US futures

Dow future -0.26% at 42214

S&P futures -0.07% at 5757

Nasdaq futures 0.02% at 20064

In Europe

FTSE 0.43% at 8276

Dax 0.5% at 19439

- Stocks are muted in cautious trade

- Fed Chair Powell lowered 50 bps rate cut expectations

- ISM manufacturing & JOLTS jobs openings data due

- Oil falls on supply worries

Fed Powell was more hawkish, JOLTS job openings up next

U.S. stocks point to a muted open after a slightly more hawkish tone from Federal Reserve chair Jerome Powell and in the run-up to U.S. jobs data this week.

At an economic conference yesterday, Federal Reserve chair Jerome Powell reiterated that the central bank would likely continue cutting interest rates but reined in expectations of a 50 basis point cut in November. Powell highlighted robust consumer spending and GDP as reasons for a smaller rate cut this time.

Following his comments the market is now pricing in a 60% probability of a 25 basis point rate cut next month, up from 40% a week ago.

The market will listen to other Fed officials scheduled to speak today, including Raphael Bostic, Thomas Barkin, and Suzanne Collins. The comments will be scrutinized for clues about the outlook for the economy and monetary policy.

Attention is now turning to ISM manufacturing PMI data, which is expected to remain in contraction at 47.5, up from 47.2. JOLTS job openings are expected to remain steady at 7.67 million ahead of Friday’s non-farm payroll report. Should data this week point to a much weaker labour market, the Fed could still opt towards a 50 bps cut.

Meanwhile, the market will also watch strikes on the East Coast and Gulf Coast, which are halting the flow of about half the nation's ocean shipping. Retailers account for almost half of the container ship volumes, so shares of Costco, Walmart, and designer brands will be in focus, but so far, little changed.

Corporate news

Ford is set to rise 2.4% after Goldman Sachs upgraded its stance on the auto giant to buy from neutral.

Boeing is falling a further 0.5% on reports that the manufacturer is considering raising around $10 billion by selling new stock.

Tesla is set to open higher ahead of reporting Q3 deliveries on Wednesday, which are expected to be up around 8% from a year ago.

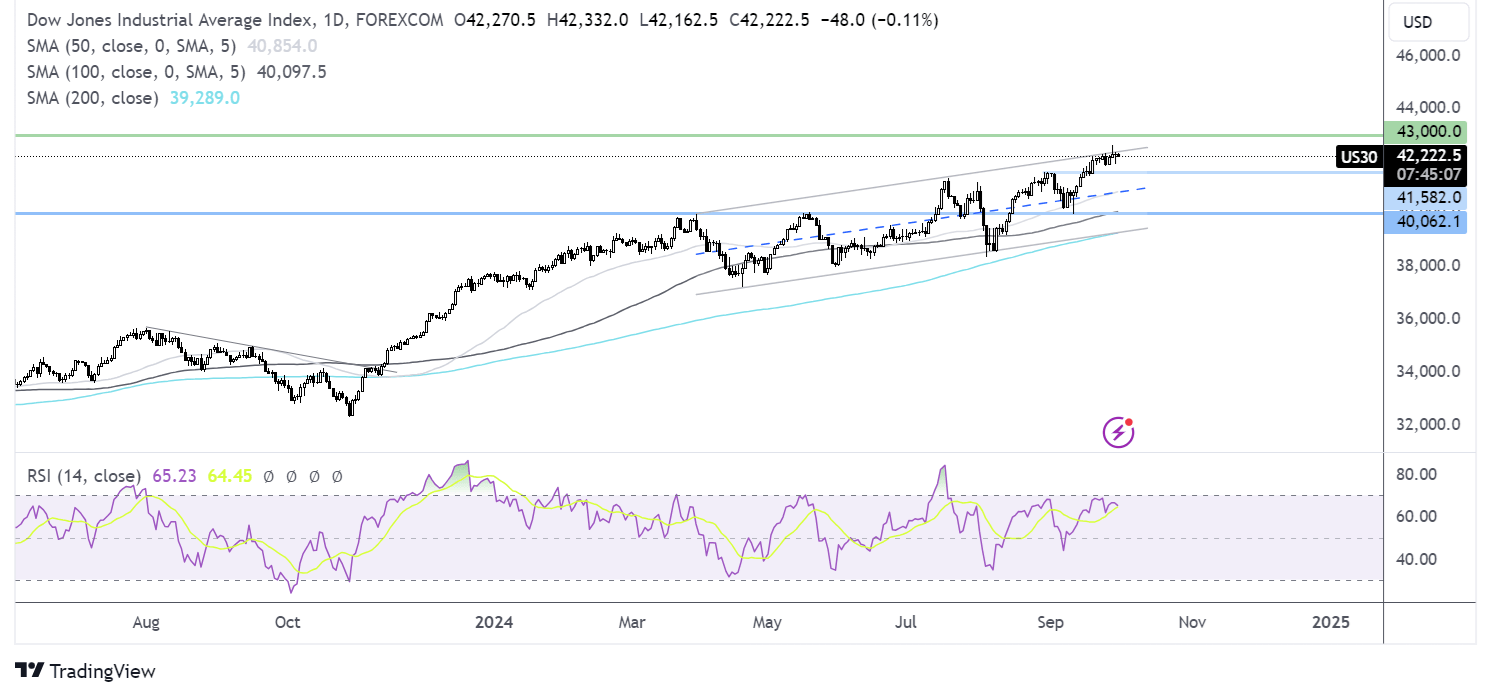

Dow Jones forecast – technical analysis.

After recovering from a 41000 low in September, the Dow has rebounded higher, tracking the upper band of the rising channel. Buyers will look to rise above 42,630 to scale to fresh record highs. On the downside, immediate support is seen at 41,500, the August high, with a break below here bringing 41,000 into play.

FX markets – USD rises, EUR/USD rises

USD is rising, recovering from a 14-month low after Federal Reserve chair Jerome Powell's more hawkish tone in yesterday's conference speech. Attention is now on the US ISM manufacturing PMI data and jolts job openings for more insight into the health of the US economy.

EUR/USD is falling after cooler-than-expected eurozone inflation data. CPI dropped below the ECB's 2% target in September to 1.8%. This marks its lowest level since 2021 and supports the view that the ECB will cut interest rates by 25 basis points further in the October meeting.

GBP/USD is falling amid a stronger US dollar and a more pessimistic outlook for British manufacturers in September. The mood has deteriorated ahead of the newly elected labor government's first budget. The manufacturing PMI edged down to 51.5, matching the preliminary estimate down from a 2-year high of 52.5 in August.

Oil falls further on supply worries.

Oil prices were falling on Tuesday as investors weighed the possibility of oversupply against the improving global demand outlook.

A group of top ministers from the OPEC+ producer group will meet tomorrow to review the market. While no policy changes are expected, the group is scheduled to raise output by 180,000 barrels per day each month from December as it unwinds previous production cuts.

Libyan oil output is also recovering as the parliament agreed to approve a new central bank governor to help end a crisis that has reduced the country's oil output.

The prospect of more supply is offsetting optimism surrounding the global demand outlook following last week's vast Chinese stimulus and expectations that the Federal Reserve will continue cutting interest rates.

Meanwhile, escalating tensions in the Middle East will also remain a focus. However, the risk premium on oil remains low as investors appear more numb to Middle East escalations unless there is a direct confrontation with Iran.