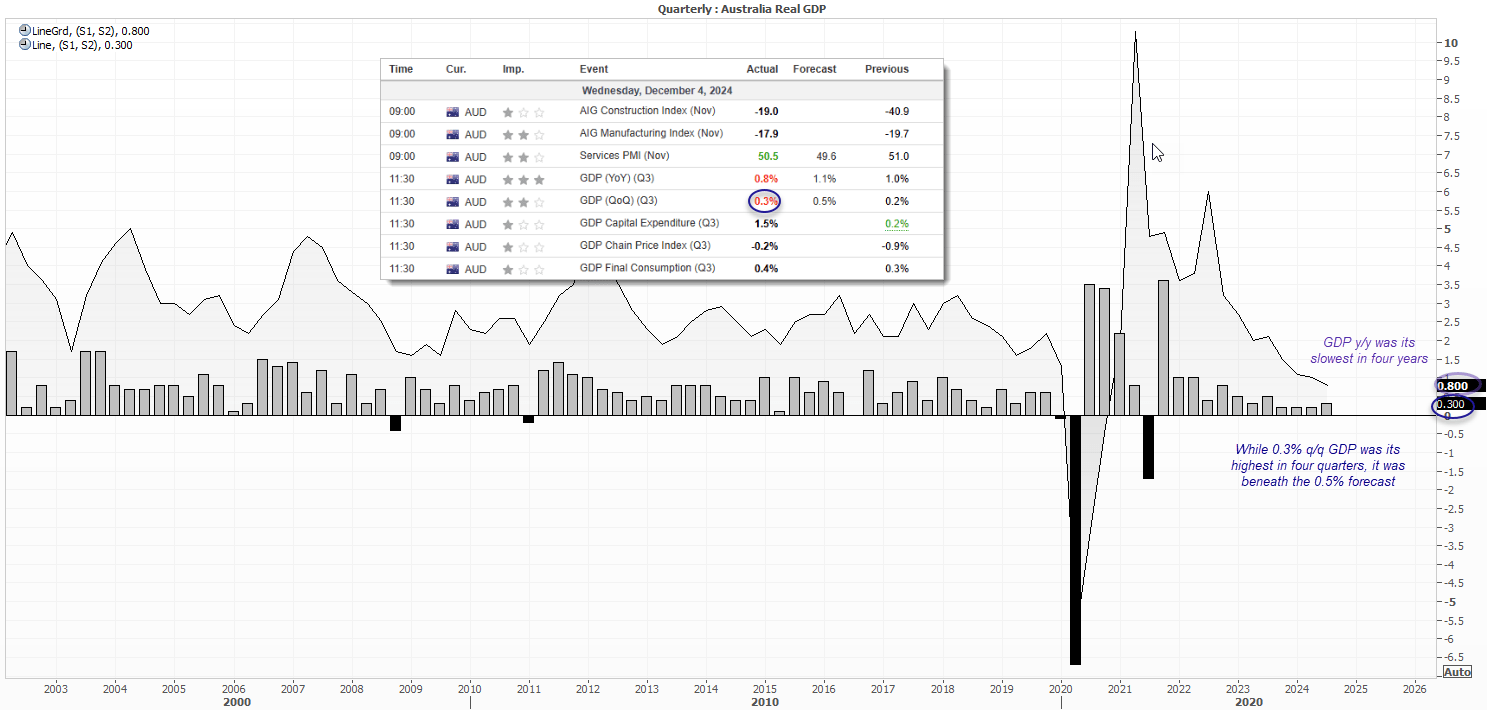

Australian GDP slowed to a 4-year low of 0.8% y/y, down from 1% in Q2 and missing its estimate of 1.1%. And while GDP q/q rose at its fastest quarter in four, it also missed its estimate of 0.5%. I had a hunch the data would be miss given weak data released earlier in the week, which saw housing approvals and company profits also miss the mark on Monday. And while retail sales delivered an upside surprise of 0.6%, I strongly suspect we’ll see weak data for December on the assumption shoppers brought forward their purchases for the Black Friday sales again this year.

While this will no doubt result in further calls for the RBA to cut rates, I doubt they will soon. Inflation remains too high and the employment figures remain robust. However, rates traders are pricing in cuts, with the RBA 30-day cash rate futures implying as 70% chance of a cut in April. A cut s fully priced in by June and 50bp of cuts have been priced in by October.

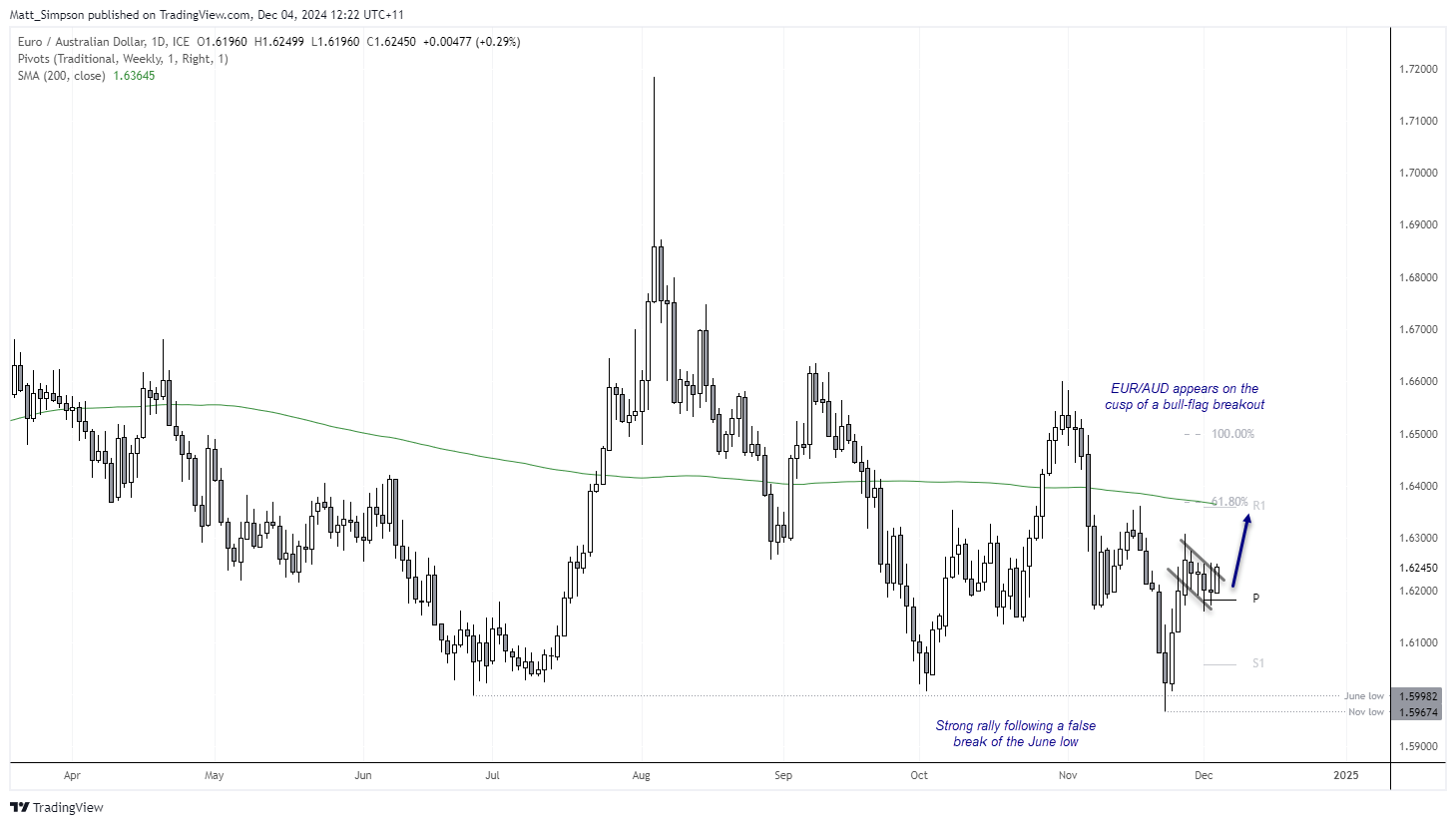

EUR/AUD technical analysis

A false break of its June low quickly reversed to see EUR/AUD print a strong 3-day rally. Prices drifted lower over the next four days in a corrective fashion, the last of which was a doji at the weekly pivot point. We have since seen bullish range expansion to suggest a swing low could be in place.

A measured move from the supposed bull flag sets an upside target around 1.65. However, since bull flag are really supposed to appear in uptrends, I’d prefer a more conservative target around the 91.8% projection, which lands around the 200-day SMA and weekly S1 pivot.

Bulls could seek long setups within today’s range, using a break of Thursday’s low as an invalidation point for the bullish bias.

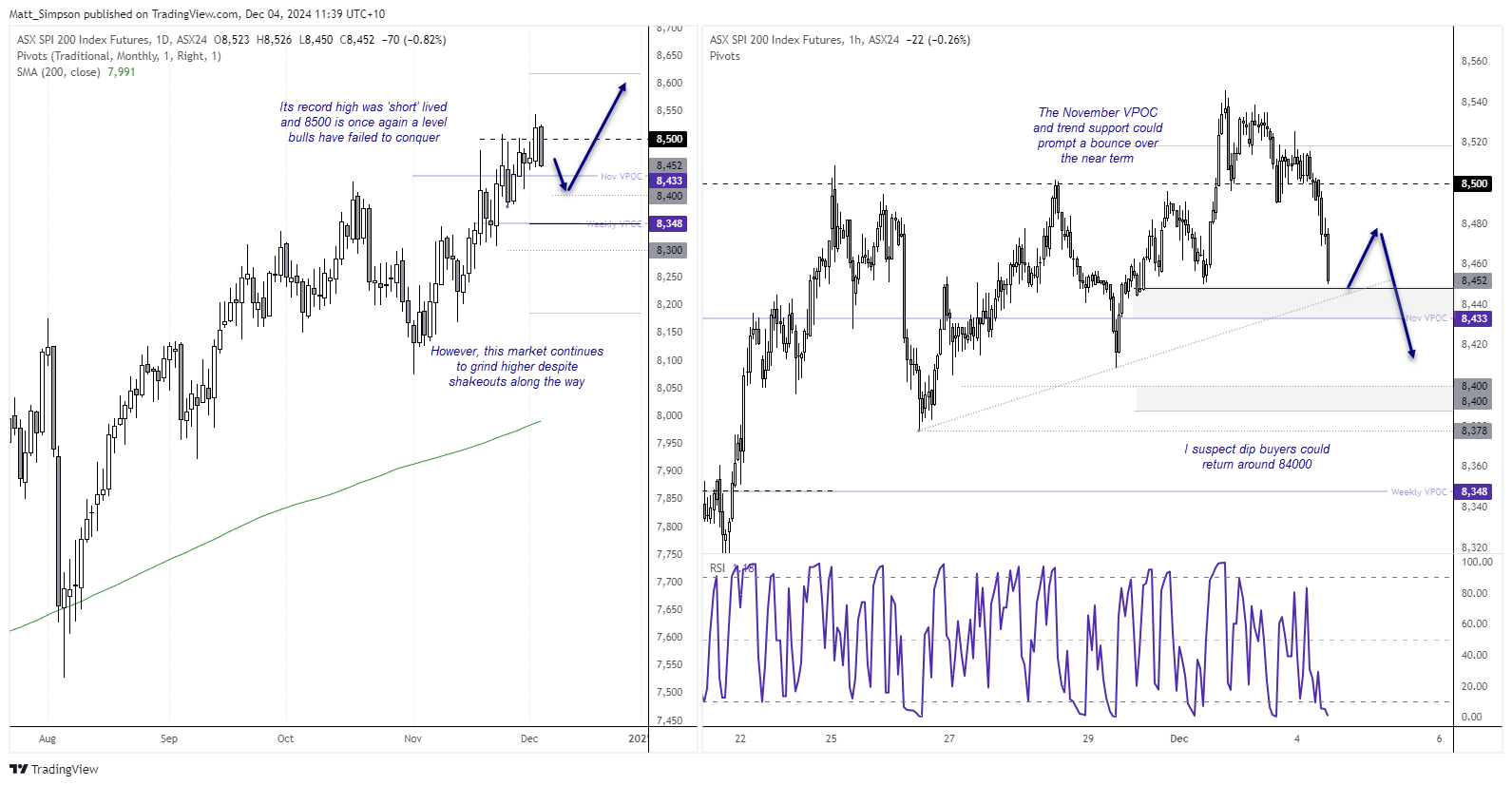

ASX 200 futures (SPI 200) technical analysis

The ASX 200 finally printed a daily close above 8500 on Tuesday reached a record high. Yet today’s weak GDP figures have seen a swift reversal and erased all of yesterday’s gains, which once again shows the significance of 8500 as resistance.

Still, the November VPOC (volume point of control) is nearby at 8348 for a potential support level. And as unsatisfying as this rally is, the ASX does keep grinding higher with a few shakeouts along the way. Whether it can regain its footing and print a new high this week, or embark upon a deeper correction is likely now down to the performance on Wall Street.

For now, I assume dip buyers will seek to return while prices hold above 8400, a break of which then brings 8350 and 8300 into focus for bears.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge