers at Monday’s Asian open, with EUR/USD extending its post-NFP losses from Friday and breaking beneath its 200-day EMA. EUR/GBP has already exceeded its 10-day ATR ahead of the open and sits at its lowest level since August 2022.

- EUR/USD -0.4% (4-week low)

- EUR/GBP -0.4% (21-month low)

- EUR/JPY -0.2% (3-day low)

- DAX futures -0.25%

- European 2-year yield +8bp (4-day high)

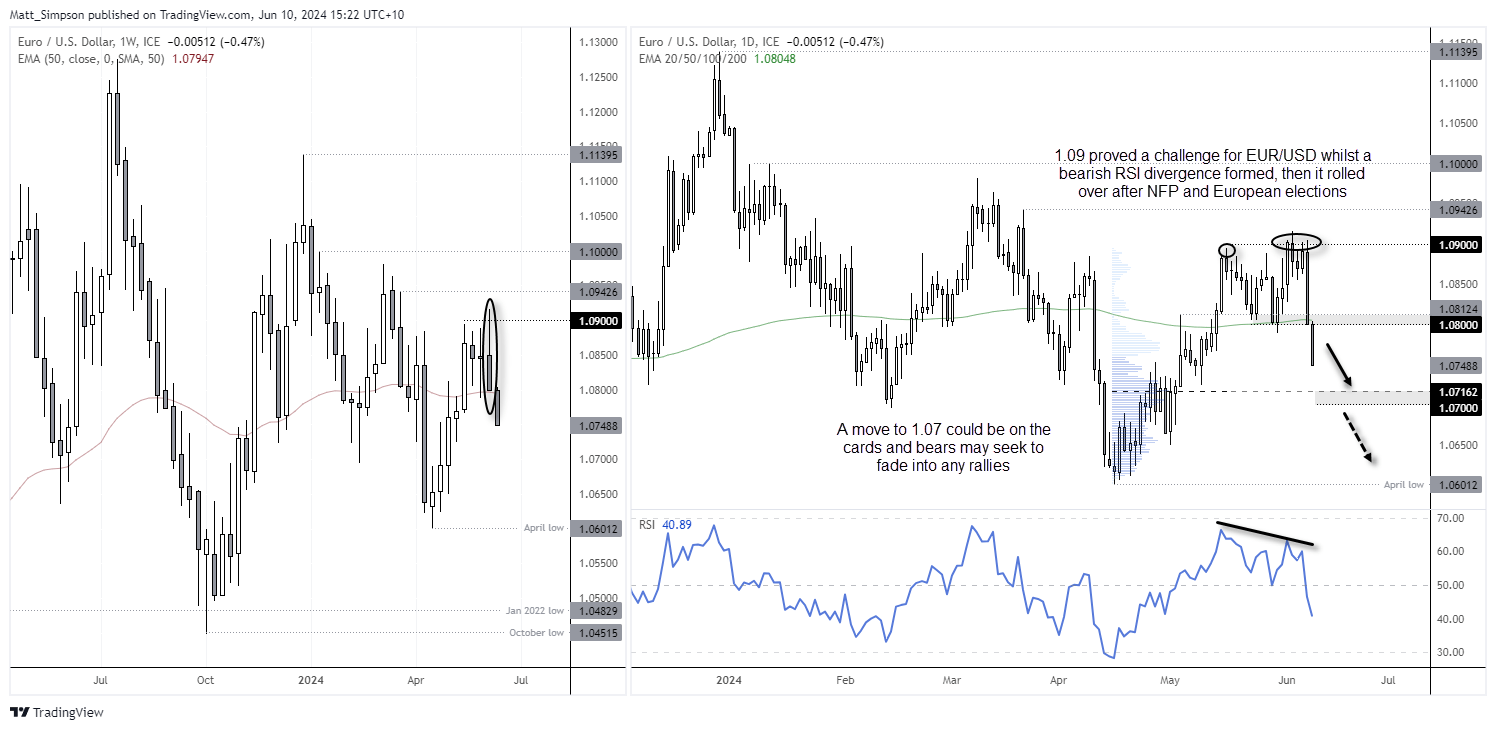

EUR/USD technical analysis:

I noted on Friday that 1.09 was a pivotal level for EUR/USD ahead of the NFP report, and that could not have been further from the truth. EUR/USD fell 90 pips from the 1.09 and erased more than a week’s worth of gains within two hours, before finding support at the 200-day EMA. Yet the snap election proved too much to send EUR/USD to a 4-week low and beneath its 200-day EMA, during a session that is usually a non-event for the pair.

Prices have clearly broken beneath last week’s bearish engulfing candle and look set to head for 1.07, near a high-volume node on the daily chart. It is possible that we’ve seen the worst knee-jerk reaction for now, which leaves EUR/USD open for a potential bounce. Yet doubt there’s much appetite to drive EUR/USD up to or beyond 1.08 for now, making the pair primed for a ‘fade the rally’ watchlist.

Should US CPI data come in hot and concerns over the political climate across Europe intensify, then a move down to 1.06 does not seem out of the question.

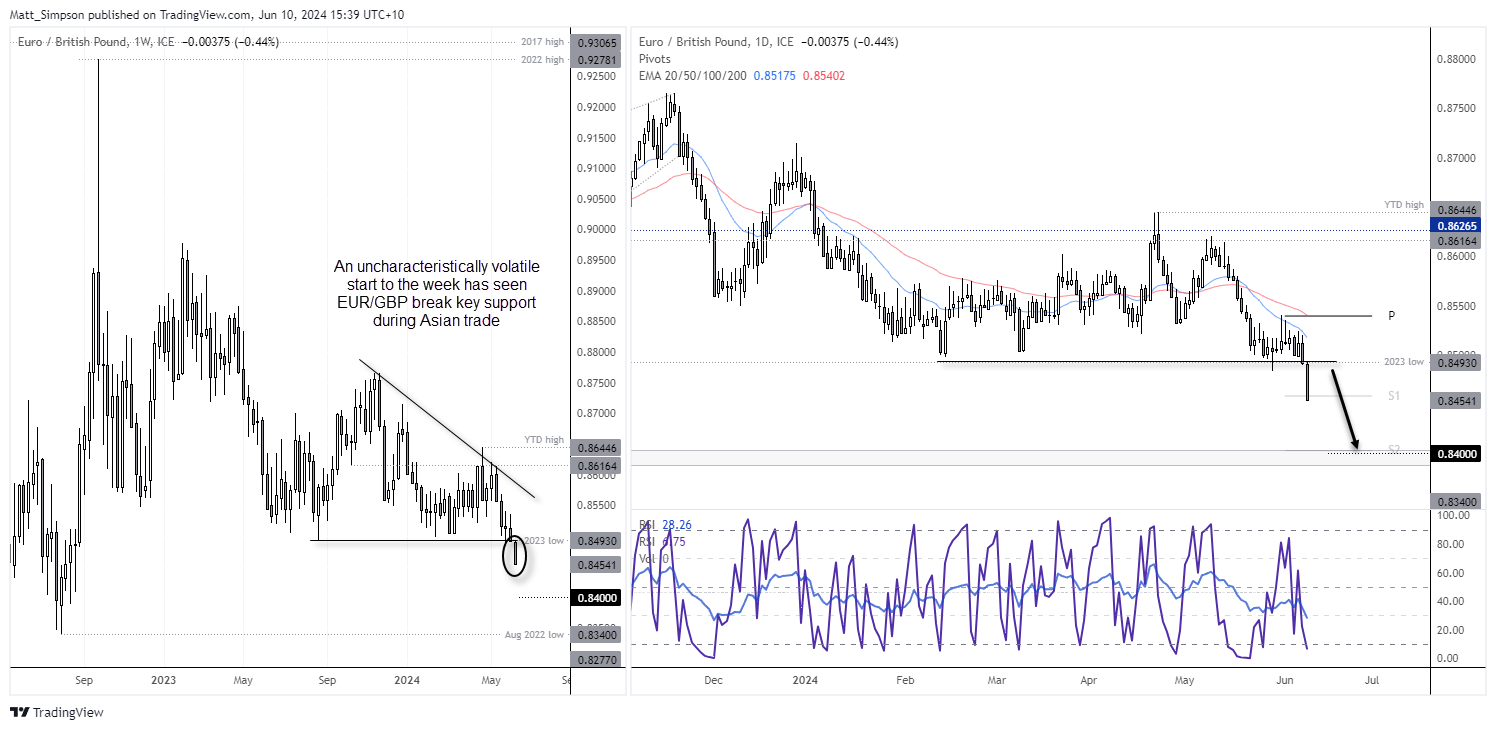

EUR/GBP technical analysis:

The euro selloff has sent EUR/GBP well beneath the 2023 low, which is on track for its second worst day of the year – and Europe has not even opened yet. Now sitting at a 22-month low, EUR/GBP seems ready to carve out a new range after mostly holding above 0.8500 since August 2022. As noted in the weekly COT report, large speculators increased their net-long exposure and asset managers reduce net-short exposure, and with sentiment clearly on the ropes for Europe the pair could be headed for 0.8400 over the coming weeks.

Prices are beginning to stabilise around the weekly S1 pivot and the daily RSI (2) has sunk to the oversold level, which also points to a potential bounce after an uncharacteristically volatile start during Asian trade. But like EUR/USD, the pair seems favourable for bears to fade into rallies beneath the 2023 low.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge