US futures

Dow futures -0.10% at 38830

S&P futures -0.15% at 5170

Nasdaq futures -0.46% at 18009

In Europe

FTSE 0.25% at 8339

Dax 0.14% at 18464

- Fed rate cut expectations remain in focus

- Fed speakers raise doubts over a rate cut this year

- UBER drives lower after posting a loss

- Oil falls as crude inventories rise

Fed speakers remain in focus

US stocks are pointing to a modestly weaker open as bond yields trend higher and as investors wait for more clarity from the Federal Reserve over plans for interest rate cuts.

Yesterday, the indices ended mixed after Minneapolis Fed president Neel Kashkari said that recent stronger economic data suggests that monetary policy may be less restrictive than initially thought. His comments raised questions over whether the central bank could cut interest rates this year.

Amid a quiet U.S. economic calendar. Attention will remain on Fed speakers later in the session, who could provide further clarity over the Fed's future path for interest rates.

Currently, the market is pricing in a 65% probability that the central bank will start cutting interest rates by at least 25 basis points in September, up from around 54% just a week ago ago.

Meanwhile, earnings season is starting to wind down, with first-quarter earnings coming through much better than expected.

Of the 424 S&P 500 companies that have reported up to today, 78% have beaten analysts' expectations, which is well ahead of a typical 67% beat.

Corporate news

Uber drives lower after the ride-hailing firm unexpectedly posted a loss in the first quarter and forecasted second-quarter gross bookings below expectations.

Meanwhile, Lyft is set to open over 5% higher after the ride-hailing company and Uber's rival projected higher-than-expected gross bookings and core profits for the current quarter.

Shopify plunged 16% pre-market after disappointing revenue guidance. The e-commerce firm posted EPS and revenue that beat expectations. However, Q2 revenue growth is expected in the high teens, which failed to impress.

Apple is set to open 0.4% higher after its iPhone shipments to China reportedly rose by 12% in March, according to data from a Chinese research firm. The move comes after the tech giant and retailers reduced its price.

Reddit is set to open over 12% higher after the social media platform said it could post a profit in the second quarter thanks to booming advertising and deals with AI companies.

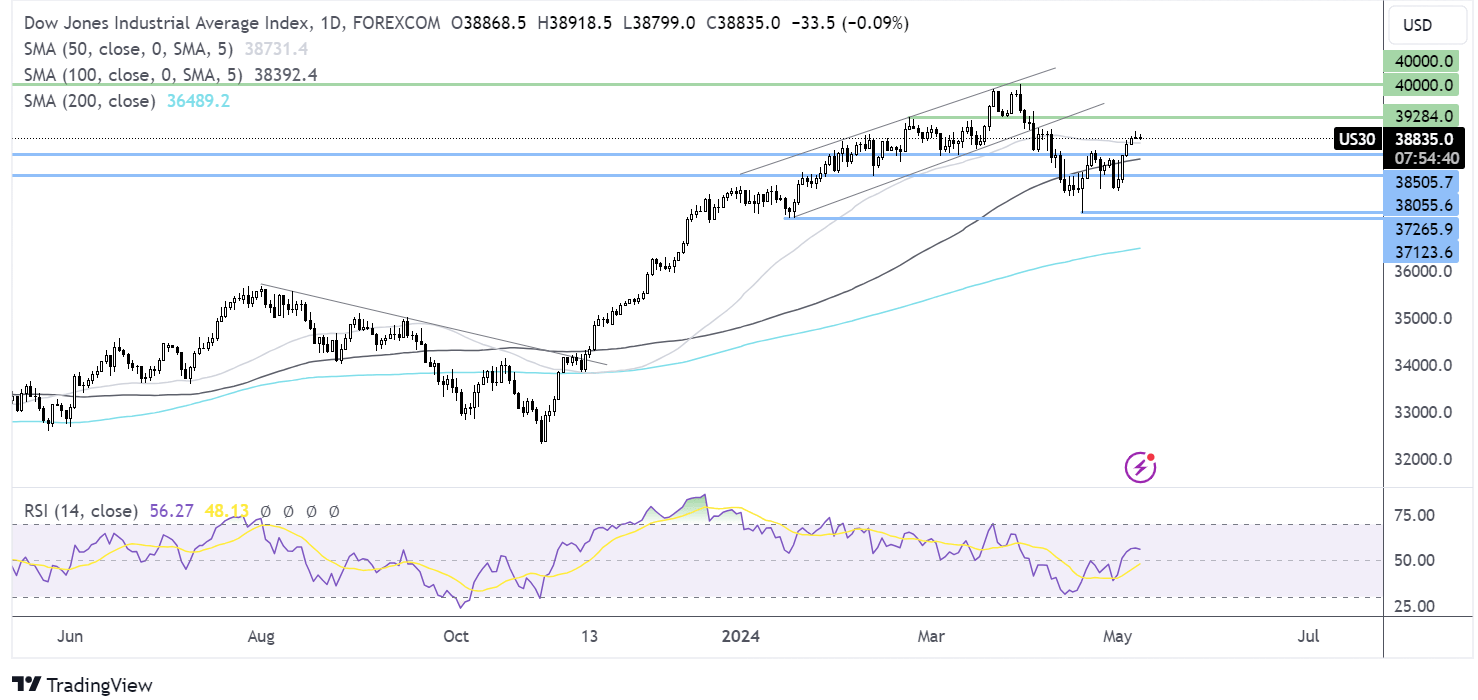

Dow Jones forecast – technical analysis.

The Dow Jones' recovery from last week’s low of 37750 appears to be running out of steam. The rise higher has pushed above 38500, the March low, and the 50 SMA at 38730 before stalling at 37800. Buyers will look to extend gains towards 39284, the February high, before bringing 40,000 back into focus. Meanwhile, immediate support can be seen at 38500, ahead of 38000.

FX markets – USD rises, GBP/USD falls

The USD is rising, supported by hawkish comments from Federal Reserve speakers in recent sessions. Neil Kashkari's suggestion that the Fed may not even cut rates this year helped treasury yields rise, boosting the US dollar.

EUR/USD is inching lower on USD strength after the German industrial output fell in March, adding to concerns over the economic outlook in the eurozone's largest economy. Industrial production fell 0.4% month on month and comes after factory orders also unexpectedly fell yesterday. The German institute IW warned that the German economy will likely stagnate across 2024 after a solid start to the year.

GBP/USD is falling for a second straight day as investors look ahead to tomorrow's Bank of England interest rate decision. The central bank is expected to leave interest rates on hold out the 15-year high of 5.25%; however, with inflation cooling, the central bank may start paving the way for a rate cut in the coming months.

Oil steadies after steep losses last week

Oil prices are heading lower on a stronger U.S. dollar and amid rising concerns over the demand outlook in the US following a rise in inventories.

Oil prices are falling for a second straight day after US crude stockpiles rose by 509,000 in the week ending May 3rd, according to the API. Gasoline and distillate fuel inventories also rose on a double whammy of bad news for oil.

The EIA stockpile data will be released later today and is expected to show a 1.1 million barrel draw.

Meanwhile, the rising U.S. dollar following hawkish Federal Reserve commentary overnight is also making oil more expensive for buyers of foreign currencies.

Finally, hopes of a ceasefire in Gaza also add pressure to oil prices as the risk premium fades.