Dow Forecast Update: The Dow has risen along with the Russell 200 index after the Consumer Price Index (CPI) came in at 3.0% instead of the expected 3.1%. Small caps are set for a big rally, with Russell 2000 index breaking out a good 3% at the time of writing. Conversely, technology stocks have fallen amid rotation into value from growth. Bank earnings, the University of Michigan (UoM) survey, and the Producer Price Index (PPI) are among Friday’s highlights.

Following the release of today’s weaker-than-expected US CPI report, index futures traded mixed, with small caps and the Dow outperforming the tech-heavy S&P 500 and Nasdaq 100, leading to a mixed open. This follows another tech-fuelled lift that pushed the S&P 500 and Nasdaq 100 to new record highs yesterday, before the sector dropped today. Sentiment has remained towards US stocks amid confidence that the Federal Reserve will cut rates. Confident that the latest inflation data would not derail progress, we had seen markets rise in recent days. Meanwhile, the Dow broke out of a recent consolidation zone ahead of the start of the earnings season, with banks in focus on Friday.

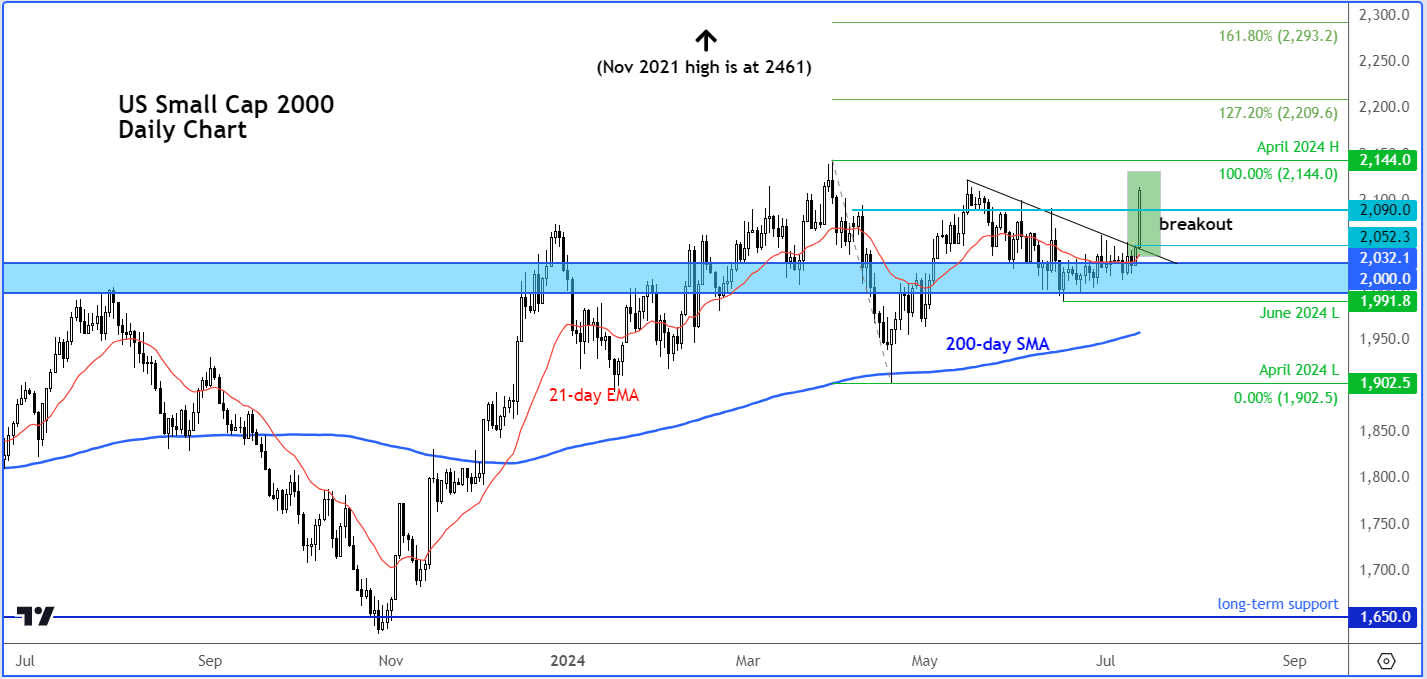

With rate cut expectations on the rise, the Dow forecast remains positive even if some major indices like the Nasdaq 100 are at extreme overbought levels. Indeed, the weaker-than-expected CPI has fuelled a big breakout in the small-cap Russell 2000 index.

What Does Today’s CPI Data Mean for Stocks and the Fed?

Unlike the FX markets, the consistent gains in the stock indices over the past few weeks suggest investors were not too concerned about the impact of the US CPI data on the markets. It appears they anticipated a weakening in inflation.

CPI was expected to decline to 3.1% year-over-year from 3.3% previously, with a 0.1% monthly rise. However, it eased to 3.0% as the monthly CPI fell by 0.1% instead of rising. Core CPI rose by 0.1% instead of the expected 0.2%, making the year-over-year rate 3.3% instead of the 3.4% expected.

Today’s weaker CPI release follows last week's underwhelming US data, including the ISM services and manufacturing PMIs and various jobs market indicators. This latest weaker-than-expected CPI print strongly indicates that the disinflation process is on track, moving inflation towards the Fed’s target and keeping stock market bulls happy.

Federal Reserve Chair Jerome Powell's recent testimony emphasised that the economy was no longer overheated, although he refrained from committing to a timeline for the next rate cut. Expectations of a 25-basis point rate cut in September have been rising, and today's weaker CPI report is likely to further increase these expectations, supporting a positive Dow forecast.

What Else Will Traders Watch This Week?

Later in the week, on Friday, attention will be on the latest PPI measure of inflation, along with the University of Michigan’s surveys on consumer sentiment and inflation expectations.

The University of Michigan's consumer sentiment index has been steadily declining, frequently missing forecasts. Additionally, the UoM's Inflation Expectations survey dropped to 3.0% from last month's 3.3%. Persistently lower inflation expectations might reduce actual inflation by mitigating the wage-price spiral, which stock market bulls hope to see. However, signs of persistent inflation could temporarily undermine stocks.

Dow Forecast: Banks to Kick Off Earnings Season This Week as Oil Rebounds

Banks will be in focus ahead of the start of the earnings season on Friday, which could help fuel a fresh breakout in the Dow and Russell. It's also worth monitoring oil prices, which rebounded after a three-day losing streak. Further gains could boost the appeal of energy names in the Dow and the small-cap Russell 2000 index. Oil prices rose after the latest oil inventories data showed a sharper-than-expected fall, while the EIA revised its demand outlook higher and lowered its production forecast.

Russell Breaks Out

The Russell 2000 has now broken above its bearish trend line that had been in place since mid-May. This is clearly a positive development for small caps. We could very well see follow-up technical buying in this market in the days ahead. Definitely one to watch.

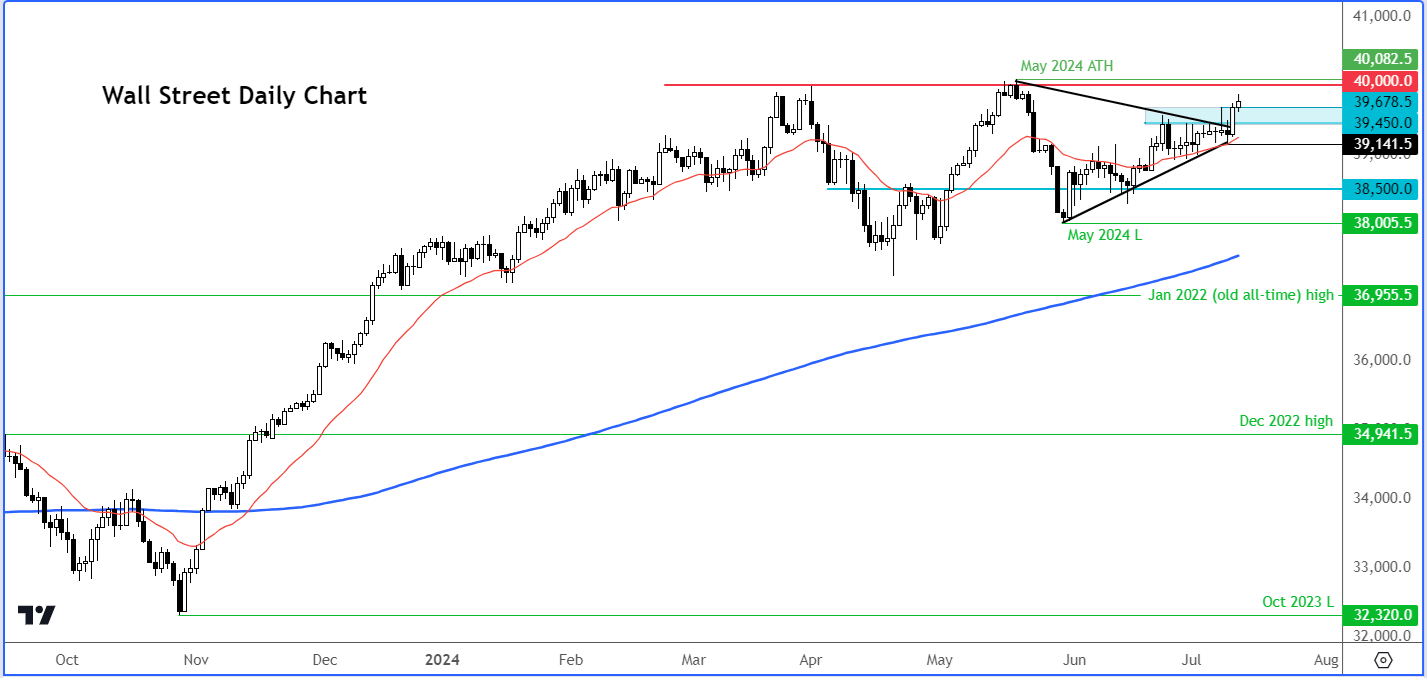

Dow Likely Heading Above 40K

Given this week’s bullish technical developments, the Dow Jones could rise above 40,000, if it can maintain its breakout above the 39450-39680 area. Once strong resistance, this zone is now going to be the key support area to watch.

Source for all charts used in this article: TradingView.com