To the surprise of absolutely no one (including my colleague Fiona Cincotta – see her full preview report here), the European Central Bank left main refinancing rate unchanged at 0.00% and reiterated that it would continue buying bonds at a “moderately lower pace” until at least the end of March 2022. In sticking to the proverbial script, the central bank also made only insignificant tweaks to its accompanying monetary policy statement.

As Fiona noted, the fireworks, if there were going to be any, would always be centered around ECB President Christine Lagarde’s press conference, specifically the extent to which she would push back on the market pricing for interest rate hikes as soon as next year.

On that front, we had a number of notable comments from Ms. Lagarde:

- PHASE OF HIGHER INFLATION TO LAST LONGER THAN EXPECTED BUT EXPECTED TO DECLINE NEXT YEAR

- CONTINUE TO SEE MEDIUM-TERM INFLATION BELOW TARGET

- TALKED ABOUT INFLATION, INFLATION, INFLATION

- CONDITIONS FOR A RATE RISE NOT LIKELY TO BE MET IN THE TIMEFRAME EXPECTED BY MARKETS, NOR SOON THEREAFTER

- NOT FOR ME TO SAY IF MARKETS ARE AHEAD OF THEMSELVES (Ed note: This directly contradicts the above the comment)

- HAVE EVERY REASON TO THINK THE PEPP PROGRAM WILL END IN MARCH 2022

While Lagarde predictably pushed back on the market’s interest rate hike expectations, she subsequently walked that back; meanwhile, her strongest statement was around the PEPP purchases ending in March, making the statement more hawkish than anticipated, at least in the short term. In the end, this month’s meeting was always going to be an appetizer for the December meeting, when the central bank will issue updated economic forecasts, clarify its plans for tapering asset purchases, and lay out its initial plans for monetary policy in 2022.

Market reaction

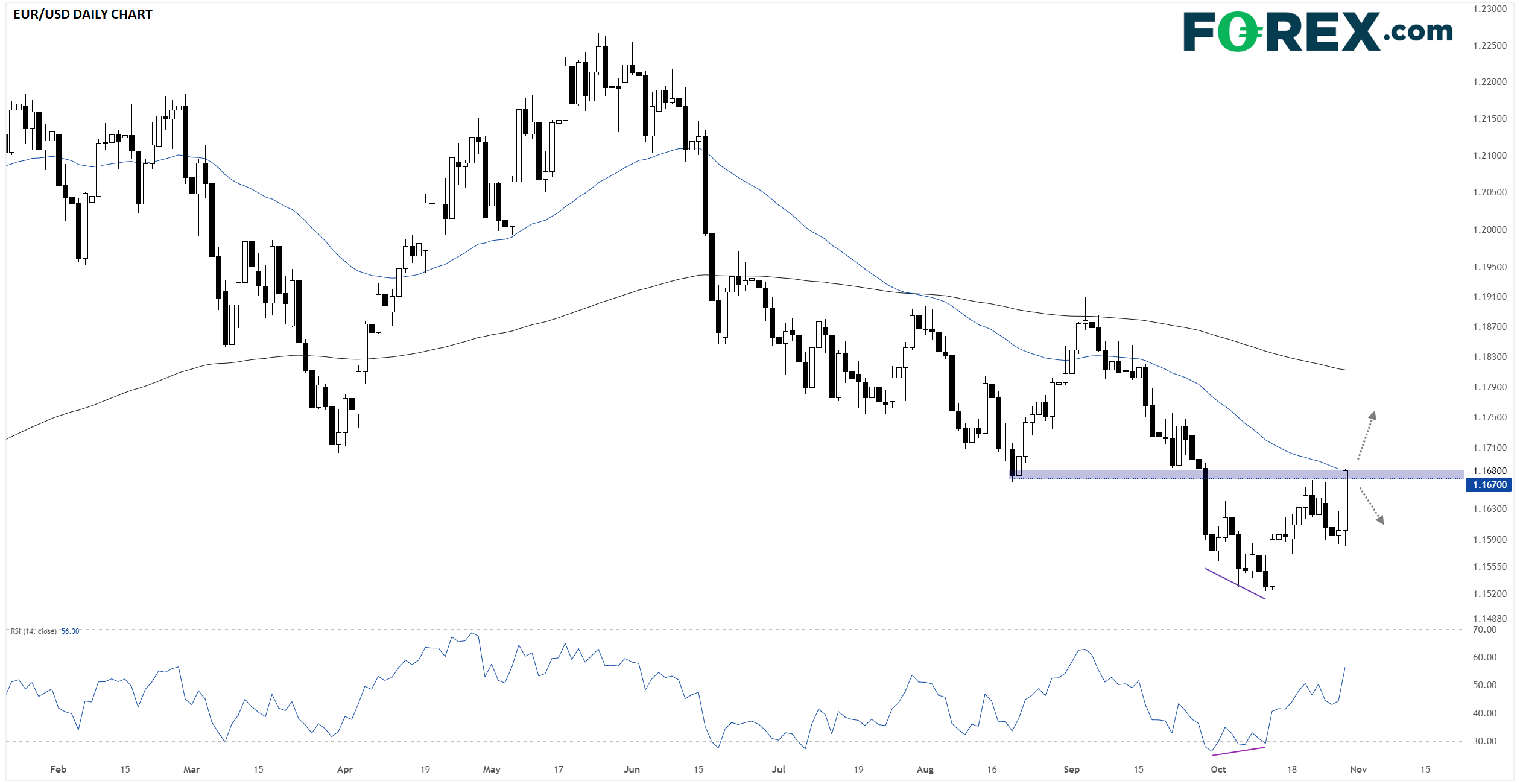

Based on the initial market reaction, traders are viewing the statement as more hawkish (or perhaps, less dovish) than expected, with EUR/USD rallying 80 pips on the day to hit its highest level of the month. In other markets, 10-year yields in Germany, France, Italy, and Spain are rising 6-12bps across the board while major European stock markets trade mixed.

Looking ahead, a close above previous-support-turned-resistance at 1.1670 (and ideally the 50-day EMA at 1.1680) on EUR/USD would open the door for an extended rally toward the mid- or upper-1.17s in the coming days. A failure to hold above this key zone would keep bears in control of the pair in the medium-term.

Source: TradingView, StoneX

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.