- EUR/AUD rebound stalls below key resistance; selling rallies favoured

- GBP/AUD bullish setup in play after breaking through support

Overview

Though the US election, Federal Reserve interest rate decision and China stimulus announcement late Friday obliterated many technicals levels for currencies against the US dollar, for Aussie dollar crosses, it was a different story. Remarkably, through the volatility, many known levels on EUR/AUD and GBP/USD continued to be respected.

EUR/AUD: selling rallies preferred

Source: TradingView

EUR/AUD rebounded strongly from 1.6164 on Friday, reversing back to test former uptrend support dating back to early October. However, the price was unable to break through the level, likely reflecting the proximity of the 50-day moving average just above, along with resistance from 1.6318, a level that repelled numerous bullish probes in September and October.

While RSI (14) and MACD are providing mixed signals on momentum, the inclination is to sell rallies should the price hold beneath this resistance zone. The preference would be to enter short trades closer to 1.6300, allowing for a stop to be placed above the 50DMA for protection. As for potential targets, 1.6161, 1.6115 and 1.6000 screen as appropriate.

If the price were to break above the resistance zone, the bearish bias would be negated.

GBP/AUD: uptrend break would reinforce bullish bias

Source: TradingView

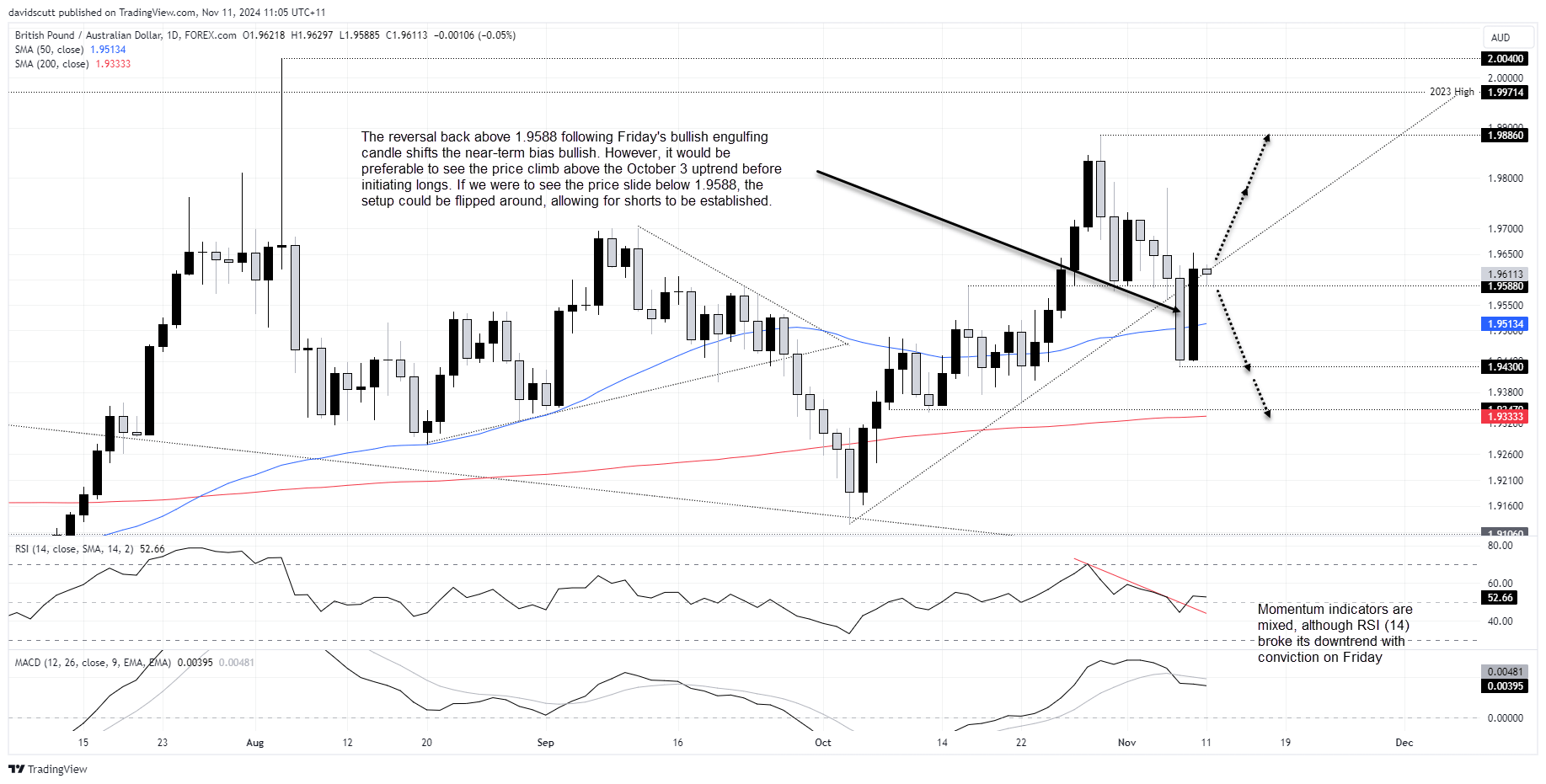

While the preference is to sell rips in EUR/AUD, the story is more nuanced for GBP/AUD given the price action last week.

The bullish engulfing candle last Friday saw the price reverse back through 1.9588, a level that previously acted as support over recent weeks. It has since backtested and bounced from it in early Asian trade on Monday.

Some may be prepared to initiate longs based purely on the price action, although it would be preferable to see the price break back above the uptrend that began on October 3 first. That would add conviction to the bullish bias, allowing for longs to be established with a stop below 1.9588 for protection. Selling may be encountered from 1.9780, although the ideal trade target would be the October 30 high of 1.9886. Momentum indicators are mixed, although RSI (14) broke the downtrend it was sitting in with conviction on Friday.

If the price were to break and hold beneath 1.9588, the setup could be flipped, allowing for shorts to be established with a stop above the level for protection. Along with 1.9430, other potential targets include 1.9347 and 200DMA.

Fundamental considerations

From a fundamental perspective, key events to watch this week include UK wage data and the German ZEW survey on Tuesday, Australian wage data on Wednesday, followed by Australian jobs data and speeches from RBA Governor Michele Bullock and UK Chancellor Rachel Reeves on Thursday. Broadly, a positive risk environment should support the AUD against European currencies.

-- Written by David Scutt

Follow David on Twitter @scutty