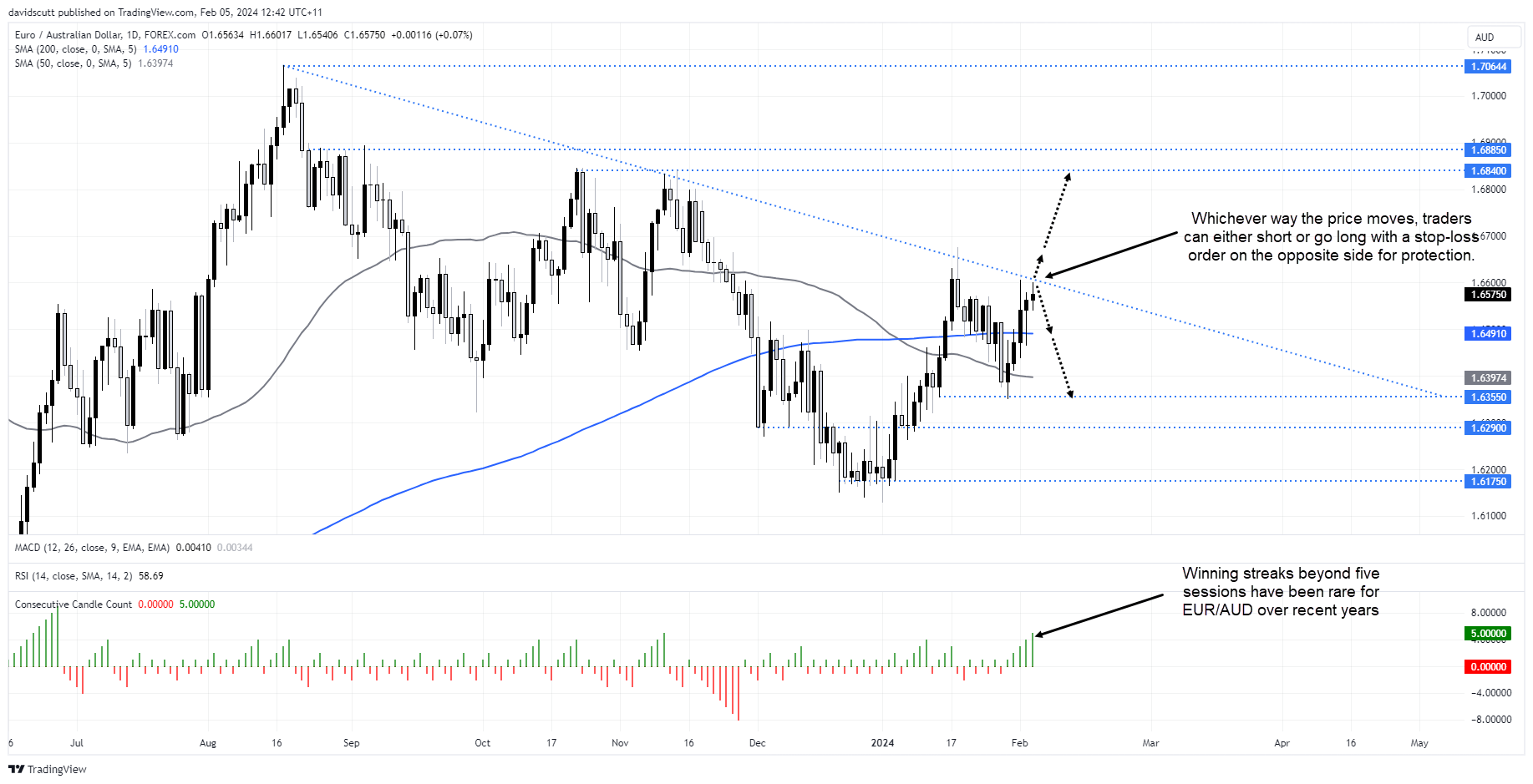

- EUR/AUD looks set to rally for a fifth consecutive session, equaling the longest winning streak since June 2023

- The pair now sits just below downtrend resistance where bullish breaks have been thwarted over recent months.

- The RBA may abandon its tightening bias at its February monetary policy meeting, generating renewed pressure on the AUD

EUR/AUD is on track to record its fifth consecutive daily gain to start the trading week, moving the pair to within touching distance of the downtrend bulls have been thwarted at on several separate occasions dating back to the middle of last year.

However, while momentum remains higher near-term, it’s worthwhile pointing out winning streaks of this duration are rare with only two occasions in the past two years lasting longer than the current episode.

AUD sensitive to USD, Asia FX shifts

Relative to EUR, AUD is far more sensitive to shifts in the USD right now, generally rallying more when the greenback softens while quickly coming under pressure when the dollar starts to strengthen. The AUD is also being influenced by moves in other Asian currencies with its correlation against the USD/JPY over the past month sitting at -0.87, near the most extreme levels seen since the middle of last year when the USD was charging higher.

With the USD gaining last week on an unwind in Fed rate cut bets, that contributed to EUR/AUD pushing from support at 1.6355 to just shy of 1.6600, leaving it just below downtrend resistance dating back to August last year. The move was also assisted by markets bringing forward the expected timing of the RBA’s first interest rate cut to June following a softer-than-expected quarterly Q4 CPI report.

RBA’s first meeting of 2024 looms

Given EUR/AUD has not had a great track record when interacting with this downtrend, failing on two separate occasions to break through in the past few months, it will be interesting to see how the pair fares on this occasion given the proximity to the RBA’s first interest rate decision of 2024 on Tuesday. While the cash rate is almost certain to remain at 4.35%, what markets are likely to react to is whether the bank will retain its tightening bias, a decision that will likely be determined by its latest economic forecasts that will be released alongside the decision.

RBA may abandon tightening bias, pressuring AUD

The consensus view is the RBA will continue to signal the risk that rates may need to increase further, but I suspect it may move to a neutral bias given building evidence that tighter policy and more efficient transmission to private sector borrowers is helping to bring inflation back to the 2.5% midpoint of its inflation target, albeit gradually.

Even though that fits with market pricing, an acknowledgement rates are unlikely to increase further will only heighten speculation the RBA could now begin to ease around the same time as other major central banks, or perhaps even earlier should economic activity weaken further. Under those circumstances, it would likely add to pressure on the AUD, putting a potential break higher for EUR/AUD in play.

EUR/AUD eyeing upside test

Depending on how EUR/AUD interacts with downtrend resistance will help inform traders whether to play for a break or reversal in the short to medium-term.

On the upside, a failed attempt to break the downtrend in January stalled above 1.6670, making that the first target to watch. Above, resistance was noted at 1.6840 and 1.6885 throughout the second half of last year. Should the downtrend hold, the 200-day moving average looms as the first for shorts, with support located at 1.6355 the next target after that.

Before the RBA decision, the US ISM services PMI for January and performance of Chinese markets on Monday may be influential on the EUR/AUD’s near-term direction.

-- Written by David Scutt

Follow David on Twitter @scutty