US futures

Dow future -1.2% at 42883

S&P futures -0.97% at 5839

Nasdaq futures 1% at 20311

In Europe

FTSE -0.65% at 8050

Dax -1% at 18815

- US stocks fall amid a rising nuclear threat from Russia

- Risk off trade drives stocks lower, Gold rallies

- Walmart rises after solid results

- Oil steadies after gains yesterday

US stocks tumble in risk-off trade

U.S. stocks are heading for a weaker at open after a thinly veiled nuclear threat from Russian President Vladimir Putin and as investors digest more corporate earnings.

Russian President Putin issued a warning to the US on Tuesday, lowering the threshold for a nuclear attack. This comes after President Biden reportedly allowed Ukraine to fire US missiles deep into Russia – marking a change of stance.

The ramping up of tensions and nuclear threats has resulted in investors taking risk off the table while also seeking safe haven assets, such as Gold.

The US economic calendar is relatively quiet today, with just housing starts in focus and Fed speakers.

The market is pricing in a 60% probability of a rate cut in December after last week's hotter inflation and as Fed speakers adopt a less dovish tone.

Corporate news

Walmart is set to open 4% higher after the retail giant delivered another solid quarter. The retailer beat both earning and revenue forecasts and saw strong comparable sales across the US. The firm also lifted its annual earnings outlook.

Lowe's is set to open over 1% lower. The home improvement retailer posted a larger-than-expected fall in annual comparable sales amid softness in DIY bigger-ticket discretionary demand.

Alphabet is set to open lower on reports that the Department of Justice could recommend the tech giant sell off its Chrome browser as part of an antitrust crackdown.

Super micro computer has jumped over 25% after saying it had appointed a new auditor and was on track to file its financial reports this year.

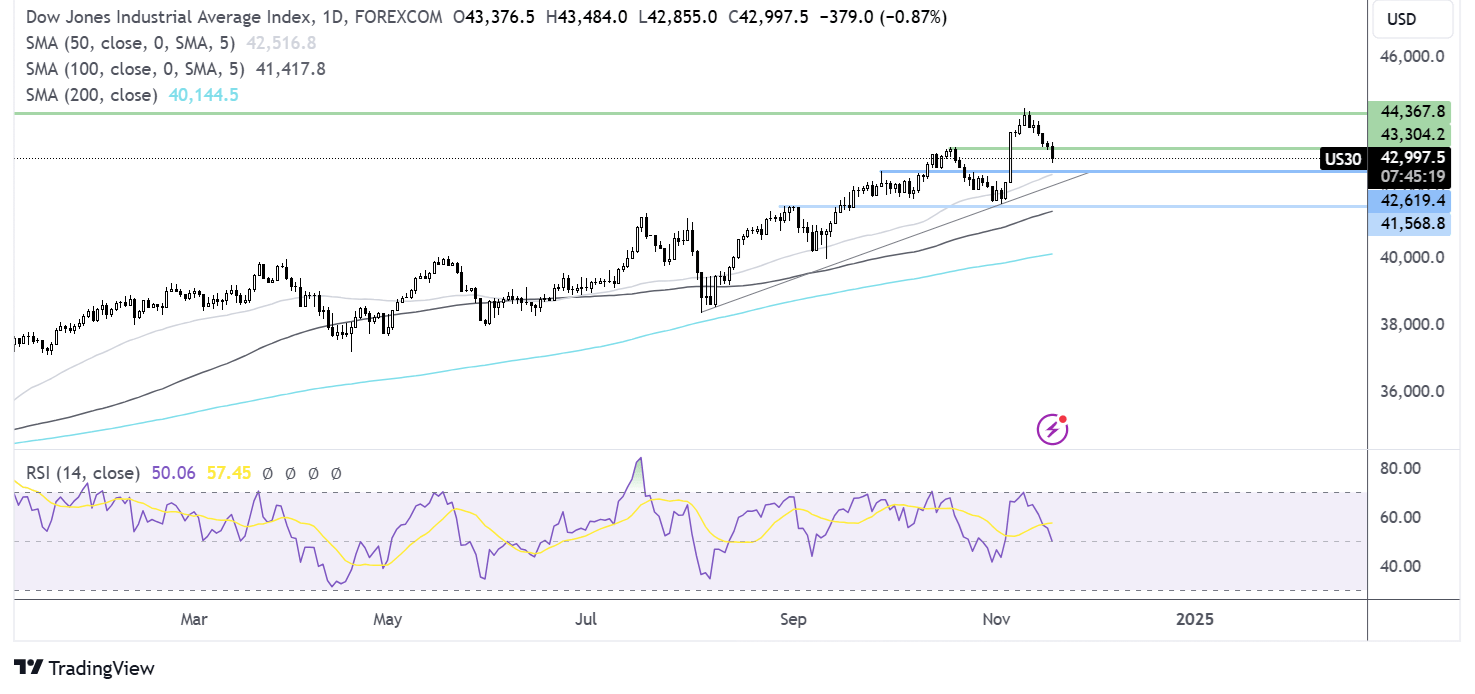

Wall Street forecast – technical analysis.

After running into resistance at 44,411, the Dow Jones rebounded lower, taking out support at 43,325, negating the near-term uptrend. The Dow is extending losses towards 42630, the December high and the 50 SMA. A break below here exposes the rising trendline support. It would take a move below 41,630, the November low, to create a lower low.

FX markets – USD rises, EUR/USD falls

The USD is rising, resuming its uptrend back towards 2024 highs, supported by safe-haven demand amid rising geopolitical tensions. The USD is up 2% this month on bets the Fed will cut rates at a slower pace.

EUR/USD is resuming its downward trend amid a stronger U.S. dollar and despite eurozone inflation rising in October. Eurozone CPI rose to 2% in October, up from 1.7% in September and in line with its preliminary reading. The ECB is still expected to cut rates in December, although, with inflation at the 2% target, the data supports a 25 basis point cut rather than 50 basis points.

GBP/USD is resuming its sell-off despite a slightly more hawkish tone from BoE governor Andrew Bailey as he speaks before the UK Treasury Select Committee. Bailey warned that the government's move to raise taxes on employers means the central bank will take a more cautious approach to easing borrowing costs as it monitors the impact on the economy. UK inflation data is due tomorrow and is expected to show CPI rose to 2.2%.

Oil falls after strong gains yesterday.

Oil prices are falling on Tuesday giving back some of yesterday's gains as traders weigh up the outlook for supply.

Oil prices surged 3% on Monday after Equinor halted production at an oilfield in Norway, the largest oil field in Western Europe.

The outage raises concerns over the region's supply and adds to concerns already stemming from the Ukraine—Russia war.

While Russian oil exports have seen little impact from the war so far, should Ukraine start to target oil infrastructure, this could quickly change.

Meanwhile, in its monthly report, the IEA forecasts that the global oil supply will be in surplus in 2025, which is keeping pressure on the oil price. US production remains close to record highs above 13 million barrels a day.

Attention will now turn to API oil inventory data. Lower-than-expected inventories could boost the oil price.

.