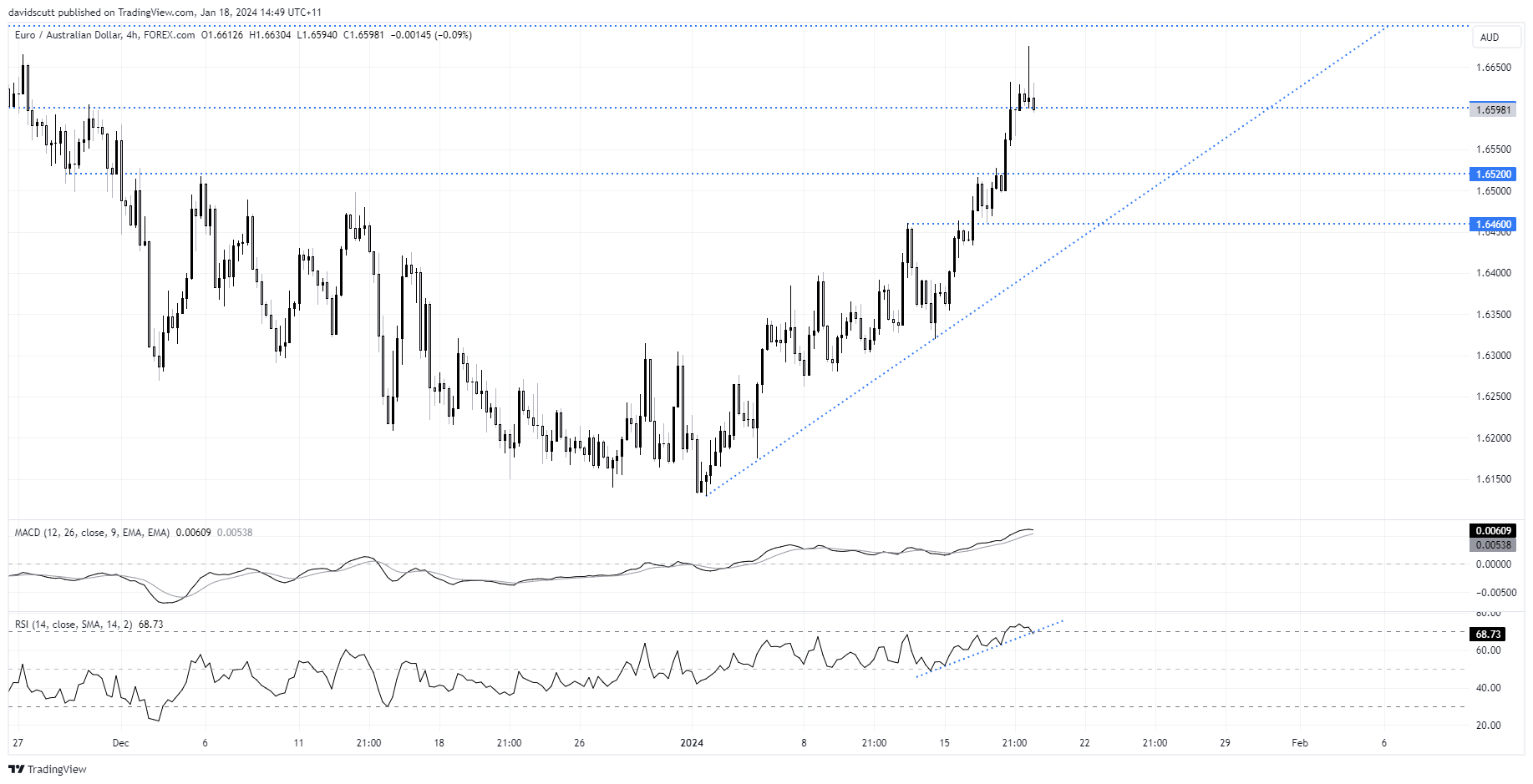

EUR/AUD has enjoyed a solid run it may be coming to an end. Having spiked to two-month highs in the immediate aftermath of Australia’s December jobs report, the pair reversed hard, generating a bearish pin candle on the four-hourly suggesting it may have seen a near-term top.

The reversal reflects market skepticism towards the details of the jobs report, coming across as more noise than signal thanks to growing evidence of a change in seasonal patterns in the labour force.

EUR/AUD spikes, then reverses hard, as jobs report picked apart

The ABS reported employment fell by over 56,000 against expectations for an increase of 15,000, with over 106,000 full-time positions apparently lost. Outside the early stages of the pandemic when everyone in Australia was essentially locked down, it was the largest one-month decrease in full-time workers on record. Creating additional confusion, the estimated labour force participation rate collapsed 0.4 percentage points, a decline so large you need to go back to the early 2000s to find a larger fall other than in the pandemic. That helped to keep the unemployment rate unchanged at 3.9% with underemployment and underutilisation also holding steady from November.

The market reaction reflected the dire details before a closer look revealed plenty of reasons for caution, helping to reverse all or much of the initial move. Signs of stabilisation in some Chinese equity markets may also be contributing to the Aussie’s modest gains.

EUR/AUD bearish pin candle may signal top

Looking at EUR/AUD, you can see the reversal on the four hourly chart, seeing the upper wick test downtrend resistance located around 166.80 before sliding back lower. It now sits just above 1.6600, a level that has acted as both support and resistance dating back to late last year. A break below may open a larger reversal to 1.6520 or even 1.6460. If that level were to go, a stop above would offer protection for those entering shorts. MACD and RSI continue to trend higher, so a break to the downside in those indicators would add conviction to the trade.

The European and US calendars are relatively light on Thursday with ECB speakers and jobless claims and Philadelphia Fed manufacturing survey the events of note. Regarding the ECB, further pushback against aggressive rate cut pricing from markets, although that should be entirely expected now after it’s all we’ve heard this week.

-- Written by David Scutt

Follow David on Twitter @scutty